The Berkshire Beat #69: Digging Into Berkshire's Quarterly Earnings Report

All of the latest Berkshire Hathaway news and my must-reads of the week!

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

The latest news and notes out of Omaha…

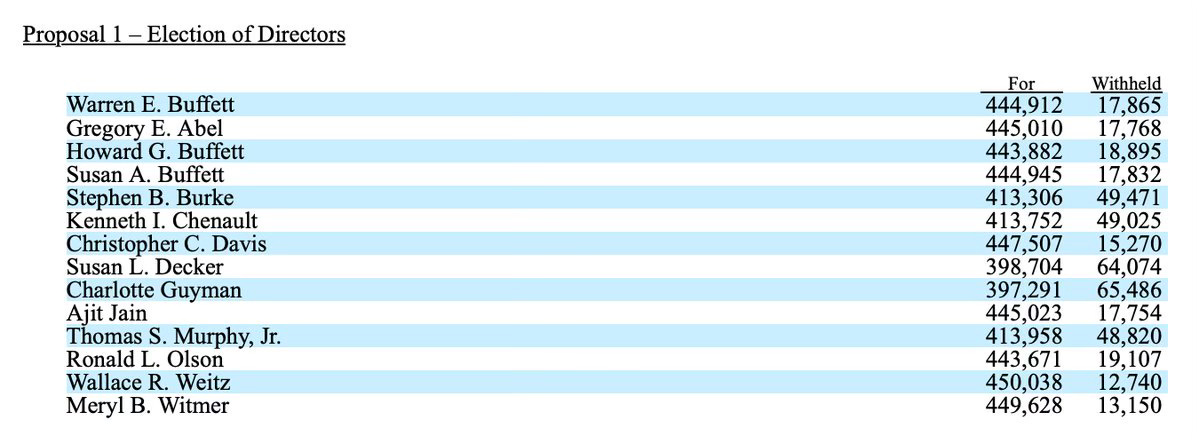

BERKSHIRE AGM: Lost in the shuffle of Saturday’s Q&A session is that Berkshire Hathaway had a few pressing matters to deal with at the annual meeting proper. Like re-electing the board of directors and voting on a raft of shareholder proposals that Warren Buffett opposed. All went as expected — with the directors winning election by wide margins and the six proposals going down in flames. Congrats to Wally Weitz who won the Mr. Popularity award as this year’s top vote-getter!

iPHONE TO THE RESCUE: According to the Omaha World-Herald, Warren Buffett showed up to work on Monday morning basking in the afterglow of last weekend’s AGM, only to discover that Berkshire’s phones were down — and would remain that way for the next few days. “We had this [annual] meeting that went over very well and now anybody who has phoned us in the last three days, they think we have gone out of business,” he joked on Wednesday. The phone outage hit Buffett particularly hard on Monday because he left his iPhone at home. Since then, though, that tiny device has been his business life-line. “I don’t know how to do much with it,” said Buffett, “but I do know how to answer calls. I’m glad we didn’t sell all of our Apple.” 🤣

“[The annual meeting] was a huge success,” he told the World-Herald. “Everything went perfectly and everybody in Omaha made [the shareholders] feel so welcome.”

VALUING BERKSHIRE: On Wednesday, Whitney Tilson released his latest intrinsic value estimate for Berkshire: $656,000 for Class A shares and $437 for Class B shares. That means that Berkshire shares currently trade at about a 7% discount. “That’s not a bad discount,” he writes, “but, again, the undervaluation isn’t as great as it has been at certain times in the past. However, I still like the stock overall because it remains somewhat undervalued, is incredibly safe, and its intrinsic value is growing nicely.”

REMEMBERING CHARLIE (PART 1): In the run-up to last weekend’s annual meeting, the Omaha World-Herald shared some new details about Charlie Munger’s death and its impact on Warren Buffett. Susie Buffett admitted that Charlie’s death “was a huge surprise to everyone. At first, she said, it was hard for her dad to even talk about it.” About a week later, Buffett channeled his grief into the written tribute — which named Munger the architect of Berkshire — that opened this year’s annual letter. Susie also shared that her dad enjoyed seeing Charlie receive so much acclaim from the wider world — “feeling Munger, at last, has been ‘getting his due’.”

REMEMBERING CHARLIE (PART 2): This year’s VALUExBRK conference in Omaha featured a very special guest: Doerthe Obert, executive assistant to the late Charlie Munger. She regaled the crowd with stories about working for Charlie, his Buffett-like love for McDonalds and other fast food, and much more.

“[Charlie] was really self-disciplined,” said Obert. “If he was [working] on something, the world could fall apart and he would just continue.”

“I wouldn’t let anybody walk over me,” she said, “and he knew that. He wouldn’t challenge me. And, sometimes, he even would listen to me.”

DAVITA: Berkshire owns 41.2% of DaVita — and, on April 30, reached an agreement with the dialysis provider to sell back any shares beyond 45.0% in the future. (Berkshire is not planning to buy any more DVA 0.00%↑ stock, but could see its stake increase due to share repurchases.) DaVita CEO Javier Rodriguez said that his company “aspires” to buy back $1-1.5 billion worth of stock this calendar year.

CHEVRON: CEO Mike Wirth declared that “the end of the oil age is not yet upon us” at the Milken Institute Global Conference. He expects oil demand — and production — to increase through the end of 2024. “It’s important that we continue to meet that [demand] with new production,” he said, “which is certainly what we’ve been doing.”

Wirth also predicted that Chevron will grow its free cash flow by 10% annually over the next few years. “Driven by the Permian, driven by some other shale assets in our portfolio, projects in the deepwater Gulf of Mexico, we’ve got a number of other assets that are delivering growth,” he said. “The combination with Hess only strengthens our cash flow longer into the future. Not only to the end of this decade, but well into the next.” Chevron’s $53 billion acquisition of Hess remains in a holding pattern due to a legal dispute with Exxon Mobil.

AND A FEW QUICK HITS…

This week, Berkshire received $106.1 million in quarterly dividends from American Express and $2.6 million from Mastercard.

Reuters reports that Occidental Petroleum is exploring the sale of some Permian Basin assets to help reduce debt from the CrownRock acquisition. This parcel of 27,500 acres in the Barilla Draw region could fetch Oxy more than $1 billion.

CEO Vicki Hollub said this week that she still expects the CrownRock deal to close sometime in the third quarter.

Apple announced new iPad Pro and iPad Air models at its “Let Loose” event on Tuesday. Good timing: iPad revenue fell 17% last quarter — though Apple expects a double-digit boost to this segment once these new models come out.

Odds & Ends from Berkshire Hathaway’s Quarterly Earnings Report

On Monday, I wrote about the most important moments from Warren Buffett’s marathon Q&A session at the annual shareholders meeting.

That masterclass of wit and wisdom understandably overshadowed the 10-Q earnings report that Berkshire Hathaway released earlier that morning. But, here at Kingswell, I try not to let any interesting Berkshire-related facts or figures slip through the cracks.

So, today, I’ve gathered together as many of these little factoids as I could find — all in hopes of giving us the most balanced accounting of Berkshire’s recent performance as possible.

BUYING BACK BERKSHIRE: Warren Buffett allocated about $2.6 billion towards share repurchases in the first quarter. Here’s what he spent each month…

January — $479.1 million

February — $1.8 billion

March — $264.2 million

PILOT: Buffett was circumspect in his remarks about the whole Pilot legal saga — though he did note that a few members of Berkshire’s board expressed concern about going into business with the Haslam family in the first place. I agree with Adam Mead that Buffett’s conciliatory comments towards Pilot founder Big Jim Haslam seemed like a subtle dig at his son, Jimmy Haslam. (Don’t miss Mead’s Berkshire Debrief for more of his thoughts and observations from the annual meeting.)

GEICO: The auto insurer’s current plan is simple — trade growth for profitability. And, with an 81.2% combined ratio in the first quarter, it seems to be working. But we’re also starting to see signs that GEICO is (slowly) shifting back into growth mode. Policies-in-force continued to decline, but at a slower rate than in past quarters — buoyed by “new business and higher retention rates”. Another encouraging sign: GEICO boosted its advertising expenses for the first time in a while.

INSURANCE: Elsewhere in Berkshire’s insurance empire, both the BH Primary Group (89.3%) and BH Reinsurance Group (81.5%) achieved impressive combined ratios of their own. In all, underwriting profits rocketed up 185.2%.

STOCK PORTFOLIO: We’ll get a full look at Berkshire’s investing activity from last quarter when the company files its 13F next Wednesday. But here’s what we already know — Buffett sold some Apple, tinkered (once again) with Chevron, and bought 4.3 million shares of Occidental Petroleum. And, of course, the frequent purchases of Liberty Media Sirius XM tracking stock by either Todd Combs or Ted Weschler. Overall, Berkshire finished the quarter as a net seller — with $20 billion of sales and just $2.7 billion of new purchases.

MSR: As a whole, “Manufacturing, Service, & Retailing” grew net earnings by just 1.3% in the first quarter. We’re always sort of at Berkshire’s mercy as to what earnings information we get about the specific companies that make up this vast segment of the conglomerate. After scouring through the 10-Q, here’s what I managed to turn up…

Precision Castparts continued its turnaround with a 16.8% boost in pre-tax earnings on $2.5 billion of revenue

Lubrizol’s pre-tax earnings increased 44.5%

Marmon’s earnings dropped 6.7%

IMC (International Metalworking Companies) down 3.8%

Clayton Homes jumped 11.3% — an increase of $46 million

Forest River’s pre-tax earnings climbed 22.7% with unit sales up 9.4%

Apparel and footwear earnings rocketed up 58.4%

Jazwares had higher revenue on increased volume

TTI’s earnings decreased by 49.3%

Aviation services dipped 10.3% — with increased maintenance and personnel costs eating away at margins

Berkshire Hathaway Automotive’s pre-tax earnings dropped 11.3%

McLane’s earnings shot up 46% ($52 million) as the margin grew to 1.3%. (That’s a heady number for this high-volume seller.) Perhaps a sign of Greg Abel’s more attentive and hands-on management style.

Become a paid supporter today and receive immediate access to ten (and counting) annotated transcripts full of wit and wisdom from the top names at Berkshire Hathaway.

Paid subscribers will also continue to receive a new annotated transcript each month.

The Must List

Other awesome things that I read this week…

The Impact of Debt || Howard Marks

“Clearly, all else being equal, people and companies that are indebted are more likely to run into trouble than those that aren’t. And it goes without saying that a home or a car that hasn’t been used as collateral for a loan can’t be foreclosed on or repossessed. It’s the presence of debt that creates the possibility of default, foreclosure, and bankruptcy.”

How to Find a Partner like Charlie Munger || Frederik Gieschen

“Buffett and Munger met when the latter was in Omaha for his father’s funeral. Imagine if Buffett had declined to go out because he’d rather … read another annual report, watch TV, or simply because he didn’t feel like being social that night. You have to make space in your life for meeting new people.”

Berkshire Hathaway’s 2024 Q&A Session || The Rational Walk

“From some of the commentary online, it seems like this statement was taken as a lack of confidence in Mr. Combs and Mr. Weschler. However, I think that the point was that Mr. Abel, as CEO, must have overall responsibility for all of Berkshire’s capital allocation. In my opinion, it is likely that Mr. Abel will delegate some responsibility to Berkshire’s investment managers, just as Mr. Buffett has done for over a decade. But that will be a decision to be made in the future, in consultation with the board.”

The Religiosity of the Berkshire AGM, the Downside of Consumer Surplus, and Being Right for the Wrong Reasons || Todd Wenning

“A friend once told me that he was comfortable leaving his laptop on his seat in the arena while he grabbed food at the concession stand. You wouldn’t do this at most events with 40,000 strangers. No one at the Berkshire AGM wants to be known as the laptop thief. That’s instant excommunication, after all.”

11 Public Speaking Techniques from the World’s Greatest Speakers || Polina Pompliano

“Becoming a better public speaker begins with the word ‘yes’. You need to be ready to say ‘yes’ to every little opportunity to speak. A panel? Yes. A wedding toast? Yes. Your friend’s out-of-control birthday party where you need to reel everyone in at the end of the night? Yes. All those tiny practice sessions earn you the confidence to perform in the moments that matter.”