Warren Buffett Q&A Transcript || Detroit Homecoming (2014)

"In my zip code, there are over 100 shareholders of Berkshire Hathaway. I’m with friends [in Omaha] — as long as the stock is up, anyway."

On September 18, 2014, Warren Buffett spoke to a crowd of ultra-successful Detroit natives as part of the beleaguered city’s first-ever “Detroit Homecoming” event.1

For nearly an hour, he fielded questions from Quicken Loans co-founder (and Cleveland Cavaliers owner) Dan Gilbert — on topics ranging from the Global Financial Crisis to that time that Buffett almost bought a bridge in Detroit. 👀

Over the past few weeks, I transcribed (and lightly annotated) his remarks for posterity and future study.

A few notes:

Each transcript is done entirely by hand — with no AI or software assistance — so any and all mistakes are my own.

I summarized and paraphrased a few of the questions to save space. All of Warren’s answers are transcribed verbatim.

I added footnotes — 30 in all — to provide additional information at relevant points. Hopefully, these will prove useful to readers.

The full transcript is available to all paid supporters. Free subscribers have access to the first 1,500-ish words. (That’s longer than the typical Kingswell article.)

I’ve tried to do my best to ensure that no one feels short-changed.

Become a paid subscriber today and receive immediate access to this transcript — along with six other annotated transcripts full of wit and wisdom from the top names at Berkshire Hathaway.

Now, without further ado, here is the complete transcript of Warren Buffett’s discussion with Dan Gilbert at “Detroit Homecoming” from 2014…

Dan Gilbert: So, Warren, I had this dream that I was interviewing Warren Buffett.

Warren Buffett: It probably was a nightmare. (Laughs)

DG: (Laughs) I just read that you made the first official bet of your life — because what you do normally is not betting, it’s informed decision-making — on a Nebraska college football game. Who were they playing?

WB: They were playing Fresno State. Normally, I like to be the house. (Laughs) I was at the MGM for the Floyd Mayweather fight and I was walking by this sportsbook and it said 12.5 points, Nebraska [vs.] Fresno State. I like to buy mis-priced things, so I went up and I said, “Are you sure?” The guy said, “Yeah.”

DG: You told me backstage that you thought maybe the line moved because people were following you.

WB: What happened is when I made the bet, a bunch of guys came over and you remember that movie where Meg Ryan says, “I’ll have what she’s having!”?2

DG: I do remember that.

WB: Well, it wasn’t quite as much fun as that… (Laughs) But, yeah, a lot of guys followed me up and said that they wanted to do what I did.

DG: And you won big.3

WB: Yeah, it was really a mis-priced thing. We had a lousy game4 the week before, but it didn’t mean anything.

DG: There’s this stock I heard about, it hit its new all-time high today, by the name of Berkshire Hathaway. I guess you’re pretty pleased.

WB: That has a nice ring to it. (Laughs)

DG: And that just beat the new high yesterday, correct?

WB: Yeah, [but] it really doesn’t make any difference — except in terms of giving away more money.

DG: We have some stuff for you on that later.

[Crowd Laughs]

WB: It doesn't change my life in any way, shape, or form. I’ve never sold a share of Berkshire in my life.

DG: But it’s still exciting, right?

WB: It’s fun to have it [go up]. It will be 50 years next May since I took over and I’ve spent my life working on it.

DG: I have so many questions. I don’t know if we have the hours for all of them.

WB: I don’t have very many answers, so space them out. (Laughs)

DG: Let’s talk a little bit here about Detroit. From the outside, what is your view on what happened here?5

WB: Well, the biggest thing is the finances got out of hand.

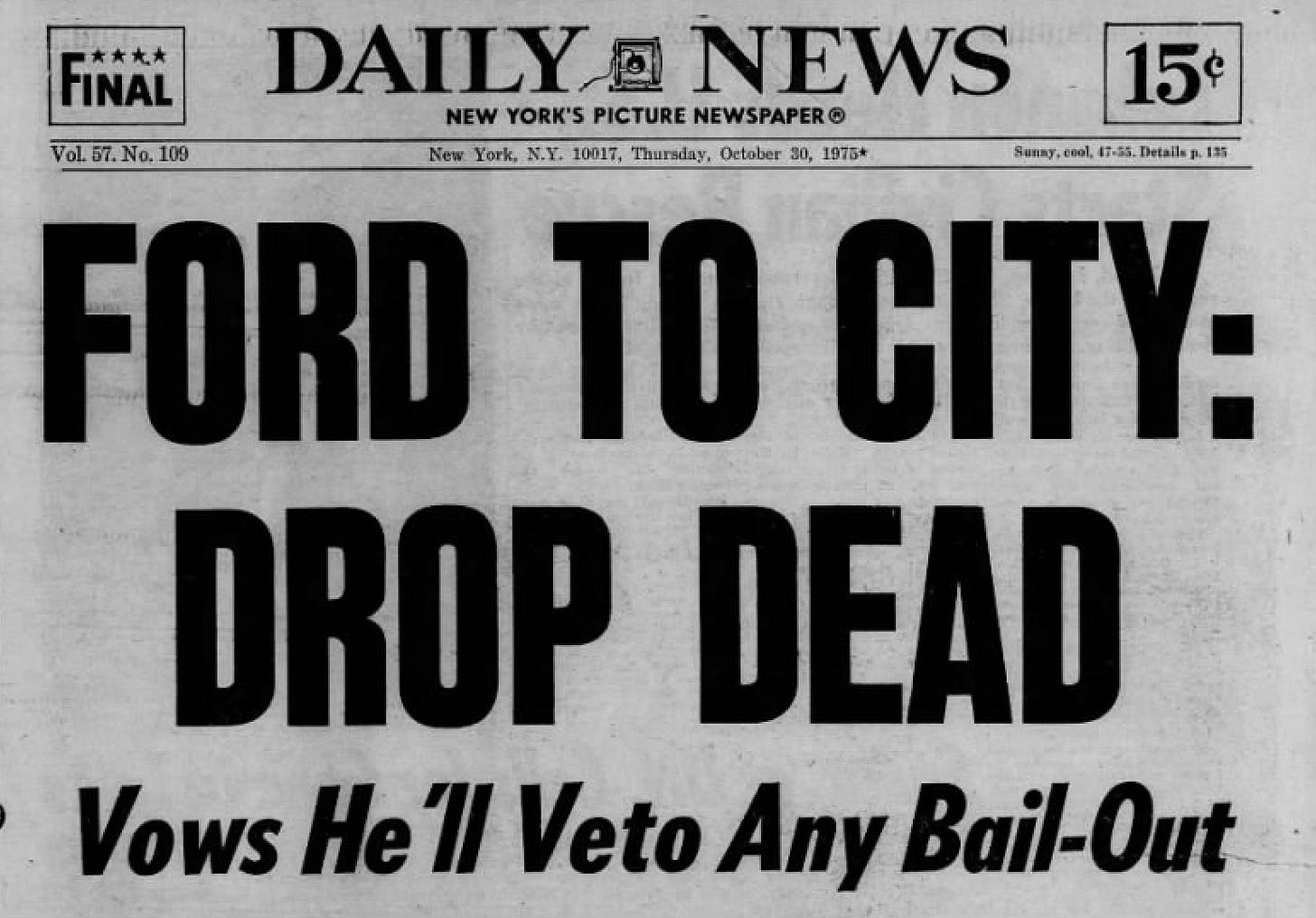

That has happened to plenty of cities before. Forty years ago, in New York, [the city] was on its back and the President of the United States actually said to New York, “Drop Dead!”6 There was a famous headline —

DG: He didn’t mean it, though, right?

WB: No, but they felt he meant it in New York. It was a headline in the New York Daily News — “President to New York: Drop Dead”.

The city lost their credit and everybody was fighting with everybody else. The unions, the politicians, the bankers, the business people — they were all mad at each other. But they sat down and they actually worked out a solution that was like a bankruptcy, but it wasn’t an official one.

They set up something called Big MAC7 and Felix Rohatyn was involved and Victor Gotbaum from the unions was involved — and they worked out something that made sense. Now, it didn’t transform things in a day or a week or a month, but just look at what’s happened.

Cities, they have an inherent strength. You’ve got great headquarters companies in Detroit and that’s enormously important. It’s been important in Omaha.

DG: Speaking of headquarters, if I’ve done my research correctly, Berkshire owns 2%-ish or something of General Motors and you guys have just added to the position.

WB: Yeah, we’ve got two fellas — one of whom we hired maybe 3-4 years ago and the other one 2-3 years ago.8 When I hired them, they managed $1 billion each, but I have kept giving them more money to manage.

DG: Sooner or later, that adds up.

WB: They’re up to $9 billion a piece now and, when I’m not in the picture, they’ll be running a couple hundred billion. They’re terrific guys.

One of them has close to 15% of his fund in General Motors stock. And, actually, when Mary Barra came out three or four months ago — this fellow’s name is Ted Weschler9 — the three of us went out to lunch.

DG: How did that go?

WB: I was enormously impressed with her. As I drove her down in my 2006 Cadillac, I said, “Mary, is the new one any better than this?” Well, I got a rather fulsome answer to that. (Laughs) So the next day I told my daughter, “Go out and buy me one of these new Cadillacs,” and I wrote Mary about it later.

Mary is a real car guy, I will tell you that. You can just tell. She has a passion for it. I love it when CEOs have a passion for their business. It’s enormously important. If I had a one-line employment form, I’d almost say, “Are you passionate about what you do?” — because it works.

And she really is [passionate]— and she knows cars forwards and backwards. She’s really good.

DG: What is your view, overall, of the Detroit automobile makers? Post-bankruptcy, what does their future look like?

WB: When I was sixteen, I was only thinking about two things: cars and girls. And I wasn’t very good with girls, so that kind of narrowed it down a little bit. (Laughs) If you had the right car, it helped with girls, too.

Americans love cars. They are in love with their cars. And it all started here, too. There’s really nothing more quintessentially American than the car. I think people feel that the world over. They’re driving American cars.

DG: But you probably wouldn’t have bought 2% of General Motors seven or eight years ago. What, from an investment standpoint, changed so that you allowed your guy [to buy stock in GM]?