The Berkshire Beat #66: Charlie Munger & Physics Envy

All of the latest Berkshire Hathaway news and my must-reads of the week!

Happy Friday and welcome to our new subscribers!

The latest news and notes out of Omaha…

REMEMBERING CHARLIE: Last month, Mohnish Pabrai spoke to YPO (Young Presidents’ Organization) about his friendship with Charlie Munger and how the lessons he learned from the late polymath continue to impact his life today. “The day before he passed away, when he was in the hospital, he was [still] trying to close one last grant to a nonprofit,” said Pabrai. “He extracted everything he could from his mind and his body until the last day. His family is with him [at the hospital], but he still tried to help some nonprofit do better. There’s no upside to him doing that. He’s not trying to publicize that. There’s no legacy or anything. It’s just a selfless act.”

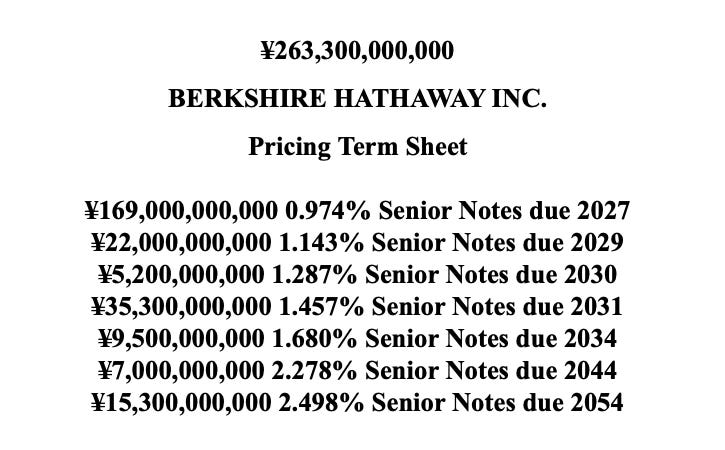

JAPAN UPDATE: According to a prospectus filed yesterday, Berkshire Hathaway plans to sell ¥263.3 billion ($1.71 billion) of yen-denominated bonds in Japan. Bloomberg calls it “the firm’s largest yen debt deal since its debut sale in the currency in 2019”. This could be the prelude to Warren Buffett increasing his investments in the five leading Japanese trading companies even further. Stay tuned.

INCREASINGLY SIRIUS: This is becoming something of a regular occurrence. Berkshire bought 1.9 million more shares of Liberty Media Sirius XM tracking stock over the back half of last week. (803,890 shares of LSXMA 0.00%↑ and 1.1 million shares of LSXMK 0.00%↑ for a total outlay of $97.1 million — which comes out to an average price of $25.88 per share.)

ALL ABOUT APPLE: In Q1 2024, Samsung overtook Apple as the world’s top smartphone seller. It’s yet another bad headline for the Cupertino-based tech giant — in a year that’s already been full of them — but should not come as any surprise to the even-keeled observer. As the chart below shows, Apple’s iPhone shipments always surge ahead of Samsung in the holiday quarter, before sinking lower for the rest of the year. A sales pattern so consistent that you could set your watch by it.

What might trouble investors, though, is the IDC’s estimate that iPhone sales dropped by 10% year over year. If true, that’s not great. But the IDC’s numbers are far from official — John Gruber of Daring Fireball calls them “sketchy at best” — so we’ll have to wait for Apple’s next earnings report on May 2. (Apple doesn’t report unit sales, but iPhone revenue could provide a rough approximation.)

Apple CEO Tim Cook traveled to Southeast Asia this week as the company hopes to cultivate both new consumer markets and manufacturing partners outside of China. He hopes to increase investment in Vietnam — which already plays a key role in MacBook, iPad, and Apple Watch production — and pledged to “look at” Indonesia as a potential part of the supply chain, too.

ANNUAL MEETING: Todd Finkle of Gonzaga University, author of Warren Buffett: Investor and Entrepreneur, recently previewed the upcoming Berkshire annual meeting over at Wall Street Frontline. “Last year’s financial hit to Buffett’s railroad interests with BNSF and the energy sector, partly due to the wildfires in the western United States, is sure to raise questions … The meetings are an opportunity to delve into these pressing issues, in an environment where Warren Buffett’s words resonate with quiet authority. The dynamic that Charlie brought to the meetings will be sorely missed this year. Their interplay, reminiscent of the comedic rapport of Laurel and Hardy, brought levity to the serious business of investment and company strategy. His legacy, undoubtedly, will be acknowledged and felt throughout the meeting.”

BHE: The CEOs of two Berkshire Hathaway Energy subsidiaries called for more natural gas power plants at this week’s S&P Global Power Markets conference. “We are seeing these [natural gas plants] are needed to bring that reliability longer-term in our system,” said Cindy Crane of PacifiCorp. NV Energy’s Doug Cannon agreed: “For the time being, natural gas will still continue to play an important role for powering the future of energy.” Cannon added that his Nevada utility expects electricity demand to more than double this decade — which will require more nat-gas generators coming on-line. Bloomberg also reports that these plants “will be constructed so they can eventually run on cleaner-burning hydrogen”.

AND A COUPLE OF ODDS & ENDS…

Berkshire received nearly $225 million in quarterly dividends from Occidental Petroleum on Monday. That includes $54.6 million via the common stock position and $169.8 million via the preferred shares from the Anadarko financing.

CNBC’s David Faber does not believe that Paramount Global can reach a deal with Skydance Media before the 30-day exclusive window expires on May 3.

“They are not going to have a deal done by then,” said Faber. “I don’t think the market expected that that would be the case. It’s going to take more time than that — and it may be more twists and turns from here.”

A Slow Read of Poor Charlie’s Almanack

Talk 9: Academic Economics — Strengths and Faults After Considering Interdisciplinary Needs

Up above, I linked to Mohnish Pabrai’s recent interview with YPO. Near the end, he spoke about Poor Charlie’s Almanack — and how it remains a vital resource for investors and thinkers today.

There’s a lifetime of wisdom in those speeches. If someone went through those speeches and understood them, it’s better than a four-year college degree anywhere.

In one of those speeches, The Psychology of Human Misjudgment, he goes through different mental models of the different quirks in our brain’s wiring. Because of all our evolution, our brains are very far from purely rational — so having a good understanding of exactly how the apparatus between our ears really functions gives us a huge leg up.

A lot of [Charlie’s] wisdom was distilled into those eleven speeches. I try to re-read them every year. And, every year, I can swear that I’m reading something I’ve never read before.

After that well-deserved praise from Pabrai, it seems only fitting that we’re looking at this particular speech this week. One that editor Peter Kaufman called “the Grand Unified Theory of the Munger approach”.

In this 2003 lecture at the UCSB economics department, Charlie Munger plays the greatest hits of his collected wisdom: avoid man-with-a-hammer syndrome, build a latticework of mental models, pay great attention to psychology and second-order effects, be a reliable person, and so on.

Charlie also pointed out a troubling tendency among economists — which he cheekily dubbed “physics envy” — in which they tried to precisely analyze markets like physicists do in their field. “The craving for that physics-style precision,” he said, “does little but get you in terrible trouble.”

After all, the methodical rationality of physics bears little resemblance to the mercurial and irrational moods that rage inside Mr. Market.

Charlie linked this misguided belief to one of his favorite punching bags — the Efficient Market Hypothesis — and shared how its stubborn adherents made one of Berkshire Hathaway’s greatest investments possible.

“They taught this theory to some partner at McKinsey when he was at some school of business that had adopted this crazy line of reasoning from economics,” he said, “and the partner became a paid consultant for The Washington Post.”

“Washington Post stock was selling at a fifth of what an orangutan could figure was the plain value per share just by counting up the values and dividing. But he so believed what he’d been taught in graduate school that he told The Washington Post it shouldn’t buy [back] its own stock.”

“Well, fortunately, they put Warren Buffett on the board and he convinced them to buy back more than half of the outstanding stock, which enriched the shareholders by much more than a billion dollars.”

Highly-educated EMH scholars might have believed that the market had accurately priced The Washington Post back in the early 1970s, but Buffett’s “orangutan” math told a different story. One that made Berkshire shareholders a heck of a lot of money.

One of Charlie’s All-Time Best Lines: “I don’t use formal projections. I don’t let people do them for me because I don’t like throwing up on the desk.” 🤣

Become a paid supporter today and receive immediate access to nine (and counting) annotated transcripts full of wit and wisdom from the top names at Berkshire Hathaway.

Paid subscribers will also continue to receive a new annotated transcript each month.

The Must List

Other awesome things that I read this week…

Please Stop Asking Me When I Plan to Retire Herb Greenberg

“It’s not like you turn a certain age and can simply flip off that creative switch. You can’t. Your brain is always firing. That’s why Norman Lear was working until the day he died at 101. Or why at the age of 90, composer John Williams called off his retirement. ‘I can’t retire from music,’ he said. ‘A day without music is a mistake.’ Or 80-year-old R.L. Stine, known for the Goosebumps series of kids’ books that I used to read to my kids, once told an interviewer: ‘I don’t think writers retire. They just drop dead on their keyboards.’”

MKBHDs For Everything (Ben Thompson || Stratechery)

“Wall-E erred by assuming that every human was the same, all gleefully enslaved by AUTO, the ship’s AI. In fact, though, I suspect humanity will be distributed bi-modally, with the vast majority of people happily wearing their Vision Pros or watching their streaming service or viewing their TikTok videos, while increasingly sovereign individuals, aided by AI, pilot the ship.”

10 Interview Techniques From the World’s Best Interviewers Polina Pompliano

“If there’s one thing Oprah Winfrey has learned from conducting more than 37,000 interviews, it’s this: We all have a basic need to feel validated and understood. As soon as the camera shuts off, her interview subject often turns to her and asks the same question: ‘Was that okay?’ Winfrey says she’s heard that question from George W. Bush, Barack Obama, and Beyoncé.”

Powerful Experiences, Considering Momentum, and Casino-Like Markets Todd Wenning

“Day turned into dusk for two minutes, the temperature plunged, and in that moment you could look directly at the sun, ringed by the white glow of the corona. Birds fell silent, thinking it was night time. Planets could be seen. It was surreal. Totality must have been a terrifying sight to those who didn’t understand the science behind it, but knowing what’s going on turns it into a beautiful sight. I can understand why people chase totality around the globe to get that feeling again.”