The Berkshire Beat #62: More Proxy Talk

All of the latest Berkshire Hathaway news and my must-reads of the week!

Happy Friday and welcome to our new subscribers!

The latest news and notes out of Omaha…

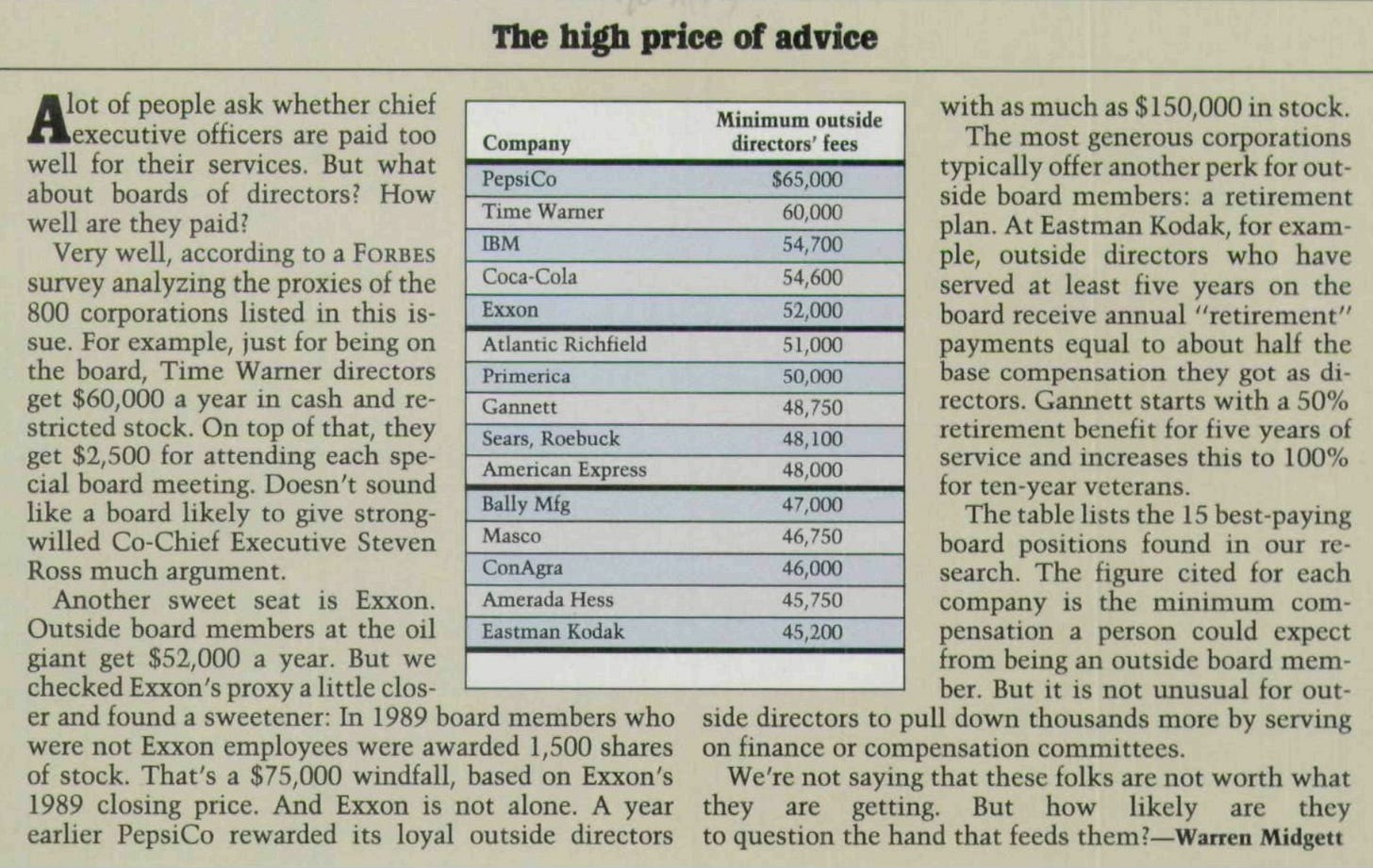

PROXY WRAP-UP: Over the weekend, I jotted down (more than) a few thoughts on Berkshire Hathaway’s annual proxy statement. If you haven’t read that one yet, please do. In it, I highlighted the relative pittance that Berkshire directors get paid to serve on the company’s board — $900 for each in-person meeting and $300 for each phone meeting. To put those numbers in perspective, check out this short Forbes article from 1990 about the munificent fees and perks lavished upon directors of that era. Today, the typical Berkshire director makes less than 1/10 of what these other board members pulled down 35 years ago. As Chris Davis said, Berkshire directors aren’t there for the paycheck — but, rather, out of a sense of duty to preserve the company’s culture.

The Rational Walk also wrote an excellent summary of Berkshire’s proxy — including one observation that deserves special mention. Unlike many of its corporate peers, Berkshire steadfastly refuses to pay stock-based compensation of any kind. If employees — from the newest recruit up to Warren Buffett himself — want to own Berkshire stock, they must purchase it with their own money. And, this year, the company stiffened the anti-SBC language in its proxy statement. “Berkshire does not grant stock options to executive officers” has been replaced by “Berkshire never intends to use Berkshire stock in compensating employees”.

MUNGER MEMORIES: Last week, I briefly mentioned Charlie Munger’s recent memorial service at the Harvard-Westlake School in Los Angeles. This was a private event for family and friends — but John Harvey Taylor of the local Episcopal Diocese put together a short recap for public consumption. And it starts with this story that is just quintessentially Charlie. “Charlie Munger, who died in November within sight of his 100th birthday on Jan. 1, fell ill at his home in Santa Barbara. When he got to the hospital, a nurse asked him how he was. ‘I’m dying,’ he said. ‘How are you?’”

His daughter, Emilie, also shared that “[Charlie] placed a call from his hospital bed to Warren Buffett” before he passed away.

MORE MUNGER: François Rochon also paid tribute to Munger in his annual letter to Giverny Capital partners. “To me, Charlie was the triumph of erudition, rationality, and honesty … He yearned to always know more about everything.”

OCCIDENTAL PETROLEUM: On Monday, Occidental Petroleum CEO Vicki Hollub spoke to Yahoo Finance at the CERAWeek energy conference about all of the latest goings-on at the Berkshire-backed O&G giant.

The $12 billion CrownRock acquisition is all about scale, efficiency, and shareholder value. “In the Permian Basin,” Hollub says, “we had a very large position in the Delaware and that gave us the scale we need to bring efficiencies of not just proximity but of size.” And CrownRock’s inventory will allow Occidental to apply that same formula in the Midland Basin. “It will be 1 + 1 equals more than 2.”

Share repurchases on pause. “Over the next couple of years, we’ll continue to pay debt down,” she says. “[After] those two years, we’ll get back to repurchasing shares. We’ve had a very healthy repurchase program over the past couple of years because of the fact that our stock right now is very undervalued.”

Occidental is perfectly positioned for Direct Air Capture. “We’ve actually been using carbon dioxide for enhanced oil recovery for more than 50 years,” Hollub says, “so that’s a core competence for us.” Add in the company’s expertise with PVC and potassium hydroxide — key elements of the DAC process — and “it was like this was meant for us to do”. She even described it as “like the Holy Grail for us”.

Hollub also announced that Occidental has already sold about 70% of the carbon reduction credits for its STRATOS facility in the Permian, which should be operational sometime next year. Time will tell, though, about this nascent technology’s ultimate profitability.

APPLE & AI: The specter of artificial intelligence has hung over Apple like a storm cloud in recent months, with precious little known about the Cupertino-based company’s efforts in this arena other than CEO Tim Cook’s assurance that something would be revealed later this year. But, just this week, multiple outlets reported that Apple is in preliminary talks with both Google (Gemini) and OpenAI (ChatGPT) about licensing their generative large-language models for use in iPhones and other devices.

At the same time, Apple engineers quietly released a research paper detailing the company’s own generative AI model — known as MM1 — which claims to work seamlessly with both images and text. Here’s what Wired had to say: “One example in the Apple research paper shows what happened when MM1 was provided with a photo of a sun-dappled restaurant table with a couple of beer bottles and also an image of the menu. When asked how much someone would expect to pay for ‘all the beer on the table’, the model correctly reads off the correct price and tallies up the cost.”

TROUBLE ON THE RAILS: Last week, BNSF Railway executive director Lena Kent warned that a new rule by the California Resources Board — which would mandate all-electric locomotives by 2035 — could endanger the company’s $1.5 billion Barstow International Gateway project. “We let the state know if that [rule] were to go through and be implemented, BNSF would not be able to build this project,” said Kent. “We don’t even know how much we’d be able to operate in the state of California.”

AND A FEW ODDS & ENDS…

In unhappy news for Apple, the U.S. Department of Justice filed suit yesterday against the iPhone maker for alleged antitrust violations. Apple responded that, if successful, this lawsuit would “set a dangerous precedent” by “empowering government to take a heavy hand” in the design of technology. Apple called it “wrong on the facts and law” and pledged a vigorous defense against all charges.

Apollo Global Management reportedly submitted an $11 billion offer for the Paramount Pictures film studio, but the Financial Times says that Shari Redstone prefers a rival deal from David Ellison and RedBird Capital.

This month’s (much-anticipated) annotated transcript for paid supporters will be sent out early next week. This is a fun one — an old interview with one of Berkshire’s superstars who typically prefers to stay out of the spotlight.

A Slow Read of Poor Charlie’s Almanack

Talk 5: The Need for More Multidisciplinary Skills from Professionals — Educational Implications

After so many speeches in which Charlie Munger addressed college students trying to learn from his example — the tables are turned a little bit with this one. Here, Charlie speaks before his fellow classmates from the Harvard Law School Class of 1948 on the occasion of their fiftieth reunion.

And, once again, he emphasizes the critical importance of a multidisciplinary base of knowledge — and warns against allowing your intellect to become pigeonholed in one area. In particular, Charlie lauds one of his classmates, Roger Fisher, for introducing lessons about negotiation into law school classes. This cross-pollination of disciplines earns the very highest of praise from Munger: “[Roger’s] life achievement may well be the best — ever — from our whole class.”

But it’s not just that a multidisciplinary mindset leads to better results. It actually changes everything. The way you think, perceive, interact, and more — all undeniably changed for the better. And once you’ve achieved this intellectual nirvana, there is no going back. “The happier mental realm I recommend is one from which no one willingly returns,” Charlie says. “A return would be like cutting off one’s hands.”

Quote of the Week: “In filling scarce academic vacancies, professors of super-strong, passionate political ideology — whether on the left or right — should usually be avoided. So also for students. Best-form multidisciplinarity requires an objectivity such passionate people have lost, and a difficult synthesis is not likely to be achieved by minds in ideological fetters.”

Become a paid supporter today and receive immediate access to eight (and counting) annotated transcripts full of wit and wisdom from the top names at Berkshire Hathaway.

Paid subscribers will also continue to receive a new annotated transcript each month.

The Must List

Other awesome things that I read, watched, and listened to this week…

🎧 Survive & Thrive with Guy Spier (William Green || Richer, Wiser, Happier)

“It’s so scary to tell the truth because you don’t know where it will go. My experience has been that whenever you do tell the truth, God smiles … [Since] I started telling the truth, life has been an extraordinary adventure.”

Graham’s “Unpopular Large Caps” Part 2: Thoughts on Diversification John Huber

“Each investor has their own ‘correct’ level of diversification that matches their investment style and perhaps more importantly, their personality. My view on diversification is this: the minimum level of diversification you need is the level that allows you to ‘zoom out’, meaning the level that allows you to behave in a rational manner at all times … I think the behavioral tendencies of the person managing the portfolio are just as critical as the stock selection.”

Giverny Capital Annual Letter 2023 (François Rochon)

“There will always be investors who want to try to predict the stock market despite all the studies which demonstrate the futility of such a quest. The intentions of these investors are laudable (optimizing the return on their capital), but they remain illusory … The reasons provided change from one year to the next, but it always comes down to the same mistake: depriving oneself of owning quality companies out of fear of macroeconomic and/or political events (which are undoubtedly temporary in nature).”

Signs of a Good Investment Process, Revisited Todd Wenning

“Over a long enough timeframe, every process will face an existential crisis. It could be due to prolonged underperformance or a single stock blowing up, but the tenets of the process will be challenged and doubted. When that happens, you either reaffirm your approach and rebuild upon it or become untethered. As such, it’s preferable to base it on timeless principles.”

Why I Started Renting DVDs Again: Quantifying a Silly Thing Daniel Parris

“So much of my life is built around efficiency — streamlining my day-to-day in order to save the most money and time — it’s nice to do something against my better judgment. With each DVD rental and its myriad inconveniences, I stray further from Homo economicus, pursuing something irrational, purposeful, and decidedly human.”

Trains can move one ton of freight about five hundred miles on a single gallon of diesel fuel. The state of California’s stance on fossil fuels is better compared to the articles of faith of a religion than sound public policy.