The Berkshire Beat #57: Warren Buffett’s Mystery Stock Remains… Well, A Mystery

All of the latest Berkshire Hathaway news and my must-reads of the week!

Happy Friday and welcome to our new subscribers!

The latest news and notes out of Omaha…

It’s a Valentine’s Day tradition unlike any other: Feverishly refreshing the SEC website starting at 4 p.m. waiting for Berkshire Hathaway’s 13F to be released. I always eagerly anticipate this quarterly peek behind the curtain at Berkshire’s investment activity, which affords all of us the opportunity to learn more about how Warren Buffett and co. ply their trade.

But, as it turns out, the most interesting part of this week’s filing is what wasn’t there. Namely, the identity of the mystery stock that Berkshire has been purchasing over the past two quarters. (For those in need of a quick refresher, Berkshire omitted one or more holding(s) in Q3 2023 after requesting — and receiving — confidential treatment from the SEC. This, in turn, fueled a ton of speculation and sleuthing in shareholder circles. Most now agree that this unnamed purchase likely belongs to the “Banks, Insurance, & Finance” category of stocks.)

Everyone expected the guessing game to end on Wednesday — when Berkshire would file an amended 13F for the third quarter and reveal the identity of the mystery stock. Nope. The SEC threw us a curveball by granting confidential treatment once again. So now we wait. Maybe next quarter.

Why all the secrecy? Well, it certainly suggests that someone at Berkshire has been snapping up shares in this mystery company during the past two quarters — and anticipates adding even more in Q1 2024. Impossible to say for sure at this point, but this could wind up being a pretty significant position when it’s all said and done.

The rest of the 13F filing mostly went to form. Of note, though, is Berkshire’s sale of 10 million shares of Apple. Notice I said Berkshire, and not Buffett. This could easily be Ted Weschler paring back his smaller holding of AAPL 0.00%↑ stock. On more than one occasion, Buffett has referred to his past trimming of Apple as a mistake — and sometimes gives the impression that he views his stake in the company as a permanent position. Maybe he will shed some light on this decision at the annual meeting in May. (Okay, that’s probably wishful thinking.)

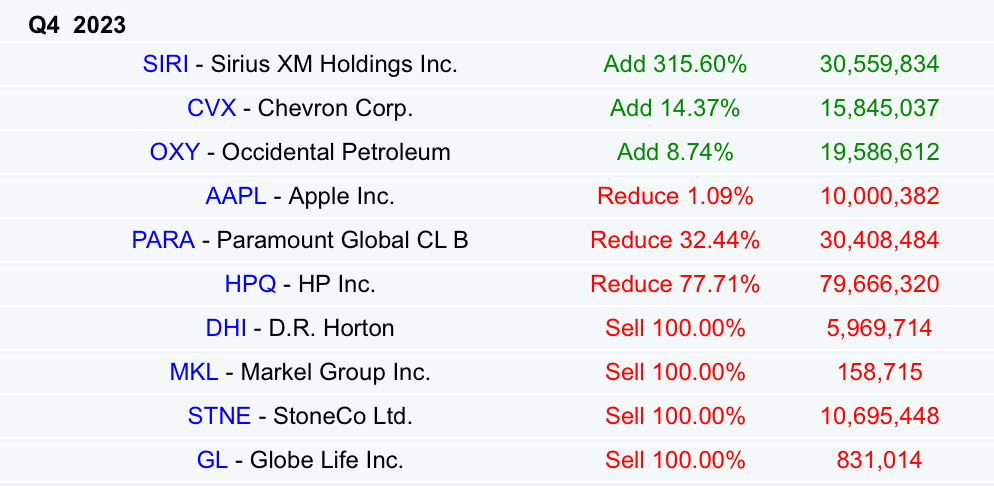

Berkshire also added to three of its existing positions (Sirius XM Holdings, Chevron, and Occidental Petroleum). In Chevron’s case, that’s now fourteen — yes, fourteen — consecutive quarters that Buffett has either bought or sold shares of the California-based oil major. That’s got to be some kind of record.

Over on the chopping block, Berkshire fully exited D.R. Horton, Markel, StoneCo, and Globe Life — while also slashing Paramount Global by 32.4% and HP by 77.7%. Wouldn’t be at all surprised to see HP gone by next quarter.

Another week, another new all-time high for Berkshire. Both the Class A shares ($608,500) and Class B shares ($404.27) set new price records yesterday.

On Monday, analyst Dan Ives of Wedbush Securities spoke to CNBC about Apple. “A year from now,” he waxed, “we’re going to see AAPL 0.00%↑ at a $4 trillion market cap.” (Currently: $2.84 trillion.) His bullish view mostly stems from the iPhone maker’s impending entrance into the AI arms race and better-than-expected sales of the Vision Pro headset. “We originally had 300,000 [sales projected] in terms of Vision Pro units for the year. Now, it’s 600,000.”

🤑 Speaking of Apple, the Cupertino-based tech giant paid out $217.3 million in quarterly dividends to Berkshire yesterday. Even after trimming those 10 million shares in Q4 2023, Apple remains — by far — the largest holding in Berkshire’s massive stock portfolio at a current value of $166.5 billion.

Berkshire also pocketed dividends of $8.7 million from Ally Financial and $2.5 million from Aon this week.

LPL Financial recently helped create a six-week course for San Diego-based high school students to better prepare them for their financial futures. Not surprisingly, the curriculum is heavily based on Warren Buffett’s annual letters. LPL calls Buffett “a near-perfect capitalist — the kind of citizen capitalist who follows a principled, fair approach. And we need more citizen capitalists.” In particular, students will read and ponder Buffett’s letters from 1983, 1995, and 2022 (among many others).

Ralph Bender of Enduring Wealth Advisors summed up the potentially life-changing benefits for these young investors: “People who understand how to handle money are more likely to succeed than others. And since compounding works over time, the earlier one discovers how to get and stay on the right side of it, the greater their chances for opportunity.”

A Slow Read of Poor Charlie’s Almanack

Talk 2: A Lesson on Elementary Worldly Wisdom as It Relates to Investment Management and Business (Part One)

Executive decision: I’m splitting this rather lengthy commentary into two parts.

Professor Guilford Babcock’s students could not possibly have known what they were in for when Charlie Munger strode to the front of the class on April 14, 1994. The Berkshire Hathaway vice-chairman launched right into a wide-ranging discourse on how best to cultivate a sense of “worldly wisdom” in one’s own life — and how doing so would surely bear abundant (not to mention profitable) fruit.

Happily, Charlie’s speech that day can be neatly divided into two equal parts. First, a detailed explanation of how anyone can acquire this worldly wisdom. And, second, how such a lofty corpus of knowledge — so assiduously pieced together — can then be applied to so profane a task as stock-picking.

He compared this dichotomy to his grandmother’s rule that everyone had “to eat the carrots before you get the dessert”.

So, today, we’re eating carrots. 🥕

Charlie’s definition of worldly wisdom basically boils down to learning the big ideas from a wide range of disciplines and then turning them into mental models.

The operative word being “wide”. Charlie warned that if you fail to cast your net widely enough when accumulating wisdom, you risk falling into the specialist’s trap: defaulting to your favored realm of expertise no matter the problem. Even if other disciplines would prove far more effective.

Or, to paraphrase the old saw: To the man with a hammer, everything looks like a nail.

“That’s a perfectly disastrous way to think,” Charlie said, “and a perfectly disastrous way to operate in the world.”

He then rattled off a few of his favorite “big ideas” — displaying the breadth of know-how needed to truly achieve worldly wisdom:

Mathematics: Start with a basic grasp of numbers and work your way up to a serious study of probability. As Charlie so colorfully put it, “If you don’t get this elementary — but mildly unnatural — mathematics of probability into your repertoire, then you go through a long life like a one-legged man in an ass-kicking contest.”

He also pointed out that Warren Buffett “automatically thinks in terms of decision trees and the elementary math of permutations and combinations”. That’s the goal — internalizing these big ideas so effectively that they become second nature.

Engineering: To Charlie, concepts such as backup systems, breakpoints, and critical mass “have great utility in looking at ordinary reality”.

Biology: “All of us are programmed by our genetic makeup to be much the same.”

Psychology: “Ungodly important,” noted Charlie. Later in the Almanack, he goes into much greater detail on this topic in “The Psychology of Human Misjudgment”. We’ll get to that one in a few months.

Microeconomics: The advantages (and disadvantages) of scale and how technology can disrupt — and destroy — businesses.

These all combine to form what Charlie called “the general substructure of worldly wisdom”. And, now, it’s up to each one of us to assemble our own collection of mental models for the many challenges in life and business that lay ahead.

Become a paid supporter today and receive immediate access to seven (and counting) annotated transcripts full of wit and wisdom from the top names at Berkshire Hathaway.

Paid subscribers will also continue to receive a new annotated transcript each month.

More Must-Reads

Other awesome things that I read this week…

The Berkshire Hathaway Playbook The Rational Walk

“It is insufficient to simply purchase businesses and allow CEOs free rein. Much effort was made to select subsidiaries that not only had solid economics but already had capable and honest management in place. Berkshire would offer a fair price for these subsidiaries without the drama typical in acquisition activity … CEOs of subsidiaries, while almost always already securely rich, would stay on board because they loved the business and drew energy from it.”

🎉 Today is The Rational Walk’s 15th blog anniversary. It’s no exaggeration to say that Kingswell would not exist in its current state (with 5,000+ subscribers) if not for RW’s kindness and support back in the early days. Congratulations — and here’s to the next fifteen years!

A Buffett Protégé Makes an Offbeat Bet: Buy San Francisco Real Estate (Wall Street Journal || Matt Wirz)

“[Buffett] hinted that he might find a project for [Ian] Jacobs if he was ever in Omaha, Neb., where Berkshire is located. Jacobs showed up in the summer of 2002 and landed a job doing financial analysis for his idol. After Jacobs left to start his own investment firm in 2009, Tracy Britt took over the job.”

For The Person Who Has Everything Tom Morgan

“But how do you know where to steer your car or point your arrow? The short answer is wisdom. Wisdom isn’t about intelligence stuck inside your head, it’s about how effectively you can interact with subtle relational forces in the world around you. These can feel like love, aliveness, novelty, interestingness, excitement, curiosity, or attraction. And they are fundamentally non-verbal, right-hemispheric intuitions.”

Ben Graham’s Train Station Blunder (Beyond Ben Graham)

“As we see from Ben Graham’s choice of reading material during his solo night at Pavonia Terminal, this boy thirsted for knowledge and devoured challenging literature — more than any other teenager I’ve known. He’d rather devote his time to education than entertainment.”

One of the few Newsletters worthy reading! Congrats to the writer.

Thanks for your kind words, much appreciated! Congratulations on reaching 5000 subs!