The Berkshire Beat: January 19, 2024

All of the latest Berkshire Hathaway news and my must-reads of the week!

Happy Friday and welcome to our new subscribers!

The latest news and notes out of Omaha…

After countless twists and turns, Berkshire Hathaway — finally — owns 100% of Pilot Travel Centers. On Tuesday, per the terms of last week’s settlement, the Haslam family sold its remaining 20% interest in Pilot to Warren Buffett and company. “While this has certainly been an emotional decision for us,” founder Jim Haslam II said in a statement, “it is one we felt was right for our family at this time.” No word yet on exactly how much Berkshire paid to complete the acquisition. But I, for one, am glad that this soap opera is over.

Berkshire bought 2.8 million more shares of Liberty Media SiriusXM (Series A & C) tracking stock between January 12-17. In all, an outlay of $85 million. The LSXM trackers remain priced at a significant discount ahead of the proposed combination with Sirius XM Holdings in Q3 2024.

Earlier this week, Sumitomo CEO Masayuki Hyodo seemingly suggested that Berkshire had recently upped its stake in the sogo shosha. “Through the information I have, [Berkshire’s stake] is increasing — not only Sumitomo, but all five trading companies,” he told Barron’s at the World Economic Forum meeting in Davos. “His share is increasing every day.” This news caused the price of the Japanese trading houses to jump by as much as 3-5% in response.

But… Sumitomo quickly characterized this “news” as one big misunderstanding. “Although there have been media reports on January 16 referencing remarks by Masayuki Hyodo, our President and CEO, with respect to Berkshire Hathaway … we wish to clarify that the remarks were mentioned and stated as a ‘possibility’.”

The company added: “The most current information we have about [Berkshire’s] shareholding ratio is 8.23% … as of June 12, 2023.”

🤑 The rich get richer: On Tuesday, Berkshire collected over $200 million in quarterly dividends from Occidental Petroleum. That includes $41.0 million via the common stock position and $169.8 million via the preferred shares from the Anadarko deal. Despite several erroneous reports last week, Berkshire continues to own 27.7% (not including unexercised warrants) of the O&G giant.

FYI: Berkshire bought 15.7 million shares of OXY 0.00%↑ back in December, but those purchases occurred after the record date for this dividend payment.

Jacob McDonough’s excellent book about Berkshire — Capital Allocation: The Financials of a New England Textile Mill (1955-1985) — is now available as a free PDF download. A must-read for Berkshire and Buffett fans.

In 2023, BNSF Railway recorded its lowest injury frequency rate in the company’s 175-year history. From the press release: “BNSF … operated its 32,500-mile network without loss of life, and with the fewest number of employee injuries ever. Employee injury rates decreased more than 20%, and injury severity was down nearly 35%, year over year, leading the industry in safety.”

CEO Katie Farmer: “Our performance in 2023 is a giant step forward in bringing us closer to our ultimate safety vision of a workplace free of accidents and injuries. This monumental achievement is a credit to the commitment and passion for safety demonstrated by everyone at BNSF, especially our Operations teams.”

Berkshire owns 5.9% of Apple — a position currently valued at $172.7 billion — so I try to keep an eye on what’s happening out in Cupertino. And, on that front, it’s been a pretty busy few days…

AAPL 0.00%↑ has gotten off to a scuffling start in 2024 — down 2.0% in the new year and seeing Microsoft usurp its spot as the world’s most valuable company. But here’s a little good news: According to the International Data Corporation, Apple was — for the first time ever — the top smartphone seller (by units) in the world last year.

The iPhone maker’s 20.1% market share narrowly edged out Samsung’s 19.4% — ending the Korean company’s 12-year reign as top seller.

Yesterday, Apple removed the blood oxygen functionality from newly-sold Apple Watch Series 9 and Ultra 2 models to comply with the ITC’s import ban. This is far from ideal, but the sensor could still be re-activated by a software update if Apple wins its appeal against Masimo.

Just this morning, Apple opened up preorders for its Vision Pro mixed-reality headset — with the official launch slated for February 2. My snap judgment from June remains pretty much unchanged: “This certainly looks like it could become the interface of the future, but Apple’s Vision Pro remains several years away from being a super-compelling consumer item. The to-do list: A lower price, a more streamlined form factor, and lots and lots of apps. (Still, I’m pretty impressed with the marker that Apple just laid down in the nascent headset/meta wars.)”

For the time being, though, the $3,499 price tag is sadly outside my budget.

A Slow Read of Poor Charlie’s Almanack

Chapter One: A Portrait of Charles T. Munger

In this opening chapter of Poor Charlie’s Almanack, historian Michael Broggie provides a biographical sketch of the Berkshire Hathaway vice chairman. The broad outline of Charlie’s life is pretty well known to Berkshire fans, so I won’t belabor the point with a detailed recounting of the highs and lows.

But Broggie astutely highlights a particularly pivotal moment in Charlie’s development as both a man and an investor: growing up during the Great Depression.

And while the economic calamity did not touch the Munger household directly, he nevertheless had a front row seat to the devastation and panic that it caused. As well as how the bonds of family, loyalty, and trust can keep the wolves away from the door even under the very worst of conditions.

Charlie has spoken about walking through a “hobo jungle” near his home in Omaha, where displaced and desperate men — suddenly out of work with nowhere else to turn — lived on the streets and begged for handouts and sustenance. His father’s prosperous law practice carried Charlie’s immediate family through the Depression, but the young boy was nevertheless confronted with the stark reality of that era every time he walked out the front door.

Charlie’s extended family also had its share of troubles. One uncle’s bank nearly went bust until Grandfather Munger — a federal judge — bailed him out by trading $35,000 in stable mortgages for an equal amount of the beleaguered bank’s weakest assets. This magnanimous move shored up the bank’s balance sheet and allowed it to survive the week-long bank holiday in 1933.

Judge Munger also stepped in when his son-in-law’s music career flamed out. “So my grandfather, who didn’t have that much money, sent him to pharmacy school — carefully picking a profession that couldn’t fail — and found him a bankrupt pharmacy to buy and loaned him the money,” Charlie once said. “My uncle was soon prosperous and remained prosperous the rest of his life.”

In both cases, Charlie witnessed how conservative money management put his grandfather in position to weather the economic storm — and to ensure that his family made it through, too.

This experience, no doubt, helped to shape Charlie into the exemplar that he would ultimately become: one especially concerned with society and the people around him, who shared his lessons and advice freely, and who always put his family first.

Other highlights from Chapter 1…

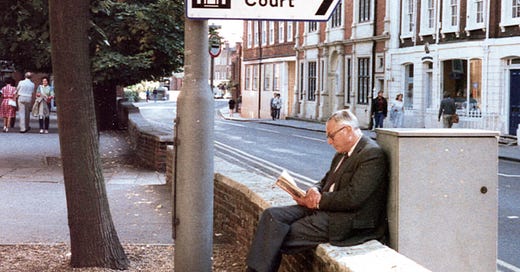

Alongside this chapter, the Stripe Press website edition includes some old photos from Charlie’s life. These two, in particular, show that he was never far away from a good book — even while on vacation or out and about with his wife.

In the early days of their friendship, Charlie exchanged many letters with Warren Buffett — at least one of which, Broggie writes, was nine pages long. It would be amazing if some (or all) of these letters could be made public someday — or, at least, preserved in an archive for research purposes. Fingers crossed.

Great line: “Despite his healthy self-image, Charlie would prefer to be anonymous.”

Become a paid supporter today and receive immediate access to six (and counting) annotated transcripts full of wit and wisdom from the top names at Berkshire Hathaway.

Paid subscribers will also continue to receive a new annotated transcript each month.

More Must-Reads

Other awesome things that I read (and listened to) this week…

“So, no lists, but some simple advice: Read, synthesize ideas, try them, abandon those that aren’t working, try new ones, read some more. Tell people about your hopes and goals. Listen for good advice; it does exist. But ruthlessly remove the bad advice, the naysayers, the permanent pessimists. Keep your mind wide open to ideas; indeed, read and understand those you might have an aversion to so that you improve your understanding and knowledge.”

🎧 High Conviction Value Investing with Chris Davis (Excess Returns || Validea)

“Berkshire has been unconventional enough that I can imagine all sorts of people coming out of the woodwork [after Warren and Charlie are gone] with shareholder proposals to unlock short-term value at the expense of long-term value … It will be the job of the board to protect that culture.”

“The long and short of it is that specialists can easily succumb to cognitive dissonance; the tendency to block out information that is contrary to your strongly held beliefs. Specialists can also fall victim to the inside view, while generalists are more suited to adopting the outside view; the ability to assess scenarios from an external perspective, taking into account a broad array of factors and historical contexts. The stock market megaphone rings 24 hours a day, 7 days a week. In no place is this more evident than in mainstream media and platforms like Twitter.”

Warren Buffett’s Plane-Parts Business Stands to Lose from Boeing’s Latest Blunder (Theron Mohamed || Business Insider)

“Precision [Castparts] has suffered from Boeing’s previous problems. The key aerospace division was hit by production delays in Boeing’s 737 Max and 787 programs in 2019, 2020, and 2021, Berkshire’s annual report said last year. Boeing’s 737 Max fleet was grounded worldwide after two fatal crashes, and the company faced quality issues with the 787.”

Would love to read your thoughts if you get around to researching it - thank you!

Thank you for the great post as always! Would be interested in digging more into what their assumed thesis is for the Liberty trade. I haven’t looked at it beyond what you’ve noted in your posts, but could be worth a closer look. Liberty (Malone) is known for their financial engineering!