The Berkshire Beat: December 15, 2023

All of the latest Berkshire Hathaway news and my must-reads of the week!

Happy Friday and welcome to our new subscribers!

The latest news and notes out of Omaha…

On Monday, Occidental Petroleum announced the acquisition of CrownRock — a coveted Permian Basin oil producer — for $12 billion (including assumed debt). CrownRock boasts 94,000 net acres in the Permian, with a particular concentration in the Midland Basin where Oxy desperately needed more scale. To finance this deal, Vicki Hollub and co. will issue $9.1 billion of debt and $1.7 billion of common stock. Adding CrownRock to the family should prove immediately accretive to free cash flow and will also allow Oxy to divest at least $4.5 billion of certain non-core assets to reduce the overall debt load.

Hollub then hopped on CNBC and tackled a couple of burning questions:

Did Berkshire Hathaway provide any financing? “Berkshire and Warren Buffett were helpful with the Anadarko acquisition [in 2019]. We wouldn’t be in the position we are had it not been for Berkshire and Warren Buffett — [but] we didn’t need help with this deal.”

What about Oxy’s private plane spotted in Omaha? “The jet was there,” she confirmed. “I’m not always [in Omaha] to talk about business. I talk about other things with Warren Buffett. He’s an amazing person to get the opportunity to speak to and I feel grateful and fortunate that I’m able to go and have opportunities to speak to him.”

Alongside the CrownRock acquisition, Oxy also announced a 22% dividend hike coming in the new year. Good news for the oiler’s largest shareholder.

🤑 Speaking of dividends, Berkshire received $166.5 million in quarterly dividends from Chevron on Monday. (Assuming, of course, that Buffett did not sell any more shares in the first half of Q4…) Despite paring back on CVX 0.00%↑ in four consecutive quarters, Berkshire still owns 5.9% of the oil major — a position currently valued at $16.5 billion.

And, today, Berkshire is also set to collect $184 million from long-time holding Coca-Cola and $18.9 million from Moody’s.

It’s probably safe to say that Buffett approves of the CrownRock deal. After all, he bought 10.48 million more shares of Occidental Petroleum in the three days following the big announcement at prices ranging from $55.125 to $57.27. That’s good for a total outlay of $588.7 million and boosts Berkshire’s stake in the O&G giant up to 27.1%.

And let’s not forget about those warrants for another 83.8 million shares of common stock. Assuming that Berkshire eventually exercises them at the agreed-upon price of $59.62 per share, it would then own 33.4% of Oxy. 👀

We stopped getting regular updates on HP in early October after Berkshire’s stake dipped under 10% following a period of sustained selling. Well, a new SEC filing reveals that the sell-off continued apace thereafter — with Berkshire’s position withering to just 5.2% as of November 30. To put that in perspective, Buffett and co. owned over 11% of the printer and PC maker a year ago. (And there’s no reason to think that Berkshire stopped selling in December, either.)

The great William Green (of Richer, Wiser, Happier fame) released a special episode of his podcast over the weekend to celebrate the life and legacy of Charlie Munger. It features memorable clips from past conversations — with big names like Mohnish Pabrai, Tom Gayner, Joel Greenblatt, and Chris Davis — as well as Green’s own recollections of meeting Munger. A must-listen for all Charlie fans.

Berkshire’s legal battle with the Haslam family is never boring. During a court hearing on Wednesday, a Pilot lawyer revealed that “Jimmy Haslam is under investigation by federal prosecutors looking into whether he offered illicit payments to executives at Pilot Travel Centers”.

This likely stems from allegations that Haslam offered secret payments to Pilot execs to inflate current-year earnings in order to get a higher price for the family’s remaining stake from Berkshire. Tsk tsk.

This month’s annotated transcript “bonus” for paid subscribers — which, of course, will feature Charlie Munger — comes out on Monday!

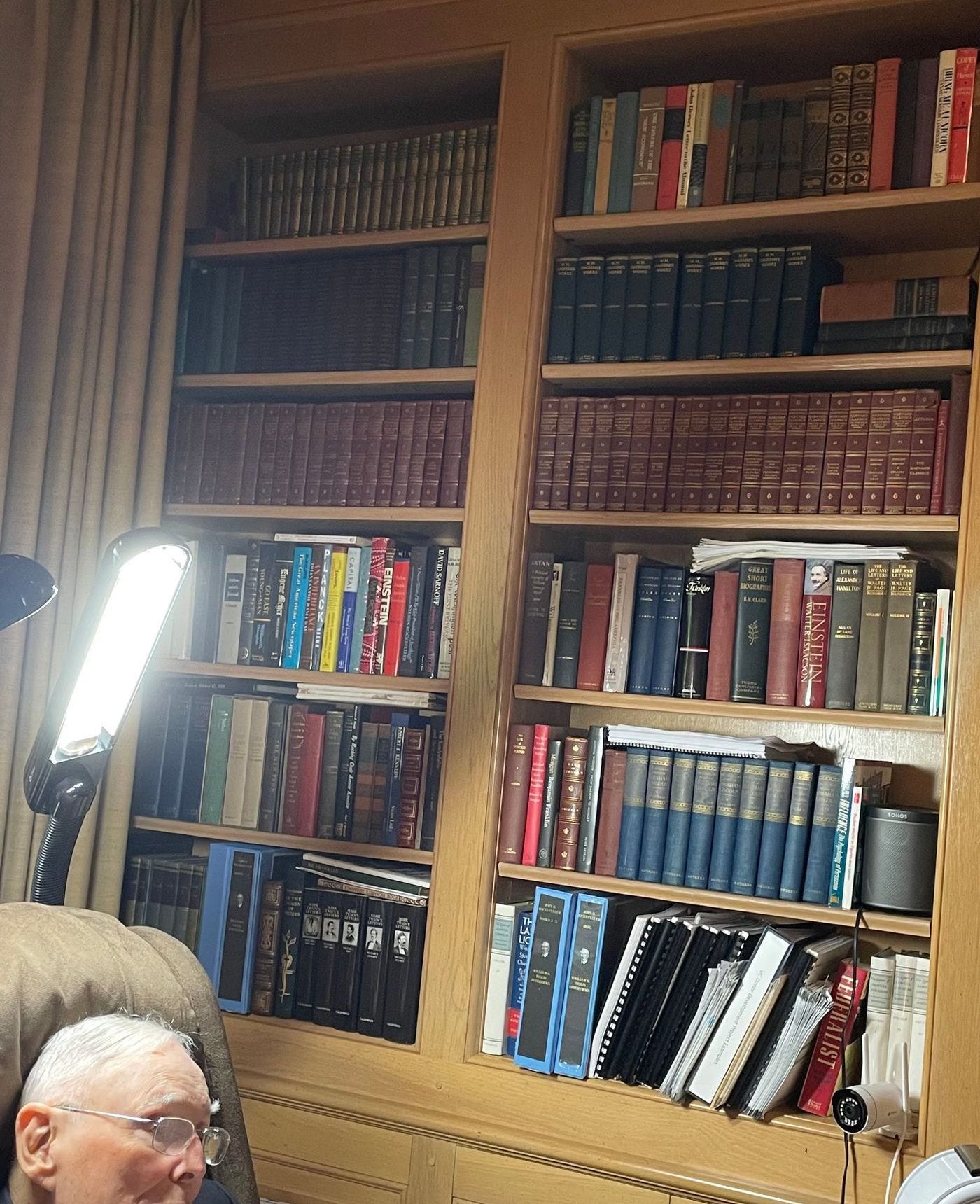

A Closer Look at Charlie Munger’s Bookshelf

In a recent Wall Street Journal article — “My Morning With Charlie Munger” — the author included a photo of Charlie’s bookshelf. (One of many, I assume, in his library.)

And, while it’s not exactly a high-resolution photo, it does grant us a rare peek inside the late polymath’s inner sanctum — and a better understanding of his prodigious reading habits.

I posted this photo on Twitter/X earlier this week and many people (with much better eyesight than me) have been chiming in and identifying the books on Charlie’s shelves. No surprise here — I count lots and lots of biographies. As well as several collections of timeless works like the Harvard Classics.

But there are some obscure choices, too. Like William O. Inglis’s interviews with John D. Rockefeller — collected here in blue-rimmed binders on the lowest shelf. Or the two-volume Life & Letters of Walter H. Page (who served as U.S. ambassador to Great Britain during World War I).

If you recognize any of the books on Charlie’s bookshelf, please drop its name down in the comments. I would love to compile as complete a list as possible of these books. (And, of course, send it out to everyone in a future newsletter.)

Another interesting nugget from the same WSJ article:

To Munger’s left sat a small wooden table with two oversize and worn Value Line binders featuring details of various companies. Munger said he relied on these relics of a bygone era to evaluate new investments.

“They’re easy to navigate and you get a good overview of companies,” he explained.

Score one for Value Line, I suppose.

Become a paid supporter today and receive immediate access to five (and counting) annotated transcripts full of wit and wisdom from the top names at Berkshire Hathaway.

Paid subscribers will also continue to receive a new annotated transcript each month.

More Must-Reads

Other awesome things that I read this week…

“Machiavelli warns rulers to be on guard against those who do not see men as they are, and see them through spectacles colored by their hopes and wishes, their loves and hatreds, in terms of an idealized image that they want men to be, and not as they are.”

“Progress in the inner dimension is discontinuous. Nothing may happen for a long time, then suddenly everything shifts. Or things are turned upside down in a few minutes or hours and it takes years for you to fully process and integrate what you learned … The inner game requires investment and curiosity without expectations. It asks that you surrender to the process and drop the idea of progress on a particular time frame. Here, the concept of a year has no meaning. Stop grasping and, suddenly, flow will take you up to the next level.”

Suppose I Wanted to Kill a Lot of Pilots (But What For?)

“Charlie [Munger] inverted the problem in a similar way to the TRIZ practitioners — if he wanted to kill pilots, he could get them into icy conditions whereby they couldn’t continue flying, or put them in situations where they would run out of fuel and fall into the ocean. So he drew more applicable maps and better predicted the weather factors that were relevant by keeping in mind the best ways to do the exact opposite of bringing his pilots home.”

“Safari launched a slew of features this past June focusing on privacy and seamless experience for users who are part of the Apple ecosystem. That seems to have worked well because Safari quietly gained significant market share [among web browsers].”

As promised - I tried again and didn't get much better results... but here is what I have so far:

Autobiography of Benjamin Franklin

Capital (El Capital) by Karl Marx

David Sarnoff: A Biography by Eugene Lyons

Einstein by Walter Isaacson

Go East Young Man by Justice William Douglas

Great Short Biographies by B. H. Clark

Harvard Classics: The Five Foot Shelf of Books (~1910 version, I believe)

Influence by Cialdini

Planck: Driven by Vision, Broken by War by Brandon Brown

The Federalist by Jacob Cooke

The Great American Newspaper: The Rise and Fall of the Village Voice by Kevin McAuliffe

The Life and Letters of Walter H. Page by Burton Hendrick

Will Rogers: The Man and His Times by Richard Ketchum