The Berkshire Beat: December 1, 2023

RIP Charlie Munger 💔😢

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

On Tuesday, Berkshire Hathaway vice chairman Charlie Munger passed away at the age of 99. “Berkshire Hathaway, a few minutes ago, was advised by members of Charlie Munger’s family that he peacefully died this morning at a California hospital,” read the press release. “Warren Buffett wishes to say: ‘Berkshire could not have been built to its present status without Charlie’s inspiration, wisdom, and participation.’”

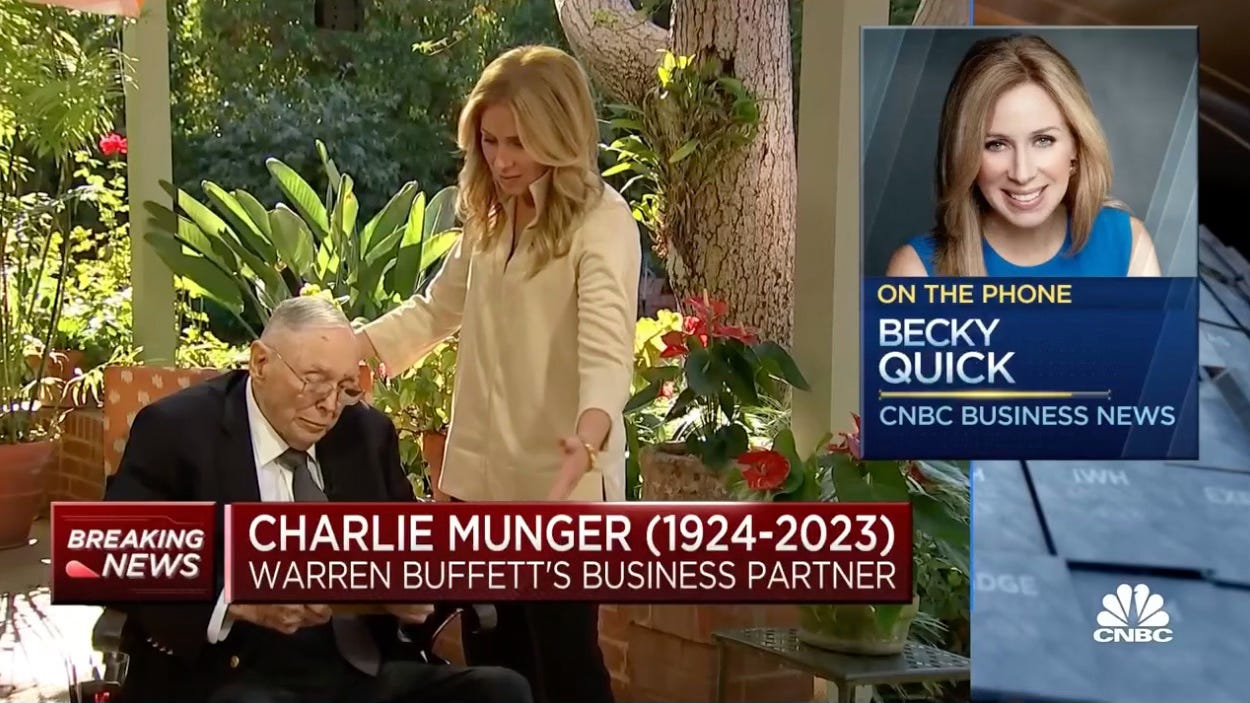

Becky Quick, who recently visited with Munger at his home in Los Angeles, called into CNBC on Tuesday afternoon and offered a fitting tribute to one of the GOATs.

“[Warren Buffett and Charlie Munger] were partners on so many different levels. They worked together for so many years. Charlie was a vice chairman at Berkshire Hathaway for 46 years … [but] that alone doesn’t describe the impact he had on building Berkshire.”

“Charlie Munger’s thinking really influenced Warren Buffett and how he built Berkshire from 1962 on. They were friends and collaborators and, while Charlie didn’t have an ownership stake at that point, he was actively involved with extending Warren Buffett’s mind and how he thought about investing.”

He said to look for great companies at decent prices. Not good companies at cheap prices. The cigar butt [investor], that was the earlier version of Warren. Charlie Munger told him, ‘Don’t worry about the textile mills. Just look for other great companies and build around that.’ And [Warren] did.”

“I was in Los Angeles two weeks ago to sit down with Charlie Munger at his home … Even two weeks ago, he was in fine form mentally. I was really able to go through and talk about his life and things he’s learned along the way.”

Here at Kingswell, the month of December will be dedicated to the memory and legacy of Charlie Munger. Until the very end, he remained the unwavering moral center of not only Berkshire Hathaway, but the investment world as a whole. Imparting lessons for a life well lived just as often as he did for compounding wealth.

So, over the next month, I’ll do my best to explore some of the most fascinating aspects of his life and career.

In the meantime, though, here’s a brief selection of old Munger-related articles from the Kingswell archive:

Other news and notes out of Omaha…

Earlier this week, Berkshire Hathaway countersued the Haslam family for allegedly promising secret payments to Pilot staff in an attempt to inflate the company’s value and, thus, make more money on the eventual sale of its remaining 20% stake. According to the lawsuit, Jimmy Haslam promised “massive side payments” to Pilot execs to make short-term decisions — which boosted earnings — at the expense of what was best for the company in the long run.

All in an effort to add a few more bucks to the company’s valuation when the Haslams sell the remaining 20% interest to Berkshire. Allegedly.

Berkshire’s countersuit characterizes Haslam’s actions as an “outrageous and illegitimate scheme”. It adds: “By secretly distorting the incentives of [Pilot] employees for personal gain, Haslam breached the fiduciary duty he owes to [Pilot and Berkshire].”

I’ve always liked Pilot and think it fits in well with Berkshire, but the Haslams are an entirely different story. As a Cleveland Browns fan, I’m inclined to think the worst of them (and they usually end up proving me right).

🤑 The dividends just keep rolling into Berkshire HQ — albeit, this week, some fairly modest ones. Warren Buffett and co. collected $14.5 million from Kroger, $4.3 million from Visa, and $1.8 million from D.R. Horton. And, in the “Under $1 Million” category, we’ve got $257,000 from new boy Sirius XM Holdings and $130,000 from Jefferies Financial Group.

Last week, Berkshire fully exited its 2.5% position in Paytm — selling 15.6 million shares of the Indian fintech company for approximately $164.4 million. Most reports peg Berkshire’s ultimate loss at more than $70 million. (But, fair warning, there are a lot of different numbers floating around out there because of currency conversions and such.)

Kraft Heinz announced a new $3 billion share repurchase program that will run through 2026. Importantly, these buybacks come in addition to “share repurchases to offset the dilutive effect of equity-based compensation”.

“In the third quarter, we hit a milestone in our transformation — reaching our targeted Net Leverage of approximately 3.0x,” said outgoing CEO Miguel Patricio. “A stronger balance sheet, along with advancements we have made across the business, gives us further conviction behind our strategy and the belief that company shares are an attractive investment opportunity.”

According to the WSJ, Occidental Petroleum might soon add even more Permian Basin assets with the purchase of CrownRock. “A deal for the closely held company — which could be valued well above $10 billion including debt — could come together soon.” Stay tuned.

Apple CEO Tim Cook paid tribute to the late Charlie Munger on Twitter/X: “A titan of business and keen observer of the world around him, Charlie Munger helped build an American institution, and through his wisdom and insights, inspired a generation of leaders. He will be sorely missed. Rest in peace, Charlie.”

Charlie Munger’s Final Interview

On November 14, CNBC’s Becky Quick visited Charlie Munger at his home and filmed an interview with him that she planned to use in a televised special next year to commemorate his 100th birthday.

After Munger’s death on Tuesday, CNBC kindly released more footage from this interview — including what may well turn out to be Charlie’s final public comments.

Here are some of the best parts…

✨ “I’ve written my obituary [by] the way I’ve lived my life — and if you want to pay attention to it, that’s alright with me. And if [you] want to ignore it, that’s okay with me, too. I’ll be dead — what difference will it make.”

✨ “Warren and I both lived in the same house for decade after decade after decade. All our friends got rich and built bigger and better houses. And, naturally, we both considered bigger and better houses. I had a huge number of children, so it was justifiable even — [but] I still decided not to live a life where I look like the Duke of Worcester or anything. I was going to avoid it. I did it on purpose.”

✨ “I basically believe in the ‘soldier on’ system. Lots of hardship will come and you’ve got to handle it well by soldiering through.”

✨ “A few rare opportunities will [also] come. You’ve got to learn how to recognize them when they come and not to make too minor of a trip to the pie counter when the opportunity is available.”

✨ “I did not anticipate, when Warren and I were starting, that we’d ever get to $100 million — much less several hundred billion. It was an amazing occurrence … We [were] a little less crazy than most people and a little less stupid than most people. And that really helped us.”

Become a paid supporter today and receive immediate access to five (and counting) annotated transcripts full of wit and wisdom from the top names at Berkshire Hathaway.

Paid subscribers will also continue to receive a new annotated transcript each month.

More Must-Reads

Other awesome things that I read this week…

The Generosity of Charlie Munger Mindset Value

“I looked at my phone and wondered if Charlie would call me back. And sure enough, fifteen minutes later he did, and he continued on and spent another ten minutes talking to me, calming me down. A few weeks later, I received in the mail a list of money managers with their performance circled, showing me that even the best money managers were suffering, not just me … Warren Buffett and Charlie Munger were literally working on saving the U.S. economy and bailing out companies at the time, but Charlie took time to share wisdom and experience with someone he barely knew.”

Reflecting on Charlie Munger Watchlist Investing

“I think it felt so sudden because Charlie was so active right up until the end. Someone said he died with his boots on, which is apt. I picture him reading an annual report or book about science in his final hours, making the Grim Reaper wait until he finished. Charlie himself would very likely tell us we should not be sad given it is 100% certain we are all going to die. But I think he’d also recognize the biological/psychological necessity of grieving, even for a man 99.92 years old.”

Remembering Charlie Munger The Rational Walk

“For the past two decades, Charlie Munger has been a business celebrity and everyone paid attention to his words and conduct. The same was not true in 1982 when he was a relatively obscure individual and few were watching. It did not matter. Charlie Munger operated from a position of integrity and it made no difference how many people were watching. A man with an inner scorecard never cares about how many people are watching when deciding whether to do the right thing.”

Excellent idea...thank you!