The Berkshire Beat: September 22, 2023

All of the latest Berkshire Hathaway news and my must-reads of the week!

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

The latest news and notes out of Omaha…

Berkshire Hathaway shot out of the gate this week, reaching new all-time intraday highs on both Monday and Tuesday. And, even though the share price tailed off a bit on Wednesday and Thursday, Berkshire still managed to extend its lead over the S&P 500’s year-to-date total return.

Class A: +17.68%

Class B: +17.60%

S&P 500: +14.14%

Last week, BNSF Logistics (an affiliate of the Berkshire-owned railroad) announced the sale of its brokerage operations to J.B. Hunt. This cash transaction is expected to close before year-end. BNSF chief exec Katie Farmer: “This agreement with J.B. Hunt reflects our companies’ shared commitment to provide industry-leading intermodal service to our customers. This continues more than thirty years of partnership between BNSF and J.B. Hunt and builds on our announcement to further integrate our joint services.”

Farmer is not exaggerating about the close relationship between these two companies. In 1989, Burlington Northern and J.B. Hunt worked together to develop the first double-stack shipping solution (stacking one intermodal container on top of another). And, just last year, the two companies launched a joint effort to “substantially improve capacity” in intermodal operations.

What is intermodal? It involves the transportation of crates/trailers by rail, but with either water or truck movement at one or both ends. For example, a container is offloaded from a shipping vessel at the West Coast ports and then carried by the BNSF to its final destination.

Even after last week’s sale of 5.5 million shares, Berkshire remains HP’s largest shareholder — with Vanguard in the #2 spot.

In a recent FT profile, American Express CEO Stephen Squeri explained how he shepherded his company through the pandemic — with a little help from Warren Buffett. Instead of laying off employees and scaling back on product innovation, Squeri opted to protect the AmEx brand at all costs, even if that resulted in some painful losses along the way.

“I called Warren Buffett and said, ‘We’re probably going to lose $4 a share and I am not sure when billing is going to come back … But I think that we need to take care of our colleagues [and] take care of our customers. If we do that, I think, we’ll have long-term viability for our shareholders.”

Buffett was on board. “The most important thing to take care of is your customers and your brand,” he told Squeri. “It’s hard to get customers back. And, once you damage the brand, it’s damaged.”

“[My decision] was based on a philosophy that we were not playing a short-term game. In any downturn, there’s always an upswing. And, if you’re not ready for the upswing, you’ve missed an opportunity to move ahead.”

“The pandemic turned us into a higher growth company,” Squeri told the FT. Before Covid, AXP 0.00%↑ mostly targeted steady 8-10% revenue growth. But, in 2022, that rocketed up to 25% — and, this year, should end up around 15-17%.

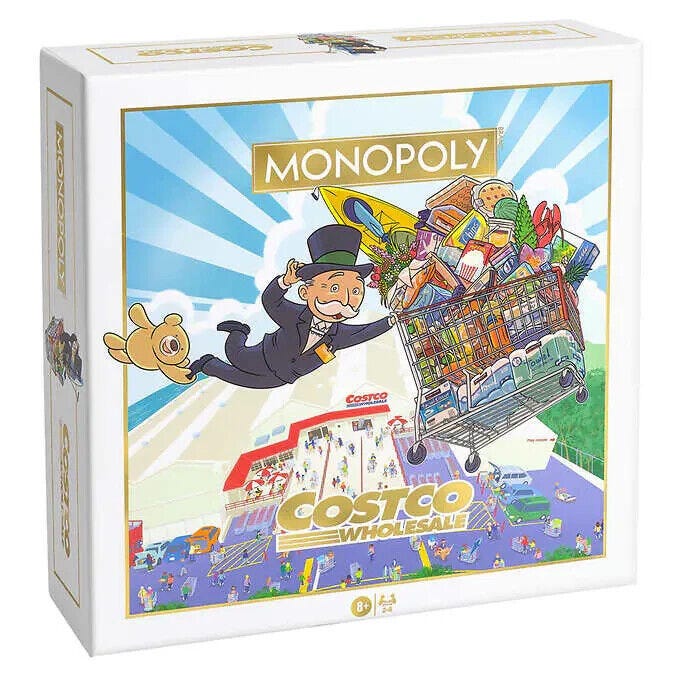

Owing to Charlie Munger’s unending affection for the company, I’ve always considered Costco to be Berkshire-adjacent. On September 15, the retail giant celebrated its 40th anniversary — and, to mark the occasion, is now selling a special Costco-themed version of Monopoly. (The iconic $1.50 hot dog and soda combo is even one of the game pieces!)

Speaking of Munger, here’s a Poor Charlie’s Almanack update: The print edition of the upcoming Almanack re-release (via Stripe Press) now shows a street date of December 5 on Amazon. The Kindle version is seemingly still on schedule for a November 14 release, but physical copies might be slightly delayed.

On Wednesday, NetJets announced a new fleet agreement with Textron Aviation that gives the Berkshire-owned company the option to purchase up to 1,500 additional Cessna Citation business jets over the next fifteen years. NetJets has also been named the fleet launch customer for the much-anticipated Citation Ascend model — which is expected to be ready in 2025.

NetJets EVP Doug Henneberry: “Based on past demand for the popular Citation Latitude and Longitude, the new Ascend and all our new Citations will undoubtedly be well received by our Owners.”

Back in May, both Buffett and Munger lavished praise on NetJets at Berkshire’s annual meeting. “NetJets has been remarkable,” said Munger. “You can argue that it’s worth as much as any airline now.”

The September “bonus” for paid supporters is coming out on Tuesday. I’m very excited to bring you an annotated transcript of Warren Buffett’s Q&A session with University of North Carolina students from 1994. If you’ve been on the fence about upgrading to a paid subscription, there’s no time like the present. Plus, you get immediate access to the two annotated transcripts from July and August.

Here are two snippets from Buffett’s discussion at UNC:

“Some student at Harvard asked me, in a talk last year, ‘Who should I go to work with?’ I said, ‘Go to work for whomever you admire the most.’ I got a call from the Dean about two weeks later and he said, ‘What did you tell these kids? They’re all becoming self-employed.’”

“I make more mistakes when I have a lot of cash around. I think my decision-making acuity fades with extra cash because there’s more of a compulsion to do something when you’re sitting around with cash than if you have to either sell something or borrow money [to buy it].”

And, as always, the first 2,500-ish words (counting footnotes) are available to everyone. I try my best to ensure that no one feels short-changed.

In the Spotlight: BNSF’s Matthew Garland 🚂

Times are tough in the railroad biz. Earlier this week, the American Association of Railroads announced that rail traffic across North America is down 4.1% year over year — with notable drops in intermodal volume and forest products.

In Berkshire Hathaway’s most recent 10-Q, BNSF Railway reported an 11.1% decrease in volume during the second quarter. Earnings also sagged 24% in that period.

Railway Age caught up with Matthew Garland, BNSF’s vice president of transportation, to discuss the railroad’s operations and plans for the future.

On BNSF’s capital program…

Our capital investment is $3.96 billion in 2023 for both maintenance and expansion. The largest component is for maintenance — and we’ll spend $2.85 billion this year alone keeping our railroad in the best condition it’s ever been.

We also continue to increase capacity — and our capabilities — along the Southern Transcon (a key intermodal line between California and Chicago) with our multi-year double-tracking projects in Eastern Kansas and Southern California.

Along our northern route, we recently completed the Sandpoint Bridge project, so we now have bi-directional traffic across Lake Pend Oreille (Idaho), which has been a chokepoint on our route to the Pacific Northwest. The bridge, coupled with the double-track work in Eastern Washington, opens up significant capacity across the north. Additionally, we are excited to bring Montana Rail Link back to the BNSF network on January 1, 2024. This will provide even more capacity and drive additional efficiencies across our northern corridor.

On intermodal expansion…

We announced the Barstow International Gateway — or BIG — last fall, which is one of the most exciting intermodal infrastructure projects to be launched by BNSF in a generation. This $1.5 billion, state-of-the-art, master-planned rail facility in Southern California will be the first of its kind in the U.S.

Once built, it will be the largest intermodal facility in North America, sitting on more than 4,500 acres, and will consist of a rail yard, intermodal facility, and warehouses for trans-loading freight from international to domestic consumers.

It also benefits our intermodal partners by reducing dwell at the Southern California ports and providing a lower cost rail move to an inland trans-load facility vs. the truck move today to existing facilities.

This combination of yard, intermodal facility, and customer warehousing will allow us to offer new service lanes, more consistent and faster transit off the West Coast ports, and access to additional, scarce warehouse capacity in Southern California.

On sustainable growth…

We have a bias for growth. Our business model has always been to grow, provide industry-leading service, receive appropriate value for what we do, and invest those returns back into the railroad to be positioned for further growth. We call it the virtuous cycle.

Part of being focused on capturing growth is having a strong cost structure — getting everything you can out of your assets and driving efficiency. When you have a strong cost structure and drive value for the service you deliver, you usually have returns that justify reinvestment and the capacity to grow with your current customers while pursuing new growth opportunities. We have always relied on growth to be successful and will continue to do so into the future.

I recommend reading Garland’s whole interview. Lots of good information on BNSF.

More Must-Reads

Other awesome things that I read this week…

Warren Buffett on Inflation — Part 1

“One of the enduring misconceptions among investors is that Warren Buffett ignores the macroeconomy. To the contrary, a careful reading of Mr. Buffett’s shareholder letters over many decades makes it clear that he closely monitors macroeconomic conditions. It is more accurate to say that Berkshire Hathaway rarely makes bets directly on macroeconomic factors.”

Warren Buffett on Living Off Dividends in Retirement (Dividend Growth Investor)

“I recently saw an interesting video clip of Warren Buffett, which discussed how he would invest if he were retired … ‘If I were retired and I had a million-dollar portfolio of stocks paying me $30,000 a year in dividends, my children were grown, and the house was paid off — I wouldn’t worry too much about having a lot of cash around.’”

High Interest Rates Usher In New Normal For Young People

“The pain will continue until young people realize the world has changed and they now live in a new regime. Their investment decisions now have to account for 5% interest rates. Their car and mortgage payments are going to be higher than they anticipated. But that is the price for living today. It may not seem fair, but the worst mistake would be sitting around complaining rather than living your life. Time is the most finite resource we get. Letting the central bank steal it from you because they made capital expensive sounds like a bad plan.”

How [Berkshire-Owned] Ben Bridge Uses Subscription Diamond Inventory Tech to Propel Growth (TotalRetail)

“Engagement ring spending in the United States rose 9.2% in 2022 … Depending on the store and location, the diamond engagement ring sale can represent 60-90% of a jewelry retailer’s gross revenue. It’s also the primary point of entry for younger customers who are making the first jewelry purchase of a lifetime. Therefore, getting it right the first time can ensure that both partners in that young couple will become a customer for the retail jewelry store for their next forty years of discretionary spending.”

Nature Is Our Sister, Not Our Mother (Robert Barron)

“No one seems more fidgety than [Tim] Cook, which only puzzles the viewer more: Who could this person be who can intimidate the top leadership of Apple? The president of the United States? Oprah? The Dalai Lama? No one as lowly as that, it turns out, for into the conference room comes Mother Nature herself, in the guise of a middle-aged and rather grumpy woman.”

Thanks for putting this together. Very helpful!!