The Berkshire Beat: October 25, 2024

All of the latest Warren Buffett and Berkshire Hathaway news!

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

The annotated transcript for October will go out to paid subscribers on Monday. And, this month, I’m trying something a little different: an Alice Schroeder Q&A from 2008.

Schroeder had unprecedented access to the inner goings-on at Berkshire Hathaway (and Warren Buffett) while she wrote The Snowball — leaving her with many insights and stories to share. It’s a good one!

So, if you’ve been on the fence about upgrading, there’s no time like the present.

Now, with that bit of housekeeping out of the way, let’s turn our attention to the latest news and notes out of Omaha…

IT’S NOT EVERY DAY THAT BERKSHIRE HATHAWAY ADDS SOMETHING NEW TO ITS WEBSITE. On Wednesday, though, a note about “Fraudulent Claims Regarding Mr. Buffett’s Endorsements” was tacked to the top. “In light of the increased usage of social media,” it reads, “there have been numerous fraudulent claims regarding Mr. Buffett’s endorsement of investment products as well as his endorsement and support of political candidates. Mr. Buffett does not currently and will not prospectively endorse investment products or endorse and support political candidates.”

CNBC reports that a fake Buffett political endorsement recently popped up on Instagram — spurring Berkshire to issue this clarification. “I don’t even know how to get on Instagram,” Buffett told Becky Quick. “Anything they see [on there] with my image or my voice, it just ain’t me.”

“I’m worried about people impersonating me and that’s why we put that on the Berkshire website,” he continued. “Nobody should believe anybody saying I’m telling them how to invest or how to vote.”

Buffett has changed his mind on this subject in his later years. In 2022, he explained why he had decided to back off on making overtly political statements. “You can make a whole lot more people sustainably mad than you can make temporarily happy by speaking on any subject,” said Buffett. And since that anger would negatively impact innocent Berkshire employees and shareholders, he had resolved to remain mum on the subject of politics.

When Berkshire pinned the disclaimer about fake Buffett endorsements on its website, it removed his 2022 letter regarding Activision Blizzard from the front page. Here is a PDF of that letter in case anyone wants to save a copy.

AMERICAN EXPRESS REPURCHASED 6.5 MILLION SHARES OVER THE PAST THREE MONTHS. As a result, Berkshire’s ownership interest in AXP 0.00%↑ jumps from 21.3% to 21.5%. Every little bit counts.

SOMEONE AT BERKSHIRE BOUGHT 1.56 MILLION MORE SHARES OF SIRIUS XM LAST WEEK. (Ted Weschler is the odds-on favorite.) This $42.1 million purchase boosts Berkshire’s stake in SIRI 0.00%↑ up to 32.5%.

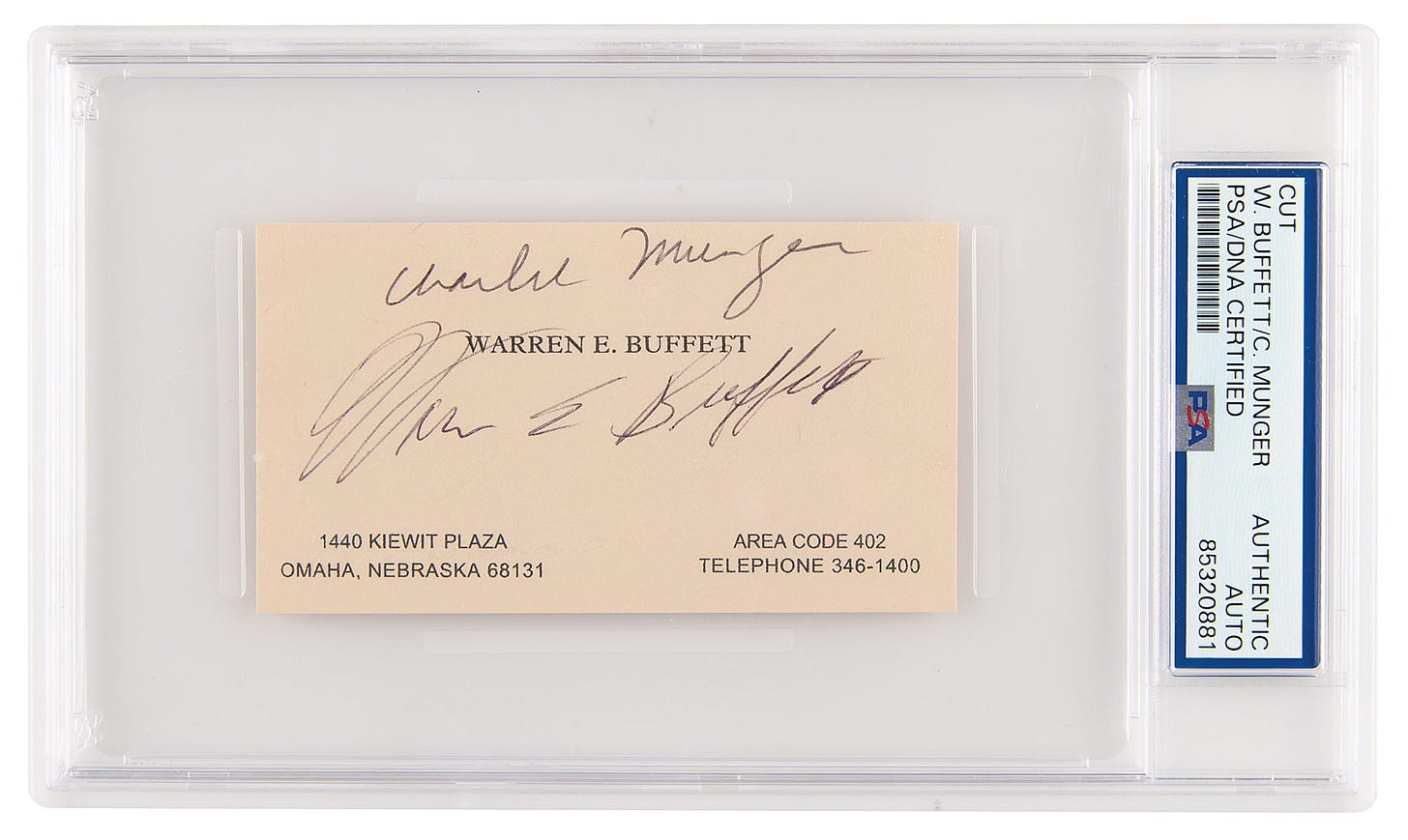

OKAY, WHICH ONE OF YOU WAS IT? A business card signed by both Warren Buffett and Charlie Munger sold for $15,115 at auction last week.

JASON ZWEIG ONCE ASKED BUFFETT: ARE YOU GOOD — OR JUST LUCKY? “When I interviewed Buffett for the first time [in] 2003 or 2004,” Zweig told William Green, “I asked him, ‘There are so many people out there who think you’re a genius, but most finance professors think you’re lucky. Well, what is it? How do you think about yourself?’ And his answer was really interesting. He basically said I don’t have any interest in thinking about that other than acknowledging that he was lucky to be born when and where he was so that he could make the most of the skills he had. To him, the question of his superiority was not interesting and he spent no time on it. And it clearly wasn’t an act. He was very matter of fact about it. Just like, ‘I’m not interested in figuring out whether I’m smarter than everybody else. It doesn’t matter.’”

IS THERE A HAPPY MESSAGE HIDDEN INSIDE COCA-COLA’S ICONIC SCRIPT LOGO? A theory has been buzzing around the internet that the elongated tail on the first C in Coca-Cola’s logo is meant to evoke a smile. “This subtle message may go unnoticed,” said Richard Lau of LOGO.com, “but it subconsciously creates a positive association with the brand in the minds of consumers.” I don’t know if this is true or not — it certainly isn’t as noticeable as the FedEx arrow or Amazon’s A-to-Z smile — but it nevertheless reminds me of this moment from a Berkshire AGM when Buffett discussed how Coke purposely aims for a “mind share” of happiness.

BUFFETT: “WHEN I SEE MEMOS FROM HOWARD MARKS IN THE MAIL, THEY’RE THE FIRST THING I OPEN AND READ.” Who am I to argue with that? Marks dropped a new memo this week — Ruminating on Asset Allocation — in which he doles out some home truths about balancing risk in your investment portfolio. “You can’t simultaneously emphasize both preservation of capital and maximization of growth, or offense and defense,” he writes. “This is the fundamental, inescapable truth in investing.” Find the place on the risk/reward continuum that feels right to you.

More from Marks: “At bottom, there are only two asset classes — ownership and debt. If someone wants to participate financially in a business, the essential choice is between (a) owning part of it and (b) making a loan to it.”

Tim Cook’s Apple: Not First, But Best

When Berkshire Hathaway reports its Q3 2024 earnings next weekend, the first thing I’ll be checking on is whether Warren Buffett sold any more Apple stock. He unloaded over half of his once-massive AAPL 0.00%↑ position during the first half of the year — and it’s anyone’s guess whether he kept on selling during the third quarter.

Some believe that, with the Apple position now at exactly 400 million shares (the same amount as permanent holding Coca-Cola), Buffett might be done selling. We’ll see. I’m personally rooting for the round number theory, but wouldn’t be surprised either way. That’s the kind of brave analysis you can expect around here. 😜

Speaking of Apple, the Wall Street Journal profiled CEO Tim Cook this week ahead of the imminent release of Apple Intelligence.

Critics say the Cook era has been one of optimization rather than innovation. And, compared to the prodigiously creative tenure of Steve Jobs, that might be true. But Apple has been busy in 2024: launching the Vision Pro mixed-reality headset back in February and now its much-anticipated entrance into the AI arena.

Cook acknowledged that Apple is certainly not the first Big Tech player to lay down its chips on artificial intelligence, but he hopes that Apple’s take on AI will prove to be just what consumers are looking for. “We’re perfectly fine with not being first,” he told the Wall Street Journal. “As it turns out, it takes a while to get it really great. It takes a lot of iteration. It takes worrying about every detail.”

“We would rather come out with that kind of product and that kind of contribution to the people versus running to get something out first. If we can do both, that’s fantastic. But if we can only do one, there’s no doubt around here. If you talk to 100 people [at Apple], 100 of them would tell you: It’s about being the best.”

Cook even compared Apple Intelligence to such groundbreaking advances as the iPod’s click wheel and the iPhone’s touch interface — and believes that it will propel Apple onto a higher technological curve. “We weren’t the first to do intelligence,” he said, “but we’ve done it in a way that we think is the best for the customer.”

Apple Intelligence is set to debut with iOS 18.1 on October 28.

✨ Cook also discussed the Vision Pro — even detailing how he likes to wear it while laying on the couch and watching TV shows and movies on the ceiling. “It’s a lot more pleasant way to watch something than to sit like a statue in front of a TV,” he said.

Vision Pro has not exactly set the sales charts on fire, but that can’t be too big of a surprise considering its $3,500 price tag. A mass market product it is not.

(As opposed to the iPhone, which sells seven devices every second.) 👀

“I’d always like to sell more of everything,” conceded Cook, “because, ultimately, we want our products to be in as many people’s hands as possible. So, obviously, I’d like to sell more [Vision Pros] … Right now, it’s an early-adopter product. People who want to have tomorrow’s technology today — that’s who it’s for. Fortunately, there’s enough people who are in that camp that it’s exciting.”

With the large accelerated filer deadline of Nov 12, I assumed that BRK will release its Q on Saturday, Nov 9 but maybe it’ll be the 2nd. Either way, it’ll be interesting to read.

Useful calendar of SEC deadlines for this year: https://www.gibsondunn.com/wp-content/uploads/2017/06/SEC-Filing-Deadline-Calendar-2024.pdf