The Berkshire Beat: May 9, 2025

All of the latest Warren Buffett and Berkshire Hathaway news!

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

The day after Warren Buffett announced his intention to step down as CEO of Berkshire Hathaway at year’s end, the board of directors voted unanimously to elevate vice chairman Greg Abel to the top spot effective January 1, 2026.

And, best of all, it decided that Buffett will stay on as chairman.

CNBC’s Becky Quick also confirmed on X that Buffett will “still be going to the office every day” to provide a steady hand as Abel transitions into the CEO role.

The next morning — on Squawk Box — she explained that Buffett’s announcement was more about ensuring continuity at Berkshire than him exiting the conglomerate altogether. “The board voted that Warren Buffett will remain chairman,” said Quick, “so some of these rumors of his retirement have been greatly exaggerated. This is the next step in the transition, but Buffett is not exactly exiting the stage.”

Abel will have full (and final) authority on all operational and capital allocation decisions, but Buffett will stick around to provide help as needed. Perhaps in a Charlie Munger-like role as former director Ron Olson suggested.

Quick also highlighted the timing of Buffett’s announcement — at the very end of a four-and-a-half hour long Q&A session. One in which he never skipped a beat, lost his train of thought, or struggled for words. It came on his own terms, immediately after he ably demonstrated to everyone there (and watching at home) that he’s still got it.

A subtle reminder that this transition is motivated by strength and strategy — not frailty or necessity.

And, now, on to the latest news and notes out of Omaha…

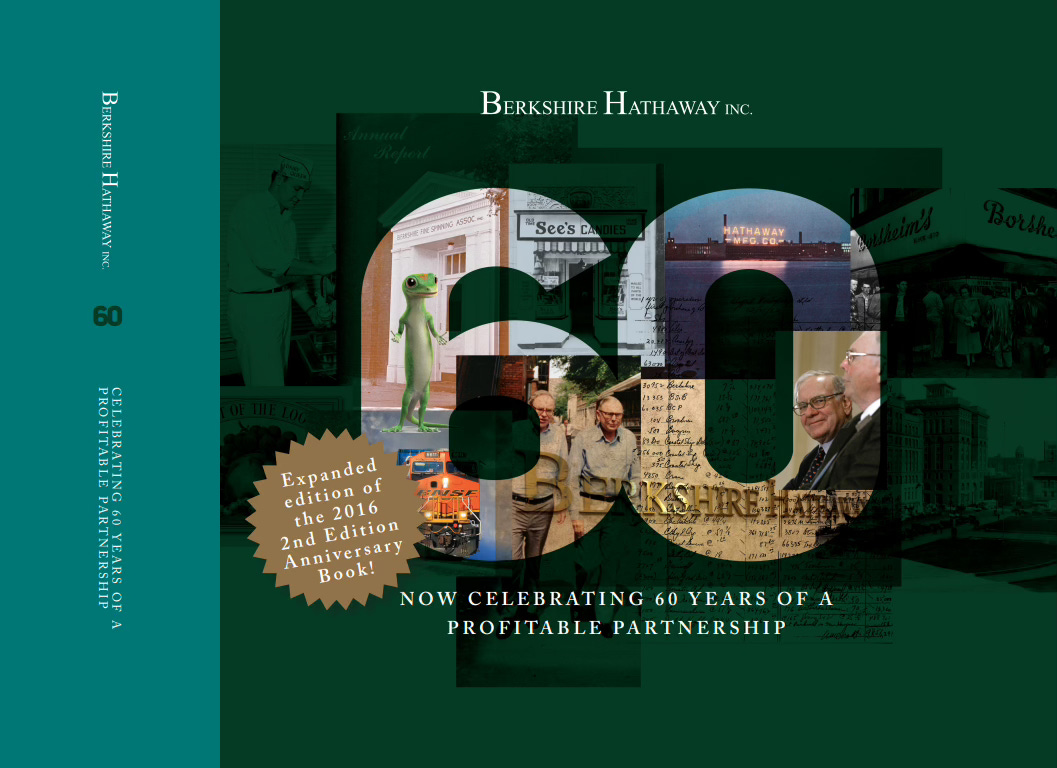

If, like me, you missed out on the commemorative 60th anniversary book which quickly sold out at the Berkshire Hathaway AGM, here’s another chance. Berkshire decided to combat the resellers by printing additional copies and selling them on eBay for $50 with delivery slated for summer. Orders can be placed now.

The business world met Warren Buffett’s announcement with an outpouring of tributes, underscoring the Oracle’s unparalleled influence on global finance. “There’s never been someone like Warren,” said Apple CEO Tim Cook. “It’s been one of the great privileges of my life to know him. And there’s no question that Warren is leaving Berkshire in great hands with Greg.” JPMorgan Chase CEO Jamie Dimon echoed those sentiments. “Warren Buffett represents everything that is good about American capitalism and America itself,” he said, “investing in the growth of our nation and its businesses with integrity, optimism, and common sense.” Bank of America CEO Brian Moynihan, meanwhile, paid homage to another of Buffett’s gifts. “His life lessons — delivered to young and old — are as valuable as his business acumen. I have personally learned so much from him and look forward to continuing to benefit from his insights.”

Of particular note, though, were Alice Schroeder’s comments. The author of The Snowball spoke to Business Insider over the weekend about Buffett’s decision to hand the reins over to Greg Abel — and what it means for Berkshire in the future. “Warren is literally not replaceable,” said Schroeder, “so of course Berkshire Hathaway will be different.” How different is the trillion dollar question. (Shameless plug: I recently sent out an annotated transcript of an old Alice Schroeder interview for paid supporters!)

“I think [Warren] will achieve the one goal that he told me he had a long time ago,” said Schroeder, “which is that he constructed [Berkshire] to survive and still be a viable, reasonable, successful company for 30 years after he’s no longer running it. So I think those who own the stock should not be worried because the business side could be almost put on autopilot.”

Are dividends in Berkshire’s future? “I think that the possibility of a dividend could be there under someone other than Warren — but I wouldn’t expect Berkshire to change its approach to managing risk or asset liability management or anything like that.”

“I don’t think a dividend will be announced in the short term,” she continued, “[but] I think that it will go from being absolutely ruled out to being potentially on the table at some point.” Schroeder went on to guess that Abel won’t want to make waves right off the bat, instead prioritizing a period of time where “nothing remarkable happens without Warren in the CEO role”.

For anyone wishing to thank Buffett for his decades of excellence, Schroeder recommends sending him some snail mail. “He enjoys reading mail,” she said. “He particularly appreciates it — and I know he keeps it. If you want to really say ‘Here’s what you meant to me’ then the best way for Warren is to send a letter.”

Buffett’s big announcement completely stole the spotlight from Berkshire’s Q1 2025 results, which were also released on Saturday. Rather than trying to cram in all of my thoughts here, I will write a whole article on Berkshire’s earnings early next week. On Monday, Berkshire’s stock price dropped as much as 6% as the market digested the CEO hand-off — and, to some extent, a decline in first quarter earnings.

National Indemnity — alongside Chubb and Zurich — unveiled a new insurance partnership. This new excess casualty facility will offer up to $100 million in lead excess capacity to large national and multinational companies in the United States. It hopes to fill a critical market gap, as large companies continue to struggle to obtain adequate coverage in a hostile litigation environment. “We and Zurich and Chubb have arranged a joint operation to be the writer of really large sums that very few people can do,” Buffett said last weekend. “We can do that sort of thing without blinking. Anybody that wants to do it, wants to get us [involved].”

According to Railway Age, Berkshire-owned BNSF is in “increasingly good shape” these days. The railroad’s network velocity — a measure of how quickly freight cars move through the system — recently reached a fourteen-week high. At the same time, terminal dwell (the amount of time that freight cars spend idle in rail yards) dropped to a seven-month low. Another important efficiency metric is moving in the right direction, too. BNSF achieved a 4.2% reduction in “cars on line” over the past four weeks, meaning that the railroad is moving freight with fewer cars.

Clayton Homes showcased its Laurel home model at Berkshire’s annual meeting. It’s part of the company’s innovative CrossMod series of homes — built partly off-site and partly on-site to seamlessly integrate with traditional homes in any neighborhood. “What we don’t want to do is bring a concept idea,” Justin DeSpain told Knox News. “We want to talk about who we are and what we’re about — and amplify that on a national stage.” This model arrived in Omaha a week ahead of the meeting and featured products from other Berkshire subsidiaries like Shaw flooring and Benjamin Moore paint. “We want people to have that experience and touch the product because this might be their first time in one of our homes.”

And a few odds and ends to finish off the week…

This week, Berkshire collected $124.3 million in quarterly dividends from American Express, $3 million from Mastercard, and somewhat-less-impressively-but-still-more-than-my-annual-salary $76,286 from Lennar.

Brooks Running CEO Dan Sheridan on being in the arena for Buffett’s announcement: “You knew history was happening.” He also told Liz Claman that Brooks sold more than 2,000 pairs of shoes at the AGM, up 20% over last year.

Greg Abel always tells Sheridan to “focus on the customer”.

Kraft Heinz CEO Carlos Abrams-Rivera doesn’t sound overly worried about tariffs. “70% of our revenue in Kraft Heinz globally comes from the U.S.,” he told Fortune, “and 99% of goods we sell in the U.S. are made in the U.S.”

“So, for us, it’s less of a concern,” he continued. “Our tomatoes are grown in California [and] our potatoes are grown between Oregon and Idaho.”

Buffett’s transition is strategic, not reactive — ensuring continuity without compromising Berkshire’s culture of discipline. For shareholders, this isn’t a turning point to fear — it’s one to study.

Alice is right: Warren is literally not replaceable. And BRK either... no matter what other investors/ceo-marketers says about their companies (the next BRK of "X").

Did you get a copy of the 60th anniversary book? I did!