The Berkshire Beat: February 7, 2025

All of the latest Warren Buffett and Berkshire Hathaway news!

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

To quote the great John “Hannibal” Smith, “I love it when a plan comes together.”

I’ve written about this before, but American Express charted a brave course during the Covid-19 pandemic. One that looks to have paid off in spades.

Faced with a global shutdown and the terrifying financial consequences that come with it, CEO Stephen Squeri called his biggest shareholder — Warren Buffett of Berkshire Hathaway — with some bad news. “We’re probably going to lose $4 a share and I am not sure when billing is going to come back,” he said. “But I think that we need to take care of our colleagues [and] take care of our customers. If we do that, we’ll have long-term viability for our shareholders.”

Squeri did not want to lay off employees and roll up into a defensive ball until the world returned to normal. Instead, he planned to double down on American Express’s reputation for top-of-the-line cardholder perks and services. Particularly ones geared towards those members stuck at home unable to travel.

After all, the credit card giant’s bread and butter — business and luxury travel — was on indefinite hiatus and the idea of racking up more airline miles on purchases might not seem especially relevant in early 2020.

So Squeri and co. pivoted and added perks around streaming services, meal delivery, and online shipping. Basically, a quarantined cardholder’s survival pack of sorts.

Putting the American Express brand — and customers — first was obviously right up Buffett’s alley. “I don’t care about this year,” he told Squeri, “and I don’t care about next year. What I care about is that you keep the brand special, that you continue to invest in the brand, and that you retain your customers.”

American Express not only retained its customers, but saw the number of cards in circulation break out sharply upwards. Along with the average membership fee that customers were willing to pay to join the prestigious AmEx family.

“[My decision] was based on a philosophy that we were not playing a short-term game,” said Squeri. “In any downturn, there’s always an upswing. And, if you’re not ready for the upswing, you’ve missed an opportunity to move ahead.”

The American Express brand now seems as strong as ever — evidenced by a record $10.1 billion of net profit last year and a best-ever 13 million new card acquisitions. Plus, it continues to thrive with the youngsters. 75% of the high-priced Platinum and Gold cards were opened by Millennials and Gen Z. Good news all around.

And, now, the latest news and notes out of Omaha…

Berkshire Hathaway is still Sirius about satellite radio. Between January 30 and February 3, someone at Berkshire (probably not Warren Buffett) purchased 2.3 million more shares of Sirius XM Holdings for $53.9 million. That boosts Berkshire’s stake in SIRI 0.00%↑ up to a cool 35.4%.

Berkshire did not, though, add more Occidental Petroleum after the oiler fell down near its 52-week low. Oxy’s share price did not quite reach the $45.99 a piece average that Buffett paid in December, but it came pretty darn close.

An Ad Age article about GEICO shed some new light on the Berkshire-owned auto insurer. Over the past few years, GEICO drastically reduced its advertising expenses as a way to stanch the flow of red ink. Ad Age reports that what was once a $1.145 billion advertising budget in 2021 dwindled to just $558.6 million in 2023. That was all part of the insurer’s plan to trade growth for profits. And, while GEICO has returned to consistent profitability, this decision did take a toll on its market share. It has dropped from a high of 14.4% of the auto insurance market in 2021 to 12.3% in 2023. That is six points behind leader State Farm and nearly three behind Progressive.

A new S-3 filing revealed that Berkshire has shifted at least a little bit of its legal work from Munger, Tolles & Olson to Baker McKenzie. Berkshire Hathaway Finance Corporation enlisted the new firm to handle a potential debt sale. Barron’s reports that, last year, a team of corporate lawyers moved from MTO to Baker McKenzie, which might explain why Berkshire made this unexpected switch.

The filing also told us that the number of people employed across the Berkshire empire decreased from 396,440 to 392,000 in 2024. No word on which subsidiaries reduced their headcount.

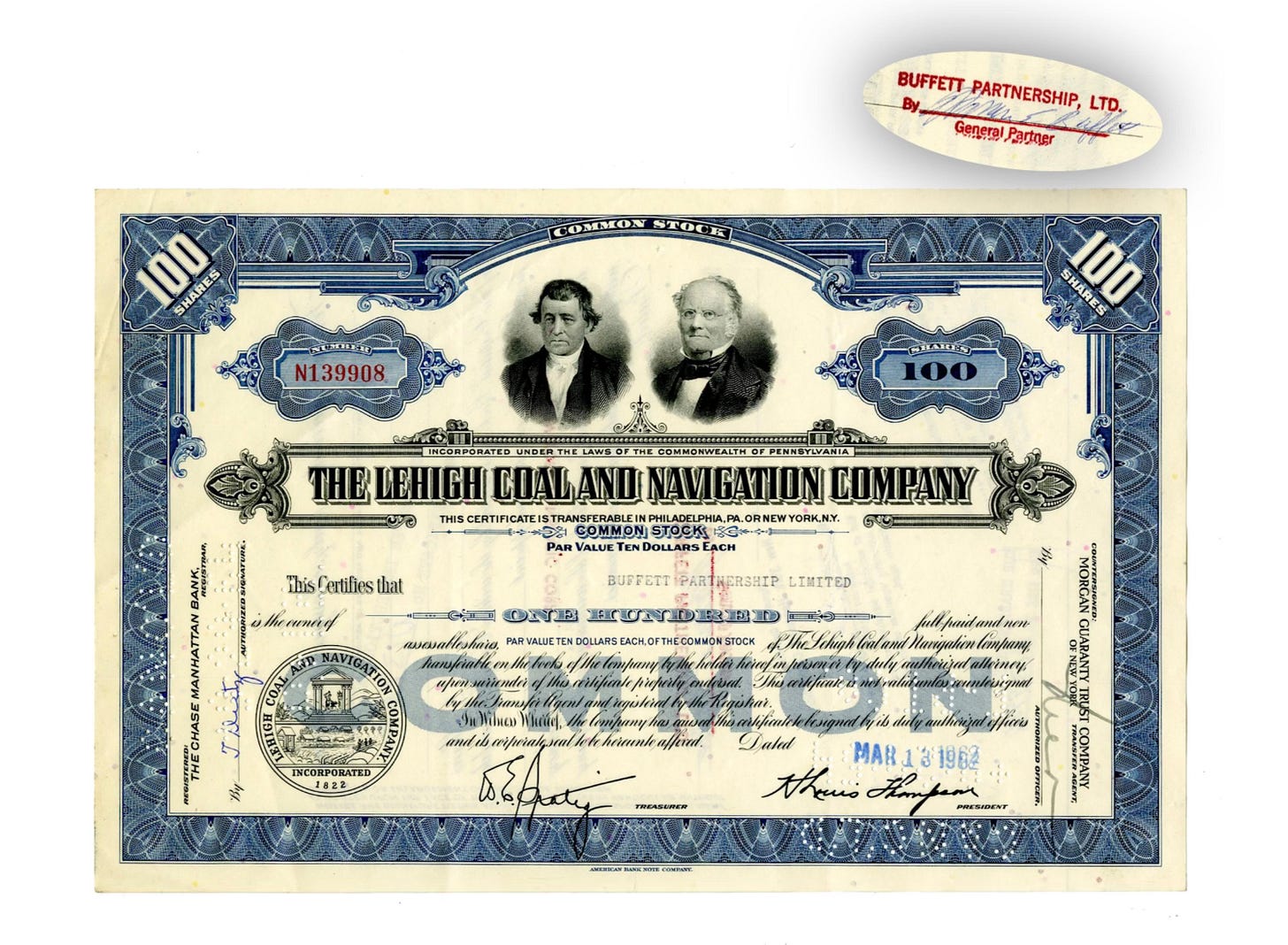

A stock certificate — signed by Warren Buffett — sold for $15,000 last week. This Lehigh Coal & Navigation Company certificate, from way back in the Buffett Partnership Ltd. days, was signed by Buffett on March 13, 1962. At the same University Archives auction, a Tribune Oil Corporation stock certificate signed by Buffett’s mother, Leila, also sold for $300.

🤑 Dividends: Today, Berkshire will collect $3 million in quarterly dividends from Mastercard. Not a whole lot by Berkshire standards, but every little bit helps.

Apple — for the time being, at least — remains the largest holding in Berkshire’s stock portfolio. And, while iPhone sales haven’t budged much, the tech giant’s ascendant Services segment continues to impress. (This includes iCloud, the App Store, Apple Music, Apple TV+, and more.) Services brought in $26.3 billion of revenue during the holiday quarter — up 14% year over year — and nearly reached $100 billion over the past year as a whole. Apple also revealed that it now has more than 1 billion subscriptions across all of its services (including third-party apps).

This area of Apple’s business is huge — and booming. Let’s put it this way: If Services was a standalone company, it would rank #37 by revenue in the S&P 500.

Brooks Running announced yesterday that its global revenue increased by 9% in 2024 — marking nine straight years of sales growth. The Berkshire-owned footwear brand remained #1 in the U.S. adult performance running field — while also recording 228% revenue growth in the world’s second-largest running market, China. “The sun is shining on the performance running category,” said CEO Dan Sheridan, “and we continue to welcome new people into the sport and our brand. The Brooks team has never been better at crafting best-in-class running gear and experiences and then connecting with runners and active people in their health and wellness journeys.”