The Power of Tangible Things: An Ode to Stock Certificates

Call me a Luddite, but those brightly-decorated, physical pieces of paper symbolized ownership of a real business in a way that ticker symbols on a computer screen never will...

Happy Thursday and welcome to our new subscribers!

Forgive me, but I’m on something of a Sir John Templeton (and family) kick these days.

Earlier this week, Lauren Templeton (great-niece of Sir John and co-author of Investing the Templeton Way) appeared on Everything Money to discuss the timeless principles of value investing.

During the interview, EM’s Paul Gabrail said, “I used to believe that value investing was [all] about numbers and then I very quickly realized that value investing has about 20% to do with numbers and 80% to do with impulse control and responding to your emotions.”

Truer words.

Stock picking and short-term gyrations in price dominate so much of the FinTwit and media hive mind — while the crucial foundation of a composed and rational mindset falls forgotten by the wayside.

Anyone can outsource the nitty-gritty of investing to index funds. Select an ETF that covers a wide swath of the market — like SPY or VOO for the S&P 500 — and dollar cost average your way to big bucks (over the course of several decades).

What you can’t outsource, though, is the patience and discipline needed to stay the course when storm clouds appear on the horizon. Panicked, emotional trading has robbed investors of more money than all the bad stock tips in the world.

Don’t despair: this is actually good news.

Not every person is blessed with the intellect and analytical skills necessary for prescient stock picking. But everyone can embrace their inner sluggard — make regular contributions to an ETF and then sit on their hands while the magic of compound interest does its thing.

No genius required.

Just the proper mindset.

In a nutshell, that’s what Kingswell is all about. I think it’s incredibly important for investors of all stripes to immerse themselves in the stories and lessons of the past and present. Historical examples of fortunes won and lost in the market, as well as careful scrutiny of how the greats (Warren Buffett, Charlie Munger, Peter Lynch, et al.) go about their business.

I’ll leave it to others to write highly-detailed, technical breakdowns of a particular company’s financials and future outlook. They’ll do it better than I ever could.

Here at Kingswell, my mission is simple — and lifted straight out of the preface to George Goodman’s The Money Game: “Enjoy the stories, they always teach more than the rules.”

Okay, back to Lauren Templeton.

😍 I love the story she told on Everything Money about her father’s rather unusual (but amazing) method of decorating her childhood bedroom:

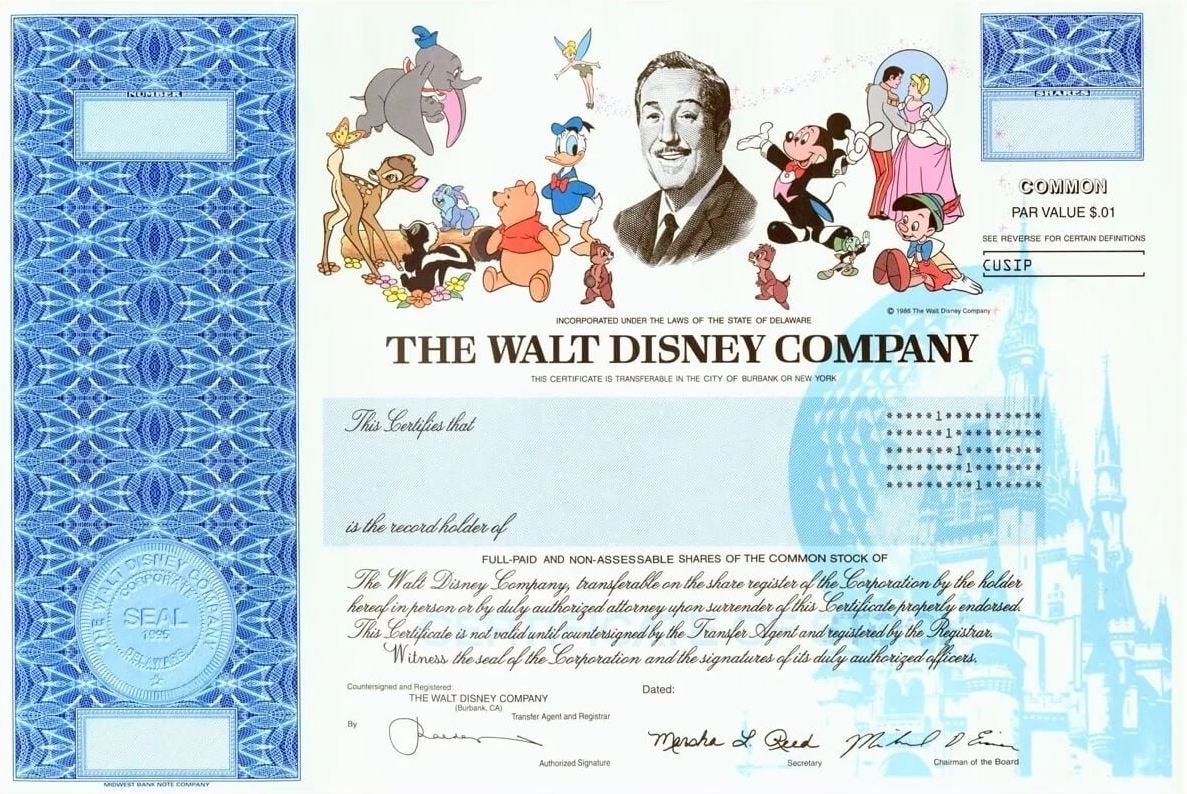

As a child, he would let me pick one stock per month. It could be any company I wanted, and he would buy me one share.

At the time, it was very easy to get a stock certificate. Stock certificates, you can’t even really get them these days. But they would send stock certificates to the house and he would have them matted and framed — nothing fancy — and hang them on the walls of my room.

When I was a kid, the walls of my room were covered in stock certificates and it really influenced me because my dad would come into my room and say, “You’re an owner of that business.”

It was through that lens that I started to look at the stock market. Not as a place for gambling or speculation, but I really felt like I was an owner of these businesses.

Obnoxiously, I probably went to school and told my friends, “I own Disney!” and they were like, “You’re lying!” but I felt it.

Even so much that, as a child, I went to Walmart one time, I went to the restroom and the bathrooms were dirty and dad was like, “What are you going to do about it? You’re an owner.”

So I wrote to Sam Walton and explained the problem — and he wrote me back. He said he would take care of the problem and he thanked me for letting him know the problem existed.

But it was that lens and that unique vantage point that I had as a child that really pushed me to investing and developed me as an investor.

Nominate that man for the Benjamin Graham Parent of the Year award!

One of the most fundamental lessons handed down by the dean of security analysis is that a share of stock represents a real piece of an actual business. But, for many, it’s one that hasn’t entirely sunk in yet.

And, in the age of Robinhood, can you really blame them?

When you can hop on an app and buy/sell at the touch of a button, stocks become little more than digital playthings — ticker symbols to be flipped and traded on a whim.

Such short-termism is an all-too-human problem that has surely vexed investors for ages. But, also, one made much worse by a relatively recent change: the elimination of stock certificates.

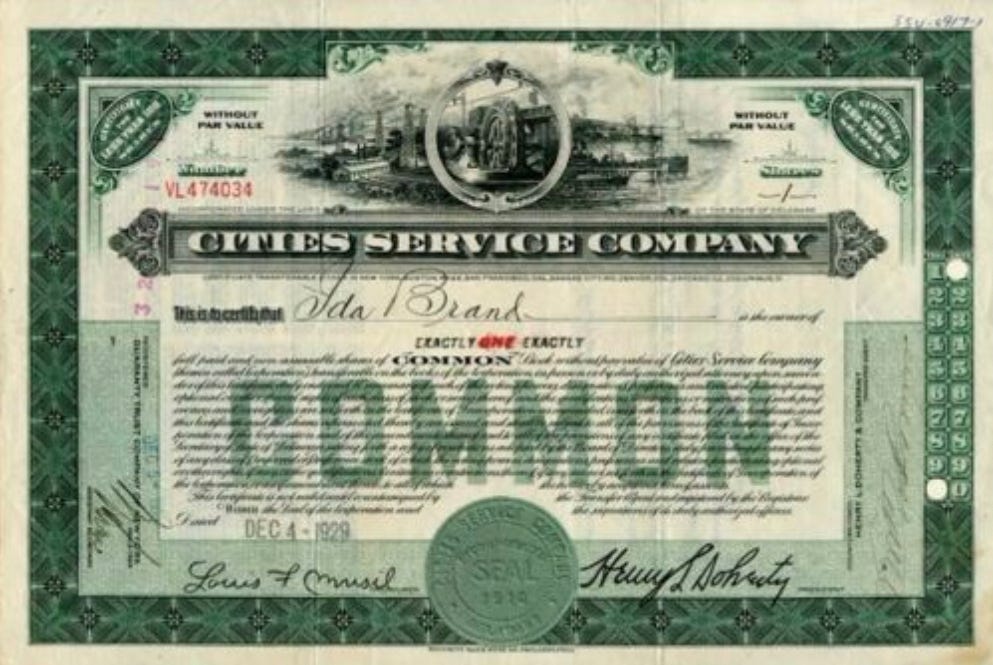

It wasn’t all that long ago that, when you bought a stock, you received an actual piece of paper certifying your ownership in that particular company. These brightly-colored, decorated certificates were almost little works of art in themselves — garish and classic all at once.

One felt vaguely tycoonish thumbing through a stack of such certificates.

And, sadly, those days appear to be gone for good.

Call me a Luddite if you wish, but those pieces of paper symbolized ownership of a real business in a way that ticker symbols on a computer screen never will.

Now, to be fair, stock certificates made some things harder.

If you wanted to sell your shares, you had to pack up the certificates and mail them back to your broker to process and finalize the transaction.

But selling a stock should be hard.

And you should have to think long and hard about it before pulling the trigger.

If stock certificates ever introduced just enough friction to the process to actually deter someone from selling out too soon, then all the better.

These weren’t anachronisms needing to be swept away in a wave of progress, but an important teaching tool and physical reminder of the tangibility of your investment.

I think it’s highly regrettable that there are no more young Lauren Templetons out there with a growing collection of stock certificates lining their walls — intuitively inheriting an ownership mindset from these small pieces of paper.

We’re much poorer for their absence.

The Templeton family’s unique approach to interior decorating reminded me of a post I once read over at The Conservative Income Investor.

In one of the earliest entries on his blog, TCII described a memorable visit to a boutique investment firm that he likened to Floyd’s barbershop in Mayberry.

I saw a bunch of checks sitting on the grandpa’s desk. When I inquired, he explained that “Mr. Smith” did not trust electronic deposit, and chose to pick up his dividend checks himself. I am glad I got to experience that moment. While it is nice and convenient that everything is electronic these days, I do think it sometimes takes away from the “realness” of the fact that we are dealing with living, breathing businesses when we buy shares of stock in a company.

Nowadays, grandparents cannot even give their grandchildren a Series E or Series I savings bond in paper form for Christmas. Instead, they have to register their grandchildren for an account at treasurydirect.gov and they can print out an electronic receipt. Something gets lost when we take away the tangibility of things. These abstractions can ruin the lives of investors that are not good at dealing with things on the theoretical level.

He calls this the “transformative moment” of his investing life.

And for good reason.

Seeing a pile of dividend checks in person brings the whole dividend snowball concept to life in a way that doesn’t easily translate to the digital age.

There’s no turning back now, though. Stock certificates and paper dividend checks have mostly gone the way of the dodo.

That’s life.

I just hope we never forget the power that these physical, tangible artifacts once held.

If you’ve enjoyed reading this issue of Kingswell, please hit the ❤️ below and share it with your friends (and enemies) so they don’t miss out. It only costs you a few clicks of the mouse, but means the world to me. Thank you!

Disclosure: This is not financial advice. I am not a financial advisor. Do your own research before making any investment decisions.

I own an European electric utility company. Once a year I go to an appointed bank to get my dividends in cash (instead of having them deposited directly onto my brokerage account). I love that feeling of receiving my dividends in cash.