The Berkshire Beat: February 14, 2025

All of the latest Warren Buffett and Berkshire Hathaway news!

Happy Valentine’s Day and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

We are just a few hours away from finding out which stocks Warren Buffett and co. bought and sold in Q4 2024. Berkshire Hathaway’s latest 13F should hit the streets shortly after 4 p.m. ET this afternoon. And I, for one, can’t wait.

For my money, this is probably the most intriguing filing on the calendar. It’s the one time each year that Berkshire releases its 13F ahead of that quarter’s earnings report — so we won’t know ahead of time whether there are any changes to the five largest holdings or not. We are pretty much going in blind.

(Other than the Occidental Petroleum, Bank of America, Sirius XM, and Verisign moves that required timely disclosure via Form 4’s.)

On this 13F deadline day, I’ve got three big questions on my mind…

(1) What’s going on with Apple?

Over the past year, Buffett has been a consistent seller of AAPL 0.00%↑ — which once accounted for close to 50% of Berkshire’s overall stock portfolio. The position has shrunk from ~915 million shares down to 300 million shares. Did Buffett continue to sell in the fourth quarter? And, if so, is Apple still the largest holding in Berkshire’s portfolio? I could see this one going either way.

(2) How low can Bank of America go?

In October, Berkshire reduced its Bank of America position — once the second-largest in its portfolio — down to 9.9%. Which, in turn, meant that any further sales did not have to be disclosed within two days. So, for the past few months, we’ve been in the dark over whether Buffett stopped there or kept unloading BAC 0.00%↑ stock.

(3) Is Buffett ready to buy again?

Last quarter, Berkshire’s only purchases were dribs and drabs of HEICO, Pool Corp., and Domino’s Pizza. These almost certainly came from Todd Combs or Ted Weschler. Buffett, meanwhile, seems to have stayed on the sidelines (from a buying perspective) the whole time. We already know that he snapped up 8.9 million shares of Occidental Petroleum in December, but I’m curious to see if anything else caught his eye.

Since the 13F comes out on a Friday afternoon — and I don’t want to wait a whole week to talk about it — I will probably send out a short post about all of Berkshire’s ins and outs early next week. There might be much to discuss — or very little.

Either way, that should land in your inbox on Monday morning.

And, now, onto the latest news and notes out of Omaha…

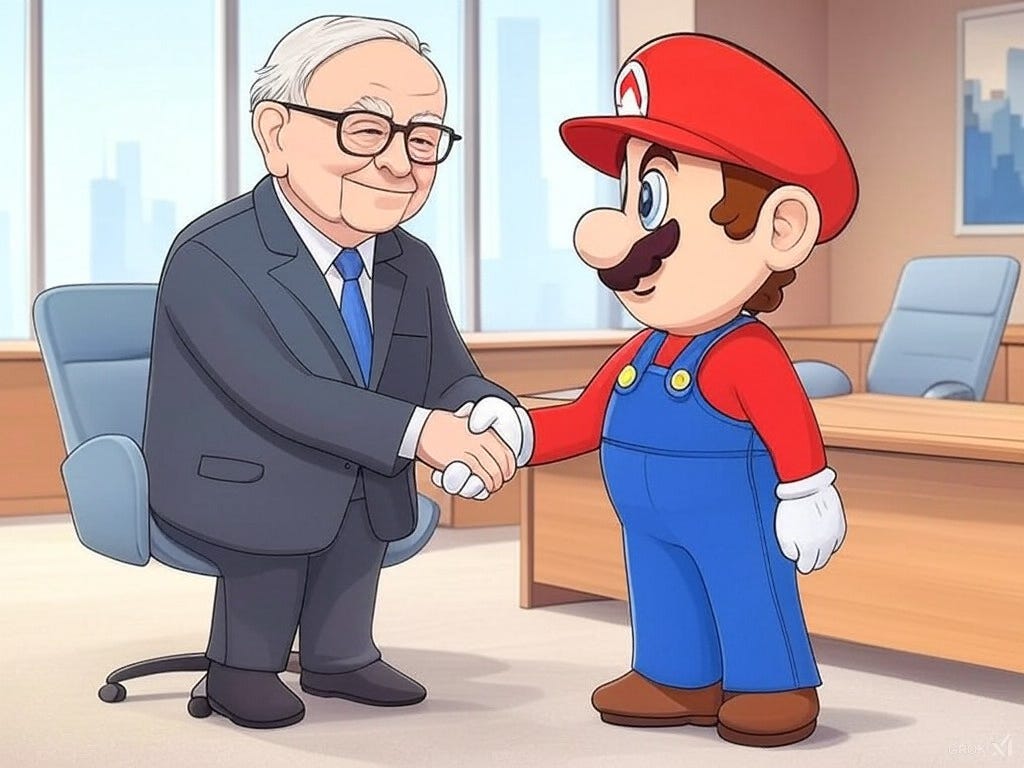

Former Activision Blizzard CEO Bobby Kotick revealed on a podcast that Berkshire Hathaway once eyed Nintendo as a potential acquisition. Some of the initial reporting on Kotick’s remarks say that it was Charlie Munger who expressed interest in the Kyoto-based gaming giant, but a closer listen makes it sound like Warren Buffett was at the wheel. In 2012 or 2013, Kotick traveled to Omaha to discuss Activision’s efforts to buy itself back from Vivendi with Buffett. Over lunch, Buffett admitted that he would be interested in acquiring Activision — and Nintendo, too. At the time, Nintendo’s market cap had plummeted down to $13 billion (including $7 billion of cash on hand) amidst the disastrous Wii U launch and pressure from mobile games. Buffett joked that if this foray into gaming didn’t work out, Berkshire shareholders would chalk it up as “the folly of an 82-year-old” to buy these video game companies in the first place. Obviously, none of this ever came to fruition — but I wonder if Buffett ever reached out to Nintendo to discuss a deal. I’ve always viewed Nintendo as a “Berkshire-type” company, so I’m quite sad that we missed out on this dream partnership.

Munger, on the other hand, was no fan of the video game industry — despite his friendship with Kotick. “He respected the way I ran the business,” said the former Activision CEO, “[but] he didn’t like the business. He thought it was like a step removed from gambling, which he really hated. He was like, ‘You know, you’re preying off people’s addictions.’ And I was like, ‘I’m not! I’m actually giving them joy and fun — and if you ever tried a video game, you’d see that. And if you don’t want to play them, you don’t have to play them.’ He always had this little bit of an aversion [to video games].” Despite all that, Charlie was fond of his frequent lunch companion. “I like Bobby Kotick a lot,” he said in 2023. “I consider him one of the reasonable people in that field.”

When Buffett broached the subject of Berkshire buying Activision Blizzard, a shocked Kotick played devil’s advocate. He told Buffett that he didn’t think Activision fit in as a Berkshire-type company, but Buffett pointed to its deep moat. Kotick then countered that financial results in the gaming biz — driven by big hits that don’t necessarily come out on a regular basis — are too lumpy for Buffett’s taste. “I like lumpy,” said Buffett. “I ensure super catastrophic events. Lumpy is okay.”

Okay, one last story before I leave the Kotick interview. He served alongside Charlie on the Harvard-Westlake School Board of Trustees and called the late polymath “the most authentic person” he has ever known. “That was really why I went on the board,” said Kotick, “to sit next to Charlie. [One time], we had a new head of school and he comes to the board meeting and circulates a mission statement. He was like, ‘We’ve got a new mission statement,’ and it was one of these progressive mission statements. Charlie reads it and says, ‘I’ve been on the board for 50 years and the mission statement at this school has served the school and the students very well.’ He goes like this and rips it in half and says, ‘We don’t need a new mission statement. What’s next on the agenda?’” 🤣

Buffett bought more (but not much) Occidental Petroleum stock last week. A minuscule purchase by his standards — just 763,017 shares for $35.7 million — but still a sign that his enthusiasm for OXY 0.00%↑ has not entirely dimmed. Berkshire’s stake in the oiler remains at 28.2%.

Berkshire also sold 203,091 shares of Davita back to the dialysis provider for $31.7 million. In April, the two companies agreed to a Share Repurchase Agreement that compels Berkshire to sell back shares any time its stake in DVA 0.00%↑ surpasses 45.0%. Davita repurchased 2.3 million shares of its own stock in Q4 2024, which bumped Berkshire’s ownership percentage over the magic line. Hence this small sale.

Duracell ran its first-ever Super Bowl commercial over the weekend. The 30-second spot tricked viewers into thinking that the commercial break was over, until announcer Tom Brady ran out of batteries and shut down. This prompted a visit from The Duracell Scientist, who changed Brady’s batteries from generic alternatives to Duracells, restoring him to full power. Northwestern’s Kellogg School of Management grades all of the Super Bowl ads each year and awarded Duracell’s inaugural effort a B.

“You have a bar that’s the highest all year [at the Super Bowl],” said Duracell CMO Ramon Velutini, “with all the advertisers trying to get their message through in the most compelling way. You need to go for something that is going to break through. We are trying unapologetically to sell Duracell batteries.”

More from Velutini: “I always say that when it comes to batteries, that part of your brain reserved to think about batteries is very small — and that part [reserved] to battery advertising is even smaller.”

This week, Berkshire collected nearly $200 million in quarterly dividends. That includes $106.1 million from American Express, $75 million from Apple, $8.7 million from Ally Financial, $2.8 million from Aon, and $76,286 from Lennar. (I was going to make a joke about that Lennar number — and then remembered that’s more than I make in a year…)

“Run clubs are the new dating app,” said Brooks Running CEO Dan Sheridan. “It’s where you’re finding your mate. And people are choosing run clubs over going to the bar.” That’s a fitting sentiment for this Valentine’s Day edition of The Berkshire Beat.

William Green spoke to one of my favorite investing characters, Terry Smith, on the Richer, Wiser, Happier podcast. “[Charlie] Munger is great,” said Smith, “because he had this idea that if you invest in good stuff, you’ll be alright. Roughly speaking, you could take our entire investment philosophy and boil it down to that. If you’ve got good stuff, you’ll be alright. That’s it. You might not be the best fund and you might not outperform everybody in the world, but you’ll be alright.”

We were behind and skipping through most commercials and I was “tricked” into hitting play for the Duracell ad! Very clever of them. It was interesting to see a BRK company pay up for a Super Bowl spot but I’m sure Buffett allows the CEOs to decide on that!

Wow! What an interestin' fact. I didn't know Mr. Mario visited The Oracle of Omaha to sell his "Plumber business".xD