The Berkshire Beat: December 22, 2023 🎄

All of the latest Berkshire Hathaway news and my must-reads of the week!

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

As a small token of my immense appreciation for your loyal support this year, I’ve made the first annotated transcript (previously available only to paid subscribers) free for everyone to read until the end of the year. On January 1, it will be re-locked.

If you enjoy reading this type of annotated transcript — and want immediate access to five more — there’s no better time than now to become a paid subscriber. (I’m within spitting distance of my 2023 goal for paid subs and just need a few more before New Year’s…)

Merry Christmas! Your support means the world to me!

The latest news and notes out of Omaha…

This one came in right under the wire: Last night, a new SEC filing revealed that Berkshire Hathaway bought 5.18 million more shares of Occidental Petroleum over the past three business days — at an average purchase price of $60.22 per share. That’s good for a total outlay of approximately $312.1 million. Berkshire now owns 27.7% of the Texas oil giant.

It’s been a tough year for BNSF Railway — with earnings falling 24% in Q2 and another 15% in Q3. But, according to one industry publication, the railroad’s fortunes might be starting to turn around. Railway Age: “Total loads unexpectedly rallied from 90,000 per week to above 100,000 between August and early October.” This surging freight volume took a noticeable toll on speed and reliability — but BNSF’s on-time performance quickly bounced back to a normal-ish 89%.

Last week, I touched on Occidental Petroleum’s proposed $12 billion acquisition of CrownRock — and how Berkshire Hathaway is not involved in financing this particular deal. CEO Vicki Hollub also explained why OXY 0.00%↑ targeted CrownRock during this latest round of consolidation in the oil-and-gas sector.

(1) Inventory: “The acquisition of CrownRock further strengthens us in terms of adding incredible inventory,” she told CNBC. “They actually have 1,700 well locations that we will add to our inventory [and] 1,250 of those wells are less than $60 break-even.”

(2) Free Cash Flow: “It’s highly accretive to our free cash flow … For the last few years, we’ve been delivering value to our investors by increasing value per share through debt reduction and the repurchase of shares. Now, this acquisition — because of the FCF accretion — adds a step-change difference in terms of the value per share for our investors.”

(3) Scale: “[CrownRock] provides scale to our Midland Basin operations. It’s important for people to know that the Permian Basin is huge … about the size of North Dakota. So, when you actually break down the basin, there are three big sub-basins — the Midland Basin, the Central Basin Platform, and the Delaware Basin. In the Delaware Basin, we had the scale we needed and we’ve been able to use that scale to improve and optimize our operations there. We didn’t have enough scale, we felt, in the Midland Basin.” (And now they do.)

To pay for CrownRock, Oxy will have to issue about $9.1 billion in new debt. But, Hollub says, that’s no cause for concern. “The debt picture over the next two to three years is actually about what it would have been without this acquisition because we will use the combination of cash flow and [some planned] divestitures to work the debt down.”

Berkshire Hathaway Energy subsidiary PacifiCorp reached a $250 million settlement with commercial timber operators in Oregon — all stemming from the deadly wildfires back in 2020. This comes just two weeks after the company agreed to a similar settlement with Oregon homeowners.

You may remember that mounting litigation against PacifiCorp really battered BHE’s earnings in Q3 2023, so it’s probably good to get this settled now and eliminate the financial uncertainty of a trial.

Lots of chatter around Paramount Global this week: (1) Axios reported that Warner Bros. Discovery CEO David Zaslav met with his Paramount counterpart, Bob Bakish, in New York City to discuss a potential merger; (2) Bloomberg countered with news that Paramount is, once again, in negotiations to sell BET — this time to a management-led investor group for a little under $2 billion; and (3) Bloomberg added that Byron Allen recently emailed Paramount execs and offered $3.5 billion for BET. No clue how this all turns out, but things are heating up.

A few weeks ago, I wrote about Sirius XM Holdings — and how Liberty Media’s proposal to combine its tracking stock with the company seemed a fait accompli. After all, Liberty owns 83% of the satellite radio provider and Greg Maffei doubles as both Sirius XM’s chairman and Liberty’s CEO. Well, now it’s official. The new entity — to be called “New SiriusXM” — will trade under the SIRI 0.00%↑ ticker once the transaction closes in Q3 2024.

Berkshire owns 5.9% of Apple — a stake currently valued at $178.3 billion — which makes it, by far, the largest holding in Warren Buffett and co.’s massive stock portfolio. So, needless to say, I try to keep tabs on what’s happening out in Cupertino. These are heady days for the iPhone maker with AAPL 0.00%↑ up 49.9% so far this year and, once again, boasting a market cap over $3 trillion.

What lies ahead in 2024? Bloomberg’s Mark Gurman (who I regard as something of an Apple whisperer) provided a sneak peek at the company’s future plans in his latest Power On newsletter. In sum: “It will be the company’s wearables business — including the upcoming Vision Pro, AirPods, and Apple Watch — that takes center stage [in 2024].”

🥽 Vision Pro: “This [mixed-reality] headset will certainly grab the spotlight in 2024 — even without bringing in much revenue … Apple is still trying to figure out the key selling points for the headset, but does seem to believe it could become a big part of its financial story within a few years.”

Gurman adds that Apple insiders expect the Vision Pro to chart a similar course to that of the Apple Watch — which took a few generations to achieve mass-market sales and acclaim.

📱 iPhone: “The iPhone will still get an upgrade next year, of course. It’s the company’s most important product and still brings in more than half of revenue. But there won’t be major changes.”

🎧 AirPods: “Apple is readying a major software-based development: hearing aid functionality. The company plans to release that feature later next year, and it could be the start of something big. Apple believes its take on the hearing aid has the potential to upend a multi-billion-dollar industry.” 👀

⌚️ Apple Watch: “Apple is working on a pair of health features designed to take the smartwatch to new heights: hypertension and sleep apnea detection … I think that’s going to sell a lot of devices.”

Speaking of Apple Watch, the company will (temporarily?) stop selling the Series 9 and Ultra 2 models because of an import ban issued by the International Trade Commission. The ITC ruled that the watch’s blood oxygen sensor infringed on another company’s patent. Of course, Apple will not remove these models until after the Christmas sales rush is over (Thursday for online orders and Sunday for in-store), so it should not have a noticeable effect on holiday results.

Apple is reportedly working on a software update to circumvent the patent issue, as well as crossing its fingers that the White House vetoes the ITC’s decision before the December 25 deadline.

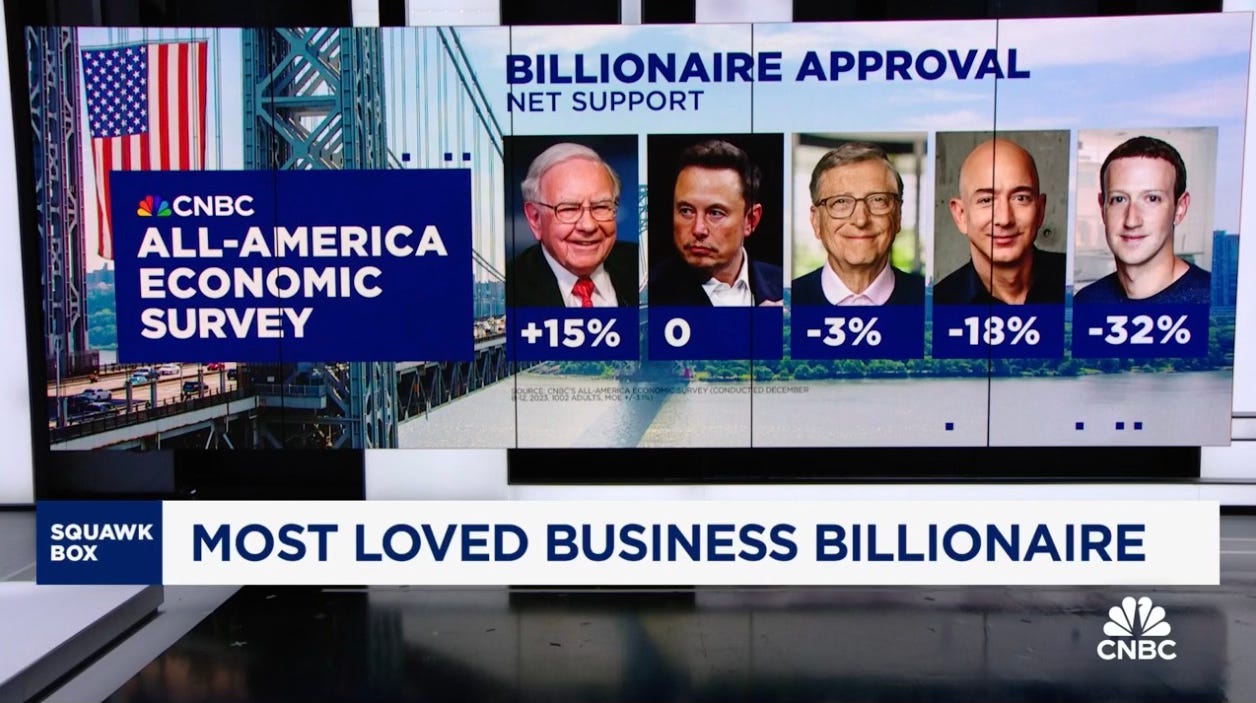

Warren Buffett = America’s Most-Loved Business Billionaire

On Wednesday, CNBC released the results of its latest All-America Economic Survey — and, in a surprise to no one, Warren Buffett took home the crown as America’s most-loved business billionaire. Who would have thought that decades of scrupulous honesty and selfless philanthropic gestures would make such a big difference?

Buffett fared even better among the so-called “financial elites” — with his net approval spiking up to 41%.

Two other thoughts:

If I’m Bill Gates — and I’m not — I’m thrilled with a -3 net approval after all of his various and sundry controversies over the past few years. He’s Teflon Bill.

Jeff Bezos’s numbers, on the other hand, look surprisingly low.

Elon Musk, no stranger to controversy himself, checks in with an even-steven score of 0 — which, all things considered, seems pretty impressive to me.

More Must-Reads

Other awesome things that I read this week…

Legendary Investor Charlie Munger Was Frank, But Funny — And Showed People How To Win In Business & Life (Theron Mohamed || Business Insider)

“[Becky] Quick first interviewed Munger around 16 years ago. ‘I was terrified,’ she said, as she knew Munger had no qualms about openly dismissing a question as stupid. ‘I didn’t want to look like a fool.’ However, she found Munger to be very kind. She later realized that he was a devoted teacher like Buffett, but he employed a more subtle approach that weaved in stories and fables.”

The Gift That Keeps On Giving Dividend Growth Investor

“I have come to the conclusion that no one will remember your gift ten or twenty years down the road. It is very rare that this gift will be a life-changing event. I believe that the best gift to provide to others is the gift of stock. I think that the best gift should be buying quality dividend-paying stocks [for] recipients. The gift recipient will receive dividends for decades. Every time they receive a new dividend check, and every time that dividend check increases with dividend growth, they will think fondly of the person that gave them that stock.”

The Joy of Being Idle Alejandro Lopez

“The book — The Usefulness of the Useless, by Nuccio Ordine — consisted of plenty of fragments from classical literature emphasizing the relevance of ‘useless’ knowledge. Ancient Greek, opera, ballet, history of art, painting… You name it. These are all things that don’t help you pay the bills, but that warm your soul.”

Every Restaurant Chain Wants To Beat Chick-fil-A, But It’s Stronger Than Ever (Amelia Lucas || CNBC)

“The average non-mall franchised Chick-fil-A restaurant rakes in $8.7 million in sales annually. That’s despite being closed on Sundays … For comparison, the average franchised McDonald’s location that has been open at least a year sees about $3.7 million in annual sales. McDonald’s, which is the largest U.S. restaurant chain by sales, has a clear size advantage over Chick-fil-A, with roughly 14,000 U.S. locations, and plans to build 900 more by 2027. But McDonald’s hasn’t been able to match Chick-fil-A’s massive annual unit volumes or its reputation for customer service.”

Love to see that Warren is the most popular billionaire and that people recognize his unique character and actions.

Definitely more surprised to see Gates at ‘only’ -3% than Buffett being regarded the most likable. Gates has a lot of controversy over him with his connection to the Epstein situation - and his unexplainable counteroffensive after his death, would like for his association to Buffett and therefore Berkshire to be discontinued.