The Berkshire Beat: August 16, 2024

All of the latest Warren Buffett and Berkshire Hathaway news! Including updates on Berkshire's Q2 2024 investment activity, Apple, Ulta Beauty, HEICO, Occidental Petroleum, and more...

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

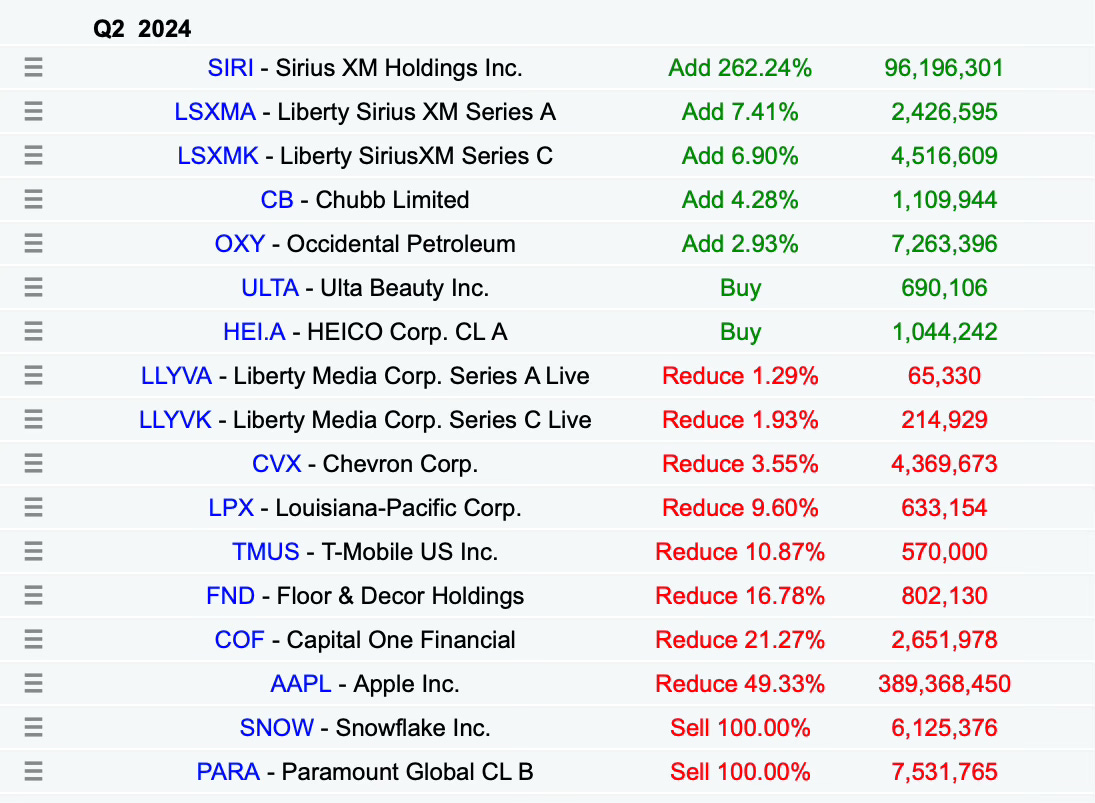

On Wednesday afternoon, Berkshire Hathaway’s 13F granted us our quarterly peek behind the curtain at Warren Buffett and co.’s investment activity during Q2 2024.

The conglomerate’s recent 10-Q spoiled some of the bigger surprises — like Buffett selling nearly half his remaining Apple stock — but the filing still affords all of us the opportunity to learn more about how our favorite super-investors ply their trade.

Let’s take a closer look at the in’s and out’s of the Berkshire portfolio — as well as all of the latest news and notes out of Omaha…

Berkshire Hathaway opened two new common stock positions in the second quarter: Ulta Beauty and HEICO. Based on the size of these investments — both roughly in the $200-250 million range — we’re probably talking about Todd Combs or Ted Weschler picks here.

Combs seems the likeliest buyer of HEICO. He has dabbled in the aerospace industry before with Precision Castparts. (Warren Buffett said he didn’t know anything about Precision before Combs started investing in it. “You’ve got to give credit to Todd Combs for this deal,” he said when Berkshire acquired the Portland-based company in 2016.)

And, while I can’t offer any personal testimony about Ulta’s products, the specialty beauty retailer has built a strong brand with female customers — evidenced by consistent same-store sales growth. International expansion could be a future tailwind, too.

Other additions include more Occidental Petroleum, Chubb (topping up Berkshire’s stake in the insurer from 6.4% to 6.7%), and Sirius XM Holdings. We already knew about the 6.9 million shares of Liberty Media Sirius XM trackers, but Berkshire also loaded up on SIRI 0.00%↑ ahead of next month’s combination.

Ten different stocks ended up on the chopping block. Berkshire trimmed its Liberty Live trackers (Series A & C), Chevron, Louisiana-Pacific (for the second quarter in a row), T-Mobile, Floor & Decor, Capital One Financial, and Apple — and also fully exited Paramount Global and Snowflake.

Buffett reduced his Apple position down to 400 million shares on the nose. That’s the exact same amount as Coca-Cola, which is commonly believed to be a permanent holding. Is that 400 million number a random fluke or a sign that he might be done selling Apple? The obsessive round-number-lover inside of me very much hopes it’s the latter.

Barron’s estimates that Berkshire will owe about $15 billion in taxes on its recent sale of Apple stock. With a cost basis of about $34 per share, the vast majority of each sale represents a taxable capital gain. But, while Berkshire will be writing a pretty hefty check to the government, it will not affect the company’s earnings number. “When Apple or another stock appreciates,” writes Andrew Bary, “Berkshire Hathaway sets aside about 25% of the gains in a provision for income taxes.” This provision totaled $57 billion at year-end 2023 — covering gains on Bank of America, Coca-Cola, American Express, as well as Apple.

The bottom line from Bary: “Buffett essentially decided that he’d rather have cash equal to nearly 80% of the value of the Apple stake — our estimate — than the Apple stock.”

John Huber of Saber Capital Management warns investors not to get the wrong idea about Buffett’s buzz cut of Apple. “One thing his Apple sale is not: a market prediction,” writes John Huber. “I’ve seen all kinds of commentary that references the Apple sale in the context that Buffett is bearish or is predicting a market decline. He has always said he doesn’t have any idea what the market is going to do near term (nor does anyone else). He is not predicting anything bad happening to Apple or to stocks in general. I think his Apple sale is simply a byproduct of his investment process. The stock has become more expensive, offering less value, and therefore he views cash as a better alternative. It says much about Apple’s valuation, but little about where the stock is headed next.”

Sticking with Apple for a second, the iPhone maker might end up catching a stray in Google’s antitrust tussle. Earlier this month, parent company Alphabet got hit with an antitrust verdict in district court which mostly focused on the dominance of Google Search — and the eventual fallout from this could cost Apple more than $20 billion per year. Alphabet currently pays that amount to make Google the default search engine in Apple’s Safari internet browser. If that kind of arrangement gets outlawed, Apple would be out the $20+ billion while the vast majority of iPhone users would likely carry on using Google like always.

CrownRock Holdings — which sold CrownRock LP to Occidental Petroleum — is ready to cash in on Oxy stock. It received 29.6 million shares of OXY 0.00%↑ common stock as part of the payment for CrownRock LP — and will not waste any time before monetizing those shares. CrownRock Holdings hopes to bring in $1.7 billion through the sale of these shares. Might Berkshire be interested?

Dividend checks keep rolling into Omaha: Yesterday, Berkshire collected $100 million from Apple, $8.7 million from Ally Financial, and $2.8 million from Aon in quarterly dividends. (That Apple number might be lower if Buffett sold more shares during the third quarter.)

Over his long career, Warren Buffett has handled “overvalued” holdings in many different ways. Dividend Growth Investor takes a closer look at the hits and misses — from Coca-Cola to Costco — and how they all shaped his decision to pare back on Berkshire’s massive position in Apple. “The game of investing is fascinating,” writes DGI, “because there are no hard and fast rules. The same type of logic and reasoning could work very well under one set of conditions, and fail miserably under another. The investor can only hope that consistent application of sound principles could average out to an overall record of profits.”

I’ve always considered Li Lu to be Berkshire-adjacent. The Charlie Munger seal of approval counts for a heck of a lot around here. Well, anyway, the Chinese-born investor purchased 1.46 million shares of Occidental Petroleum for his Himalaya Capital Management fund in the second quarter.

Another Memorable Occidental Petroleum Earnings Call

During the last weekend of February in 2022 — when the rest of the investing world was poring over his just-released annual letter to Berkshire Hathaway shareholders — Warren Buffett was reading something else: the transcript of Occidental Petroleum’s earnings call from the previous day.

And I think it’s safe to say that it made a big impression.

“I read every word,” Buffett told CNBC the following week, “and said this is exactly what I would be doing. [CEO Vicki Hollub] is running the company the right way.”

“We started buying on Monday and we bought all we could.”

Two and a half years later, Berkshire is (by far) the O&G giant’s largest shareholder — with a position worth close to $15 billion.

So, with that backstory in place, let’s turn our attention to Oxy’s most recent earnings call from last week. This one may not rival the aforementioned 2022 edition in terms of impact, but nevertheless contains plenty to chew on for Berkshire shareholders…

✨ Occidental Petroleum was close to selling 30% of its newly-acquired CrownRock assets to Ecopetrol for $3.6 billion — but the deal fell apart at the last second.

That begged the question: What does it say about those CrownRock assets if Oxy was ready and willing to sell them — and couldn’t even do that?

On the earnings call, CEO Vicki Hollub explained exactly what happened.

I actually informed Ecopetrol on numerous occasions that our preference was to purchase 100% of CrownRock. But, as a part of the Rodeo JV, we had an agreement with Ecopetrol that they had the right to purchase 49% of anything that we purchased within a certain area — and vice versa. So we wanted it all, but they also wanted to be a part of it.

They saw the assets. They know they are high-quality assets. They wanted to be a part of it. Since they are a valued partner to us — we’ve been in partnerships with them for decades and we have a great relationship with them — we negotiated to a 30% working interest that we felt would be fair and beneficial to both of us.

We worked on that deal from March to just last week and we thought we were done — but President Petro of Colombia didn’t approve of it. He’s made it very clear to the world that he’s anti-oil-and-gas, anti-fracking, and anti-U.S.

And, with those three strikes, he pretty much dealt Ecopetrol out of the deal.

✨ Even without the Ecopetrol investment, Hollub said that Occidental Petroleum remains on track to lower its debt after the $12 billion CrownRock acquisition.

“We have a clear line of sight to meeting the debt reduction targets we set out when we announced the [CrownRock] deal last December,” she said.

In fact, Oxy expects to retire about $3 billion of its debt during the third quarter alone. That’s two-thirds of the way to the lower end of the company’s debt reduction target of $4.5 billion to $6 billion over the next eighteen months.

And, as I write this, Oxy appears to be on the verge of selling some of its ownership interest in Western Midstream Partners MLP. That would move the oiler even closer to its near-term debt goal.

✨ As a result of the CrownRock acquisition, Occidental Petroleum has paused share repurchases (common and preferred) until its total debt gets below $15 billion. Hollub said this is “doable by the end of 2026 or the first [part] of 2027”.

“Our share price is so much lower than we believe it should be,” she said. “So, as we get through this period and we get our debt back down to $15 billion, we will then resume share repurchases.”

Nevertheless, Hollub insisted that the accretive addition of CrownRock “delivers better value than buying back shares”.

what's your estimate of how much in capital gains taxes Berkshire has to pay on those sales?

The Apple sale should also be seen as a position sizing decision, as I wrote when BRK announced the first sale. https://harveysawikin.substack.com/publish/posts/detail/144414554?referrer=%2Fpublish%2Fposts