A Closer Look at Berkshire Hathaway's Q3 2025 Earnings Report

All of the little (and big) details from Berkshire's latest 10-Q

Berkshire Hathaway released its Q3 2025 earnings report on Saturday morning, offering us a fresh glimpse into the inner workings of the legendary conglomerate.

In the spirit of Warren Buffett’s shareholder letters — renowned for distilling complex financial concepts into clear, essential insights — this is my own humble attempt to sift through the deluge of third quarter numbers and highlight only those items that matter most to Berkshire’s long-term trajectory.

Where else could we possibly start other than with Berkshire Hathaway’s growing cash mountain? This hoard swelled to an astounding $354.3 billion in the third quarter, up nearly $15 billion in the space of just three months. That might not be the cash number you see elsewhere, though. The vast majority of the mainstream financial press seems to be running with $382 billion as Berkshire’s cash total, but that misses the mark on a few points.

Following in Warren Buffett’s footsteps, I do not include cash held in Railroad, Utilities, & Energy in Berkshire’s total.

There’s also that pesky $23.2 billion U.S. Treasury Bills payable that some forget to subtract out. This payable pops up when there are unsettled purchases of Treasury Bills that “were paid shortly after the respective balance sheet date”.

And, last but not least, $354.3 billion is the number that Berkshire itself uses on Page 50 of the 10-Q.

A big part of this continued cash accumulation is that Berkshire’s share buyback spigot remains firmly shut off. Buffett did not repurchase any shares in the third quarter — and that reticence extended into the first three weeks of October, too. There had been some thought that the ol’ buyback machine might kick back into gear over the summer, as the conglomerate’s stock price continued to dip. Chris Bloomstran even noted that, at the August lows, Berkshire’s stock was “fundamentally undervalued to the same degree as when Berkshire last repurchased shares”.

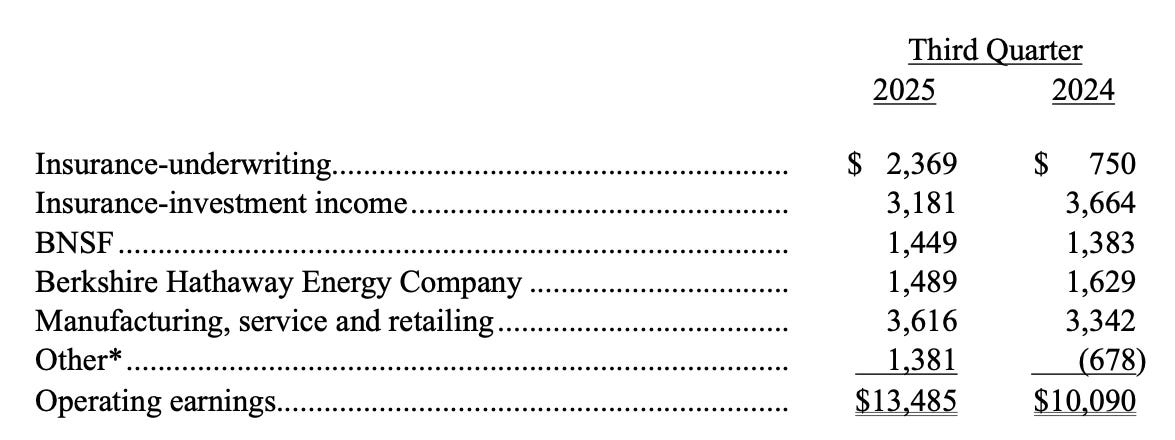

Around Berkshire, operating earnings are the performance metric of choice. Unlike net earnings, which have a tendency to fluctuate wildly due to mark-to-market mood swings in the stock portfolio, Berkshire’s operating earnings tell us how its many wholly-owned businesses actually did in said quarter. On the face of it, Berkshire’s operating earnings soared 33.6% to $13.5 billion — but that does not quite tell the full story. If you strip out the impact of foreign currency exchange — removing the $331 million “gain” in Q3 2025 and the $1.1 billion “loss” in 2024 — operating earnings are actually up a still-impressive 17.6% on the quarter.

Berkshire’s stock portfolio finished the quarter valued at $283.2 billion, but we’ll have to wait for next week’s 13F to learn the specifics. It doesn’t look like we’re going to get sneak peeks at investment activity in these reports anymore, as Berkshire once again omitted the current market value of its five largest holdings. These heavy hitters — still Apple, American Express, Bank of America, Coca-Cola, and Chevron — now only account for 66% of the overall portfolio, as opposed to 71% at the start of the year.

GEICO had another great quarter — posting a stellar 84.3% combined ratio and nearly $1.8 billion of pre-tax earnings — albeit not quite as great as a year ago. Earnings fell $260 million from Q3 2024, but GEICO must feel like a victim of its own success with such a tough year-over-year comparator. Even though its combined ratio crept up by more than three points, almost all of that came on the expense side as the auto insurer began trying to win back market share. The 10-Q specifically notes that the $412 million increase in underwriting expenses was policy acquisition-related. And it seems like money well spent, as premiums written increased by $563 million, reflecting a surge in policies-in-force.

BH Primary Group rebounded from last year’s ghastly 114.7% combined ratio with a much-improved 89.3% mark in the third quarter. Premiums written eked out a modest gain (led by MedPro, BH Homestate, National Indemnity, BH Direct, and USLI) and loss expenses declined by $1.2 billion as GUARD tries to regain its footing.

BH Reinsurance Group — buoyed by a mild (so far) hurricane season — contributed $884 million of pre-tax profit. The property/casualty division did the heavy lifting here with a sparkling 79.4% combined ratio and $1.1 billion of pre-tax profit, though as-to-be-expected losses from retroactive reinsurance and periodic payment annuities ate away at that result a bit.

Two other insurance-related items of note: (1) Float increased to $176 billion and, as Berkshire’s underwriting continues to be profitable, the cost of this float is negative. (2) Insurance income declined by $483 million as “interest and other investment income” dropped 25% in response to lower short-term interest rates.

BNSF Railway seems to be mostly back on track. The railroad increased after-tax earnings by 4.8% to $1.45 billion, helped along by core pricing gains and improved operating efficiencies. BNSF’s operating ratio also continued to inch in the right direction, going from 64.8% in the second quarter to 64.1% now. (That still pales in comparison to Union Pacific’s 59.2% operating ratio, but beggars can’t be choosers.) Car-loadings were up a smidge — with consumer and agricultural/energy products managing modest increases and industrial and coal products down slightly.

Berkshire Hathaway Energy struggled across the board as after-tax earnings sank 8.6% to $1.5 billion. The U.S. Utilities, Natural Gas Pipelines, and Other Energy units all suffered year-over-year reverses, with the latter two both down more than 20%. BHE also recorded another $100 million wildfire loss accrual in the third quarter. On the bright side — relatively speaking — the HomeServices real estate brokerage grew earnings by $13 million. There’s a lot of uncertainty hanging over BHE at the moment.

MSR (Manufacturing, Service, & Retailing) grew earnings by 8.2% to $3.6 billion, though results among the various operating businesses were quite mixed. We’re always somewhat at Berkshire’s mercy as to what information we receive on the many, many subsidiaries that make up this sprawling corner of the conglomerate — so I’ve tried to pull out the best little nuggets from this section of the earnings report.

First up, we got a Bell Laboratories mention! Berkshire acquired the Wisconsin-based rodent control manufacturer in very quiet fashion back in August and its results will now be included in the industrial section of MSR. I was hoping we might learn the purchase price here, but alas no luck there.

Precision Castparts increased revenue by 4.5% to $2.7 billion — while pre-tax earnings rocketed upwards 35.6% on increased aerospace sales and improved manufacturing and operating efficiencies.

Marmon (+19.7%) and IMC’s (+21.9%) pre-tax earnings soared, while Lubrizol (-2.7%) faced headwinds from weaker sales and pricing pressures.

The 10-Q warned that “certain of Berkshire’s building products businesses are experiencing slowing customer demand”. Over at Clayton Homes, home sales were flat while financial services revenue jumped 12% on higher interest income from its loan portfolio. Clayton paced the group with a $74 million increase in pre-tax earnings — with all of the rest combining to grow earnings by $7 million.

If not for Duracell’s tax credits for manufacturing some of its battery components domestically, pre-tax earnings in consumer products would have “declined significantly” in the third quarter. Brooks Running managed higher earnings, but it seems like everyone else struggled.

NetJets, FlightSafety, and TTI paced the Service group to a $109 million gain in pre-tax earnings.

The famously low-margin McLane parlayed a big margin improvement (1.1% to 1.3%) into 19.3% higher earnings.

In Retailing, there’s Berkshire Hathaway Automotive and then there’s everyone else. BHA accounted for 71% of the group’s sales so far this year and eked out a 1.8% gain in pre-tax earnings on solid performances from its parts/service/repair and finance/service businesses. Outside BHA, though, the rest of the group got tagged with a 22.7% drop in earnings.

Pilot makes for especially grim reading. The travel center network sank to a shock loss of $17 million in the third quarter on lower wholesale fuel and in-store gross margins and higher expenses.

Whether or not Warren Buffett has one last big act of capital allocation up his sleeves, he has Berkshire Hathaway in fine fettle before turning it over to Greg Abel. The soon-to-be CEO will have a nigh unimaginable amount of dry powder and resources to do with as he will — and that is all made possible because Buffett spent decades patiently building and cultivating this impressive business machine. Abel’s job will not be easy — replacing a legend never is — but the stage is set for success.

Thanks for the summary! Berkshire is in great shape as the transition approaches. With the stock back under 1.5x BV repurchases may soon resume. Berkshire has posted over $48 billion in net operating earnings alone over the past four quarters so the market cap is only slightly above 20x, and of course we have to add in some normalized figure for investment gains as well, so the normalized PE might be mid-teens. Reasonable in absolute terms and cheap relative to other mega caps.

Any theory on why the dismal numbers from Pilot? I know Abel made some managerial changes there but that was quite a while ago. Did the Haslem family sell them a lemon?