What Warren Buffett Looks For In A Stock

One of the investment world's most-asked questions was answered in a 1980 book

Happy Thursday and welcome to our new subscribers!

And many thanks to Alan Soclof for the kind words:

Mohnish Pabrai is right: We’re all incredibly blessed to live during the time of Warren Buffett.

I liken it to being a Disney fan back when Walt was still calling the shots.

In both cases, a genius at the top of his game keeps defying the odds (and critics) by continually scaling new heights and delighting his customers/shareholders.

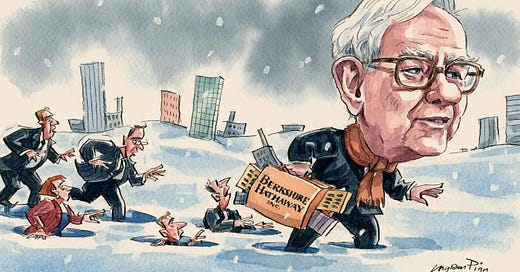

Warren Buffett has been bestowing his investment wisdom on us for the better part of seventy years. He writes voluminous annual letters to Berkshire Hathaway shareholders and sits for several wide-ranging interviews each year — including the marathon Q&A at Berkshire’s AGM.

Through it all, Buffett doles out pearls of wisdom about how to steel yourself into a more intelligent investor.

What he doesn’t do, though, is hand out advice or analysis on specific companies.

When asked about an individual stock, Buffett typically brushes the question away with a ready quip. Or, if asked how to calculate Berkshire’s (or any other company’s) intrinsic value, he demurs that the process is different for everyone and that he won’t spoil anyone’s fun by spelling out the answer.

So, while Buffett remains a one-stop shop for building a proper investor’s mindset, he rarely offers actionable advice in terms of a specific security.

In 1980, John Train featured Warren Buffett in his best-selling book, “The Money Masters”. Aside from a few mentions and guest articles in financial magazines, Buffett was still relatively unknown at the time. Train’s book, though, forced him out of the Omaha shadows and into the national spotlight.

And, in the book, Buffett dished on some of the key things that he looks for when evaluating any potential investment.

No, he doesn’t name names — you still have to do your own work (and it’s forty years out of date, anyway) — but he does provide a flexible framework to size up companies.

Here are eight of Buffett’s money game must-haves:

(1) The company is understandable

Before investing in any company, you should be able to grasp exactly what it does to earn money, why it appeals to customers, what motivates the people who work there, and what the business will look like ten (or twenty) years down the road.

Buffett touches on this point often — dating back to the persistent (and pointed) questions that he faced about his avoidance of tech stocks. He always answered those queries the same way: he just didn’t understand tech companies enough to invest in them.

Buffett was no technophobe. But he had the humility to admit that, since he didn’t understand tech companies, they didn’t belong in his portfolio.

In particular, he worried that these companies lacked a moat. Any upstart startup could come along and steal an old stalwart’s business right out from under them. Look at what Google did to Yahoo (or AltaVista) in the world of online search.

Stick to your circle of competence and don’t gamble (because that’s what you’re doing) any money away on companies and industries that you don’t understand inside and out.

(2) The company has a good return on capital — without accounting gimmicks or lots of leverage

Buffett preferred to look at return on capital, as opposed to earnings per share, because earnings numbers can be manipulated in ways that return on capital cannot.

This also underscores the need for corporate honesty. Using accounting gimmicks to massage your financial data into better shape might not be illegal, but is still a major red flag.

And, of course, Buffett recommends that investors avoid leverage at all costs.

To illustrate this — at least on a personal scale — Train recounts a story that Buffett told him about the son of GEICO’s founder.

Buffett said that he had learned from his father and from Ben Graham never to borrow. For instance, there is the sad case of Jimmy Goodwin, son of Leo Goodwin, founder of GEICO. He had $100 million of GEICO stock and he borrowed on it for living expenses and miscellaneous ventures so as not to have to pay capital gains taxes on his holdings. When GEICO’s stock collapsed, he not only lost his portfolio assets but had his house sold at a sheriff’s sale. People usually borrow because they want to get rich soon; Buffett feels that the journey should be as much fun as the destination, so why take chances?

If that can happen to an over-leveraged GEICO heir, it can happen to an over-leveraged company, too.

(3) The company sees its profits in cash

In the business world, cash is king.

But it’s also like oxygen.

Just try to survive once it’s run out.

(4) The company has a strong franchise and, thus, freedom to price

In ‘80s-era Buffett parlance, franchise basically means brand name. By this time, his transformation from Grahamian caterpillar scrounging for cigar butts (albeit a wildly successful one) into the brand-focused, super-investing butterfly of today was just about complete.

Buffett used one of his favorite holdings, American Express, as an example. At that time, AmEx sat alone upon the credit card throne and wielded incredible pricing power. Even as the company incrementally raised annual fees from $3 to $20, its user base kept growing and growing.

Plus, this all happened during the salad oil imbroglio. When a company can successfully raise prices while being dragged through the mud of scandal, you know you’ve found a winner.

And, of course, Buffett would continue to add more bulletproof brand names like Coca-Cola and Apple to Berkshire’s stock empire after his “Money Masters” profile.

(5) The company doesn’t take a genius to run

Everyone knows how highly Buffett regarded the managerial acumen of the late Tom Murphy. But, while he regarded Murphy as (by far) the top leader in the communications field, he noted that CapCities’ rivals did okay even with average-at-best management.

The rising tide of the communications biz lifted all boats. Even the mediocre ones.

A little later in the chapter, Buffett expounded on this point:

When I asked if he did not consider Tom Murphy of Capital Cities to be equally outstanding [compared to the great Henry Singleton], Buffett smiled and said, “Well, Murph plays a simpler game,” but added that part of great business ability is to get into simple games.

Simple games also have the added bonus of being (relatively) idiot-proof.

(6) The company’s earnings are predictable

If a business randomly careens back and forth between profitability and profligacy, no one — not even a master like Warren Buffett — can get a good handle on what’s coming next.

If you don’t understand a company’s long-term earnings outlook, then you don’t understand the company well enough to invest in it. Rule #1 comes first for a reason.

Buffett famously remarked that you should only buy stock in a company if you’d be happy to hold it even if the market shut down for the next ten years. That kind of zen peace of mind is only possible if you can predict (with reasonable certainty) what the company’s earnings will be during this dormant period.

(7) The best business is a royalty on the growth of others, requiring little capital itself

In the 1970s and 1980s, Buffett loaded up Berkshire Hathaway’s portfolio with international advertising agencies and media companies like Ogilvy & Mather, Interpublic, and The Washington Post. They required relatively little capital to keep growing and collected a “royalty” from other companies that were effectively forced to use their advertising services in order to survive in the marketplace.

The unfortunate capital-intensive producer — Chrysler, Monsanto, or International Harvester — can’t bring its wares to its customers’ notice without paying tribute to the “royalty” holder: the Wall Street Journal, J. Walter Thompson, the local TV station, or all three.

To bring this into the twenty-first century, any wannabe Buffetts might look at Alphabet (Google) or Meta Platforms (Facebook/Instagram) as the modern-day equivalents of ad-related royalty collectors.

The second part of this rule hints at a question that every intelligent investor should ask: How much capital is needed to keep this business growing?

Some companies require regular infusions of capital; others do not. No prize for guessing which is better.

Let’s return to the credit card well for another example. In 2012, Visa earned $2.1 billion in net income, while spending $376 million in capital expenditures. By 2021, Visa’s earnings grew to $12.3 billion (up nearly 6x), but cap-ex only increased to $705 million (not even double).

That’s the sign of an excellent, capital-light business.

(8) The management is owner-oriented

Buffett might not insist on a genius to run the company, but he does require honest, above-board stewards of capital. Owner-oriented leadership won’t be afraid to make the tough decisions — both turning away from specious short-term gains and always putting the long-term interests of the company and shareholders ahead of his own.

All too often, Buffett says, if you could put a chief executive under sodium pentathol and dig into the rationale behind his acquisitions, you’d find he was inspired by his yearning to move up a few places in the Fortune list of the 500 largest companies, not by concern for the value per share of his company. Many companies, including banks, are run into the ground because the president is concerned with size rather than quality: he becomes hypnotized by his company’s rank in terms of gross size.

Train and Buffett end the chapter driving home the same point:

Buffett once met a leading executive of a capital-intensive business giant at a time when the company was selling in the market for one-quarter of its replacement value.

Buffett asked the executive, “Why don’t you buy back your own stock? If you like to buy new facilities at one hundred cents on the dollar, why not buy the ones you know best and were responsible for creating at twenty-five cents on the dollar?”

Executive: “We should.”

Buffett: “Well?”

Executive: “That’s not what we’re here to do.”

If you come across an executive like this, one who’s lost sight of his duty to shareholders (owners), please steer clear.

If you’ve enjoyed reading this issue of Kingswell, please hit the ❤️ below and share it with your friends so they don’t miss out. It costs you a total of $0 and means the world to me. Thank you!

Disclosure: This is not financial advice. I am not a financial advisor. Do your own research before making any investment decisions.