What Did Super-Investors Buy and Sell in Q2 2022?

A 13F roundup including Warren Buffett, Charlie Munger, Michael Burry, Guy Spier, Li Lu, and more.

Happy Friday and welcome to our new subscribers!

I hope everyone survived the frenzy of 13F deadline day on Monday.

All investment managers with more than $100 million under their control must file a quarterly report, known as Form 13F, with the SEC to disclose any changes in their portfolios.

And they must do so within 45 days of the end of the previous quarter — setting up a mad rush earlier this week as heel-draggers got their papers in right under the wire.

It’s a fun (and informative) way to see what some of our favorite super-investors have been buying and selling over the past few months.

Just don’t turn 13Fs into more than an academic exercise. These are not cheat sheets of what your next move in the market should be — nor are they endorsements about the future returns of any company.

No matter who’s doing the buying.

Remember: Everything revealed in these filings are only current as of June 30, so they’re already six weeks old and quite possibly out of date.

In other words, don’t coat-tail.

On the plus side, 13Fs show how different investors — even those who espouse the same value-based principles and philosophies — go about their business in drastically different ways.

Let’s dig in…

Berkshire Hathaway’s 13F should come with a warning:

Not all investments revealed herein were made by Warren Buffett.

With Ted Weschler and Todd Combs managing an ever-increasing portion of Berkshire’s portfolio, it can be difficult to discern which investments belong to Buffett and which come from his lieutenants.

Some try to read the tea leaves or make deductions based on a particular position’s size or industry, but — at the end of the day — everyone’s just guessing.

(So, whenever I write “Buffett bought…” or “Buffett sold…” a particular security, it might actually be Weschler or Combs’s handiwork. Such is the inherent uncertainty that all Berkshire students must labor under.)

As I mentioned in last week’s post on Berkshire’s latest earnings report, Warren Buffett and co. proved to be surprisingly restrained buyers in the second quarter.

At a time when most expected him to splash the cash on undervalued opportunities, Buffett tightened Berkshire’s pursestrings instead. The company’s spending on stocks dropped from $51 billion in Q1 to just $6.2 billion in Q2.

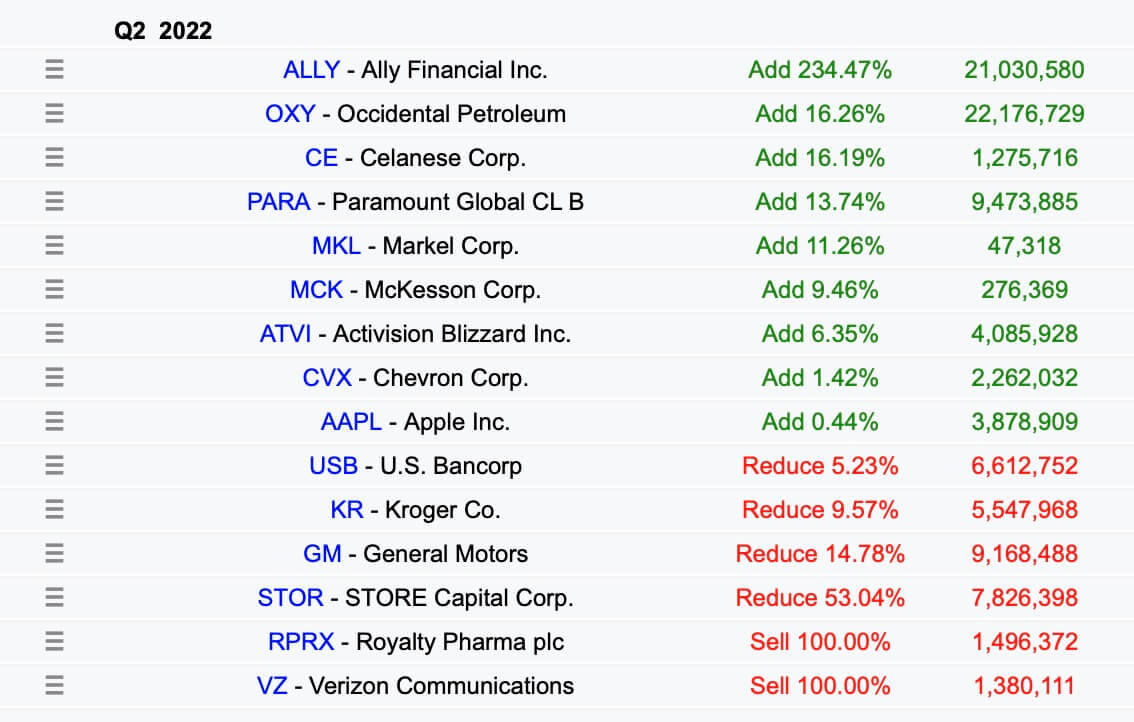

Notably, Berkshire loaded up on Ally Financial — adding 21 million more shares to bring its ownership stake in the auto and home lender up to 9.7%.

Of most interest to me, though, is Buffett’s continued interest in Paramount Global. Longtime readers know that I carry something of a torch for Paramount — especially when it’s selling for less than $30 a share — and welcome Berkshire’s involvement.

So, as soon as I got my grubby hands on Berkshire’s 13F, I scanned the list to see whether or not the company’s stake in Paramount had increased.

And, happily, it had.

Berkshire bought 9.4 million shares of Paramount in Q2 and now owns 12.9% of the television/streaming/film media conglomerate.

Granted, that’s not a huge amount — especially at current prices — but serves as at least a modest vote of confidence that the stock remains undervalued.

On that, we’re in full agreement.

Outside of any other specific stock purchases or sales, three things really stand out to me about how Buffett has shaped Berkshire’s portfolio:

(1) It’s very concentrated.

Buffett has never been afraid to commit a lot of capital to his very best ideas — dating all the way back to GEICO in his pre-partnership days and, later, American Express after the salad oil scandal.

And that hasn’t changed over the ensuing sixty-plus years.

Add up Berkshire’s stakes in Apple, Bank of America, Coca-Cola, Chevron, American Express, Kraft Heinz, and Occidental Petroleum — and that accounts for nearly 80% of the company’s massive investment portfolio.

For the visual learners among us, check out this eye-opening graph from 21st Century Value Investing:

And, with Apple making up $160 billion out of the portfolio’s $370 billion overall value, the Cupertino-based company will continue to play an outsized role in Berkshire’s investment performance in the years ahead.

(2) Buffett likes to add to existing positions.

Even at prices that raise his cost basis on a particular stock.

That can be a troublesome mental hurdle for many investors — me included.

Apple now costs a heck of a lot more than it did when Buffett started building a position in 2016, but that hasn’t stopped him from topping up Berkshire’s stake with 3.8 million more shares.

Likewise with McKesson and Chevron.

When it comes time to make a stock purchase, sometimes the best place to look is at companies that you already own. If adding to an existing position offers the best future returns, don’t let higher nominal prices dissuade you from making the smart choice.

Warren Buffett doesn't.

(3) Blue chips galore.

It’s not too often that a new name pops up in Berkshire’s portfolio that causes investors to look around and ask, “What’s that?”

Instead, Buffett has packed the portfolio full of blue chip companies with long histories of profitability, immense moats, and brand names that afford them pricing power and immediate recognition.

No long shots. No head scratchers.

Just the best of the best.

And, luckily enough for all of us mere mortals, companies that are relatively easy to study, understand, and stick with through thick and thin.

While Buffett and co. mostly stood pat on the investment front, the same can’t be said for Michael Burry.

For the second quarter in a row, it was all change at his Scion Asset Management fund. Burry, of The Big Short fame, fully exited his positions in Bristol-Myers Squibb, Meta Platforms, Warner Bros. Discovery, Alphabet, and more.

Scion now holds only one stock — GEO Group.

Very bearish stuff from Burry.

I love the man — and his Twitter game is 🔥 — but I have to agree with TCII here. Scion’s moves over the past few quarters, with the entire portfolio changing from one period to the next, is way too erratic for me.

Give me the “boring” style of Charlie Munger’s Daily Journal investments (no changes at all this quarter) or Guy Spier’s Aquamarine Fund (which only sold out of Twitter) any day.

Speaking of Munger, he once called Li Lu the “Chinese Warren Buffett” for his savvy capital allocation skills. And, while we can only see the U.S. portion of his Himalaya Capital Management holdings in 13F filings, he made two big moves last quarter:

📈 Added to his Alphabet stake with buys of both Class A shares (with voting rights) and non-voting Class C shares.

🚫 He also fully exited his Meta Platforms position.

Another interesting wrinkle: Li Lu, like so many of his fellow value investors (Mohnish Pabrai, Seth Klarman, Guy Spier, the Sequoia Fund, etc.), continues to hold a major stake in Micron.

The Idaho-based computer memory maker has proven to be something of cat nip for value investors over the past few years and might merit closer examination in a future issue of Kingswell.

Stay tuned.

If you’ve enjoyed reading this issue of Kingswell, please hit the ❤️ below and share it with your friends (and enemies) so they don’t miss out. It only costs you a few clicks of the mouse, but means the world to me. Thank you!

Disclosure: This is not financial advice. I am not a financial advisor. Do your own research before making any investment decisions.