The Berkshire Beat: September 5, 2025

All of the latest Warren Buffett and Berkshire Hathaway news!

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

Warren Buffett has been burning up the phone lines to CNBC’s Becky Quick of late. And, for the second week in a row, he shared Berkshire Hathaway’s perspective on major market developments. This time, the focus was on Kraft Heinz’s announcement that it will split up into two separate companies by the end of next year.

Basically, the beleaguered food giant hopes that separating its grocery business from the faster-growing portfolio of condiments/sauces (which it calls “taste elevation”) and shelf-stable meals will propel the combined value of the two new companies beyond Kraft Heinz’s current market cap in the $32-33 billion range.

So, with Berkshire holding a substantial 27.5% stake in Kraft Heinz, the question on everyone’s mind is what does Buffett and co. think about this dramatic reorganization?

In a word: “Disappointed.”

“Warren Buffett tells me they were disappointed with [Kraft Heinz] coming up with this idea,” said Quick, “and then disappointed on top of that that shareholders will not be getting a vote when it comes to what’s going to be happening with this.”

It’s not like Buffett thinks everything over at KHC 0.00%↑ is going swimmingly — with the stock price down ~70% since the merger in 2015. “It certainly didn’t turn out to be a brilliant idea to put [Kraft and Heinz] together,” he told her, “but I don’t think taking them apart will fix it.”

Buffett’s frustration seems to stem from both the strategic and financial implications of the split. He noted that vice chairman Greg Abel voiced strong reservations about the plan directly to the company last week — but Kraft Heinz forged ahead anyway. Buffett also ruefully highlighted the $300 million in additional overhead costs from the separation, a process he already sees as a year-long waste of time and resources.

So will Berkshire look to sell out of its Kraft Heinz position?

“We will proceed to do whatever we think is in the best interest of Berkshire,” said Buffett. “If we are approached about selling our shares, we wouldn’t accept a block bid unless the same offer is made to other Kraft Heinz shareholders.”

The apparent disregard for shareholders by Kraft Heinz decision-makers is another major sore spot — with no vote planned on whether or not to pursue the separation. And, while Buffett might be open to exiting this particular holding, he doesn’t intend to do so in a way that leaves the remaining shareholders high and dry.

Buffett doesn’t often take his disapproval public. But, for whatever reason, Kraft is something of an exception. Back in 2010, he criticized the company when it overpaid for Cadbury — and, even worse, sold its profitable frozen pizza business to help fund the unwanted acquisition. “Both deals were dumb,” said Buffett. “The pizza deal was particularly dumb.”

In May, two Berkshire-affiliated directors — Alicia Knapp (BHE Renewables) and Tim Kenesey (MedPro Group) — stepped down from the Kraft Heinz board. At the time, Berkshire dismissed the move as an internal decision to not place directors on the boards of non-controlled investments. But, on CNBC, Quick speculated that there might be more to the story. “[Berkshire] had two designated board members who resigned at, I guess, Warren Buffett and Greg Abel’s suggestion. I guess they saw where things were headed, weren’t really in favor of it, so decided they didn’t want to have their people voting on [it].”

And, now, more of the latest news and notes out of Omaha…

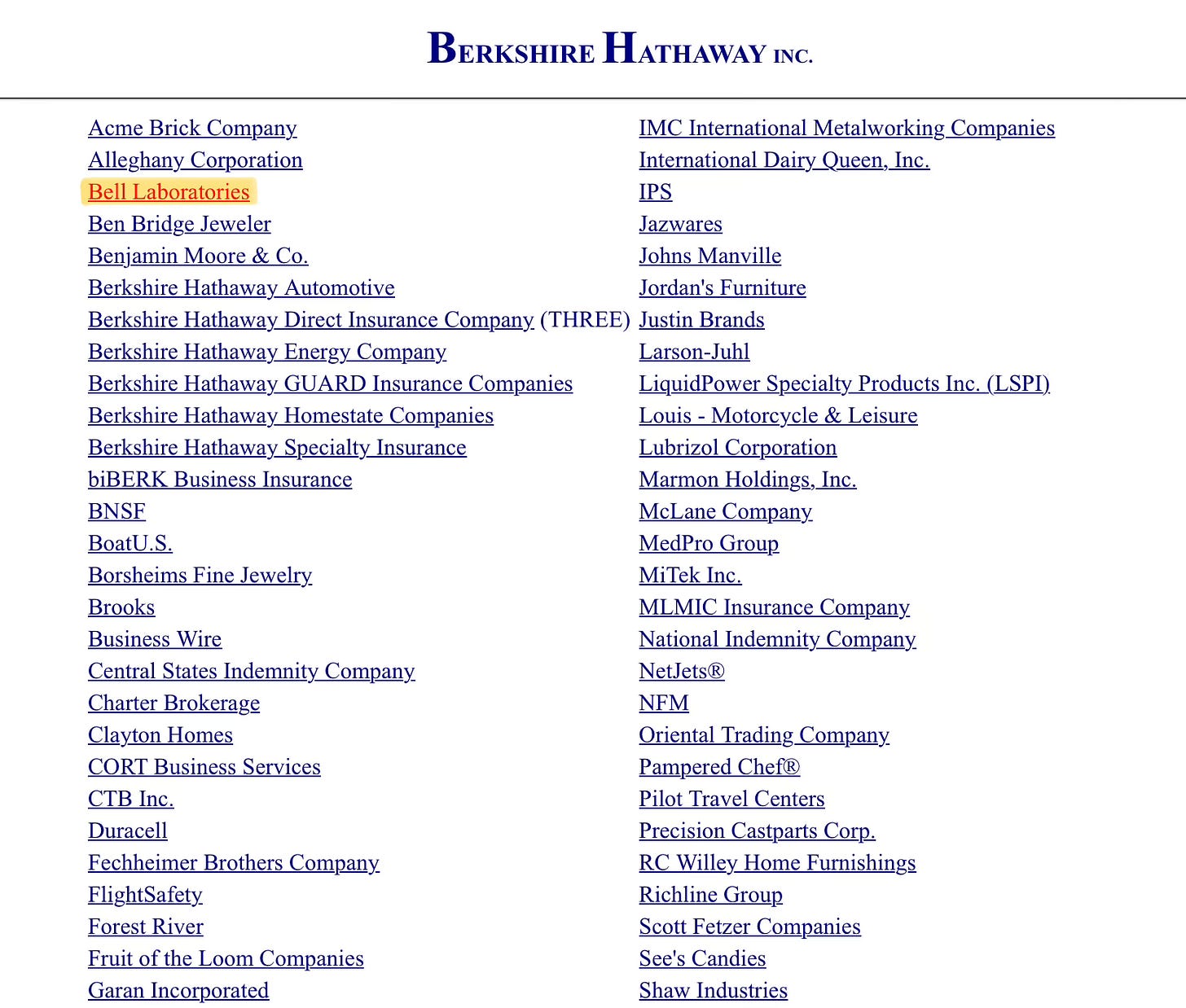

Case closed: Berkshire Hathaway DID acquire Bell Laboratories after all. Last month, reports of the acquisition popped up in a few pest control trade publications — and, then, some FlightAware sleuthing added even more fuel to the fire — but neither Berkshire nor Bell officially confirmed the deal at the time. But, now, we finally have our proof. Berkshire added Bell to the list of subsidiaries on its website, cementing its place in Buffett’s eclectic empire. Financial terms remain undisclosed, but maybe we’ll get more information in the next earnings report. (And, to clarify, this is not the Bell Labs owned by Nokia, but a rodent control company from Wisconsin.)

For a while there, it looked like Apple might catch the mother of all strays in Google’s antitrust trial. A key driver of Apple’s growing Services segment is the ~$20 billion that it receives each year from Google to make it the default search engine on iPhones — and it was widely believed that this financial arrangement would end up on the chopping block as part of the judge’s final ruling. But, in a fortuitous twist for Apple (and, by extension, Berkshire Hathaway), he decided that “Google will not be barred from making payments or offering other consideration to distribution partners for preloading or placement of Google Search, Chrome, or its GenAI products”. So, in the end, this uber-lucrative deal lives to see another day.

GEICO’s senior creative directors continue to make the rounds promoting the insurer’s new advertising campaigns. “An early read on results is showing strong in-market performance across the funnel for all lines of business,” Sialoren Spaulding told Little Black Book. “Some of our most heavily-weighted ads are topping the charts for the insurance category over the last year.” She also highlighted the distinct challenge of marketing insurance — a product that consumers don’t think much about until absolutely necessary. “Most people hardly ever think about insurance — or want to. It’s important that when they do, they think about us — and positively. Our work plays a big role in ensuring that happens.”

In a recent New York Times interview, Chevron CEO Mike Wirth offered a grounded outlook on the oil and gas industry. Responding to the International Energy Agency’s forecast of a near-term peak in global oil demand, he remained unfazed. “First of all,” said Wirth, “the IEA has not always been right, historically, on things — and it wouldn’t be surprising if the IEA is not right about this. Even if they are, once oil demand reaches a level where it’s no longer growing, it’s unlikely to drop off quickly. It’s more likely to stay at a plateau. So demand is going to be around for a long, long time.” And, in terms of any future dramatic switch in focus to alternative energy sources, Wirth was candid: “When the world stops using oil and gas, we’ll stop looking for it.”

And a few odds and ends to finish off the week…

This week, Berkshire collected $23.2 million in quarterly dividends from Moody’s, $17.5 million from Kroger, $4.9 million from Visa, and $4.3 million from Capital One Financial.

With rumors swirling that Coca-Cola may sell Costa Coffee, the hometown Atlanta Journal-Constitution spoke to industry insider Duane Stanford about this wayward acquisition. “You’re seeing a company that’s more willing to take these big bets,” he said. “But then, if it’s not working or consumer winds change, they’ll cut it and move on.”

Bloomberg reports that the Department of Justice’s probe into UnitedHealth extends beyond just Medicare billing irregularities — and also encompasses its pharmacy benefit manager Optum Rx and physician reimbursement practices.

An appropriate finale in honor of the NFL kicking off this weekend: American Express will replace Visa as the NFL’s credit card and payment sponsor starting in the 2026 season. Sports Business Journal pegs the deal at about $910-950 million over seven years.