The Berkshire Beat: September 26, 2025

All of the latest Warren Buffett and Berkshire Hathaway news!

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

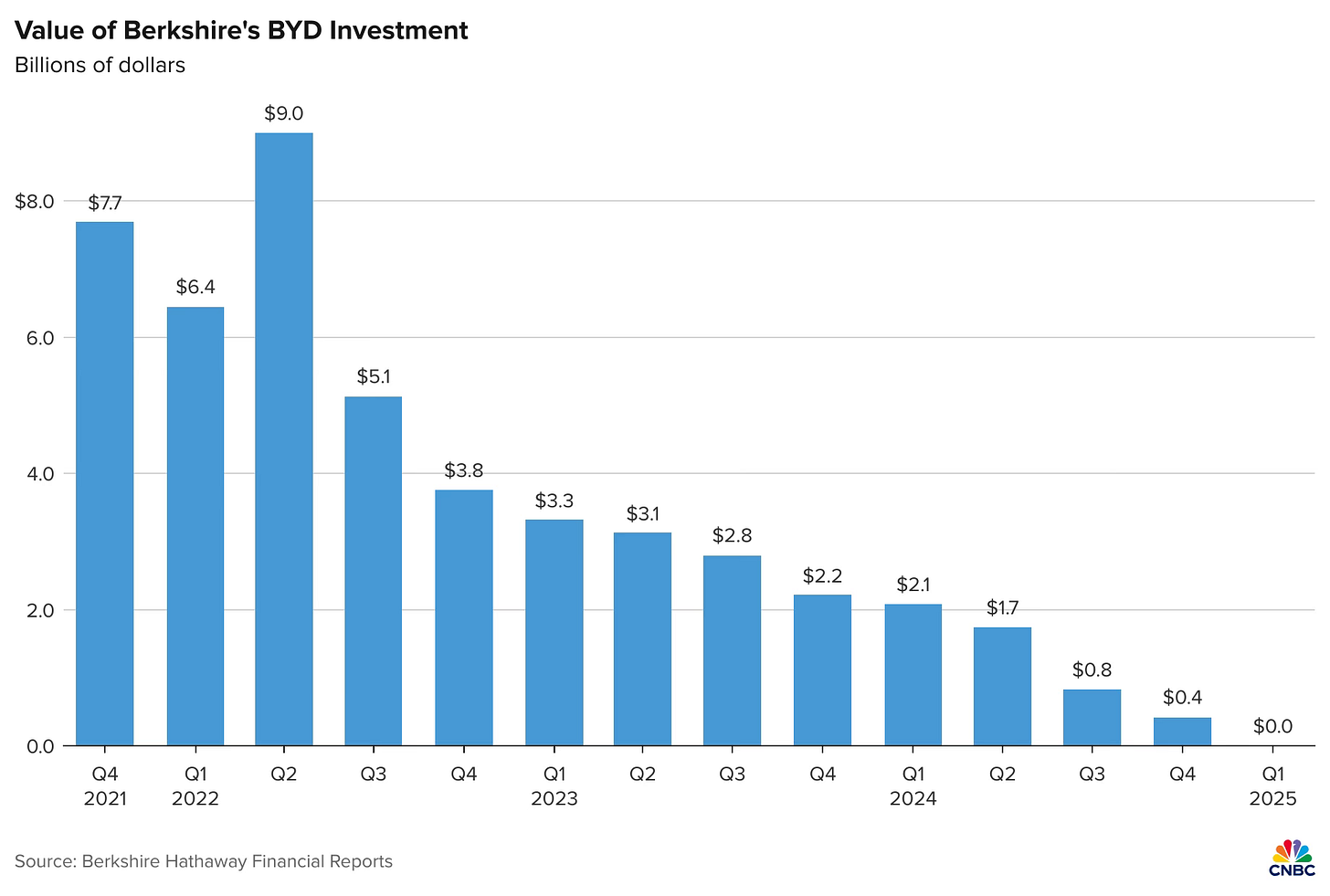

Berkshire Hathaway’s excellent EV adventure is over — as the conglomerate fully exited its BYD investment earlier this year. A sharp-eyed reader of CNBC’s Warren Buffett Watch newsletter noticed that the holding’s value dropped to zero in Berkshire Hathaway Energy’s Q1 2025 earnings report, down from $415 million at year end.

And, with that evidence in hand, Berkshire then itself confirmed the sale to CNBC.

Any way you slice it, this was a terrific bit of business from Warren Buffett and Charlie Munger — who pounded the table for BYD after learning about the company from close friend Li Lu.

MidAmerican Energy purchased 225 million of BYD’s Hong Kong-listed shares for $230 million back in September 2008. Berkshire then sat pat for the better part of fourteen years, before starting to trim the position in the summer of 2022.

Even BYD super-fan Munger couldn’t blame his partner for that. “You can understand why some people would sell BYD stock at 50x earnings,” he said at the 2023 Daily Journal annual meeting. “At the current price of BYD stock, little BYD is worth more than the entire Mercedes corporation’s market capitalization. It’s not a cheap stock.”

Berkshire continued to sell and sell, before making an orderly exit sometime in the first quarter. CNBC estimates that BYD shares increased by approximately 3,890% during the time that Berkshire owned them. A tidy profit in less than two decades.

BYD took the news in stride. “In stock investments, buying and selling is a normal part of the process,” Li Yunfei, the automaker’s head of public relations, wrote on Weibo. “We appreciate the recognition from Munger and Buffett of BYD, as well as their investment, support, and partnership over the past seventeen years.”

Executive vice president Stella Li, meanwhile, brushed aside the thought that Berkshire’s sale was a reflection on her company’s future. “Charlie Munger and Warren Buffett loved BYD,” she told CNBC this week, “[and] they loved BYD management. But they are investors and buying and selling is naturally their business. It’s not because they don’t like us.”

She also highlighted the trust and support that Berkshire provided BYD back when it was a complete unknown on the world stage. “They always encouraged us [and said], ‘Don’t worry! We invest for the long term. Business goes up and down, [so] don’t worry.’ They supported us when we were small and we are very appreciative.”

And, now, on to the latest news and notes out of Omaha…

Over the weekend, Berkshire Hathaway informed Mitsui that it now holds 10% or more of the company’s voting rights. The press release from Mitsui specifically notes that this increase comes “as a result of an additional acquisition of our shares” and not a passive boost via share repurchases. The Japanese trading house also noted that “Berkshire Hathaway plans to hold Mitsui’s shares for a long period of time and intends to consider acquiring further shares in the future”. For now, though, Mitsui says it will tally up Berkshire’s exact holding and issue that information in a separate announcement in the near future — so stay tuned for that.

In a recent Bloomberg interview, Chevron CEO Mike Wirth laid out the oil giant’s strategic priorities — and hinted that the Hess acquisition (and its Guyana assets) could surprise to the upside. “There’s an old adage in our industry that says that big fields get bigger,” he said. “There’s a reason that old adages stay around — because they have a basis [in fact]. And [the Stabroek Block] is a big field.” Wirth’s comment lines up well with one of my favorite Munger-isms: If it’s trite, it’s right.

Before retiring, Wirth hopes to sharpen Chevron’s corporate culture in a more aggressive direction — without completely losing its “polite and collaborative” attitude. “We need to compete vigorously,” he said. “We have to be honest with one another about the choices that are required in our business. We have to make hard decisions. We can’t defer them. And we have to have accountability for performance.” (Despite the retirement mention, Wirth added that he plans to stick around for a while yet.)

Renewing Chevron’s concession at the Tengiz super-giant oilfield in Kazakhstan — due to expire in 2033 — is another top priority. Just this week, Wirth met with Kazakh president Kassym-Jomart Tokayev in New York City to discuss future developments in the Tengiz and hydrocarbon routes to global markets.

Sky News reports that Coca-Cola’s efforts to sell Costa Coffee attracted just a few tepid nibbles during the opening round of bids. It seems that private equity giant Apollo Global Management did not submit an offer — and, overall, Coca-Cola received far fewer bids than expected. Which, taken all together, casts doubt on the soft drink maker’s ability to secure a favorable deal here. Already staring down the barrel of a big loss on its £3.9 billion investment from a few years ago, Coca-Cola might now struggle to get much more than £1.5 billion for Costa.

Apple CEO Tim Cook is in Japan this week to celebrate the re-opening of the Apple Ginza store, the company’s first retail location outside of the United States. Originally opened in 2003, Apple Ginza has been displaced for the past three years while the Sayegusa Building was updated and renovated. The store will officially reopen on Friday morning with Cook in attendance. In the meantime, the Apple CEO has been busy making some new friends…

And a few odds and ends to finish off the week…

This week, Berkshire Hathaway collected $169.5 million in quarterly dividends from Bank of America, $130.3 million from Kraft Heinz, and $11.1 million from UnitedHealth Group.

Berkshire subsidiaries See’s Candies and Jazwares are once again teaming up on a Halloween limited edition bundle — including both a box of the iconic chocolates and a spooky Squishmallows plush. “We were thrilled by the overwhelming enthusiasm from our customers when we rolled out the Squishmallows x See’s campaign last year,” said See’s CEO Pat Egan. Release date: October 4.

The annotated transcript for September will go out to paid subscribers early next week. This one is a Warren Buffett interview from 2011 in which he displays his trademark patience and discipline at a time when the American economy was still sputtering its way toward recovery. So, if you’ve been thinking about upgrading, there’s no time like the present. Hope everyone has a wonderful weekend!

Yes, Costa Coffee was a bad acquisition by $KO. They are boxed in a corner right now. Even Starbucks seems to be struggling and will be closing stores due to pressures from an activist.

In an inflationary or stagflation environment, people will forgo the cafe environment and just brew coffee at home. The same is happening with restaurants.