The Berkshire Beat: September 19, 2025

All of the latest Warren Buffett and Berkshire Hathaway news!

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

Any boxing fans in the crowd probably already know this, but Omaha native Terence “Bud” Crawford won the super middleweight title in dominant fashion against Canelo Alvarez over the weekend.

And he had one very notable fan — and friend — cheering him on from a distance.

“I’m a huge fan,” Warren Buffett told the Wall Street Journal through a spokesperson. “There’s nothing [else] in the world that would cause me to stay up until midnight on a Saturday.”

Buffett has long admired Crawford’s disciplined approach in the ring, even going so far as to draw parallels to intelligent investment philosophy. “Bud embodies the traits of a savvy investor,” he said a few years ago. “He uses the early rounds to meticulously study his opponent, then leverages that insight to deliver decisive victories.”

Such strategic patience, Buffett believes, mirrors the careful research and calculated timing that define his own success in the money game.

The bond between these two favored sons of Omaha deepened during a meeting at Berkshire Hathaway headquarters in 2016. Crawford, already a rising star in the boxing world, was struck by Buffett’s unassuming humility and frugality. “We’re both cheap,” he laughed. “You wouldn’t even think he was a billionaire.”

During their conversation, Buffett advised the fighter to always stay grounded despite his coming wealth and fame. “The money’s going to come,” he told Crawford. “Don’t let that be your focus. And, when you get it, be responsible.”

This unlikely friendship underscores how shared values — discipline, strategy, and humility — can forge an enduring connection across vastly different worlds. One strong enough to keep an aging billionaire up way past his bedtime.

And, now, the latest news and notes out of Omaha…

Adam Mead, author of The Complete Financial History of Berkshire Hathaway, earns this week’s MVP honors. Through a Freedom of Information Act request, he unearthed a treasure trove of previously unreleased documents related to the SEC’s 1970s-era investigation into Blue Chip Stamps and its tangled ownership structure. In all, Mead ended up with more than 4,000 pages of material — letters written by and to Warren Buffett and Charlie Munger, deposition transcripts, and detailed financial records for many of the companies involved. And, best of all, he is generously sharing this bounty with the public. The entire collection is freely available for download on Mead’s website, The Oracle’s Classroom. Just head over to the BRK Archives page and the six-part file can be found under the Blue Chip Stamps tab.

Given the sheer volume of pages on offer here, it will take a very long time to dig through everything. But, rest assured, I will do so in the coming weeks, months, maybe years — and will report back with any interesting finds and discoveries.

Berkshire Hathaway is the gift that keeps on giving. At this week’s Flatwater Free Press Festival in Nebraska, the William and Ruth Scott Foundation (founded by an early Buffett Partnership Ltd. and Berkshire employee and his wife) revealed that while it had originally planned to disperse all of its money in the fifteen years following Ruth’s eventual death, that plan has now changed. “Thanks to the performance of Berkshire Hathaway’s stock,” said foundation president John Levy, “it will likely take twenty years to spend down the money.” He also shared Ruth’s quippy outlook on philanthropy: “Money is like manure. It’s only good if you spread it.”

Apple CEO Tim Cook, speaking from the floor of Corning’s factory in Harrodsburg, Kentucky, outlined his company’s ambitious plan to invest $600 billion into American manufacturing over the next four years. “Since we announced a $500 billion commitment [later increased to $600 billion] toward the beginning of the year,” he told CNBC, “we were continually working to come up with more ways to bring manufacturing into the United States. It’s not really bringing it back because that manufacturing was not here to begin with. We came up with several things that we could do and do more of. One was the glass that you saw today — and we are thrilled with how this project is going. Another is stitching together the end-to-end silicon supply chain. I’m really pleased with how that’s going. And yet another one a little different than both of those is a deal that we did with MP Materials to do rare-earth magnets in the United States. A lot of advanced manufacturing can be done in this country — and be done competitively in this country.”

“[The $600 billion commitment] is a huge one,” continued Cook, “but we’re an American company — and we’re a proud American company. We want to do as much in the United States as we can. Not only for product that we sell in this country, but for product that we sell around the world.”

Last month, Apple announced a $2.5 billion investment in the aforementioned Corning factory to produce all of the cover glass for iPhone and Apple Watch devices worldwide. The entire facility will now be dedicated to manufacturing for Apple — and the two companies plan to open an on-site innovation center.

Good news out of China: “Pre-order sales of Apple’s new iPhone 17 series have got off to a robust start in China,” reports SCMP, “shattering previous records despite delays in the shipment of the iPhone Air. In the first minute after pre-orders began at 8 p.m. Friday local time, sales on JD.com — one of China’s largest online shopping platforms — surpassed the first-day pre-order volume of last year’s iPhone 16 series, according to the e-commerce operator.”

With harvest season fast approaching, BNSF Railway is gearing up for what could be a bumper crop. The Berkshire-owned railroad’s shuttle program, which handles roughly 80% of its grain volume, moves grain from origin to destination without costly re-routing. But, even with this efficient system already in place, BNSF is prepping for what the USDA expects to be the second-largest increase in crop production in the past nine years. The railroad has hired 1,500 new train crew members so far this year, pre-positioned locomotives and shuttles in key locations, and added 1,100 high-efficiency hoppers to the fleet.

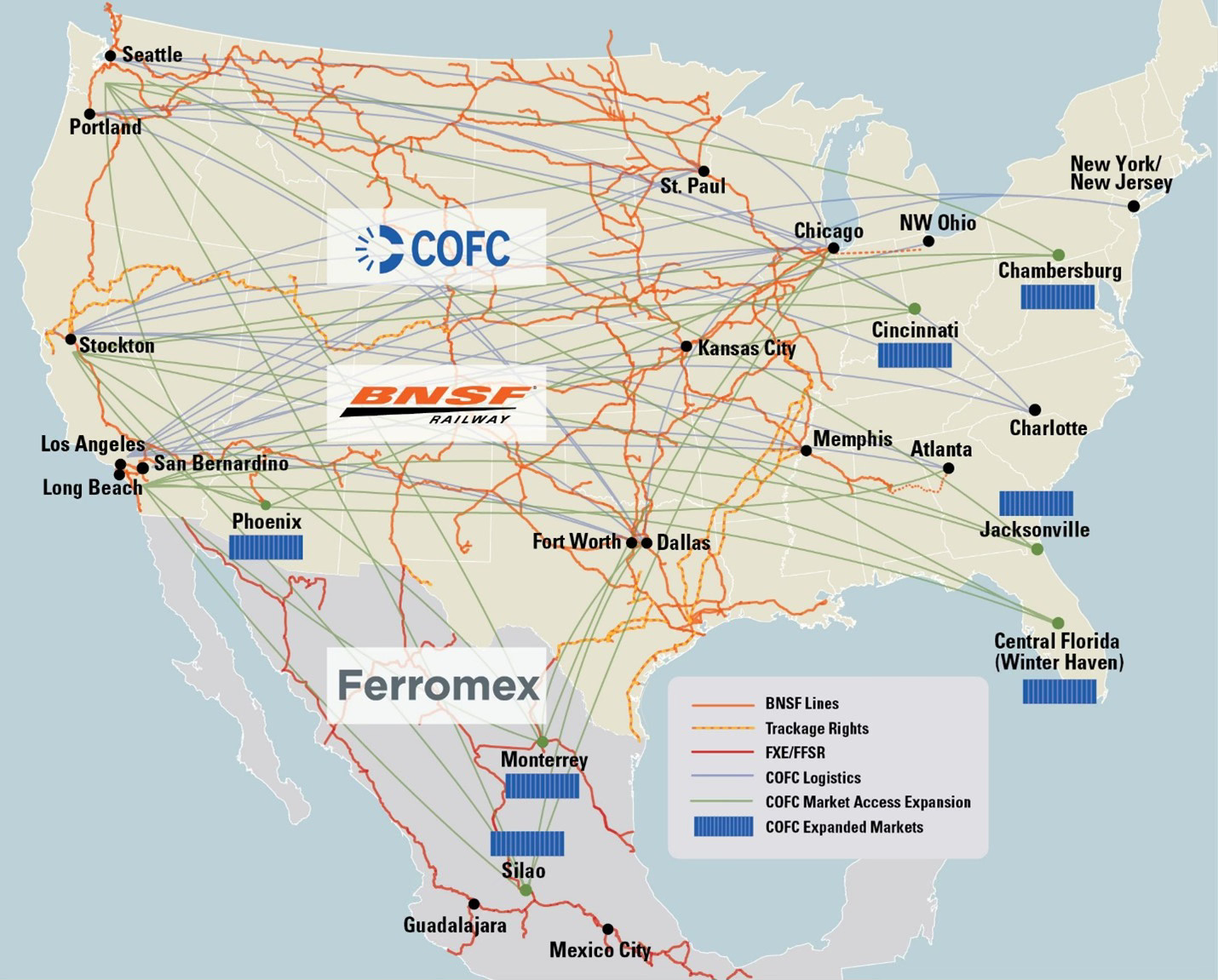

In other railroad news, BNSF and COFC Logistics are significantly expanding the latter’s network of service offerings — granting BNSF better access to the eastern United States and Mexico. “We are excited to expand the reach and capacity of our industry-leading intermodal network to the [intermodal marketing companies] community, through these key additions to COFC Logistics’ service offerings,” said BNSF vice president Jon Gabriel. “By opening and connecting a network across more of North America, we’re not just adding lanes — we’re adding opportunity to the supply chain.”

And, finally, a couple odds and ends to finish off the week…

Gary Hoogeveen, a long-time Berkshire Hathaway veteran, recently announced his retirement as president of Pilot Energy — and Jesus Guerra has been named his replacement. “Jesus has been with Pilot since 2018,” said Pilot CEO Adam Wright, “has decades of experience in the energy sector, and is committed to Pilot’s purpose-driven strategy.”

Bank of America CEO Brian Moynihan’s succession plan came into better focus last week, as Dean Athanasia and Jim DeMare were promoted to co-presidents of the entire bank and CFO Alastair Borthwick was named executive vice president. These three are now widely seen as the most likely successors to Moynihan — who, it must be said, still plans on sticking around for a while. “I’m not going anywhere in the short term or the medium term,” he told Bloomberg, “but it takes a while to set that up and get people used to the size and scale of this company.”

Awesome post! It is 110 railcars per shuttle train, not 110 total railcars