The Berkshire Beat: November 21, 2025

All of the latest Warren Buffett and Berkshire Hathaway news!

Happy Friday and welcome to our new subscribers!

I am busily putting the finishing touches on this month’s annotated transcript for paid supporters and will have it out to all of you before the holiday weekend. This one is a rare Charlie Munger interview with CNBC on the eve of the Berkshire Hathaway annual shareholders meeting in 2012.

Charlie is in vintage form here — candidly sharing his thoughts on Berkshire’s operations, the stuttering economic recovery from recession, and what he most looks forward to each year when he returns to Omaha for AGM weekend. Plus, of course, the requisite amount of stinging zingers and well-aimed scorn at the scoundrels, charlatans, and fools of the financial world.

Here is a quick sneak peek at one of his more important points:

“We have always been opportunistic,” said Charlie. “I think we have been pretty good at grasping things our duty impelled us to grasp. And it has worked way better than master-planning. I have a deep distrust of master-planning. People get to believing the plan because they created it. What is needed is the kind of propensity to disbelieve by changing your previous conclusions — and we are very good at that. Thank God!”

So, if you’ve been on the fence about upgrading, this might just be the perfect time.

And, now, for the latest news and notes out of Omaha…

Another big retirement in the Berkshire orbit could soon be in the offing. According to the Financial Times, Apple has recently accelerated its succession planning efforts because CEO Tim Cook may step down as soon as next year. And while there have been no official announcements or final decisions on the matter, just about everyone expects senior VP John Ternus to be the next man up. No changes are expected before Apple’s next earnings report in late January, but FT posits that a new CEO could be in place shortly thereafter so as to give that person ample time to settle in before pivotal events like WWDC (June) and the iPhone 18 reveal (September).

One of my favorite Apple watchers, John Gruber at Daring Fireball, sees this scoop as a textbook example of a controlled leak by the company itself — to start preparing the public for Cook’s (relatively) imminent departure. But, he adds, Cook is not expected to go far. Much like Warren Buffett at Berkshire Hathaway, he will likely become executive chairman of the Apple board.

In other Apple news, Counterpoint Research reports that iPhone sales jumped 37% in China last month — fueled by strong demand for new iPhone 17 models. It’s not only the best ever start to the holiday quarter for Apple in terms of unit sales, but the iPhone maker hit 25% market share in the month for the first time since 2022. And, best of all, Counterpoint expects Apple to keep rolling. “There is always some risk,” wrote senior analyst Ivan Lam, “especially with the Huawei Mate 80 series launching [next week]. But there’s a lot of momentum behind Apple at this point. There is not much tapering to indicate a steep drop-off.”

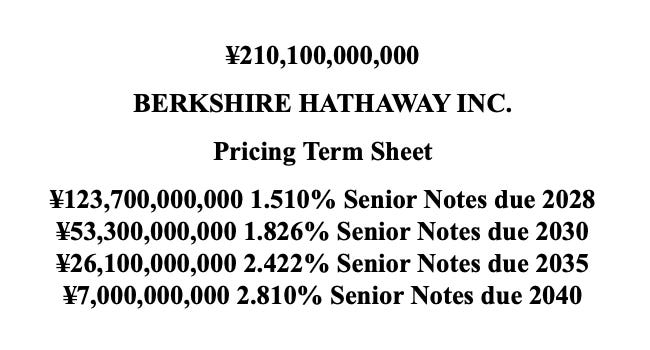

Berkshire returned to the Japanese bond market this week — issuing ¥210.1 billion ($1.4 billion) in yen-denominated debt. Buffett and co. locked in low rates ranging from 1.51% for the 2028 maturities up to 2.81% for those coming due in 2040. As usual, this latest foray into yen bonds spurred speculation that the raised capital will be used to top up Berkshire’s stakes in its favored Japanese trading houses. Time will tell.

PacifiCorp reached a $150 million settlement with 1,434 plaintiffs tied to the 2020 Labor Day wildfires. This deal stands as the largest single batch of resolutions since the floodgate of lawsuits opened five years ago — and at a fraction of the punishing costs meted out in jury verdicts. “PacifiCorp will pay [these] plaintiffs an average of $107,142 each,” noted the Willamette Week. “Juries in the class action case awarded the first round of plaintiffs between $3-5 million each. But PacifiCorp is appealing those verdicts and it will take years for the class action to wind its way through the courts.” In all, the Berkshire Hathaway Energy subsidiary has now settled nearly 4,200 wildfire claims for $1.6 billion, which accounts for ~70% of all individual claims.

Occidental Petroleum CEO Vicki Hollub outlined a disciplined approach to capital allocation (post-OxyChem sale) on a recent earnings call. “We are going to opportunistically buy back shares,” she said, “[but] it has to make sense. It’s a value calculation for us to determine whether to do that or whether it’s best to take down some more debt or put more into the business.” In general, Hollub hopes to maintain $3-4 billion in cash on the balance sheet moving forward. And then, as we approach August 2029, Occidental will ramp that cash number up even higher in preparation for resuming redemptions of Berkshire’s preferred stock.

On the OxyChem deal itself, Hollub brushed off the retained legacy environmental liabilities as essentially immaterial. “What they’re costing us right now is somewhere in the neighborhood of $20 million or so on an annual basis,” she said. “The liability that is the largest, of course, is the Passaic [River site in New Jersey]. But the Passaic is going to be spread over 20-30 years.”

Above all, Hollub framed the OxyChem sale as the capstone of a long-planned strategic pivot. “We’ve done everything that we set out to do with respect to being mostly a U.S. company and with very high quality, high margin assets that can sustain over the long term,” she said. Bolstered by a diversified mix of conventional and shale assets — and the company’s expertise in enhanced oil recovery — Occidental is right where it wants to be.

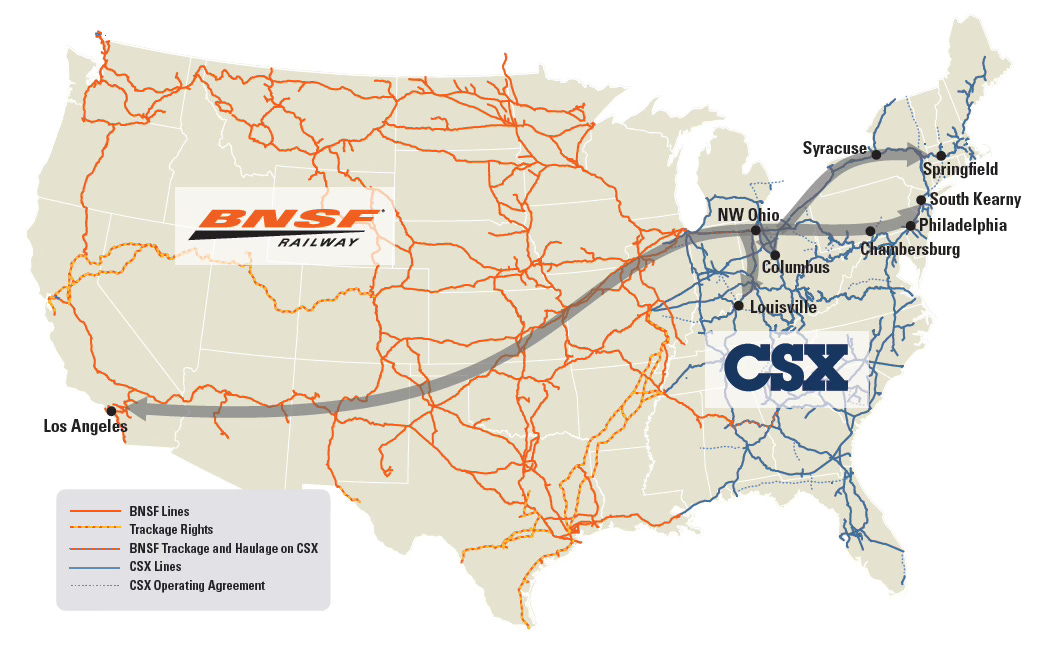

BNSF Railway broadened its intermodal partnership with CSX into the Midwest, Ohio Valley, and Northeast regions. This expansion builds on their earlier collaboration — launched in August — that extended BNSF’s reach to southeastern hubs without having to acquire CSX outright. The Berkshire-owned railroad claims that this new phase will slash transit times by 22-52 hours on key lanes from its Hobart terminal in Los Angeles to high-volume CSX hubs in Ohio, Pennsylvania, New York, New Jersey, and Massachusetts.

GEICO partnered with San Francisco-based Motive to integrate its cutting-edge AI technology into the auto insurer’s DriveEasy Pro telematics program — aimed at commercial fleets amid a surge in operational costs and risks. New policyholders in select states can save 10% on premiums if they use Motive’s dash cam. This basically creates a virtuous circle forged in data: Motive’s AI flags distracted driving — think phone glances or fatigue — leading to safer behavior and outcomes, which in turn curbs claims for GEICO and allows for lower rates and discounts to fleet owners.

Dairy Queen, the iconic quick-service restaurant chain famous for such sweet treats as Blizzards and Dilly Bars, continues to expand internationally with 187 new locations set for Hong Kong, Macau, Taiwan, and Qatar over the next decade. The first one — at the prestigious Taipei 101 tower in Taiwan — opened this week with localized menu items like Matcha Red Bean Blizzards and Avocado Milkshakes alongside traditional DQ faves. “Entering new markets and growing existing markets is a key component of our growth strategy,” said international COO Nicolas Boudet. “With 7,700 DQ restaurants in more than 20 markets, we’re pleased to add to our footprint and to do so with experienced franchise ownership groups focused on operating successful restaurants with employees that deliver on our mission to create positive memories for all who touch DQ.”

And, finally, a few odds and ends to finish off the week…

Today, Berkshire collects $33.7 million in quarterly dividends from Sirius XM.

If you’re looking for a little weekend reading, check out “A Century-Old Classic Buffett Would Love” over at Investment Masters Class.

Lennar co-CEO and president Jon Jaffe will retire next month, ending his 42-year career at the homebuilder.

Alphabet shares hit new all-time highs several times this week after the well-received launch of its Gemini 3 artificial intelligence model.

Still not really sure how these senior notes work and why they are issued. What are they really for, though?

Wow, DQ in Taiwan! I'm going to go try it there (I'm in Taipei)!