The Berkshire Beat: July 25, 2025

All of the latest Warren Buffett and Berkshire Hathaway news!

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

Speaking of which… The annotated transcript for June will go out to paid subscribers early next week. This time around, I’ve transcribed a recent-ish (2018) Alice Schroeder speech that really dives into Warren Buffett’s mind and personality in some new ways.

Schroeder’s unparalleled access to Buffett and Berkshire Hathaway for so many years gives her a unique perspective few can match. Even on well-trodden topics, she often delivers novel insights that spark new ways of thinking.

Like this short excerpt about Buffett’s friendship with Charlie Munger:

In their early years, Warren and Charlie were known for being glued together and obsessively talking for 10+ hours at a stretch. They know each other so well at this point that they can — and I’ve seen this happen — both predict exactly what the other one will think or say on any given situation. So they tend to not need to talk because they know what the other one will say.

And, in the case of both of them, they disagree on quite a number of things — particularly philanthropy. They tend to not talk when they know that the other one would say something disapproving of what they’re going to do. (Laughs) They don’t agree on politics, so they go their own way on that. They are still just as good of friends as ever, but they are sort of like a friendship where they do it by osmosis.

Elsewhere in the speech, she discusses what Buffett wants to get out of life, several of his more memorable business deals, and even his reaction to the 9/11 terrorist attacks. I’ve been doing these transcripts for two years now and this one definitely ranks up there among my favorites.

So, if you’ve been on the fence about upgrading, there’s no time like the present.

Now, with that bit of housekeeping out of the way, let’s move on to the latest news and notes out of Omaha…

On Tuesday, Warren Buffett squashed a Semafor report that claimed BNSF Railway was working with Goldman Sachs to explore its own big railroad acquisition in response to the rumored Union Pacific x Norfolk Southern transcontinental tie-up. Buffett reached out to CNBC’s Becky Quick and rubbished the whole story. “The 94-year-old billionaire investor told Quick that no one from Goldman had talked to him or Greg Abel, who is set to succeed Buffett as Berkshire CEO at the end of the year. Buffett added that he would not seek advice from external bankers on deals. The ‘Oracle of Omaha’ has long voiced disdain for expensive intermediaries as banks usually have a big incentive to make deals.”

Yesterday, Union Pacific and Norfolk Southern confirmed that they are “engaged in advanced discussions regarding a potential business combination”. As such, rumors persist that the Berkshire-owned railroad would then snap up CSX to form a transcontinental line of its own. And, interestingly, CSX CEO Joe Hinrichs did not exactly rule that eventuality out when asked earlier this week. “We’re open to all conversations and possibilities that would create shareholder value, help us grow the business, and serve our customers better,” he said. “So we’ll have to see how all that plays out.”

Jeff Windau, an analyst at Edward Jones, outlined the possible advantages of a transcontinental railroad: “If you have something coming to one port on one coast and it has to get to the middle of the country [and then] you want it to go to another state on the other side, obviously [with] the reduced switching of cars, reduced network changes, you can see where there’s going to be some operational efficiencies overall. You could see where there’s probably some leverage in capital spending between buying new locomotives and new railroad cars and track maintenance. You can leverage that scale of one larger railroad.”

BNSF already carries more intermodal, coal, and grain traffic than other railroads — and, now, plans to strengthen its carload network, too. “We know intermodal’s a big part of the growth future,” CMO Tom Williams told FreightWaves. “We’ve developed the agriculture shuttle network on the bulk side and we certainly like our bulk network. I don’t want it to be lost that we care very much about that single-car merchandise network, too.” Central to this strategy are velocity improvements and a new Short Line Select program which cuts dwell time in half on participating lines. “One-third of our carload freight originates or terminates on a short line,” said BNSF’s Mark Ganaway. “That’s a significant portion of our business. We needed a way to move from transactional relationships to strategic partnerships.”

Berkshire’s stock price has mostly scuffled after Buffett’s retirement announcement — but UBS senior insurance analyst Brian Meredith still sees enduring strength. “The company itself still has all those huge competitive edges that it had when Buffett was CEO,” he told CNBC. “The same strategic advantages that Berkshire had exist today with or without Buffett. You’ve got permanent capital, an iron-clad balance sheet, [and] $350 billion of cash on the balance sheet. All sorts of huge advantages, as well as these great businesses.”

“The other thing that is really important to understand here is Berkshire’s call as a great company in an uncertain macro environment,” continued Meredith. “It’s very defensive, but also a number of businesses that will actually do quite well in an improving economy.”

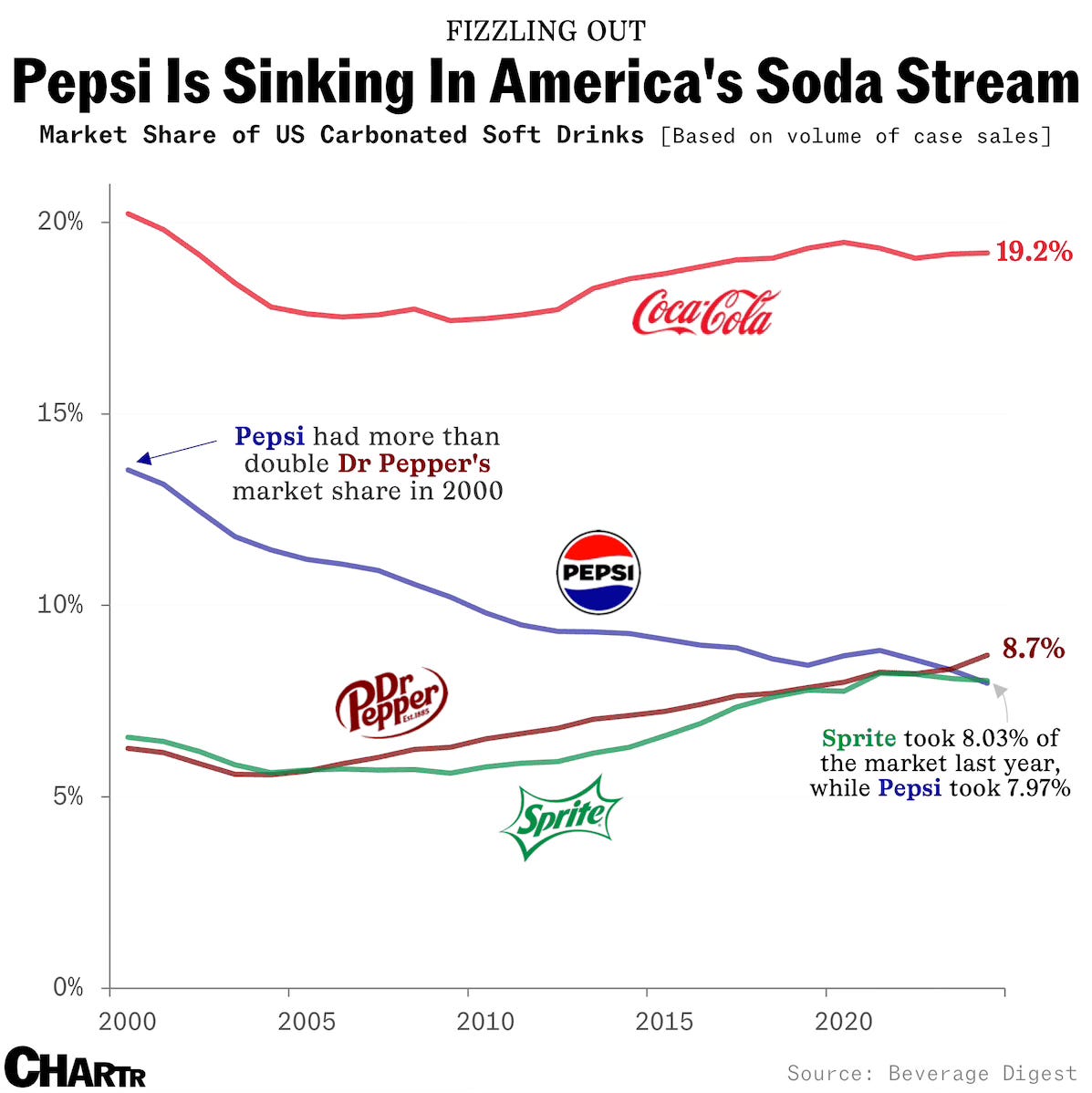

In the soft drink game, there’s Coca-Cola and then there’s everybody else. Its dominance is made all the more impressive by the fact that Coke also owns Sprite, which just overtook Pepsi in market share last year. America’s favorite soft drink also made its triumphant return to Costco food courts this month — and will be back in place at all Costco warehouses by this fall.

Chevron and Hess prevailed in their arbitration case against Exxon Mobil — which allowed the $53 billion acquisition to finally be completed. The centerpiece of the deal — and the bone of contention that led to said arbitration — was Hess’s 30% stake in the prolific Stabroek Block in Guyana. This asset is especially critical for Chevron, whose oil and gas reserves have dwindled to 9.8 billion barrels, the lowest in a decade. And, with an organic reserve replacement ratio of just 45%, the company had urgently needed to bolster its supply from the outside. “The combination [with Hess] enhances and extends our growth profile well into the next decade,” said CEO Mike Wirth. All’s well that ends well, I suppose.

The FTC also lifted its restriction on John Hess joining the Chevron board. “I’m pleased with the FTC’s unanimous decision,” added Wirth. “John is a respected industry leader and our board would benefit from his experience, relationships, and expertise.”

AM Best reaffirmed Berkshire-owned MedPro Group’s superior ratings — and shared a few details about the insurance subsidiary. “The ratings acknowledge MedPro’s risk-adjusted capitalization being at the strongest level, as well as the group’s long-term profitable operating performance and its leading market position, which it maintains in the medical professional liability sector, proving the group’s ability to underwrite profitably through market cycles.” AM Best also praised the insurer’s “substantial distribution capabilities”, “prudent claims-handling process”, and “culture of holistic management” that together allow it to outperform peers.

American Express continues to flex its pricing power with premium card fees. In Q2 2025, the company reported a robust 20% surge in card fee revenue. Since 2019, AmEx has increased its card fees by an average of 17% annually — leveraging its unrivaled perks and status to send through price hikes while still retaining customer loyalty.

Occidental Petroleum has big plans for the Powder Basin in Wyoming. These wells offer up more oil and less water than those found elsewhere, but securing the water needed to frack these deposits is a big challenge. “It’s the opposite problem that we have in the Permian Basin,” Oxy general manager Jason Sevin told Oil & Gas Investor, “where we can produce a lot of water. In the Powder, it’s a lack of enough source water for completions.” Nevertheless, Oxy is well-positioned with sufficient water reserves to support operations for several years across its 150,000 net contiguous acres in the southern Powder Basin. “We’ve got 150,000 acres of blank slate,” added Sevin. “Now, we get to draw up our development plan with a decade-and-a-half of [shale] learning to apply from the get-go … [Powder is] a pretty sizable growth wedge for our U.S. onshore business and something we’re really counting on in the next few years.”

Union Pacific continues to perform very well based on yesterday’s earnings release with an operating ratio of 59% in Q2. Buffett has said that there’s no reason for BNSF to not perform as well as its competitors but BNSF seems to have a higher structural cost base. I think that Abel will focus BNSF’s attention on narrowing their large performance gap before taking on any potential merger deals.

Have you read her original 1999 BRK analysis, the one that so Impressed Buffett it led to him asking her to write the book? Lots of great stuff in there including bits and pieces from 80's BRK meetings.