The Berkshire Beat: July 21, 2023

All of the latest Berkshire Hathaway news and my must-reads of the week!

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

The latest news and notes out of Omaha…

This week, UBS raised Berkshire Hathaway’s price target to $608,000 (from $565k) for Class A shares and $405 (from $377) for Class B shares. With Berkshire closing near its 52-week high yesterday, that implies an upside of +15.5% for A shares and +16.8% for B shares.

On Monday, we learned that Berkshire slashed its Activision Blizzard position by more than 70% in Q2 2023. Unfortunately, that means Warren Buffett and co. missed out on the video game maker’s recent run-up in price this month. Still, Berkshire could have booked a tidy profit on this arbitrage play — if Buffett sold his ATVI 0.00%↑ in the low-to-mid $80s in April or June. If he exited after the price crashed into the mid-$70s in early May, though, the math looks a bit worse. Sadly, we may never get a clear answer to this question.

Interesting observation from Reuters: “Berkshire’s remaining Activision stake — 14,658,121 shares — is exactly the size it was before Buffett started buying, suggesting that he has exited the arbitrage bet.” So, reading between the lines, Buffett sold all of his shares — but either Todd Combs or Ted Weschler is still holding on to the ones originally purchased in October/November 2021.

Berkshire owns a small position in Liberty Media, which executed a split-off of Atlanta Braves Holdings earlier this week. Full disclosure: the share structure of Liberty Media makes my head spin — so, please, bear with me. But, according to Liberty’s press release, it sounds like Berkshire will end up with some Braves stock. “Each holder of a share of Liberty Formula One common stock will receive 0.028960604 of a share of Atlanta Braves Holdings Series C common stock for each share of Liberty Formula One common stock.” Berkshire owns 7.7 million shares of FWONK 0.00%↑ — which would seemingly entitle it to 223,646 shares of Atlanta Braves Holdings (Series C). If I’m off base on this, please let me know. Like I said, the whole Liberty Media stock scene confuses me to no end.

I couldn’t fit this into Tuesday’s article on “old” energy, but Occidental Petroleum CEO Vicki Hollub also spoke at length about her company’s commitment to returning cash to its shareholders via dividends and buybacks on Barron’s Streetwise podcast. “We want to continue to grow our dividend. We’ve always been a dividend-paying company. We had to pause it during the pandemic and now we’re starting to grow it back again — but we want to make sure that our shareholders understand that we’ll be protected in low-price environments. We’re growing our dividend, but we’re doing it in a way that will keep us always close to neutrality in a $40 WTI situation. We call it break-even price, but it’s really a sustainable price at $40 … When you look at it like that, for every dollar that we reduce in debt, that’s another dollar that would be available to go towards increasing the dividend.”

More from Hollub: “The same with reduction in shares. As we reduce our shares, that reduces the absolute cost of our dividend. And that’s the way we’ll, over time, have the capacity to increase our dividend and still keep that $40 neutrality.”

Markel CEO Tom Gayner joined Coca-Cola’s board of directors on Wednesday. Berkshire owns 9.2% of KO 0.00%↑ and 3.5% of MKL 0.00%↑. Happy to see Coke add another Buffett-like voice to its board.

Warren & Charlie: A Lesson in Humility

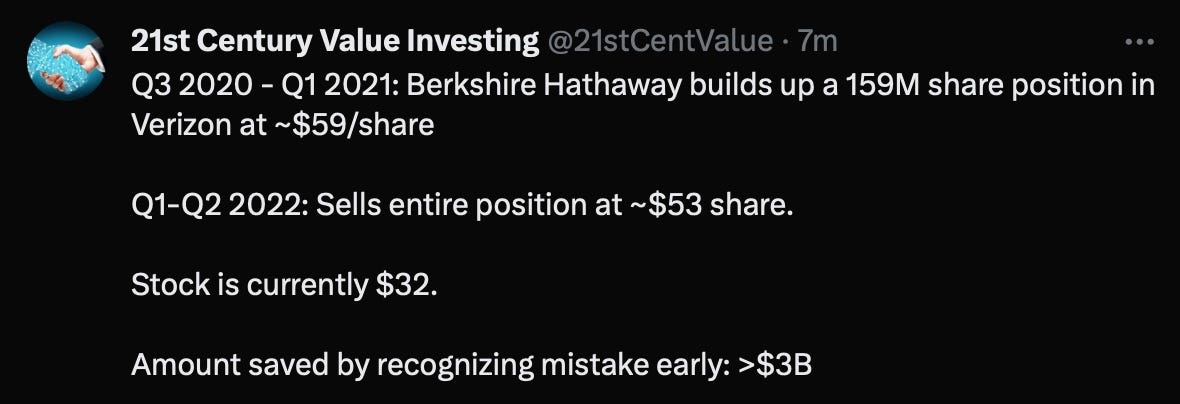

I saw an excellent tweet from 21st Century Value Investing earlier this week about how recognizing a mistake — and quickly correcting course — saved Berkshire Hathaway a ton of money on its erstwhile investment in Verizon.

Humility is a recurring theme with the Berkshire crew. Warren Buffett and Charlie Munger get a lot of (well-deserved) praise for decades of prescient stock picks and nimble capital allocation, but a not-so-insignificant part of the company’s success derives from its leaders’ willingness to recognize and rectify mistakes.

It’s hard enough to make the right decision while laboring in relative anonymity. Individual investors routinely succumb to stubbornness and pride — even when they only have to admit a mistake to themselves. It should be easy, but it isn’t.

But Buffett and Munger are under the microscope like very few others — with no shortage of critics and naysayers waiting to pounce on any shortcoming or mistake. Yet they’re willing to make the tough decisions and take whatever slings and arrows might come their way.

In just the past few months, both men faced skepticism about investment u-turns. Buffett purchased 60 million shares of Taiwan Semiconductor Manufacturing Co. in Q3 2022 — only to turn around and sell the entire position over the following two quarters. (I’m still recovering from the whiplash.)

He hadn’t changed his mind on the company itself, but rather his comfort with the geopolitical realities of being heavily invested in Taiwan. “I feel better about the capital that we’ve got deployed in Japan than Taiwan,” Buffett admitted in May. “I wish it weren’t so, but that’s the reality.”

Whether you agree with Buffett’s decision or not, he acted quickly to right a perceived wrong. And he did so knowing full well that the press would have a field day with his blink-and-you’d-miss-it reversal.

Munger, meanwhile, copped to “one of the worst mistakes [he] ever made” in regards to his Alibaba investment for the Daily Journal portfolio. He purchased 600,000 shares of BABA 0.00%↑ in 2021 — even going so far as buying some on margin — before halving the position in Q1 2022. (Again, whiplash.)

“In thinking about Alibaba, I got charmed with the idea of their position in the Chinese internet and I didn’t stop to realize that it’s still a goddamn retailer,” he said in February. “It may be online retailing, but it’s still retailing. I just got a little out of focus and that made me overestimate the future returns from Alibaba.”

I don’t know if these decisions will look wise in hindsight, but they’re representative of the humble approach that has taken Buffett and Munger so far in life.

More Must-Reads

Other awesome things that I read this week…

The Best Days Are Ahead Jared Dillian

“My wife’s grandfather is 101 years old, and just gave up playing golf last year. At age 100, he played 27 holes of golf and walked the course. He has a woodworking shop, and will make 300-odd toys for kids every Christmas. His wife died about five years ago. He still has a reason to get out of bed in the morning. That guy is going to live to be 130, and remember I said that when he does. The best days are ahead of you — even when you’re 101. More than anything, that is the key to longevity.”

Market Resilience or Investors in Denial Aswath Damodaran

“If the greatest sin in investing is arrogance, markets exist to bring us back to earth and teach us humility. The first half of 2023 was a reminder that no matter who you are as an analyst, and how well thought out your investment thesis is, the market has other plans. As you listen to market gurus spin tales about markets, sometimes based upon historical data and compelling charts, it is worth remembering that forecasting where the entire market is going is, by itself, an act of hubris.”

Coffee Can Investing The Rational Walk

“Few active investors have the ability to operate in a completely rational manner because emotion always comes into play. Financial gains and losses are not seen as sterile figures on paper, but as hopes and dreams fulfilled and lost.”

On Investing Versus Speculation Low Risk Rules

“A value philosophy does not mean that you must eschew investments in companies that are young and growing; in fact, if you have special insight into an industry, or a high risk tolerance, or the position is an appropriately small portion of your portfolio, you may actually have a preference for this type of company. What it means, however, is that you are always conscious of the price you are paying, first and foremost. First be concerned with return of capital, and then worry about return on capital.”

Up Next: Annotated transcript of Charlie Munger’s Q&A at Redlands Forum (2020) coming on Tuesday for all paid supporters.

The first two or three questions, which amounts to thousands of words, will be available for free subscribers, too.

Thanks for reading!

Could Buffett have a hand in picking Gayner to become a board member of $KO, the two have served on boards together and Markel holds no shares in the company.

re: Activision and this comment: "Sadly, we may never get a clear answer to this question." - we should be able to see the exact sale prices and dates when NICO files their Q2 National Association of Insurance Commissioners (NAIC) filings after Q2's 10Q is published.