The Berkshire Beat: January 24, 2025

All of the latest Warren Buffett and Berkshire Hathaway news!

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

Speaking of which… The annotated transcript for January will go out to paid subscribers early next week. It’s a Warren Buffett interview from 2006 that is a lot more free-wheeling and laidback than some of the others I’ve previously done.

I really like this line from the end of the conversation. “When people get to my age and they have the people who love them that they want to have love them,” said Buffett, “they are successful. It doesn’t make any difference whether they’ve got $1,000 or $1 billion in the bank.”

So, if you’ve been on the fence about upgrading, there’s no time like the present.

Now, with that bit of housekeeping out of the way, let’s move on to the latest news and notes out of Omaha…

Fortune profiled Berkshire Hathaway vice chairman (and CEO heir apparent) Greg Abel this week — but it’s a small comment from Warren Buffett that caused a stir. An email from Buffett — sent to decline Fortune’s interview request for the story — has some Berkshire fans believing that he might retire sooner rather than later. “I couldn’t feel better about Greg,” he wrote. “But I’m just not doing interviews anymore. At 94, bridge isn’t the only activity that’s slowed down for me. I am still having a lot of fun and am able to do a few things reasonably well. But other activities have been eliminated or greatly minimized.”

Berkshire’s stock price dropped as much as 2.8% on Wednesday morning. Was the dip caused by Buffett’s email? I don’t know. Anyway, I might be off base here but I did not interpret his remarks in the same worrying way as others. Your mileage might vary, though. And it seems like plenty disagree with this rose-colored take — my Twitter mentions were lit up all day long with concerned shareholders.

Remember, it was just a week or two ago that Buffett told the Wall Street Journal that he “feels good and has no plans to step aside”. Who knows what the future might hold, but Buffett’s email to Fortune did not strike me as hinting that retirement is imminent.

While the retirement debate got people talking, the profile itself is well worth a read for anyone hoping to learn more about the man who will eventually succeed Buffett. Unfortunately, Greg Abel also declined comment to Fortune — but the author nevertheless did a good job tracing his path from childhood business ventures like distributing advertising fliers and collecting discarded pop bottles all the way up to his current position as vice chairman of a $1 trillion company.

One of the more unheralded (yet pivotal) moments in Abel’s career is that his time with CalEnergy in the ‘90s coincided with Omaha-based Kiewit Corp. buying a large stake in the energy producer. That’s a company that Buffett and Munger have always held in the very highest regard — being one of the few large-scale operations out there with a Berkshire-like culture and ethos.

What will be the biggest change when Abel ascends the Berkshire throne? “Greg will not let the laggards be laggards,” said Lawrence Cunningham, author of The Essays of Warren Buffett: Lessons for Corporate America. “If you underperform, you’ll get a call from Greg.”

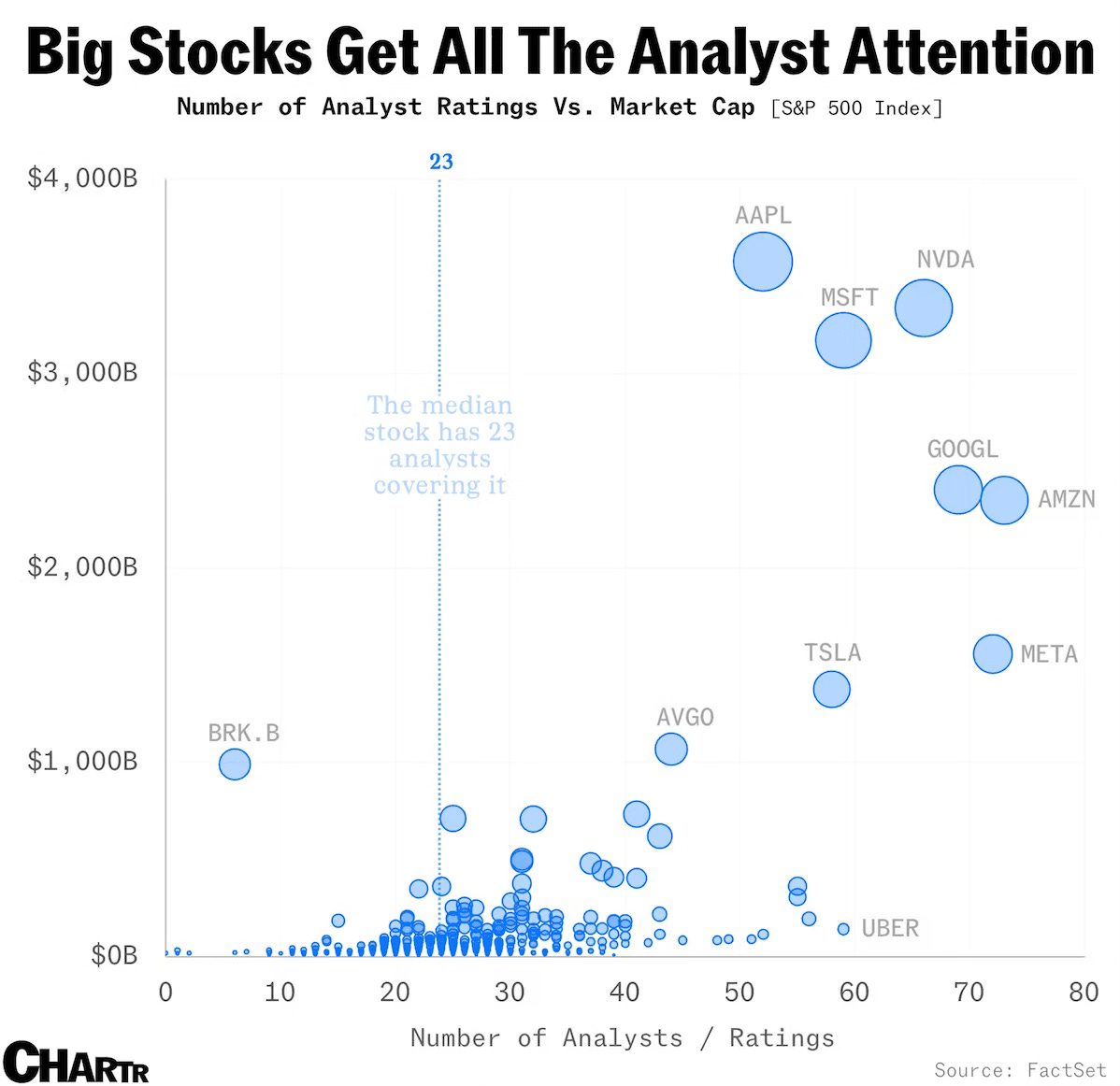

Despite Buffett’s fame and Berkshire’s well-deserved reputation as an exemplar of capitalism, the conglomerate’s stock does not draw much attention from analysts. What a difference between little ol’ Berkshire and the other members of the Trillion Dollar Club. On a related note, I miss Alice Schroeder’s coverage of Berkshire.

Back in November, BNSF Railway finally completed double-tracking its Southern Transcon route. Bill Stephens over at Trains wrote about how this achievement is the hard-won result of decades of planning and persistence. The double-tracked Southern Transcon will ease congestion and increase both speed and reliability for intermodal traffic between Los Angeles and Chicago. And, although the project was paused many times over the years, the finished product is already paying dividends. “Last fall,” said Stephens, “BNSF set several monthly intermodal volume records. It’s hard to imagine that growth without [former CEO Robert] Krebs and successors Matt Rose, Carl Ice, and Katie Farmer chipping away at single-track bottlenecks.”

As the article notes, the entire Southern Transcon is not finished yet. The two stubborn holdouts are a 1.5-mile-long bridge in Missouri (scheduled to be double-tracked by 2027) and 2.7 miles in Oklahoma — “the lowest-density segment of the route” — that will get done whenever BNSF decides that there’s enough traffic in the area to bother.

Yesterday, BNSF announced a $3.8 billion capital investment plan for 2025. That includes $2.84 billion earmarked for maintenance and $535 million for expansion.

Pilot is reportedly shutting down its global oil trading business. Reuters says that this move will allow the Berkshire-owned company to refocus its efforts on expanding its bread-and-butter travel center network here in the United States. Pilot began cutting back on oil trading in 2023, shortly after Berkshire acquired majority control.

Advertising executive Dave Schiff told Little Black Book that “the work I’m proudest of” came for Berkshire’s Clayton Homes. “Ten years ago,” he said, “a guy named Kevin Clayton read me a few letters he kept in his desk drawer. At the time, Clayton was the biggest builder of manufactured homes in the country. In essence, the letters all said the same thing: ‘My childhood home kept us all warm and happy. It didn’t matter that people made fun of us — it was a wonderful home to grow up in.’ When we asked what the goal for the work was, Kevin said he wanted to keep getting the letters, but without the part where people were made fun of. The work not only stood up for Clayton’s current customer, but gave people who might never consider a Clayton home permission to look. It also helped Clayton grow into one of the largest homebuilders in the country across every category of home. It’s not a glamorous example, but for lack of a better phrase, it felt like it meant something.”

I can’t figure out how to embed the video, so click the link to see the finished product — Clayton’s “Have It Made” advertising campaign.

As luck would have it, Schiff also worked with another client near and dear to Berkshire’s heart: Coca-Cola. After the New Coke disaster, retailers were dubious about the prospects for Coke Zero. “The beverage industry predicted we’d be gone in six months,” he said. “Instead, we had double-digit growth, quarter over quarter, for seven years straight. It was the most successful new product launch in 25 years for Coke.”

All the talk and commentary about Warren stepping down is a little irrational given that it is going to be happening and everyone knows it. If it is tomorrow vs in 2 years time, what difference does it make to the combined future cash flows over the next 10 years?

Perhaps you've already written on the topic, but a post or two on imagining how the first few years of the post-Buffett era of Berkshire plays out would be an interesting read. When as investors would we really notice the difference? In a year, three years, ten years? If Warren had passed five years ago, what would be noticeable different today? My two cents for the unwanted, but inevitable event is to expect a sell-off, followed by a buyback. In the short-term that will just be noise, but long-term it will all be about Greg Abel's capital allocation abilities which I frankly don't know much about.