The Berkshire Beat: January 23, 2026

The latest Warren Buffett and Berkshire Hathaway news!

I am busily putting the finishing touches on this month’s transcript for paid supporters and will get it out to everyone early next week.

This one is a fascinating speech and Q&A session with Li Lu that covers his investment philosophy, the psychological side of the money game, and how Benjamin Graham’s lessons remain just as relevant today as ever.

One of my favorite moments comes when Li Lu wonders why — despite the long track record of extraordinary success from superinvestors like Warren Buffett, Charlie Munger, and others of a similar bent — do so many people ignore their examples and the principles of value investing?

In value investing, you have to have this frame of mind that if you did your work correctly, you should be comfortable standing alone. But that’s really very difficult to do. It is a very unnatural thing to do — when the whole market is against you, when everybody else really thinks you are stupid and neurotic and wrong.

That is a very, very unnatural thing to do — and [almost] borderlines on self-delusion. Indeed, that’s probably most people’s view about you at the time. You look quite ridiculous. It’s very uncomfortable.

In fact, our very evolution requires a certain view of conformity. Think about over the millennia, over the millions of years of our evolutionary past, our ancestors and our animal predecessors would basically hunt in groups — and if one was left out and disagreed with everyone else in the group, that was the one not to survive.

So all of the genes that have survived from the past are the ones that tend to [reinforce] that degree of conformity.

So, if you’ve been on the fence about upgrading, now is the perfect time.

Other news and notes from the Berkshire Hathaway orbit…

In what would be the first major move of the Greg Abel era, Berkshire Hathaway may soon sell A LOT of its Kraft Heinz stock. On Tuesday, the multinational food giant filed a prospectus supplement to register the potential resale of up to 325.4 million shares of common stock “from time to time” by Berkshire. That is essentially Berkshire’s entire position — and would leave the conglomerate with ~200,000 shares.

This filing does not guarantee an immediate or complete sale, but it certainly sounds like the writing is on the wall for Berkshire and Kraft Heinz. Which probably shouldn’t be too surprising after Warren Buffett and Greg Abel each expressed disapproval about its plan to separate the company into two entities later this year.

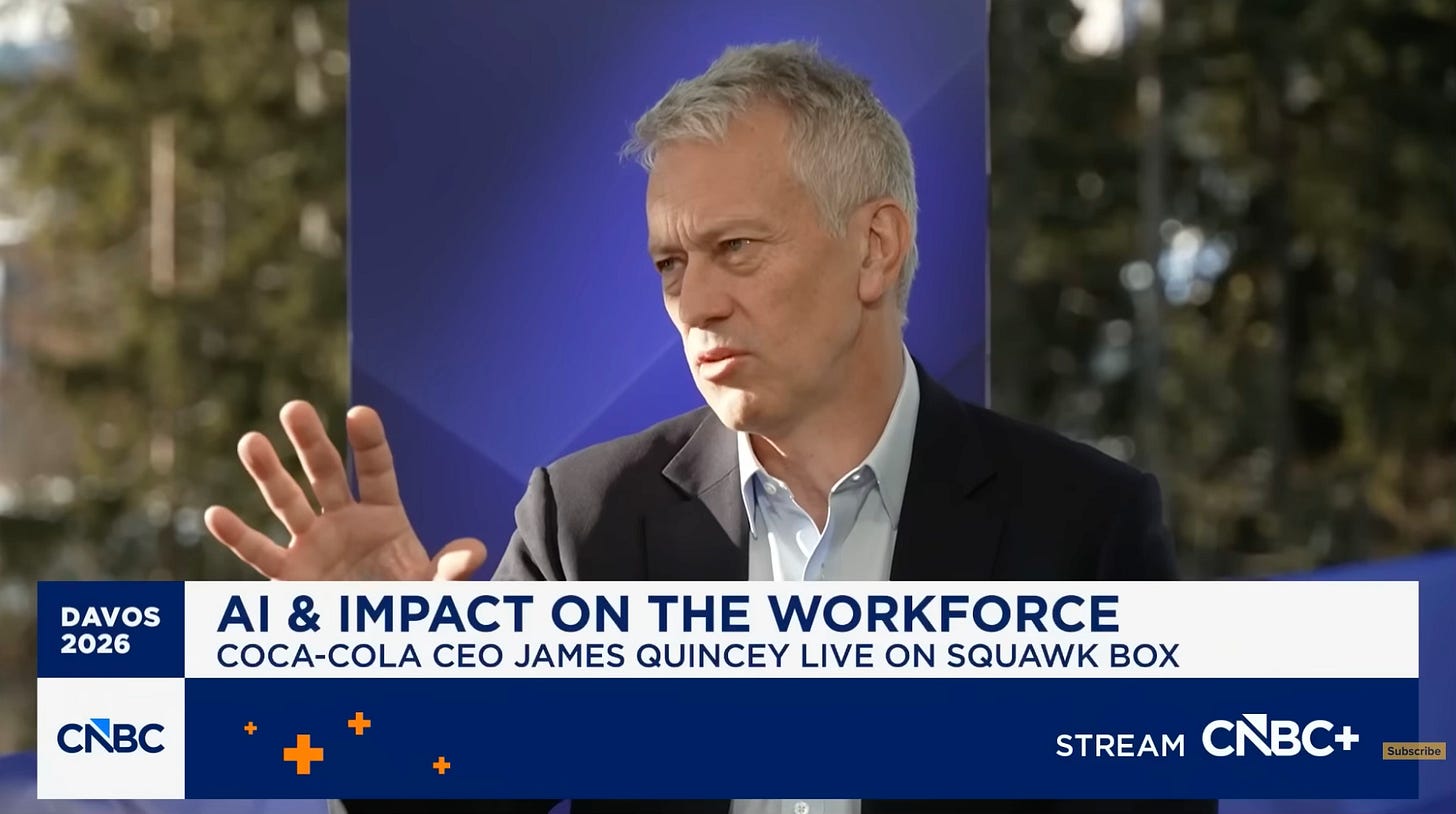

Coca-Cola CEO James Quincey — who will retire in March — told CNBC that “it’s better to go slightly early” and that he’s leaving the soft drink maker in fine fettle. “We’ve brought momentum back to the business over the last ten years,” he said, and can only see that continuing under his successor Henrique Braun. “He’s been around the system,” continued Quincey. “[He’s] someone with the energy to take us to the next stage. He’s very keen on the digital stuff and how to remain human-centric as we go forward with that. I just felt that it was the right time to pass the baton on while we are in great shape. [Basically], don’t overstay your welcome.”

On the economy: “The U.S. economy is powering forward. The U.S. consumer continues to be robust, continues to expand its resiliency, so we’re positive on the consumer. It’s not the best of times, but for sure it’s not the worst of times.”

On tariffs: “Our business system is relatively immune to the tariff thing. Literally, all of the Cokes are made in the country they’re sold [in]. Cokes in Switzerland are made in Switzerland. Cokes in the U.S. are made in the U.S. Tariffs are not our problem.”

On GLP-1s: “It’s still relatively early days in the consumption of GLP-1s, but you definitely see a shift across food and beverages. You definitely see less snacking. You see a lot less alcohol. Less of the sugar drinks. On the reverse side, you see more coffee, more diet [sodas], more protein drinks, more sports drinks.”

On growing brands: “If you look at the two biggest growing trademarks in the U.S. last year, it was the Coke trademark — basically driven by Coke Zero and Diet Coke — and Fairlife Core Power [which Coca-Cola also owns]. You’ve got a lot of focus on refreshment and a lot of focus on protein.”

Quincey guessed that fiber might be the next frontier for health-conscious customers. He mentioned, much to the CNBC panel’s amazement, that they already sell Diet Coke with added fiber in Japan, though it’s not a big mover.

On artificial intelligence: “We have made the last two Christmas ads with AI — in a quarter of the time, at a fraction of the cost — and they’ve been the highest scoring, most effective ads. So I think the future is going to be there. The next stage is all about scale.”

The Surface Transportation Board unanimously rejected the merger application filed by Union Pacific and Norfolk Southern — deeming it incomplete. In particular, the STB flagged the lack of future market share projections that would account for the anticipated combined effects of merger-driven growth. Now, before BNSF Railway or anyone else starts celebrating, the filing was rejected without prejudice — meaning that UP and NS can (and surely will) re-file with the missing information included. It’s more of a temporary procedural setback than a death knell for the merger.

According to Counterpoint Research, Apple finished the year strong in China. In Q4 2025, the iPhone maker led China’s smartphone market with a 21.8% share “driven by strong traction for the iPhone 17 series and an accelerated supply ramp”. iPhone shipments surged 28% year-over-year, bucking the broader market trend where overall smartphone shipments in China slipped 1.6%. For the full year, Apple finished with a 16.7% share — an improvement from 15.4% in 2024.

Speaking of Apple, the Cupertino-based tech giant topped Fortune’s Most Admired Companies list for the 19th straight year. Other notable names near the top: Berkshire Hathaway at #6, Alphabet at #8, American Express at #10, Coca-Cola at #13. Not bad when three of Berkshire’s largest investments all rank highly on this list.

And, finally, a few odds and ends to finish off the week…

Barron’s estimates Berkshire’s price-to-book at around 1.45 — which puts it right in the vicinity of where the company last repurchased shares nearly two years ago.

On Tuesday, Berkshire collected $155,353 in semi-annual dividends from HEICO.

GEICO continues to expand in North Texas — and even inked a sponsorship deal with the Dallas Cowboys for in-stadium signage, digital media integration, and community engagement opportunities.

Wow, the insight into how our evolutionary need for conformity makes standing alone in investment so profoundly difficult truly resonated, and I am grateful for you sharing this remarcably analytical perspective.