The Berkshire Beat: January 17, 2025

All of the latest Warren Buffett and Berkshire Hathaway news!

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

I love books. And I especially love books about Warren Buffett and Charlie Munger. (Big surprise there.) So it should probably go without saying that I’m pretty excited for Buffett & Munger Unscripted to come out on Tuesday. In it, Alex Morris of TSOH Investment Research fame has painstakingly compiled the many highlights from thirty-plus years of Berkshire Hathaway AGMs — and organized them by subject — so we can easily trace Buffett and Munger’s thoughts through the decades.

A full review of the book is coming on Tuesday — but, in the meantime, I caught up with Alex to find out what inspired him to curate and write Unscripted.

“When I got started 15+ years ago,” he said, “one of the first books I read was Larry Cunningham’s The Essays of Warren Buffett: Lessons for Corporate America, which organized investing and business insights from the annual letters by topic. When Berkshire released the annual meeting videos in 2018, my experience with The Essays as a younger investor inspired me to perform a similar act of synthesis for the annual meetings. The result is Buffett & Munger Unscripted.”

It’s a labor of love that could only come from someone with a deep appreciation for the teachings of Messrs. Buffett and Munger.

“It’s hard to think of a key part of the investment puzzle where Buffett and Munger haven’t had some influence on my thought process,” he said. “Business analysis and the ‘too hard’ pile, the importance of good management and proper incentives, thinking about valuation and opportunity costs, and many more. We should all be thankful that they’ve been willing to share their insights publicly.”

And, with Unscripted, it will be easier to access those insights than ever before.

And, now, onto the latest news and notes out of Omaha…

Over the weekend, the Wall Street Journal profiled Warren Buffett’s son, Howard, who will one day serve as non-executive chairman of Berkshire Hathaway. This position is a crucial part of Warren’s plan to keep Berkshire’s unique culture in place long after he is gone. “I care more about the future of Berkshire after I die than during the period I’m alive,” Warren told Karen Langley. “It’s my creation. What I want is a company that’s successful and also [one] that belongs to the shareholders … That is something that takes a long time to build and could be torn apart very easily if it fell into the hands of people who would want to break it up.”

“I feel I’m prepared for it because he prepared me,” said Howard. “That’s a lot of years of influence and a lot of years of teaching.”

No offense to Howard at all, but I certainly hope his ascension to non-executive chairman is still many years away. On that score, Warren told the WSJ that “he feels good and has no plans to step aside”. Long may that continue.

Howard also pledged to keep Berkshire HQ in Omaha and to continue holding annual meetings and Q&A sessions in the post-Warren era. “I just hope I can do it — and Greg [Abel] can do it — for eight hours like [my dad] does,” he laughed.

Star Furniture matriarch Shirley Toomim — known around the Berkshire-owned retailer as Mrs. T — passed away on Christmas Day. A former vice chairman of the company, she had served alongside her late brother, Melvyn Wolff, for more than fifty years. The pair sold Star Furniture to Berkshire Hathaway in 1997 and earned special praise from Buffett in that year’s annual letter. “As was the case with the Blumkins and Bill Child,” he wrote, “I had no need to check leases, work out employment contracts, etc.” In fact, Buffett never even saw the store before he bought it. Wolff and Toomim offered a tour, but the Berkshire CEO declined. “No,” he said, “I’ve seen a furniture store before.” 🤣

Berkshire managers are not only entrusted to run their businesses as they see fit, but also to recommend potential acquisition targets. Buffett first heard about Star Furniture from the Blumkins at NFM, though the company was not for sale at the time. Eventually, that changed — and the deal came together quickly (with more than a little help from Bob Denham at Salomon). Toomim said that the whole thing was hashed out in just two hours and twenty minutes. “Buffett is that sort of a person. He has such integrity. He’s a wonderful human being.”

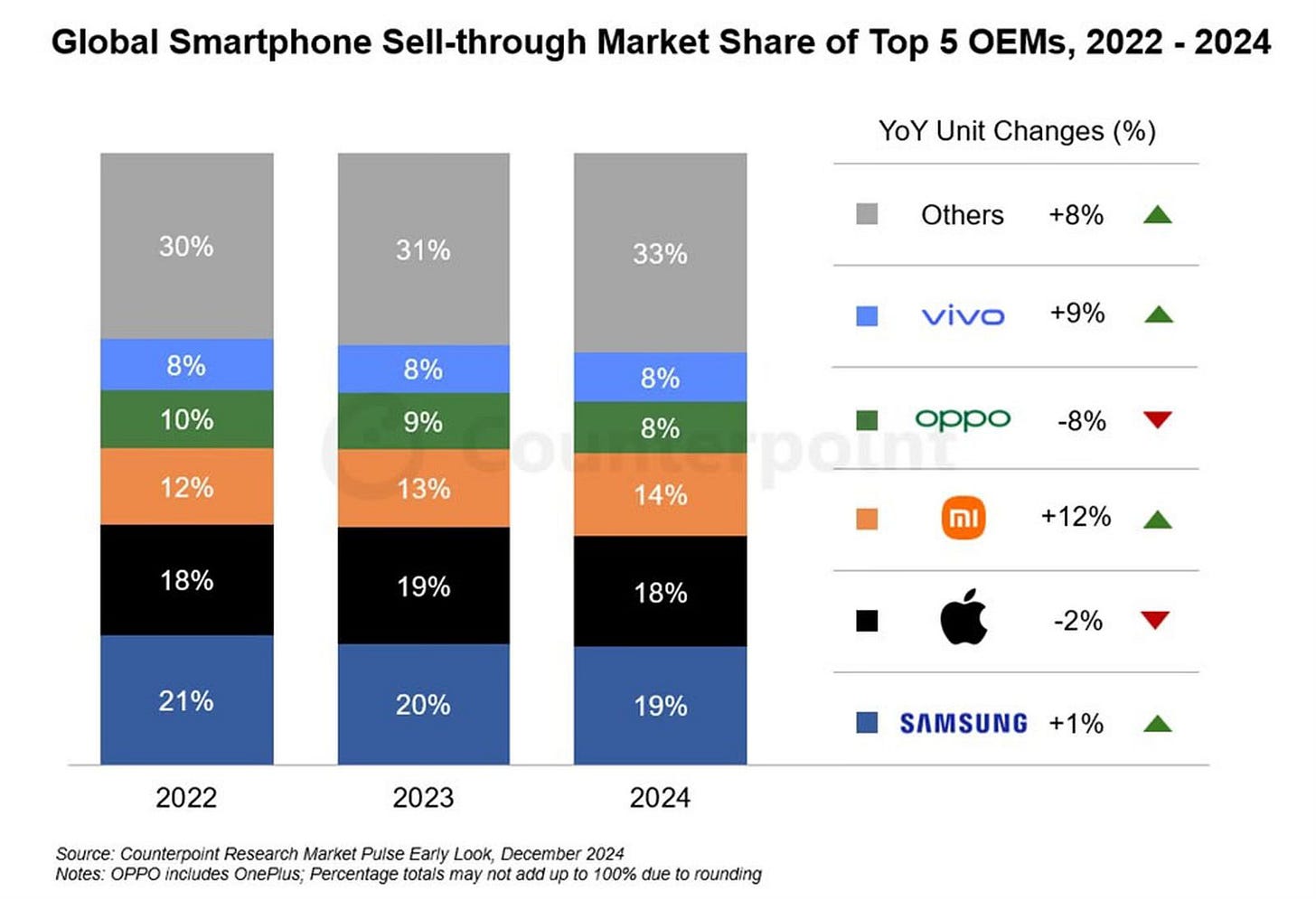

According to Counterpoint Research, Apple’s iPhone continued to spin its wheels in 2024. iPhone is still nipping at Samsung’s heels in second place, but dropped one point in global market share. It’s not all bad news, though. “iPhone sell-through was down,” said Counterpoint’s Ivan Lam, “but consumers are pivoting to Apple’s ultra-high end, helping to offset some of the declines. In markets like China, we’re seeing sell-through share of Pro series devices ballooning. To illustrate, Pro and Pro Max devices were at mid-forties share in China during Q4 2023, but in Q4 2024, we’re likely to see the final numbers tip well over the halfway mark.”

The report also noted strong growth for Apple in “non-core markets like Latin America, Africa, and Asia-Pacific-Others”.

Dividends: Berkshire received over $225 million in quarterly dividends from Occidental Petroleum this week. That includes $56.2 million via its common stock position and $169.8 million via the preferred shares from the Anadarko deal. And, somewhat less impressively, Berkshire also collected $115,465 from HEICO.

FYI: Buffett purchased 8.9 million more shares of OXY 0.00%↑ between December 17-19. Those shares are not included in this dividend payment because the record date had already passed. Next time, though.

BNSF Railway’s $1.5 billion Barstow International Gateway got a big boost this week when the California Air Resources Board scrapped its zero-emissions locomotive rule. While at the Midwest Association of Rail Shippers’ Winter Meeting, CEO Katie Farmer thanked all involved for rethinking this bit of “misguided regulation” and said that BNSF can now start moving forward on the project.

Bill Ackman’s Pershing Square hopes to buy out Howard Hughes Holdings in order to create a “modern-day Berkshire Hathaway”. And here I thought Berkshire itself was the modern-day Berkshire Hathaway. “With apologies to Mr. Buffett,” he wrote in a letter to the company, “[Howard Hughes] would become a modern-day Berkshire Hathaway that would acquire controlling interests in operating companies.” Ackman apparently sees the real estate firm’s cash flows as the engine needed to fund said acquisitions. Such comparisons to Buffett or Berkshire rarely augur well for the future of those involved — as Ackman himself found out back in 2015 when Forbes dubbed him “Baby Buffett” shortly before a few of his more notable investments turned sour. Better luck this time, I suppose.

Help me out here as I am not an industry insider.

In the quote “iPhone sell-through was down” please explain what you mean by the word "sell-through?"