The Berkshire Beat: February 21, 2025

All of the latest Warren Buffett and Berkshire Hathaway news!

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

Speaking of which… The annotated transcript for February will go out to paid subscribers on Wednesday. In it, Warren Buffett and Ajit Jain answer questions from Indian business school students on a wide range of topics. While Buffett is, as always, the star of the show, I relish any opportunity to hear more from Ajit himself.

So, if you’ve been on the fence about upgrading, there’s no time like the present.

Why isn’t the transcript coming out on Monday?

Warren Buffett’s new letter to shareholders — alongside Berkshire Hathaway’s annual report — drops online tomorrow morning. Which makes today, for all practical purposes, like Christmas Eve around these parts. And since, no doubt, there will be much to discuss about Buffett’s letter, I will be writing about that on Monday.

(I’m not necessarily expecting any big announcements — like a dividend to whittle down some of that mammoth cash pile — but I’m not ruling anything out, either.)

Now, with that bit of housekeeping out of the way, let’s move on to the latest news and notes out of Omaha…

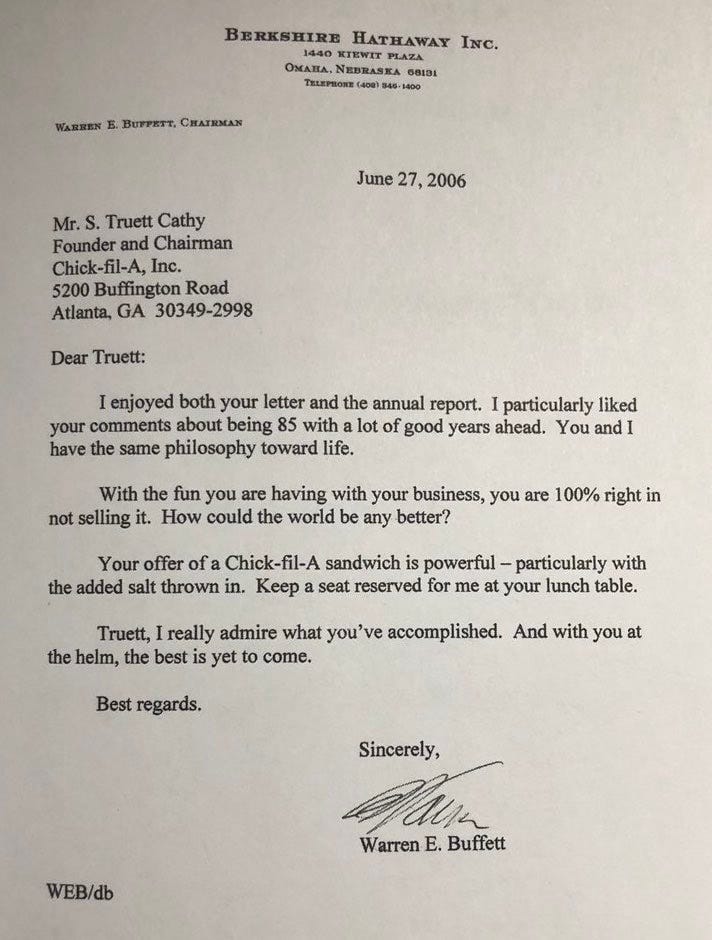

Last week’s bombshell that Warren Buffett once had his sights set on Nintendo as a potential acquisition reminded me of another elephant that got away. A while back, a letter surfaced online — written by Buffett to Chick-fil-A founder S. Truett Cathy on June 27, 2006 — wherein he expressed his admiration for the chicken sandwich empire that Cathy built. (My stomach happens to feel exactly the same way.) One cryptic line, though, stood out: Buffett said that Cathy was “100% right in not selling it”. Reading between the lines a bit — though, honestly, not very much — it seems to suggest that Buffett had asked if Chick-fil-A were for sale, but Cathy politely rebuffed his interest in a previous letter. Ah, what could have been…

If you’re not quite convinced by the above evidence, here’s the clincher: Cathy outright confirmed the story a few years later. In 2010, while speaking at an educational forum, he told the crowd that Buffett had not asked about buying Chick-fil-A just the one time, but had “camped out on [my] doorstep for ten years” hoping to strike a deal — before eventually throwing in the towel. Sad face.

Berkshire Hathaway (almost certainly Ted Weschler) sold another 750,000 shares of Davita for $116.1 million between February 14-19. But, unlike last week, the filing for this sale does not mention the Share Repurchase Agreement — which mandates Berkshire sell back shares if its stake in the dialysis provider rises above 45%. Making this move all the more curious, the DVA 0.00%↑ stock price dropped by 13% right before Weschler started selling. Berkshire now owns 43.9% of Davita.

The whole Berkshire crew likes to invest in companies that repurchase their own shares. (Assuming, of course, that said repurchases occur at the right price.) Conor Mac recently highlighted twenty of these so-called “share cannibals” across the whole market — and, no surprise, several notable Berkshire investments made the list.

Over the past decade…

American Express spent $41.6 billion repurchasing 31.3% of its own shares

Domino’s Pizza spent $5.87 billion repurchasing 37.9% of its own shares

Apple spent an eye-popping $716.3 billion repurchasing 35.5% of its own shares

On Wednesday, Apple rounded out its iPhone lineup by rebranding the entry-level iPhone SE to iPhone 16e. The new “budget” device is powered by an A18 chip — which enables Apple Intelligence functionality — and features a larger OLED screen, Face ID, and a custom-built modem that promises much-improved battery life. iPhone sales have been relatively stagnant over the past few years — stubbornly stuck right at $200 billion in annual revenue. Maybe the new iPhone 16e will kickstart the segment back into growth mode. It should also serve as a test of the Cupertino-based tech giant’s pricing power, as the iPhone entry level price now jumps from $429 to $599.

The C1 modem — which debuts in the iPhone 16e — will eventually come to the rest of the iPhone family. Which, in turn, should make Apple less reliant on Qualcomm for these chips. “C1 is the start,” Apple senior vice president Johny Srouji told Reuters, “and we’re going to keep improving that technology each generation so that it becomes a platform for us that will be used to truly differentiate this technology for our products.”

And a few odds and ends to finish off the week…

Today, Berkshire will collect $5.7 million in quarterly dividends from new boy Constellation Brands. Every little bit helps.

Lubrizol CEO Rebecca Liebert has been nominated to join Dow’s board of directors. “With more than two decades of experience leading global organizations in the chemicals sector,” the company said, “Ms. Liebert brings deep industry expertise and a proven track record of driving large-scale operational excellence.”

Occidental Petroleum repaid $4.5 billion of debt last year — and has already lined up $1.2 billion of further divestitures in the first quarter of 2025. These include non-operated Rockies assets and non-core Permian Basin assets. The proceeds from these sales will be applied to the company’s debt — while also allowing Oxy to increase its dividend by 9% starting in April.

Chris Bloomstran expects to release his much-anticipated annual letter sometime today. I can’t wait to read it. No one goes in-depth on the many moving parts of Berkshire better than him.

Coca-Cola is entering the prebiotic soda arena with Simply Pop — made with “real fruit juice, no added sugar, and no compromises” and packed with six grams of prebiotic fiber in each can. A nod to the wellness-focused taste of Gen Z.

Coke raised its dividend by 5.2% yesterday — making it 63 straight years of dividend growth. All hail the Dividend King.

I enjoyed this article from The Rational Walk about how being invested in Berkshire makes it easier to “stay the course” during times of extreme market disruption. Whether it’s Berkshire, an S&P 500 index, or something else entirely, intelligent investors should strive for such peace of mind.

Mark Tobak wrote about how Charlie Munger always taught us to make smart bets — with the odds in our favor — over at Hedge Fund Alpha. Bonus points for shouting out one of my favorite Twilight Zone episodes (“A Nice Place to Visit”) at the end!

Oh yeah! Chris annual letter it's like a yearly book on BRK.

It boggles the mind to think of how great it would have been if Buffett could have convinced Truett Cathy to sell two decades ago. But CFA generates so much cash that the family has no need to sell or to raise capital in markets. I rarely eat fast food anymore but if I’m going to, I make it count by picking CFA!