The Berkshire Beat: December 27, 2024

All of the latest Warren Buffett and Berkshire Hathaway news!

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

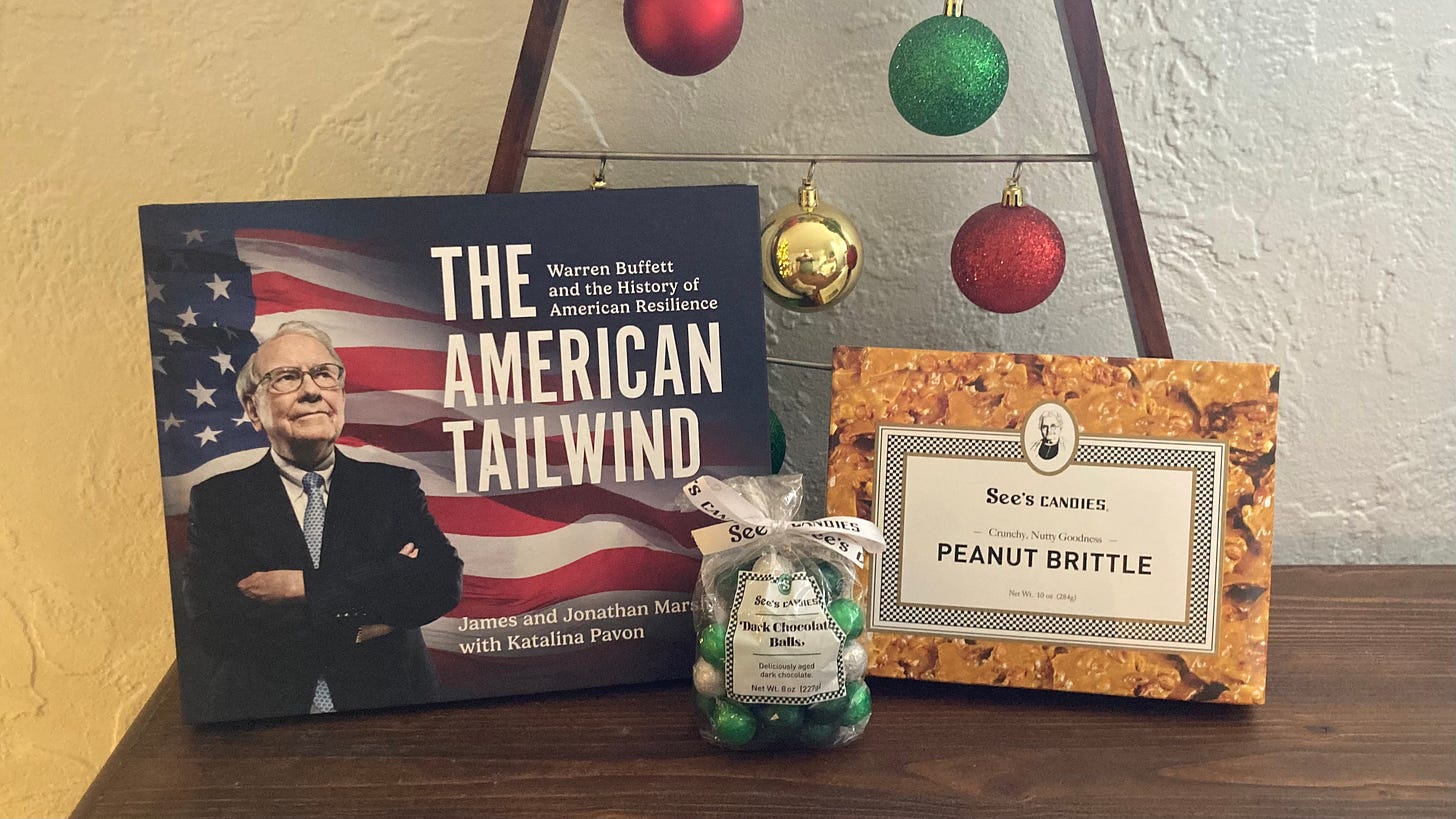

It was a very on-brand Christmas around these parts. And, no, I won’t be commenting on the disturbing amount of peanut brittle that I’ve eaten over the past two days…

Being a slow week and all, I finally had the chance to catch up on a few videos that I had been meaning to watch. One of which is from Robert Herjavec of Shark Tank fame — on the ten most important lessons he learned from the late, great Charlie Munger.

Herjavec tells how one of Charlie’s associates approached him out of the blue at a SoulCycle class and revealed that Charlie was a big fan of Shark Tank. (Seinfeld and Shark Tank. Slowly, but surely, we’re learning a lot about Charlie’s television habits.) Soon after, he was invited out to Charlie’s house for lunch.

When the surprised Shark asked his famous host why he wanted to meet, Charlie said, “You seem like the sensible, nice one on the show.” The two remained in touch during the pandemic via Zoom.

I love how an autograph from Charlie can make even a television millionaire grin like an awestruck child.

The whole video is well worth watching in its entirety — it’s only 25 minutes long — but I’ve pulled out a few of the key points below:

Charlie often joked that he was never quite given a full share of humility. But, by most measures, he lived an exceedingly humble life. He lived in the same house for more than seventy years and eschewed the flashy trappings of wealth. Costco clothes filled his closet and a $75 watch encircled his wrist. “Great wealth tends to whisper,” said Herjavec, “not shout.” Herjavec marveled at how Charlie served simple ham and cheese sandwiches (on white) when he visited. To Herjavec, his new friend was “simple in all things except his mind”.

Money was never Charlie’s end goal — but, rather, something that moved him closer to what he valued most. “Like Warren,” he once said, “I had a considerable passion to get rich. Not because I wanted Ferraris — I wanted the independence. I desperately wanted it.” Charlie’s wealth did not matter in terms of how much stuff it could buy him, but in that it freed him from having to do anything that he didn’t want to do.

Charlie did not “gate-keep” his wisdom. He preached the very same sermon at a private lunch with titans of business as he did to millions of shareholders at Berkshire Hathaway and Daily Journal annual meetings. Namely, that you should aim for businesses that could be run by an idiot — because, sooner or later, it will be. And that buying wonderful businesses at a fair price, rather than fair businesses at a wonderful price, is the surest path to long-term compounding.

And, now, the latest news and notes out of Omaha…

Berkshire Hathaway topped up its Verisign position in the days before Christmas. The conglomerate purchased 143,424 more shares of VRSN 0.00%↑ — at a total price tag of $28.5 million — between December 20-24 and now owns 13.7% of the company.

The price of cocoa is soaring — and starting to put the pinch on See’s Candies. In a holiday note to customers, CEO Pat Egan warned that the runaway cocoa market was taking its toll on the entire industry. “I avoid sharing challenges we experience as a business here, as you care most about us providing the best candy and service possible, and our job is to do that with a smile,” he wrote. “That said, I would share that our cost of chocolate has nearly tripled in the last year. The worldwide cocoa market has experienced the biggest cost increases in history, and for many in our industry, it is compelling cost-cutting measures and changes.”

Egan noted that some competitors are now opting to substitute vegetable fats for cocoa butter — or even reducing the amount of chocolate in their recipes. Not at See’s, though. “We are choosing to stay on the See’s path,” he said, “aiming to stay a cut above and to never cut corners on quality for you.”

Cocoa makes up nearly 50% of the cost of an average piece of See’s candy — leaving the chocolatier with little recourse but to raise prices. On the bright side, the “patient capital” of Berkshire Hathaway allows Egan and co. to play the long game and not cut any corners.

Today, two more presents show up under Berkshire’s Christmas tree. The conglomerate will collect $199.2 million (maybe) in quarterly dividends from Bank of America and $130.3 million from Kraft Heinz. Well, at least that’s the case based on the latest publicly-available information. The BAC 0.00%↑ number might end up being (much) lower if Warren Buffett kept selling shares after dropping under 10%.

BNSF Railway and J.B. Hunt’s new intermodal service earned high marks for efficiency during peak season. The premium Quantum intermodal offering — aimed at winning back business from the trucking industry — maintained a 95+% on-time performance record during the high-volume fall. “In October, BNSF achieved record intermodal volumes, a testament to our growing capabilities and commitment to excellence, then ramped immediately into peak season,” BNSF posted on LinkedIn. “Throughout this time, we’ve maintained a door-to-door service rate of over 95% for our over-the-road converted traffic through Quantum. This level of consistency is no small feat and highlights our unwavering focus on delivering reliable service to our customers when they need it most.”

In Q4 2024, BNSF’s intermodal volume is up 15% — with average velocity and terminal dwell metrics on the upswing, too. According to a network update earlier this month, “Overall velocity was higher than in November and our average terminal dwell improved by 9.1% versus the prior week and 16.9% from the previous month, reflecting our strong network momentum.”

I saw seven different people dip into the box of See's peanut brittle on Christmas - that's how you know it's the good stuff!