The Berkshire Beat: December 20, 2024

All of the latest Warren Buffett and Berkshire Hathaway news!

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

Speaking of which… The annotated transcript for December will go out to paid subscribers on Monday morning. It’s a Warren Buffett interview (conducted by his close friend Carol Loomis) from 2014 that touches on both his investment process and the American economy’s slow-but-steady recovery after the Global Financial Crisis.

So, if you’ve been on the fence about upgrading, there’s no time like the present.

Now, with that bit of housekeeping out of the way, let’s turn our attention to the latest news and notes out of Omaha…

Up until about 9:35 last evening, there was a whole long section here where I wondered why Berkshire Hathaway had not purchased more Occidental Petroleum and Sirius XM stock during their recent price downturns. That went up in flames, though, when a slew of new SEC filings revealed that Berkshire had indeed gone on a shopping spree of sorts over the past three days. Think of it as a little Christmas shopping for the conglomerate.

After more than six months on the sidelines as Occidental Petroleum’s stock price steadily sank down through the $50s and into the mid-$40s, Warren Buffett finally sprang into action this week and added 8.9 million more shares of the O&G giant. This $409.2 million outlay boosts Berkshire’s stake back up to 28.2%.

Some speculated that Buffett might have soured on Oxy — perhaps owing to the increased debt post-CrownRock acquisition or the resultant pause in share repurchases — but this move would seem to put those whispers to rest.

Someone at Berkshire (probably not the big man himself) also purchased another 4.96 million shares of Sirius XM for $107.2 million. Berkshire now owns 34.6% of the satellite radio and streaming provider.

And, finally, a small-ish surprise. For the first time in over a decade, Berkshire bought more Verisign stock. It’s not exactly an earthshaking transaction — 234,312 shares for $45.4 million — but I don’t think anyone saw this one coming.

How did Sirius XM wind up back in Berkshire’s wheelhouse? SIRI 0.00%↑ plummeted in price earlier this month after issuing disappointing revenue guidance for next year. As part of that guidance, the company announced that it plans to re-focus its attention on its in-car subscription service — since that’s where 90% of customers tune in. Sirius XM also hopes to reduce debt by $700 million in 2025, while continuing to repurchase shares and pay out a $1.08 annual dividend. Godspeed.

One of my favorite Munger-isms is that billion-dollar ideas come from $30 history books. David Senra, host of the excellent Founders podcast, discussed this with Chris Williamson on the equally-excellent Modern Wisdom — and made the case for reading biographies of anyone you admire. “I am an evangelist for reading biographies,” he said. “I think it’s one of the highest value activities that you could have outside of spending time on your health [and] with your friends and family. I really think people should make it a habit.” Another point in Senra’s favor: He called Charlie Munger the “wisest person I’ve ever come across”.

Apple hit more all-time highs this week — but if the tech giant hopes to stay up in such rarefied air, it probably needs to shift back into growth mode toot suite. And the fastest way to do that would be to re-accelerate static iPhone sales. (iPhone revenue — which accounts for roughly half of Apple’s overall sales — grew by less than 1% this year and is still down from 2022’s highs.) To do this, a dramatic refresh of the phone’s design and hardware might be in order. The Wall Street Journal reports that Apple plans to release a foldable iPhone as soon as 2026 — and a larger foldable iPad sometime after that. This device would seemingly create the best of both worlds for smartphone customers: a smaller, pocketable form factor when closed and a much larger screen (without visible crease) when unfolded.

🤑 Dividend: Earlier this week, Berkshire collected $194 million in quarterly dividends from long-time holding Coca-Cola.

And, speaking of Coca-Cola, I enjoyed this clip of Buffett discussing the importance of great brands and how he “wouldn’t think of selling a share” of the venerable old soft drink maker.

Berkshire-owned Lubrizol has invested hundreds of millions of dollars in India — and is now aiming to aggressively grow its business there. “I’ve challenged the team to double our business here in five years,” said CEO Rebecca Liebert. “It may be that’s aspirational, but I think if you don’t set aspirational targets, you don’t deliver.” She hopes that bolstering the Lubrizol workforce with local Indian talent will help drive those gains. “With $350 million of investment, we need a lot of engineering. These are big plants and they are complex plants, so we need people who can do the engineering, run projects, [and] manage all of the procurement spend. Having that capability set here [will] really help us set up for the future because we think the India market is going to continue to grow and expand.”

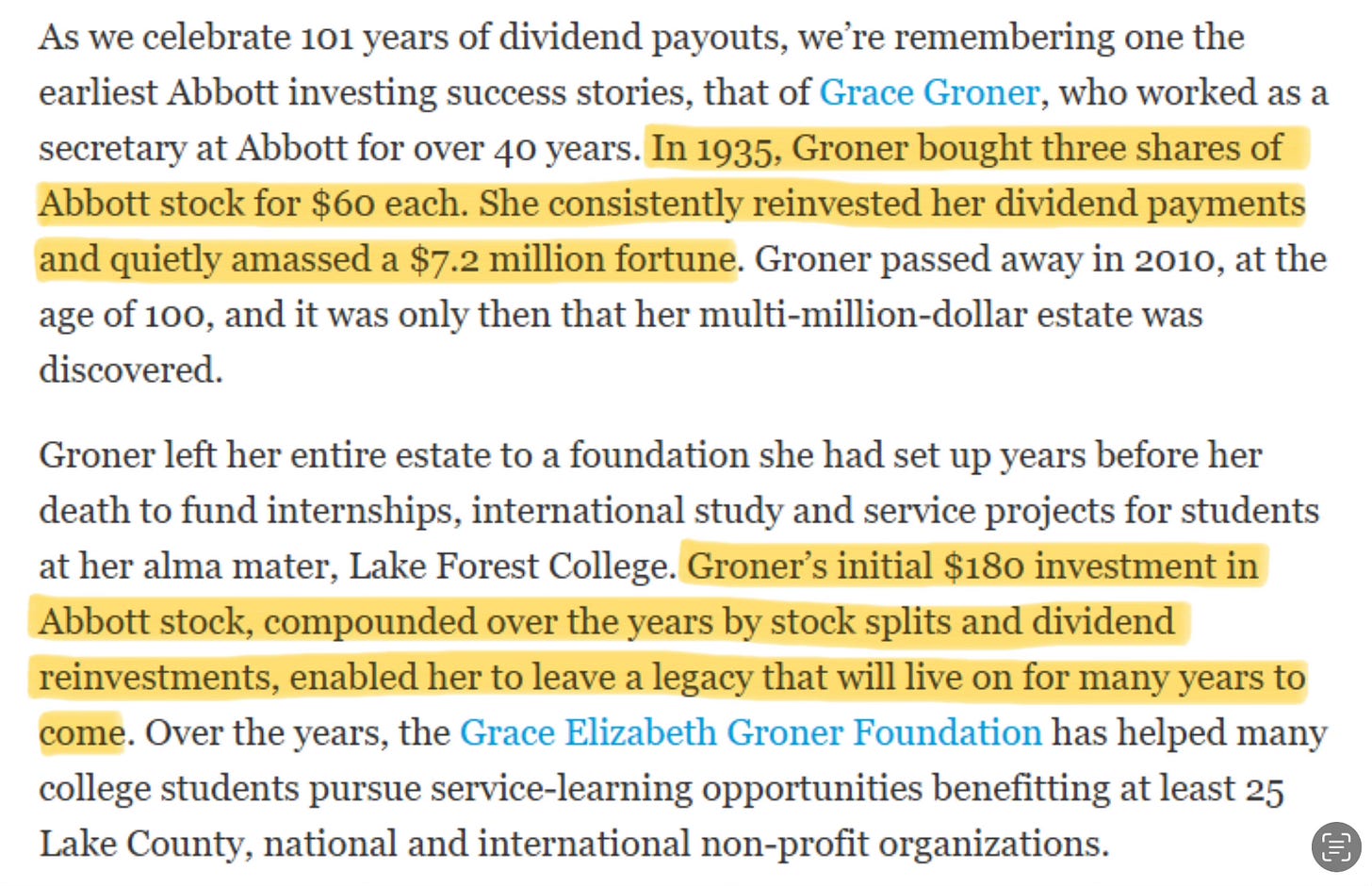

I love the below excerpt from Abbott’s latest dividend announcement. (It struck me as a very Berkshire-like thing to include.) More companies should highlight stories like this about the compounding bonanza enjoyed by long-time shareholders. It’s not only an interesting glimpse into company history, but might also persuade some people with itchy feet to hold onto their investments for the long haul.

I’ve been blown away by the response to last week’s transcript of Alice Schroeder talking about Buffett’s investment in Mid-Continent Tab Card Co. It looks on track to become the second-most-liked issue in this newsletter’s history. (I’m not sure anything will ever catch The Uncommon Sense of Charlie Munger in the #1 spot.) Thank you to everyone for reading my humble little contributions on the subject and for all of your support throughout the year. Merry Christmas!

One last thing: I always enjoy Todd Wenning’s work. His take on Schroeder’s remarks re: Mid-Continent is well worth reading.