The Berkshire Beat: April 14, 2023

The latest Berkshire Hathaway news and my must-reads of the week!

Happy Friday and welcome to our new subscribers!

Special thanks, too, for those who recently became paid supporters! ❤️

The latest news and notes out of Omaha…

Actually, most of this week’s Berkshire Hathaway news comes out of Japan. Warren Buffett and Greg Abel (Net)jetted off to the Far East, where they met with the CEOs of Japan’s five largest trading houses — and boosted Berkshire’s stake in each up to 7.4%. “These five companies are a cross-section of not only Japan, but of the world,” Buffett said. “They are really so much similar to Berkshire.”

Buffett: “We don’t think it’s impossible that we will partner with them at some point in the future in a specific deal. We would love if any of the five would come to us and say, ‘We’re thinking of doing something very big or we’re about to buy something and we would like a partner.”

It feels like Buffett and Abel laid a lot of groundwork on this trip for further (and bigger) business with the sogo shoshas in the future.

As part of Buffett’s trip to Japan, he granted a rare interview to Nikkei. It touched on a wide range of topics — including an admission that rising tensions between China and Taiwan were “a consideration” in his Q4 2022 sale of TSMC stock.

In January, Berkshire finally became majority owner of Pilot — and changes are already on the way. Adam Wright, once described as a rising star at Berkshire Hathaway Energy before joining Pacific Gas & Electric Company in 2021, will become CEO of Pilot on May 30. It’s an interesting move from the usually hands-off conglomerate. But, if Wright is as good as they say, I’m just glad to have him back in the Berkshire fold.

Pilot chairman Jimmy Haslam: “Berkshire owns 80%. It’s their call.”

The Knoxville News Sentinel says that Haslam “seemed comfortable with the shift” and “will be more involved day-to-day to support Wright’s early tenure”.

Berkshire’s stake in BYD continues to get smaller and smaller. On Tuesday, a new filing out of Hong Kong revealed that Berkshire recently reduced its interest in the Chinese EV maker (H-shares) down to 10.9% as of March 31, 2023. Due to Hong Kong regulations, the next filing will come if/when Berkshire’s position dips under 10%.

I added the PDF of Ted Weschler’s 2011 letter to the bottom of Tuesday’s article. If you’d like to download a copy for yourself, click the link and scroll all the way to the bottom. It’s a great read!

Oh, and Warren Buffett gave a three-hour interview to CNBC on Wednesday morning from Tokyo. Much more on that after the jump.

In the Spotlight: Warren Buffett’s CNBC Interview from Japan

It’s been a while since Warren Buffett took over an episode of CNBC’s Squawk Box for the full three hours. This used to be something of an annual tradition, but I feared that Covid (and old age) had scuttled these long-form sit-downs with Becky Quick.

Not so.

Even better, Greg Abel joined Buffett for the first hour of the interview. We don’t get many opportunities to hear from Berkshire’s heir apparent — but, at least in my eyes, Abel delivered an extremely impressive performance and ably demonstrated his commitment to the Berkshire culture.

In other words, I’m pretty much sold on Greg Abel.

You may notice that I’ve only included quotes here from the interview’s first hour. That’s because I had to make an unscheduled trip to the emergency room on Wednesday morning that pulled me away from the TV about halfway through Buffett’s comments. (Spoiler: Kidney stones are every bit as painful as people say.)

But that’s all behind me now — and I will have much more to say about the 7-9 a.m. ET portion of the interview early next week. Stay tuned for that.

Until then, here are a few highlights from the interview’s first hour…

On the Japanese trading houses:

Buffett started investing in the sogo shoshas back in 2020, before adding more shares in November and then again this week.

They were selling at what I felt was a ridiculous price, particularly the price compared to the interest rates prevailing at that time.

I was confounded by the fact that we could buy into these companies and, in effect, have an earnings yield of maybe 14% or something like that, with dividends that would grow … [while] people were investing their money in a quarter of a percent or nothing.

So, how’s it going?

Their results have exceeded out expectations since we purchased the group. I think their dividends, on average, have gone up 70% or something like that.

Buffett added that Berkshire plans to hold its position in the Japanese trading houses for the next ten or twenty years.

On Greg Abel:

“[Greg] does all the work and I take the bows,” Buffett quipped.

He knows more about the individuals, the businesses — he’s seen them all. They haven’t seen me at the BNSF railroad for 10-12 years or something like that. Greg is there and he understands each of our businesses.

He’s probably tougher than I would be in terms of getting things done and everything. It has already improved dramatically the management of Berkshire. We think alike on acquisitions, we think alike on capital allocation. He’s a big improvement on me, but don’t tell anybody.

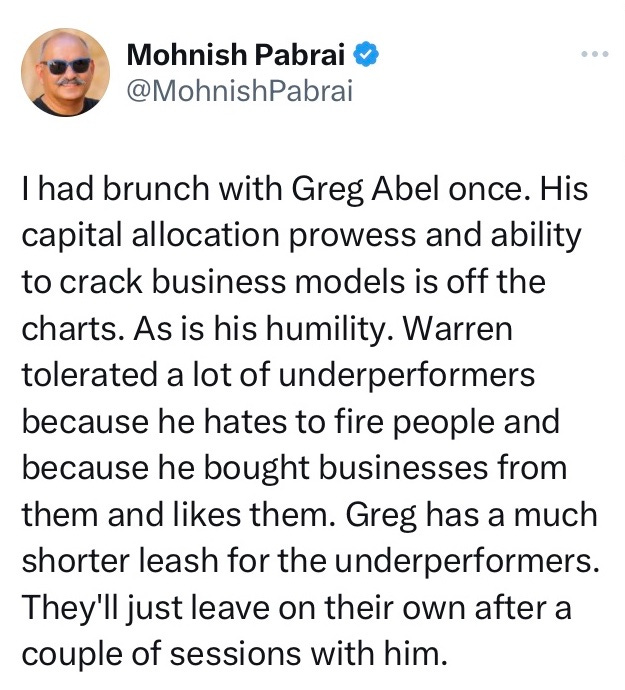

Mohnish Pabrai then tweeted out his guess as to what Buffett likely meant by that “tougher” comment.

The best news? Buffett revealed that Abel is “not looking to retire at 65 or 70 or 75”.

On Greg Abel’s skin in the game:

Last month, Abel significantly strengthened his financial commitment to the company that he will one day lead. He now owns 228 Class A shares and 2,363 Class B shares — at a current value of $112.6 million. And, thankfully, over 99% of that amount is in vote-rich Class A shares.

Becky Quick asked if he’s planning to buy more in the future…

Abel: Obviously, when I monetized the position in Berkshire Hathaway Energy, that provided an opportunity to purchase shares in Berkshire. Had I done that sooner, I would have owned the shares in Berkshire earlier. That was always the intention. And, yes, I always will continue to invest in Berkshire. I strongly believe in Berkshire. I believe in what has been created and I strongly believe, equally, that we have a great path forward.

Buffett: Becky, how many managers in the United States have put $100 million of their own money — not getting a share at a discount, not getting any special deal on it — [into shares of their own company]? I could hardly think of a case where anybody has put anything like $100 million of their own money in and gotten the exact same deal as the shareholder gets. If they make money, they make money. If they lose money, they lose money. And that’s just the way we play it at Berkshire. You don’t find it any place else.

Emphasis added.

If nothing else, this interview is a mouthwatering appetizer for the marathon Q&A at next month’s annual meeting. Can’t wait!

More Must-Reads

Other awesome things that I read this week:

People Don’t Change Jared Dillian

“We know why people get sick — we have no idea why they get better. There is no explanation for when someone suddenly figures it out and turns it all around. I can tell you what the precondition is: the person has to want to get better. Some people want to want to get better — no, you have to want to get better.”

DaVita: An Essential Provider of Dialysis Services The Rational Walk

If my article on Ted Weschler and his longstanding interest in DaVita piqued your interest in the healthcare company, check out this excellent analysis of DVA 0.00%↑. All of The Rational Walk's business reports are well worth a read.

What’s on Dimon’s Mind? Investment Talk

“He actually said those four magic words. Well, he actually expressed it in seven; ‘it may not be true this time’. By ‘it’ he is referring to the inverted yield curve, an eight-for-eight recession indicator, telling us we are due a recession. He claims it’s possible this inversion is driven by prior quantitative easing.”

I listened to the interview. As always, Mr. Buffet charms and is wise and willing to instruct and explain his actions.

Listening to Mr. Abel was interesting as he acted as Mr. Buffet’s wingman.

I think the Company could walk Mr. Buffet and Mr. Munger to the door now.

The stockholders can rest assured the company is in good hands. And Mr. Abel needn’t complicate his complicated job with escorting the founder on his PR jaunts.

I’m an owner, intend to remain an owner and have maximum respect for Mr. Buffet and Mr. Munger and their phenomenal creation.

At this point, those guys are staging a dog and pony show that’s fairly transparent and while not quite insulting the owner’s’ intelligence, does place unnecessary demands on their patience.

I’m somewhat new to your writing and really enjoy your work. Thanks.