The Berkshire Beat: April 11, 2025

All of the latest Warren Buffett and Berkshire Hathaway news!

Happy Friday and welcome to our new subscribers!

Special thanks, too, to those who recently became paid supporters! ❤️

Warren Buffett has been the toast of the financial press this week — with many marveling at the excellent timing of his shift into cash (relatively speaking) in the quarters leading up to our most recent market downturn.

For those needing a refresher, Buffett significantly pared back Berkshire Hathaway’s two largest holdings — Apple and Bank of America — in 2024. In all, Berkshire sold $143 billion worth of stock last year (while purchasing just $9 billion) to leave the conglomerate sitting on $318 billion of cash and equivalents.

Who knows where the market will go from here now that most of the reciprocal tariffs are paused for 90 days — but Buffett has looked pretty prescient so far.

In fact, he’s the only member of the Bloomberg Billionaire Index’s top ten whose net worth has gone up in 2025. That’s what happens when virtually all of your wealth is in Berkshire stock and it outperforms the wider market by more than twenty points.

So, with lots of companies plumbing new 52-week lows over the past few days, Buffett has no shortage of dry powder to deploy as he sees fit.

What Buffett has not seen fit to do — at least so far as we know — is add more Occidental Petroleum common stock after it dropped into the mid-$30s this week amid a general slump in oil prices. OXY 0.00%↑ did not hit its lows until Wednesday morning, so there could still be a surprise Form 4 this evening.

Late last week, Buffett told Becky Quick that he will not publicly address the economy, the stock market, or tariffs until Berkshire’s annual meeting in May.

But, back in 2003, he wrote an article for Fortune (“America’s Growing Trade Deficit Is Selling The Nation Out From Under Us”) that proposes a tariff-like-but-not-quite solution called Import Certificates. “My remedy may sound gimmicky,” said Buffett, “and in truth it is a tariff called by another name. But this is a tariff that retains most free-market virtues, neither protecting specific industries nor punishing specific countries nor encouraging trade wars.”

The Rational Walk and Michael Gregory (MSN) each wrote about how Buffett’s views from two decades ago fit into today’s rapidly-changing economic landscape. We will hopefully hear more about this from the man himself next month.

And, now, on to the latest news and notes out of Omaha…

I try to avoid too much navel-gazing around these parts, but I wanted to share a short video I posted last weekend on X that sort of went viral. (At last check, it’s at 1.3 million views. I don’t know if that actually counts as viral, but it’s probably the closest I’ll ever come.) In it, Warren Buffett marvels at the odd way many people react to falling stock prices. “People are really strange [during market downturns],” he said. “Most of your [viewers] are savers — and that means they’ll be net buyers. They should want the stock market to go down. They should want to buy at a lower price.”

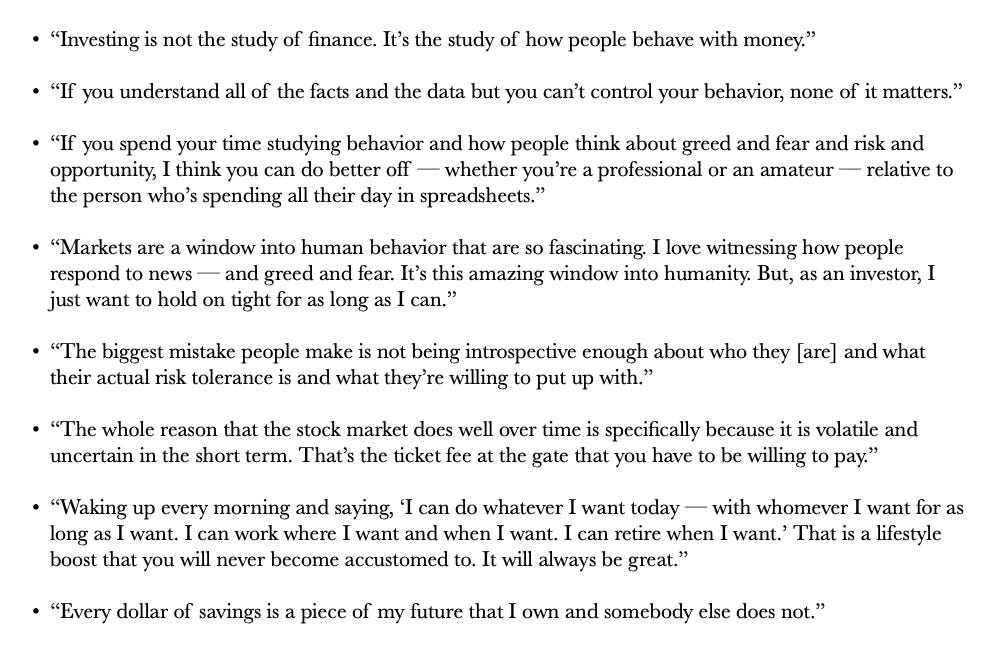

Best-selling author Morgan Housel hopped on the At Barron’s podcast last week and had much to say about the psychological forces that move markets — and men. (I jotted down a few of his most insightful comments below.) Housel, who serves on Markel’s board of directors, also explored the philosophical link between that company and Berkshire Hathaway. “Many people, for decades, have looked at Berkshire Hathaway and said, ‘We should try to replicate that.’ [But] it’s very hard to do in practice — because it’s not a technical skill, it’s a cultural skill.” Housel added that the Markel family and CEO Tom Gayner are “as close as it’s come to actually replicating that Berkshire model”.

The Wall Street Journal reports that Apple will source more iPhones from India as a way to work around the sky-high tariffs on China. The company still hopes to win an exemption from the tariffs altogether — as it did back during the first go-round in 2018. India can currently produce about 25 million iPhones per year. If all of those are now sent stateside, that would satisfy ~50% of domestic demand. The threat of tariffs weigh heavily on Apple — with its worryingly China-centric supply chain. As such, AAPL 0.00%↑ has been on a rollercoaster ride — dropping 22.9% in the week following Liberation Day, rallying 15.3% in the hours after the pause, and then falling again yesterday as the market digested the news.

Apple was not caught entirely flatfooted by the tariff standoff. The Times of India says that the iPhone maker rushed five planeloads of Apple products over to the United States during the final week of March. “Apple’s U.S. warehouses are reportedly stocked for several months ahead,” claimed the paper. Maybe even until the new iPhone comes out in September.

Here’s one piece of good news for the tech giant: American teenagers love the iPhone more than ever. Piper Sandler’s semi-annual Teens Survey revealed that 88% of teens say they own an iPhone — a 3% improvement over last year’s results. (Ten years ago, that number was a mere 66%.) Plus, 25% of respondents plan to upgrade to the iPhone 17 this fall. That’s also a 3% increase over 2024. The kids are alright.

Full steam ahead — for now — on two large BNSF Railway projects related to international freight. Both the Barstow International Gateway in California and an intermodal terminal and logistics park in Arizona remain on track despite the uncertainty created by tariffs. “We’re not reevaluating [these projects] at this time,” said a spokesman for the railroad.

BNSF also announced that it will team up with Norfolk Southern and the Northwest Seaport Alliance to shave as many as three days off current transit times for intermodal freight arriving at the ports of Seattle and Tacoma.

AM Best reaffirmed National Indemnity’s “exceptional” credit rating this week. “National Indemnity’s steady underwriting performance has been augmented by substantial investment contributions during most periods, which has led to operating results that have outperformed AM Best’s reinsurance composite, as measured by a broad range of profitability metrics, over a prolonged period of time.”

And a few odds and ends to finish off the week…

Berkshire issued ¥90 billion ($626 million) worth of yen-denominated bonds — in what is the company’s smallest yen debt sale to date.

A Louisiana jury ordered Chevron to pay $744 million for the damage it caused over many decades to coastal wetlands in the southeastern part of the state. Texaco is actually the guilty party here, but Chevron assumed these liabilities when acquiring its rival oil major in 2001. Chevron is expected to appeal.

In other Chevron news, the Houston oiler plans to use the new triple-frac drilling technique on 50-60% of its wells in the Permian Basin this year. As the name suggests, this allows the company to frack three wells at the same time — which, in turn, reduces the cost per well by 12%. “What’s really in it for us is a more efficient use of capital and a better return on our investment,” operations manager Jeff Newhook told Reuters.

BASF is suing Berkshire-owned Duracell for allegedly stealing trade secrets related to lithium ion battery technology.

Circana’s latest annual sales report reveals that Kraft Heinz’s processed cheese slices business declined by 2% last year in both revenue ($1.23 billion) and unit sales (227 million). Better luck in 2025.

Pilot has now remodeled more than 200 of its travel centers as part of the company’s New Horizons initiative. According to CStore Decisions, “Pilot’s guests shared that they are 80% more likely to return after visiting a remodeled location, underscoring the program’s impact and value.”

Not many can extract the hidden essence from the mental models of Buffett and Munger to enter the palace of Intrinsic Value and Real Compounding Evaluation.