Terry Smith Is Never Boring

"Reading what the commentators say about today’s news is not the way to make an investment decision."

Terry Smith is never boring.

The author of Accounting for Growth (The Book They Tried To Ban!) combines unflinching candor with his trademark dry wit to challenge the conventions of the money game.

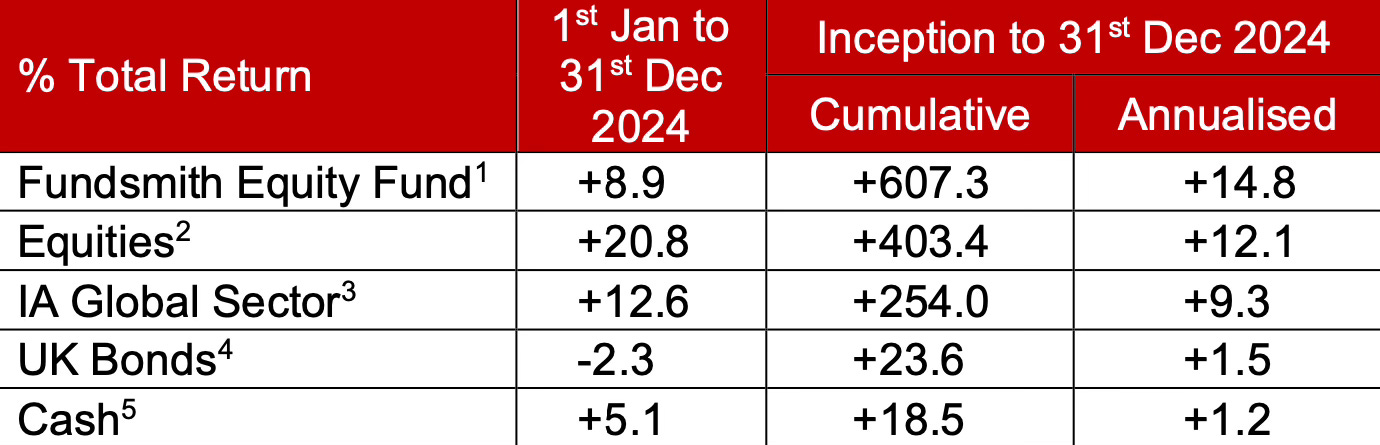

Yes, I am well aware that his results at Fundsmith leave a little something to be desired over the past four years. Still, he remains ahead of the benchmark index since the fund’s inception. And that’s not nothing.

Speaking only for myself, I prefer to cast a wide net for wisdom — without limiting myself only to those currently riding a hot streak against the market. Even if Fundsmith gets blitzed by the MSCI World Index for years to come, I’ve learned a lot from Smith and will hopefully continue to do so in the future.

Back in February, Smith headlined Fundsmith’s annual shareholders meeting in London and fielded questions (alongside head of research Julian Robins) for over ninety minutes. The whole thing is well worth a watch, but I’ve collected a few of his more notable points below. Lots of food for thought.

Volatility Takes An Emotional Toll

Warren Buffett often notes that volatility can be an investor’s best friend. “I love it when prices jump up by 100% or down by 50% in the same year,” he once said. “Volatility in stocks is what has made me rich.”

But such stoic control of emotions and discipline is easier said than done. (At least for us mere mortals.)

“On the whole,” Terry Smith told Fundsmith shareholders, “high levels of volatility — whilst it would be nice to ignore them — do tend to affect us all. When you’re holding something, which might go up over the long term but is highly volatile, it does affect our ability to make decisions on a very non-emotional basis. So owning things which are very volatile, in my view, can be quite injurious to your performance.”

In other words, volatility can mess with your head.

And, if it does, it’s probably best to just avoid those kinds of businesses altogether.

Tune Out, Cash In

“Reading what the commentators say about today’s news is not the way to make an investment decision,” said Smith.

One of Fundsmith’s best investments in recent years has been Meta Platforms — purchased when it fell out of favor with the general public amid the Cambridge Analytica data scandal and heavy spending on the metaverse. “We received a veritable tsunami of criticism from people about holding this company,” he added. But Smith tuned out the noise and bet heavily on what turned out to be a “spectacularly” successful investment.

To illustrate the point, Julian Robins offered a thought experiment. He pretended to divide the room of Fundsmith shareholders in half — with one side focusing on the long-term fundamentals of a successful business and the other side relying on financial newspapers, watching cable news programs, and focusing on what drives the short-term price action of the stock market.

“There would be absolutely no overlap at all between the two sides,” he said. “[The first half] would write down things like the quality of the product, whether it traveled well, whether they had good management, how easy it was to make, and what the economics of the business were. And [the other] half of the room would talk all about interest rates, bond rates, tariffs, Donald Trump, AI, exchange rates, etc.”

“We [at Fundsmith] spend pretty much all of our time thinking [like the first half of the room].”

If Quality Is King, Cost Is Queen

To Smith, a company’s valuation is not the most important factor — business quality comes first — but it’s not inconsequential, either.

“People talk about value investing and growth investing,” he said. “These are labels which, like many other labels, are quite unhelpful — but we don’t ignore them. The fact that [valuation] is not the first thing that we look at — we look for quality in companies first — it doesn’t mean that it’s something we completely ignore. And we would have to [be] ignoring it to own some of [the so-called Mag 7].”

At the time of the Fundsmith AGM two months ago, Microsoft traded at 38x earnings. “I’m not all that happy with that, to be honest with you,” admitted Smith. He felt okay with Meta at 24x and Alphabet at 26x, but not so much with Amazon at 45x and Apple at 32x. (Again, these were the valuations in February. Things have since changed a bit.)

Index Funds Feed The Giants

Taking his “labels are unhelpful” commentary a step further, Smith challenged the idea that index investing is really a passive strategy at all.

“It’s only passive in the sense that there’s no fund manager — no Terry or Julian — trying to make decisions involved in the process,” he said. “It’s just a computer that’s sitting there matching the index. It’s actually a momentum-based strategy.”

“The money that goes into index funds is allocated — for most index funds — in relation to the market weighting of the shares, their value in the market. Which means that the ones which are biggest get the most inflows. And guess what that does to their share prices over time?”

Smith, an active manager in direct competition with these increasingly-popular index funds, is not exactly an impartial observer here. But he raises a salient point oft overlooked as more and more money flows into index funds — which is that they amplify market trends merely as a consequence of their allocation mechanics.

This creates a self-reinforcing cycle of sorts wherein the most valuable companies — already performing well in the charts — receive the lion’s share of new investments. It’s not done based on fundamental analysis or conviction about the company’s future, but is simply a function of that company’s size in the index. As such, this can lead to inflated valuations with prices more and more detached from intrinsic value.

Dividends Don’t Come Out Of A Magic Pot

This one pains my hold-forever and dividend-loving heart…

“People say, ‘When I get my dividend, I’m not selling. [Selling] would take money out of the equity market.’ So you think when a company pays out half of its earnings to you, that’s not coming out of the equity market? You think there’s some magic pot [of money] that they’ve got that wouldn’t otherwise have been invested in the business if they had retained it?” asked Smith.

“When you get a dividend you are taking money out of the equity market as surely as if you sold a portion of your holding.”

Julian Robins agreed. “You might as well take money out of your savings account and put it into your checking account and think you’re wealthier.”

This tracks pretty well with the Berkshire Hathaway approach to paying dividends. In Buffett’s latest annual letter, he credited the absence of such payments as a big reason for Berkshire’s participation in the American miracle — even going so far as to call the company’s one previous dividend in 1967 a “bad dream”.

In an interview last year, Buffett’s sister Bertie said that when she told her brother she wished Berkshire paid a dividend, he recommended she “just sell the stock” to create her own dividend.

Live Long — In Order To Prosper

“Surviving in this business can be a bit tricky,” admitted Smith. “There are lots of historic examples of people who were wrong for quite a while, [were proven] right in the end, and didn’t manage to survive.”

He held up an old colleague, Tony Dye, as the perfect example. During the dot-com bubble, Dye was so bearish on the market that the press labeled him “Dr. Doom”. He correctly identified that investors had taken leave of their senses, knew that it could not continue forever, but unfortunately noticed this all far too early — and ended up getting fired from Phillips & Drew for his troubles.

“It almost marked the day of the collapse of the dot-com boom, when they [fired him],” said Smith. “That’s absolutely typical of the industry. So our aim, amongst other things, here is to survive and prosper in this environment long enough to reap the benefits of being able to deal with the flood of money into so-called passives, which is distorting the market.”

Being right on a long-term prediction doesn’t mean much if you get blown out of the water by short-term storms in the meantime. Sure, you might be proven right eventually — but, like Tony Dye here, it’s a hollow victory if it arrives after a pink slip.

With apologies to the Vulcans for paraphrasing their maxim: In the money game, you must live long in order to prosper.

Regardless of his somewhat iffy recent performance, he has so much good advice to offer. His book 'investing for growth' is a bit of a gem. An example of doing the basics very well, thanks for a great post :)

Well deserved praise for Terry Smith.