Intel's Silicon Heartland, Two Dividend GOATs Team Up, and Terry Smith Blasts Unilever

Happy Thursday!

Well, it’s been an eventful week so far — starting with the S&P 500 dropping into a bear market at Monday’s close. Then, just yesterday, Fed chairman Jerome Powell did his best firefighter impression by raising interest rates 0.75% and striking a defiant note that a similar hike might follow in July, too.

Despite the headwinds currently pummeling the stock market, this is no time to panic or give up. Making the right decisions now — or even just resisting the urge to sell at these lows — could set you on the road to generational wealth.

Intel & The Silicon Heartland 🖥

Along with many others, Intel hit a new 52-week low during Monday and Tuesday’s sell-off.

But Intel’s troubles really started long before this week. In fact, the company’s stock has never really recovered from the dot-com crash — as the current price of INTC ($38-ish) pales in comparison to its all-time high of $74 in August 2000.

Anyone who jumped on Intel stock during those heady days (at a P/E approaching 50), when any company even remotely connected to technology or the internet shot through the roof, would still be underwater on their investment today.

Even though Intel “won” and dominated the semiconductor market — significantly growing revenue and net income — over the ensuing twenty years, the initial purchase price was so out of whack that even long-term investors took a bath.

Such is the danger of overvaluation.

Fallen Giant. Overvaluation doesn’t explain everything, though. Whether you blame complacency, wayward leadership, or just plain ol’ incompetence, Intel completely botched the transition to 7nm (nanometer) chips in 2020 — leaving the door wide open for rival AMD to usurp the semiconductor throne.

The delay of the 7nm chips scrambled the company’s entire technological roadmap — setting them back years and breaching the trust of many computer manufacturers who relied on Intel chips to power their devices.

Even Apple jumped ship and began designing proprietary semiconductors (M1 and M2) for its Mac lineup. (Though this might be more about the Cupertino giant’s desire for total control of its ecosystem rather than a direct reflection on Intel’s travails.)

All in all, it’s been a pretty miserable few years for the company once feared as “Chipzilla”.

🇺🇸 Silicon Heartland. Not surprisingly, Intel felt the need to shake things up. So, in 2021, Pat Gelsinger returned to the company as CEO.

And, with him, he brought a bold plan to arrest Intel’s slide into semiconductor irrelevance — and, in the process, break the chains of America’s dependence on Asian manufacturers for vital computer chips.

Ambitious guy.

Gelsinger announced his new IDM (Integrated Device Manufacturing) 2.0 strategy that would focus Intel on both designing and manufacturing its own creations in-house, but also fabricating chips for other companies as well.

To pull this off, though, Intel needed more foundry capacity. A lot more.

So, in January, the company announced plans to build the world’s largest semiconductor plant in New Albany, Ohio. Intel committed to build two fabs (chip fabrication factories) for $20 billion, with another six fabs possibly coming in the future. Gelsinger hopes the new plant will be production-ready by late 2025.

This marks Intel’s first new manufacturing build in forty years. It’s an investment that the company believes will inspire a “Silicon Heartland” movement in the Midwest, where new technology can be fully manufactured on home soil.

Since this herculean (or some say quixotic) announcement, other companies like Air Products, Applied Materials, LAM Research, and Ultra Clean Technology also pledged to bring jobs and infrastructure to the Midwest near Intel’s new super-plant.

Faster, Please. Putting semiconductor manufacturing back in American (and European — Intel will invest over €33 billion across Germany, France, Ireland, etc.) hands should ease the widespread annoyance of chip shortages — as well as serve a vital national interest.

In 1990, 37% of computer chips were made in the United States. That has since dropped to 12%, with 80% now manufactured in Asia. To be exact, the lion’s share comes from Taiwan by way of TSMC, the world’s largest foundry.

Without delving too deeply into the current geopolitical landscape, that poses quite the problem for the West.

Considering Taiwan’s rather precarious position in regards to China, it’s absolutely in our best interests to control the semiconductor supply chain on safe land.

And the sooner, the better.

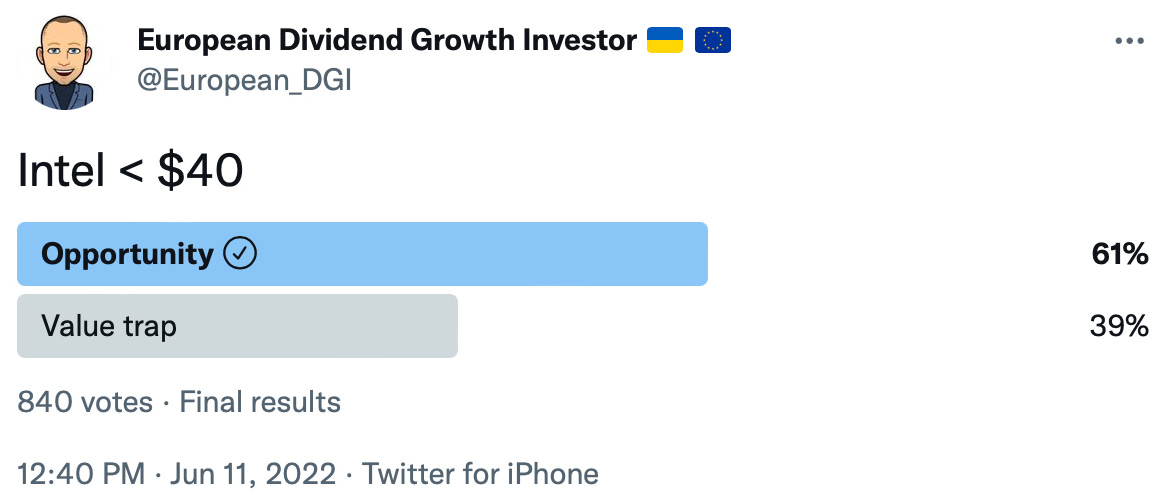

Is INTC a Value Trap? While the whole “Silicon Heartland” concept holds great promise, the level of capital investment needed to make it all possible will wreak havoc on Intel’s financials for the next few years. If Gelsinger can pull this off and bring semiconductor manufacturing back to the United States and Europe, the massive cap-ex will be worth it.

But, in the meantime, there are plenty of skeptics.

Intel forecasts an expected 4% revenue decline in 2022, with negative free cash flow and just $3.50 earnings per share. We all know that heavy infrastructure investment doesn’t come cheap, but Wall Street took it harder than (at least I) expected.

Since April, INTC is down over 20%.

Because of this drop, Intel’s price and 3.8% dividend look especially attractive. But are these metrics, most of which flag Intel as a screaming bargain, misleading investors?

The answer probably depends on your mindset — and whether you’re after a long-term investment or a quick flip.

While Intel’s short-term story makes for pretty ugly reading, Gelsinger sees rays of sunshine peeking through the clouds as early as next year. In 2023-24, Intel hopes to be back up to mid- to high-single digit revenue growth.

By 2025, though, the turnaround should be in full swing. That year, Intel guides for 10-12% revenue growth with gross margins between 54-58%. And, most importantly, the company believes it will then stay around those numbers for the foreseeable future.

Not everyone handles a rebuild like Gelsinger’s Intel. The new CEO publicly laid out a roadmap with his expectations, good and bad, at the very start. Instead of parsing comments or reading tea leaves, Intel investors have the information needed to judge management’s progress at each step of the way.

Long may that continue.

Coca-Cola 🤝 Brown-Forman

Earlier this week, Coca-Cola and Brown-Forman (owner of Jack Daniel’s, Woodford Reserve, and more) announced a long-awaited joint product: Jack-and-Coke in a can. While this doesn’t hold a ton of personal appeal to me, I think it’s fascinating to see two of the best American companies — not to mention true Dividend GOATs — working together.

Between the two of them, these companies have raised their dividends for a combined 99 years in a row. Both stocks belong in every long-term portfolio, offering an uncanny combo of growth and stability that can’t really be found elsewhere.

Unfortunately, the secret’s out. And that makes it nigh impossible to catch either one trading at a reasonable price.

Even in this battered market, neither one really qualifies as a bargain:

Coca-Cola: $59.67 (26.5 P/E)

Brown-Forman: $63.70 (36.6 P/E)

Add these two to your watchlist, bide your time, and then pounce whenever they drop into your value wheelhouse.

But be quick — they won’t be there for long.

👿 Terry Smith Blasts Unilever

Back in January, Terry Smith of Fundsmith published a postmortem on Unilever’s failed buyout of GlaxoSmithKline’s consumer health segment.

With Unilever now trading near $44 (not far off its 52-week low) and looking awfully attractive with that 4.5% dividend, I went back to read Smith’s caustic thoughts on the company’s management before hitting the buy button.

And, at least for now, that managed to curb my enthusiasm.

Love him or hate him, Smith is not one to mince words.

The Unilever management team seems to be playing what Warren Buffett lampoons as “gin rummy” management — like a player in the eponymous card game, throwing away their least promising card(s) each round in the hope they will turn over better ones. They should maybe consider whether the problem may not be with the hand/business, but with the player/management.

They have already sold the spreads and tea businesses. They have been pursuing a £50 billion acquisition and we could have expected further disposals and further major acquisitions if they had acquired GSK Consumer, taking them out of familiar businesses and into a new area where they have very limited expertise (beauty, oral care, and OTC health).

We believe the Unilever management — or someone else if they don’t want the job — should surely focus on getting the operating performance of the existing business to the level it should be before taking on any more challenges.

Emphasis added.

I’m with Smith on this one. CEO Alan Jope and the rest of Unilever management should be spending every ounce of energy on bolstering the performance of the company’s incredible consumer brands.

Not shelling out big bucks for new ones outside their circle of competence.

If you enjoy my work, please hit the ❤️ below and share this post with anyone who might be interested (or on social media). Thank you!

Disclosure: This is not financial advice. I am not a financial advisor. Do your own research before making any investment decisions.