Elon Musk, Warren Buffett, and the Unbreakable Berkshire Handshake

The market has spoken: Warren Buffett can be trusted. Elon Musk cannot. (But I still love ya, Elon!)

Happy Monday and welcome to all of our new subscribers!

After months of speculation and accusation, the Elon Musk x Twitter deal looks to be back on track. The Tesla and SpaceX founder recently expressed a renewed willingness to close his acquisition of the social media giant at the previously agreed-upon price of $54.20 per share.

Now, with both sides seemingly eager to put this whole mess behind them, Delaware’s Court of Chancery has stated that the deal must be complete by October 28 or Twitter’s lawsuit against Musk can proceed apace.

The only obstacle to a speedy resolution left in play is that the banks, who agreed to finance this acquisition back in April during rosier economic climes, might pull out.

I certainly won’t waste any time trying to predict how this soap opera will end, though I’d be thrilled to see Elon kick Twitter’s current management to the curb and start cleaning up that cesspool.

Mostly, though, watching this saga unfold from the sidelines makes me appreciate the tact and propriety of Warren Buffett and Berkshire Hathaway all the more…

Berkshire Hathaway is built on trust.

Trust that Warren Buffett is a straight shooter, that he’s not just waiting for the ink to dry before pulling the rug out from under a potential seller, that there won’t be another shoe to drop after reaching a verbal agreement.

When Buffett and Berkshire shake hands on a deal, that’s that.

No drama. No muss. No fuss.

Look at the market action of Alleghany Corporation, which Berkshire agreed to buy for $11.6 billion in March:

Y 0.00%↑ immediately jumped up into the mid-$800s — and has stayed there ever since — offering virtually no arbitrage opportunities when compared to the acquisition price of $848.02.

Arbitrage relies on uncertainty and doubt. And, when Berkshire makes a deal, those emotions are in short supply.

As you can see in the chart above, the market doesn’t seem the slightest bit concerned that the Alleghany deal might fall through or that Buffett could get cold feet.

That’s what decades upon decades of forthright and honest behavior earns you.

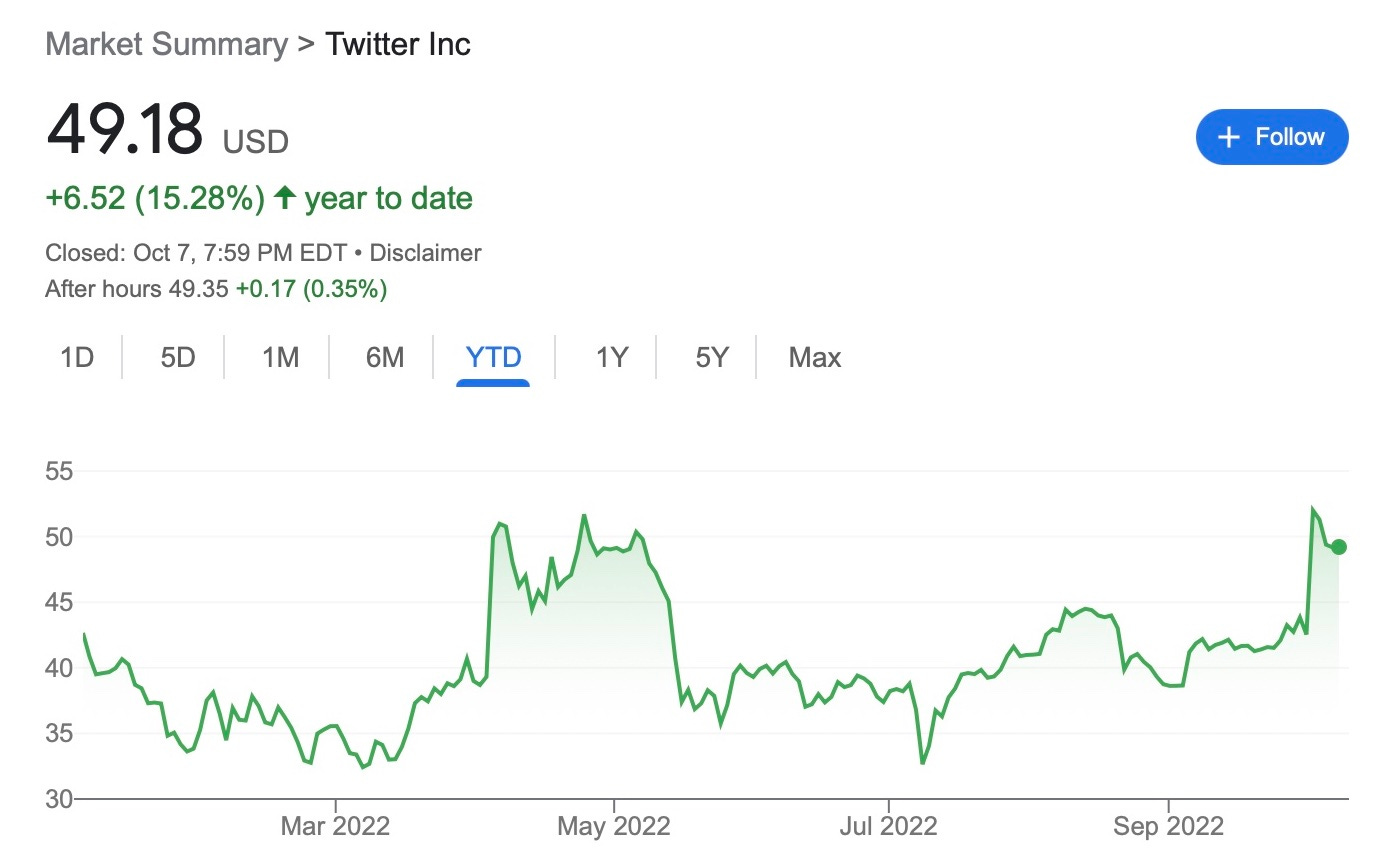

Now, let’s take a look at the mess behind Door #2:

(It’s never a good sign when a stock chart looks like my last EKG…)

TWTR 0.00%↑ shot up after the acquisition was announced in April, but then immediately embarked on a rollercoaster ride from hell that still hasn't ended.

Even now, with a willing buyer and a possible closing date less than three weeks away, the raw price differential between Twitter’s current price and acquisition price ($5.02) somehow remains larger than Alleghany’s ($4.92) — despite one stock trading in the $40-50 range and the other one way up in the $800s.

The market has spoken: Warren Buffett can be trusted. Elon Musk cannot.

(Again, I feel compelled to add — I love Elon. But the facts are the facts.)

So how does Buffett do it?

Trust.

And not just the trust that he has earned himself, but also the trust he places in others.

“Our model is a seamless web of trust that’s deserved on both sides,” Charlie Munger once said. “That’s what we’re aiming for. The Hollywood model, where everyone has a contract, and no trust is deserved on either side, is not what we want at all.”

Berkshire’s purchase of Nebraska Furniture Mart provides the perfect example of this principle in action.

Buffett walked into NFM on his birthday in 1983 and quickly reached a deal with owner Rose Blumkin — a colorful character better known as Mrs. B. — without even auditing her books.

Buffett said:

We never took an audit. We never checked the inventory. We never verified the receivables. We never checked the titles to the real estate to see whether they were really owned.

She gave me her word and I gave her the $55 million. When you’ve got Mrs. B.’s word, you’ve got something like a document from the Bank of England.

Mrs. B. (a Russian immigrant who couldn’t read or write English) told much the same story to author John Train:

One day, [Buffett] walks in and says to me, “You want to sell me your store?” And I say, “Yeah.” He says, “How much do you want?” I say, “Sixty million.” He goes to the office and brings back a check. I say, “You’re crazy. Where are your lawyers? Where are your accountants?” He says, “I trust you more.” (The Midas Touch, 1987)

After shaking hands on the deal, Buffett told Mrs. B. that it was his birthday. She replied, “Well, Mr. Buffett, you bought an oil well on your birthday.”

I can’t move on from the subject of NFM without mentioning this story from Adam Smith’s Supermoney:

We are driving down a street in Omaha; and we pass a large furniture store. I have to use letters in the story because I can’t remember the numbers. “See that store?” Warren says. “That’s a really good business. It has a square feet of floor space, does an annual volume of b, has an inventory of c, and turns over its capital at d.”

“Why don’t you buy it?” I said.

“It’s privately held,” Warren said.

“Oh,” I said.

“I might buy it anyway,” Warren said. “Someday.”

Supermoney was published in 1972.

The man certainly knows how to play the long game.

In most cases, Buffett is dealing with men and women who built a business from scratch, kept it in their family through thick and thin, and now care deeply about finding the right (permanent) home for their labor of love.

Buffett realizes that, in many ways, he’s buying that founder’s hopes and dreams — and acts accordingly.

Time for another example.

To buy the Illinois National Bank, [Buffett] went on a Friday and spent two hours there. He said to Gene Abegg, the seventy-one-year-old owner, whom he immediately liked, “If we make a deal, I’m going to make four changes that you won’t like. I’ll drop four shoes, but there are no more shoes after that. If you accept them, I’ll tell you my price on Monday and, if you like my offer, I’ll meet you at the Harris Trust on Thursday with a check and a contract that you won’t have to change a word of.” (The Money Masters, 1980)

Interestingly, the Illinois National Bank & Trust of Rockford is one of Buffett’s very few acquisitions that no longer lives under the Berkshire umbrella.

Which probably sounds odd, since I just said that a big part of the whole trust thing is that Berkshire offers a permanent home for acquired companies.

So what happened?

The law changed and Berkshire was not permitted to wholly own a bank — leading to its spin-off in 1980. If not for that federal regulation, Buffett would surely still own Illinois National Bank today.

When Gene Abegg died that same year, Buffett paid tribute to him in Berkshire’s 1980 annual letter — and highlighted Abegg’s unerring honesty and trust.

You learn a great deal about a person when you purchase a business from him and he then stays on to run it as an employee rather than as an owner. Before the purchase, the seller knows the business intimately, whereas you start from scratch. The seller has dozens of opportunities to mislead the buyer — through omissions, ambiguities, and misdirection. After the check has changed hands, subtle (and not so subtle) changes of attitude can occur and implicit understandings can evaporate. As in the courtship-marriage sequence, disappointments are not infrequent.

From the time we first met, Gene shot straight 100% of the time — the only behavior pattern he had within him. At the outset of negotiations, he laid all negative factors face up on the table; on the other hand, for years after the transaction was completed he would tell me periodically of some previously undiscussed items of value that had come with our purchase.

Though he was already 71 years of age when he sold us the Bank, Gene subsequently worked harder for us than he had for himself. He never delayed reporting a problem for a minute, but problems were few with Gene.

Because of our respective ages and positions, I was sometimes the junior partner, sometimes the senior. Whichever the relationship, it always was a special one, and I miss it.

Let the cynics roll their eyes and accuse Buffett of greed and self-interest.

And, who knows, maybe his innermost motives do fall short of sainthood.

But, no matter how you judge Buffett’s virtue, it’s smart business. Berkshire’s long-term success speaks for itself.

And it all rests squarely on trust.

If you’ve enjoyed reading this issue of Kingswell, please hit the ❤️ below and share it with your friends (and enemies) so they don’t miss out. It only costs you a few clicks of the mouse, but means the world to me. Thank you!

Disclosure: This is not financial advice. I am not a financial advisor. Do your own research before making any investment decisions.