Clash of the Titans: Apple, Alphabet, & Amazon

In which I check in on three of the biggest companies in the world (and ask ChatGPT if it's planning to usurp Google...)

Happy Tuesday and welcome to our new subscribers!

Some might say that we’re in the calm before the storm. 13F deadline day arrives on February 14, followed quickly by Charlie Munger’s Q&A at the Daily Journal meeting the next day. Then, of course, Warren Buffett’s annual letter (and Berkshire Hathaway’s 10-K) comes out on Saturday, February 25.

And, as I was reminded on Twitter, Christopher Bloomstran’s novella-sized letter usually releases right around this same time, too.

It’s gonna be a busy month. (Don’t worry, we’ll be covering all of the above in great detail.)

But, in many ways, the storm is already here. Especially after last Thursday evening, when three of the biggest companies in the world — Apple, Alphabet, and Amazon — all reported earnings within minutes of each other.

Each of the three disappointed the market in its own way — with Apple and Alphabet missing expectations on both the top and bottom lines and Amazon issuing worrying guidance for the quarter ahead. It all combined to cast a bit of a pall over Wall Street’s hot start to the new year.

Here are the highlights (and lowlights) of each company’s report…

Apple

The Cupertino-based tech giant is not only the most valuable company in the world — boasting a market cap of nearly $2.5 trillion — but also (by far) the largest holding in Berkshire Hathaway’s mammoth investment portfolio.

On Thursday, Apple reported its Q1 2023 earnings and pretty much missed expectations across the board. The company suffered its first revenue decline since 2019, with sales down 5% year over year, and fell short on profit and iPhone numbers, too.

Apple offered a simple explanation for the disappointing results: an unfortunate combination of snarls in the supply chain (particularly in regards to its flagship iPhone 14 Pro and Pro Max models), foreign exchange headwinds caused by the strong U.S. dollar, and wider macroeconomic worries.

All of which should only be temporary problems.

And, according to CEO Tim Cook, the supply shortages are already a thing of the past. “Production is now back where we want it to be,” he said on the company’s earnings call. “The problem is behind us.”

Cook’s words sparked a rally and AAPL 0.00%↑ actually gained 6% on Friday.

On this, I’m in full agreement with Mr. Market. Cook and co. should have little trouble shrugging off this rare revenue drop and putting this little bump in the road behind them. The Apple machine rolls on.

Despite weak iPhone sales, Cook pointed to high levels of customer satisfaction with the iPhone 14 Pro line of devices as a reason for optimism. “It’s definitely a strong Pro cycle,” he said. Not an issue of demand, but simply a lack of supply.

Only two segments grew revenue in Q1. One of which was iPad. Its 30% gain can be partially explained by it comping against last year’s supply-constrained quarter, but the release of the M2-powered iPad Pro and the totally redesigned base iPad (10th generation) helped, too. CFO Luca Maestri says that over half of Q1 iPad buyers were new to the product.

The other winner was Services with a 6% revenue gain. Nothing mind-blowing, but steady progress in a potential growth area. A solid result in a quarter when iPhone, Mac, and Wearables were all down.

Mark Gurman (Bloomberg) hints that an expensive iPhone Ultra might soon come down the pike. When asked, Cook didn’t sound at all worried about the rising price of iPhone. “While Cook wouldn’t say if he anticipates further price increases, he made a good argument for why even more upscale iPhones could make sense.” Good news for shareholders. Bad news for my wallet.

Alphabet

Unlike Apple, the company formerly known as Google actually grew its revenue in the holiday quarter. But that’s pretty much where the good news ends.

In Q4 2021, Alphabet’s revenue increased by an impressive 32%. This year? Just 1%.

That’s not only a ghastly year-over-year comp, but it’s even slower growth than Q3’s 6%. Not a promising trend for the company.

Like many others, Google is getting killed by the slowdown in digital advertising spending. “It’s clear that after a period of significant acceleration in digital spending during the pandemic, the macroeconomic climate has become more challenging,” CEO Sundar Pichai said on the earnings call.

“Our revenues this quarter were impacted by pullbacks in advertiser spend and the impact of foreign exchange.”

Drilling down into revenue by segment doesn’t make for much happier reading. Google Search dropped by 2% and YouTube ads by 8%. Even the mighty Google Cloud — with 32% revenue growth — might be starting to creak a little. It’s down from 38% a year ago.

And, with operating margin declining by five points, Pichai has started to rein in and “re-engineer” the company’s cost structure. In other words, layoffs. 12,000 of them.

Hanging over all of this, though, is the specter of ChatGPT. The chatbot, launched by OpenAI, has caused a bit of a stir in recent months — leading many to wonder whether this type of artificial intelligence could upend Google’s search monopoly.

“Our long-term investments in deep computer science make us extremely well-positioned as AI reaches an inflection point,” counters Pichai. “I’m excited by the AI-driven leaps we’re about to unveil in Search and beyond.”

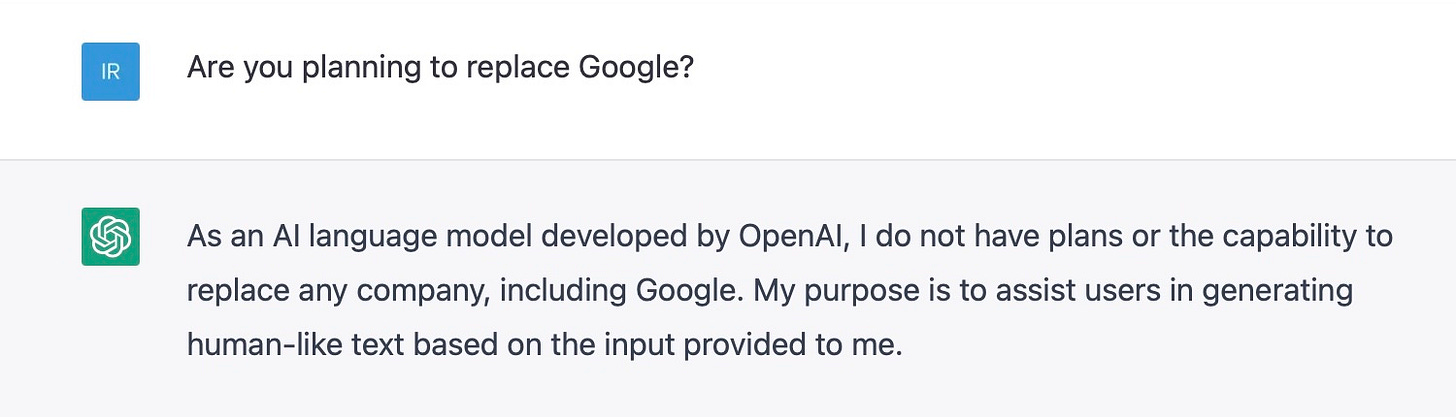

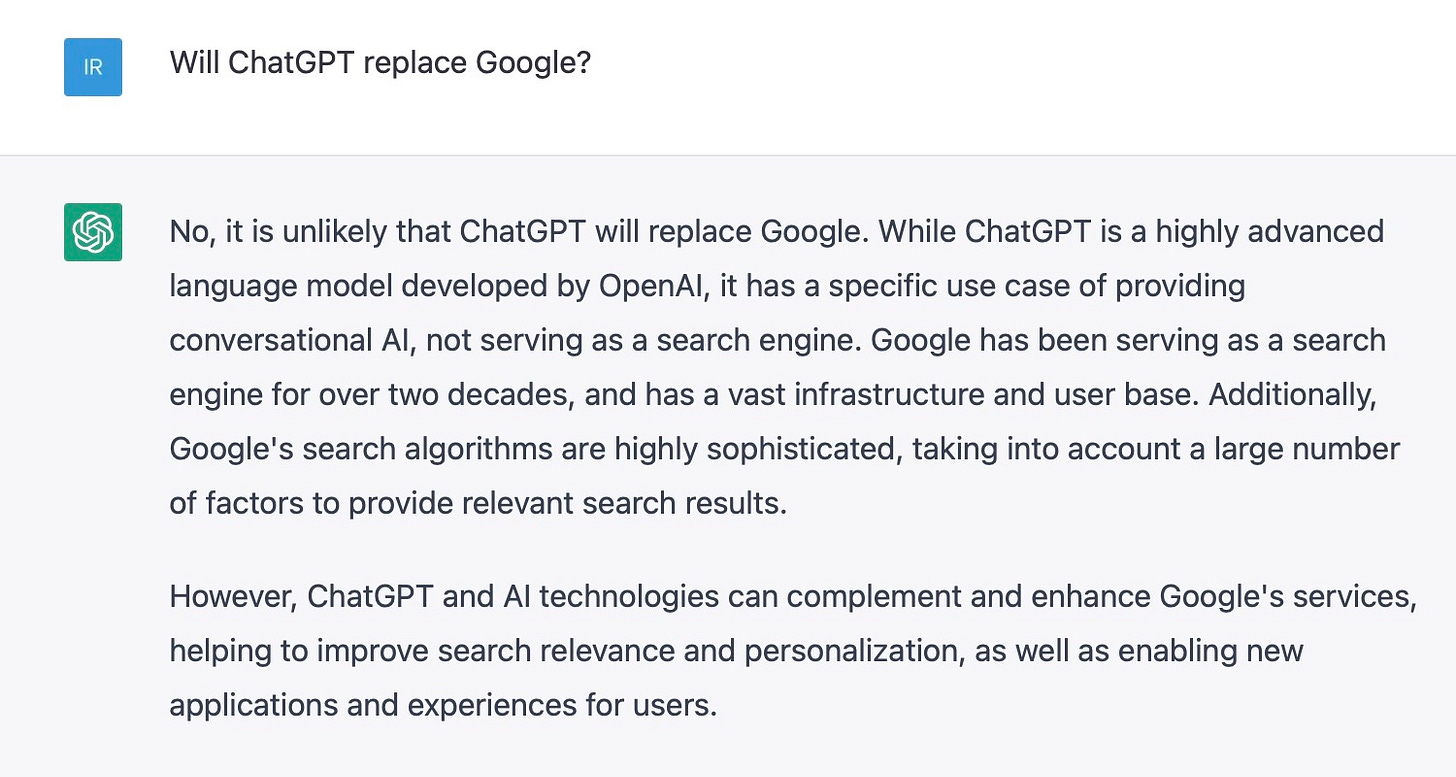

I decided to go right to the source and ask ChatGPT if it’s planning to replace Google:

Not very helpful, so I tweaked the question:

Which, to be honest, is exactly what a power-hungry AI aiming to take over search would say.

In all seriousness, Alphabet should be just fine. The digital ad slowdown is not a permanent problem and ChatGPT, while hugely impressive, won’t destroy the company’s whole business model overnight.

And, if artificial intelligence is the game changer that so many believe it to be, Alphabet has more than enough resources to be a big player in this new field. In fact, just yesterday, Google announced the imminent release of Bard A.I. to directly compete with ChatGPT. The A.I. wars are now upon us.

Nevertheless, the future remains bright in Mountain View.

(If anything, I’m hoping for a ChatGPT-fueled panic that drops Alphabet’s valuation to Meta 2022 levels. I’d love to scoop up some more shares.)

Amazon

Nothing vexes value investors quite like Amazon. The company has built an e-commerce and distribution network so vast and powerful that no one else can truly compete with it. Any one foolish enough to try would get squeezed out by Amazon’s low prices and free shipping.

All the while, its earnings multiple has stayed up in the stratosphere about as high as that Chinese spy balloon. I personally don’t make it a habit of purchasing stocks trading at 50-100x earnings, but AMZN 0.00%↑ has unquestionably been a wonderful investment over the past two decades.

On Thursday, Amazon beat expectations on revenue — but then disappointed analysts with light Q1 guidance.

When it comes to Amazon, I always check the AWS (Amazon Web Services) results first. The company’s retail operations, despite playing such a dominant role in our day-to-day lives, has never been especially profitable. Unfortunately, for pretty much the first time ever, AWS came up a little short in Q4 2022.

The cloud services segment grew revenue by only 20% (below expectations) and its margins dropped from 39% to 24%. Even worse, Amazon guided for only “mid-teens” AWS revenue growth in Q1 2023.

Still really good numbers for AWS. We’ve just been spoiled with spectacular results in the past.

On the earnings call, Amazon painted the AWS slowdown as an inevitable reaction to wider macroeconomic worries. Clients are scaling back expenses out of an abundance of caution — switching to lower-cost cloud products and running calculations less frequently. Again, just a temporary headwind.

Long term, Amazon (quite rightly) remains extremely bullish on its cloud segment. As Charlie Bilello points out on Twitter, AWS revenue of $80 billion is already higher than 457 companies in the S&P 500. I wouldn’t worry too much about AWS.

But here’s what Amazon investors need to ask themselves: Will slowing cloud growth cause Mr. Market to reevaluate the company’s generous earnings multiple? Even a contraction down to 25-30x earnings would mean a massive loss for shareholders.

Time will tell.

Very helpful summaries. Thanks man!