Berkshire Hathaway On Pace For Successful 2022

Even if this ends up as a down year for Berkshire, beating the S&P 500 by over 10% would make it a winner in Warren Buffett's book

Happy Monday and welcome to our new subscribers!

There’s no sugarcoating it — last week ended on a very sour note.

The Federal Reserve raised interest rates by 0.75% on Wednesday afternoon, sparking a furious multi-day sell-off that left the market in tatters.

Inflation remains historically high, a recession looks all but inevitable (if it’s not already here), and any hope of a so-called “soft landing” is dwindling.

The Dow Jones Industrial Average dropped under 30,000 on Friday and, if not for a late rally in the 3 p.m. hour, nearly closed in bear market territory.

All in all, not great.

I came across an interesting statistic on Friday night:

This reminded me of those old Buffett Partnership Ltd. letters from the 1950s and 1960s, in which Warren Buffett repeatedly insisted that outperforming the broader index in any given year — even a down year with negative returns — was the true measure of investing success.

I would consider a year in which we declined 15% and the Average 30% to be much superior to a year when both we and the Average advanced 20%. Over a period of time there are going to be good and bad years; there is nothing to be gained by getting enthused or depressed about the sequence in which they occur. The important thing is to be beating par; a four on a par three hole is not as good as a five on a par five hole and it is unrealistic to assume we are not going to have our share of both par three’s and par five’s. (1960)

Of course, “realistic” never applied to Warren Buffett.

He birdied every hole — no matter the par. BPL operated for thirteen years and, in each and every one of them, it outpaced the Dow.

But, for us mere mortals, this is good advice to remember.

Our job is to pile up yearly advantages over the performance of the Dow without worrying too much about whether the absolute results in a given year are a plus or a minus. I would consider a year in which we were down 15% and the Dow declined 25% to be much superior to a year when both the partnership and the Dow advanced 20%.

I have stressed this point in talking with partners and have watched them nod their heads with varying degrees of enthusiasm. It is most important to me that you fully understand my reasoning in this regard and agree with me not only in your cerebral regions, but also down in the pit of your stomach. (1961)

Emphasis added.

You probably won’t find the bolded on any list of the best Buffett quotes, but I think it ranks right up there amongst the most important things he’s ever written.

It’s easy to nod along and pay lip service to the idea that limiting losses during down years is a huge part of long-term outperformance — but it’s something else entirely to actually live through market turmoil and, nevertheless, stay the course.

Whether we do a good job or a poor job is not to be measured by whether we are plus or minus for the year. It is instead to be measured against the general experience in securities as measured by the Dow Jones Industrial Average, leading investment companies, etc. If our record is better than that of these yardsticks, we consider it a good year whether we are plus or minus. If we do poorer, we deserve the tomatoes. (1962)

Let’s look at a current example:

2021: Berkshire +29.6% vs. S&P 500 +28.7%

2022: Berkshire -11% vs. S&P 500 -23% (in progress)

While shareholders understandably consider 2021 to be a banner year — and 2022, so far, to be a disappointing one — Buffett likely feels the exact opposite.

Last year, Berkshire basically fought the S&P 500 to a draw and benefited from riding a rising tide like everyone else.

That’s all well and good in the moment, but it’s not how real wealth is built.

That happens in years like 2022, when the broader market finds itself in a free-fall and the best companies, like Berkshire, manage to minimize the damage and far outpace their respective yardsticks.

That’s exactly the kind of result that Buffett called “much superior” in his 1960 letter.

Even if 2022 ends up as one of those (very) rare down years for the Omaha-based conglomerate, beating the S&P 500 by over 10% would make it a winner in Warren Buffett’s book.

Why do I write so much about Berkshire Hathaway and Warren Buffett?

Because of days like Friday.

And weeks like the last one.

When chaos comes calling and the panicking herd thunders through the market, I have more faith in Buffett to make the right decisions with Berkshire’s (and my) money than in anyone else.

Including myself.

No one knows what Buffett was doing on Friday, but I feel reasonably confident that whatever it was will turn out to be profitable for Berkshire shareholders.

Maybe it’s more Occidental Petroleum. The Houston oiler fell back under $60 — Buffett’s magic buying line — and it would surprise absolutely no one to see a new Form 4 pop up tonight or tomorrow revealing a fresh purchase.

Or maybe he prefers to buy back shares of Berkshire itself. After all, it’s down near its 52-week low and well below the levels at which he previously made big repurchases.

Several other recent additions to the Berkshire portfolio — from Markel to Ally Financial to Paramount Global to HP — are languishing at lower prices right now than they were when Buffett (or his lieutenants) initiated positions earlier this year. Maybe he’s adding more to them.

Or something else entirely. The man likes to keep everyone guessing, after all.

And, thanks to the decisions that Buffett and co. made in past downturns, Berkshire continues to hold up better than most of its competitors.

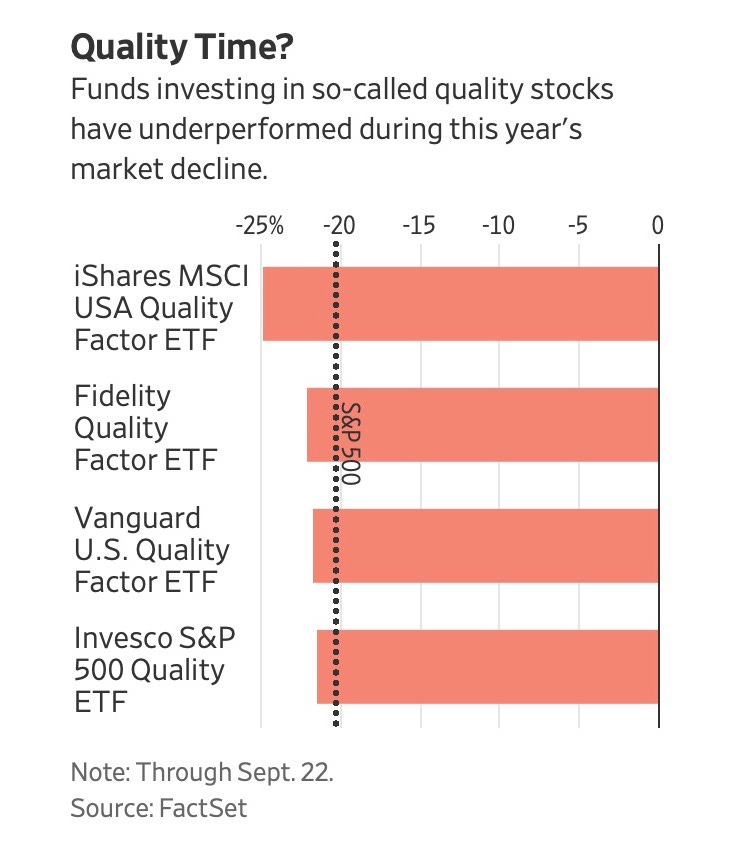

As Jason Zweig pointed out in the Wall Street Journal over the weekend, even supposed blue chips are scuffling against the twin specters of inflation and rising interest rates.

Top companies like Netflix (-62.1%), Meta Platforms (-58.5%), Adobe (-49.6%), Disney (-36.5%), Alphabet (-31.6%), Microsoft (-28.9%), Costco (-17.7%), Visa (-16.9%), and many others trail behind Berkshire in year-to-date performance.

So, what is Berkshire’s secret?

The company matches top-notch defensive characteristics — as evidenced by its performance against both the S&P 500 and other blue chips so far this year — with an ability to attack the market when things get crazy.

If the economy tanks, Buffett doesn’t hunker down and wait for the storm to pass. Rather, he leaps into action and starts putting Berkshire’s massive cash pile to work.

And it’s those opportunistic investments, whether in the form of pieces of wonderful companies or acquiring them outright, that make Berkshire Hathaway an investment for all seasons.

If you’ve enjoyed reading this issue of Kingswell, please hit the ❤️ below and share it with your friends (and enemies) so they don’t miss out. It only costs you a few clicks of the mouse, but means the world to me. Thank you!

Disclosure: This is not financial advice. I am not a financial advisor. Do your own research before making any investment decisions.