Berkshire Hathaway Blowout: On Pace for Biggest Win Over S&P 500 in Fifteen Years

"Most CEOs ought to pay more attention to what Berkshire does and how they allocate capital."

Happy Tuesday and welcome to our new subscribers!

As Berkshire Hathaway thunders down the home stretch towards another successful (and profitable) year, it also remains on track for its best finish against the S&P 500 since 2007.

With three weeks remaining in 2022, the scoreboard reads:

Berkshire: 📈 +3.69%

S&P 500: 📉 -16.8%

Advantage: Berkshire Hathaway by 20.5%.

Not that Warren Buffett cares one whit about calendar year results — or, at least, would ever admit so publicly — but a strong finish in ‘22 should silence any doubters and skeptics who popped up during the wider market’s wretched excess of 2019-2021.

Remember: Berkshire got its doors blown off by the S&P 500 in both 2019 and 2020. Back then, cryptocurrencies, SPACs, and pre-profit startups were all the rage. No earnings? No free cash flow? No problem. There seemed to be no upper limit as to how far (or how fast) these “assets” could rise in price.

Needless to say, that was not Warren Buffett’s kind of market.

Whenever Wall Street succumbs to speculative frenzy, Buffett’s value-based approach takes a beating. Slow and steady might win the race, but it can look downright old-fashioned and dinosaur-ish when your next door neighbor won’t stop bragging about his gravity-defying portfolio.

So, when the S&P 500 trounced Berkshire by 20.5% in 2019 and 16% in 2020, that was all the evidence that impatient investors needed to declare Buffett yesterday’s man.

Of course, they said the same thing in 1999 when Buffett refused to indulge in tech stocks at the height of the dot-com bubble.

Didn’t he understand that the Internet had changed everything? That Cisco was worth buying at any price? That this time really was different?

But, then, the bubble popped and Buffett was vindicated.

2022 seems to be following the exact same script.

In fact, the last twelve months have turned into something of a revenge tour for Buffett and Berkshire. (Not that he would ever put it in those terms…)

Cathie Wood’s ARK Innovation ETF posted an incredible 148% gain in 2020 and, by February 2021, held a commanding 200% lead over Berkshire Hathaway since the start of the previous year. That outperformance earned Wood plenty of glossy magazine covers and even some buzz as “the next Warren Buffett”. Ultimately, though, she flew too close to the sun on wings of speculative excess and ARKK 0.00%↑ crashed back down to earth in 2022. And, in true tortoise-and-the-hare fashion, Berkshire reversed the deficit and now leads by nearly 70%.

When Tesla motored past Berkshire on the list of most valuable companies (as measured by market cap) in late 2020, many saw it as a symbolic changing of the guard: Buffett’s staid ol’ conglomerate (with its penchant for brand names) standing down in favor of the flashy EV maker and its promise of a brave, new, automated world. Not so fast. TSLA 0.00%↑ plummeted 58% in 2022 and now trails Berkshire by more than $140 billion in company value.

And, finally, the S&P 500. Berkshire currently holds a 20.5% year-to-date advantage over the benchmark index. Once dividends are added back in, that gap will narrow by 1.5-2% — but it won’t change the final result: This will be Berkshire’s best finish since 2007 when it beat the market by 23.2%.

Here’s to an even better 2023. (What can I say, I’m greedy.)

Last week, I highlighted Christopher Bloomstran’s recent interview with Graham & Doddsville. In addition to making a compelling case for Paramount Global, the noted Buffett-ologist also explained why he builds his Semper Augustus portfolio around Berkshire Hathaway.

I try to bring clients into Berkshire at 20%, but only when it’s cheap. I was buying the heck out of it two and three and four weeks ago.

[Bloomstran spoke with G&D on October 28, placing these Berkshire purchases in early October when Class A shares dipped to around $400,000 and the Class B shares to $260-270.]

It’s still so sufficiently undervalued and so conservatively run. The earning power is so predictable that I almost look at Berkshire as though it’s a fixed income holding that happens to yield 10-12% when bought intelligently. The business earns 10-12 [percent] on equity and trades at a nominal premium to equity. It’s got the ability to reinvest. It’s got the ability to buy shares back, but only when they’re cheap.

The capital allocation levers inside of Berkshire are as well executed as they are anywhere. Most CEOs ought to pay more attention to what Berkshire does and how they allocate capital.

[Berkshire Hathaway Energy] and the [BNSF] railroad bear most of the company’s debt, but with those two groups their debt is non-hypothecated to the parent. If you look at how Berkshire termed out its debt, when interest rates were low over the last few years, they’re huge beneficiaries of very low-cost financing. Compare that with companies utilizing a lot of commercial paper or floating rate debt, with a lot of paper coming due in the next [2-3] years.

I could listen to Bloomstran break down companies all day.

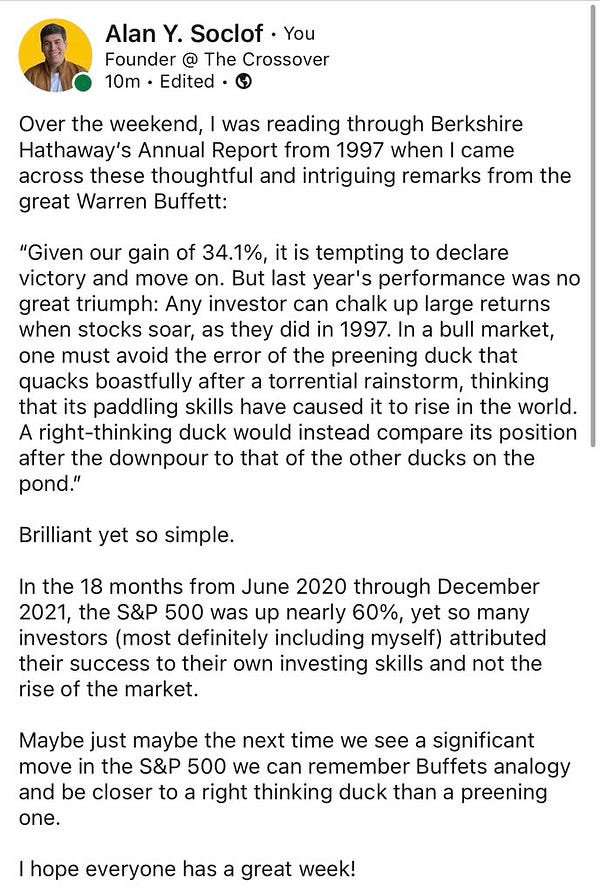

Tweet of the Week 🐦

If you’ve enjoyed reading this issue of Kingswell, please hit the ❤️ below and share it with your friends (and enemies) so they don’t miss out. It only costs you a few clicks of the mouse, but means the world to me. Thank you!

Disclosure: This is not financial advice. I am not a financial advisor. Do your own research before making any investment decisions.

Thanks for your writing. Always interesting and to point.

If I am not in touch before I take this opportunity to wish you a nice Holiday Season (politically correct I guess) and I look forward to keep reading your stuff. I would encouraged you to deep your toes outside Berkshire stuff if I may say so. Best Stefano