Earlier this week, Kingswell reached a big milestone: 1,000 subscribers!

And, more than anything, I’m filled with gratitude for the continued support of our readers. None of this would have been possible without you.

Thanks so much to everyone for reading, liking, clicking, sharing, and retweeting my little musings. Your support means the world to me!

If you’ve enjoyed reading Kingswell so far, please consider becoming a paid subscriber. Your generosity helps in more ways than you will ever know. Thanks again!!

Introducing Berkshire Bits

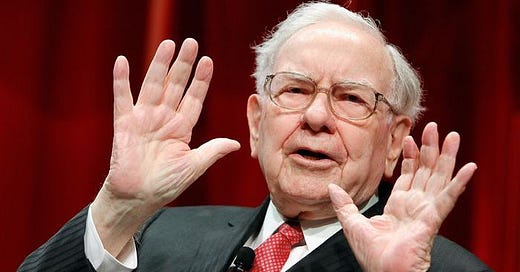

On Twitter, I try to mention any and all Berkshire Hathaway news as it happens — as well as whatever other Buffett-related factoids pop into my head. It occurred to me that, since not everyone here uses Twitter, it might be useful to gather these newsworthy items together and send out a roundup of sorts at the end of each week.

So, from now on, look forward to a new issue of Berkshire Bits every Friday.

If you already follow me on Twitter — and haven’t muted me yet — some of these blurbs may sound a little familiar. But, hopefully, putting everything together in one place will provide a valuable, week-at-a-glance look at the latest Berkshire news.

In this first issue, I’ll cover everything that’s happened so far this year. And, if you’ve already seen some of this on Twitter, scroll down and check out my must-reads of the week.

Without further ado…

Berkshire Hathaway continues to trim its position in BYD. Warren Buffett and co. sold another 1+ million shares to reduce its ownership of the Chinese EV maker to 13.97% (as of January 3, 2023). Since last August, Berkshire’s overall stake in BYD has decreased by almost one-third. Due to Hong Kong regulations, the next filing will come if (or when) the position drops under 13%.

Tuesday (January 17) was dividend day for Occidental Petroleum. Berkshire, which owns 21.4% of the oiler, received $25.2 million (plus another $200 million from its preferred shares). I like to think that OXY 0.00%↑ delivers a giant novelty check to Omaha each quarter.

Will 2023 be the year of Paramount Global? After months and months and months of soul-destroying underperformance, PARA 0.00%↑ is up 14.6% in the new year. Remember: Berkshire owns 15% of this media giant's non-voting Class B shares. We'll find out next month if Berkshire added more during Q4 2022. [When I originally tweeted this on Tuesday, Paramount was up over 20% YTD. The good news never lasts with this company...]

Speaking of 13F deadline day on February 14: Since dipping to a 52-week low on November 3, TSMC is up nearly 50%. Berkshire started a sizable position in the chip maker (60+ million shares) during Q3 2022. Did Buffett add more as the price fell throughout October and bottomed out in early November? (I hope so!)

I’ve always considered Charlie Munger’s work with the Daily Journal’s investment portfolio to be Berkshire-adjacent, so I’m gonna go ahead and include this here. Early bird: Munger and DJCO 0.00%↑ once again filed the company's 13F (for Q4 2022) more than a month ahead of the deadline. And the big news is that the Daily Journal fully exited its small position in POSCO. Munger previously sold a big chunk in 2014 and is now out of the South Korean steeler altogether.

2022 was another (relatively) busy year over at the Daily Journal investment portfolio. Munger sold 300,000+ shares of Alibaba in Q1 and fully exited POSCO to close out the year. After no 13F action from 2015-2020, the last two years have been surprisingly eventful.

In the Spotlight: Terry Smith’s Annual Letter to Shareholders 2022

Terry Smith, the famed British value investor, is one of my favorites.

I mean, just look at his investment strategy:

Buy good companies

Don’t overpay

Do nothing

How can you not love that?

And, best of all, his simple strategy works.

Smith started Fundsmith on November 1, 2010, and has soundly beaten the wider market ever since. Even with 2022 being a rare down year for the fund, he has recorded an impressive 15.5% compounded annual return over thirteen years of operation. That’s better than both the MSCI World Index’s 11% (his preferred benchmark) and the S&P 500’s 12.4% over that same period.

Here are some highlights from his latest letter to Fundsmith shareholders, which he released earlier this month…

The end of easy money:

This final round of easy money, post the pandemic, led to all the usual poor investments which people make when they are led to assume that money is endlessly available and costs zero to borrow or raise. We can see the unwinding of these unwise investments, for example, in the collapse of FTX, the cryptocurrency “exchange” (sic) and the meltdown in the share prices of those tech companies with no profits, cash flows, or even revenues.

Easy money breeds bad habits. Smart, conservative capital allocation goes out the window during these times of wretched excess. Money flows freely and investors fall prey to the siren song of riskier and riskier bets on unproven companies.

Even worse, these efforts (like QE) to suppress economic volatility seem to be having the opposite effect. We’re only a little more than two decades into the twenty-first century and we’ve already experienced three major financial crises. Make it stop.

When bad things happen to good companies:

Our highly valued and technology holdings did not fare as poorly as some of the companies which had significant market values, but no profits, cash flows, or in some cases even revenues. This may seem cold comfort and to quote an old adage, “When the police raid the bawdy house, even the nice girls get arrested.”

But, looking back to the example of Amazon over the Dotcom meltdown and its aftermath, it is a lot more comforting to own businesses which are performing well fundamentally when the share price goes down than to be found playing Greater Fool Theory in the shares of a company with no cash flows, profits, or even revenues.

When central banks throw on the brakes, everyone suffers. At least, for a while. Even though Smith mostly invests in wonderful companies selling at a fair (or better) price, the likes of Meta Platforms, Microsoft, and Amazon were all big losers in 2022.

Such is life when the era of easy money comes to an abrupt end.

The scourge of stock-based compensation:

We have coined a phrase at Fundsmith for this practice of relying upon earnings adjusted to take out the cost of share-based compensation and other real and persistent expenses (such as restructuring costs that keep recurring). Instead of the usual phrase of “fully diluted earnings per share” being earnings per share diluted by all the shares which a company has agreed to issue through options and so on, we refer to these heavily adjusted EPS measures as “fully deluded earnings per share”.

SBC is the silent killer of investment returns. (And not just because of dilution.)

More Must-Reads

Other awesome things that I read this week:

My 8 Best Techniques for Evaluating Character (The Honest Broker)

“I know some fortune tellers want to look at a person’s palm to read their future, but I’d prefer to take a glimpse at how they spend their time and money. Those reveal what a person is really all about. And that’s true for me and you, and everybody else. It’s so easy to say the right thing, but time and money are far more precious than words. Watch carefully how people allocate those two resources and you will understand them at a very deep level.”

Earning Wisdom (Rational Reflections)

“Internalizing the wisdom of others through writing goes well beyond writing down quotes verbatim. We should write about what we are reading in our own words and apply our reading to our day to day lives. This is not limited to philosophical musings. If you read an article or listen to a podcast by a successful investor, you should write down your takeaways immediately. Better yet, read the 10-K of a company that the investor mentioned and see if you can spot the attributes that he or she discussed.”

Berkshire Hathaway Could Get a Big Tax Bill. It Depends on the Market. (Barron’s)

As if mark-to-market accounting didn’t already create enough confusion, now it might have big tax implications for companies like Berkshire Hathaway. Another thing to watch in 2023, I guess.

Thinking About the Tail End and the Long-Term (Neckar’s Minds & Markets)

“There’s nothing wrong with ambition and material aspirations. But every day we face a decision of how we spend our marginal time, the brief moments not committed. Do we invest that time in trying to get ahead? Do we waste them on some app? Do we use them for ourselves or do we share them with someone important to us? Long-term thinking means that we turn ourselves into advocates of our future selves who see the tail end, and everything that truly matters, clearly.”

TSMC’s 3nm Journey: Slow Ramp, Huge Investments, Big Future (AnandTech)

“The big news coming out of TSMC for Q4 2022 is that TSMC has initiated high volume manufacturing of chips on its N3 (3nm-class) fabrication technology. The ramp of this node will be rather slow initially due to high design costs and complexities … so the world’s largest foundry does not expect it to be a significant contributor to its revenue in 2023. Yet, the firm will invest tens of billions of dollars in expanding its N3-capable manufacturing capacity as eventually N3 is expected to become a popular long-lasting family of production nodes for TSMC.”

In related news, Apple’s next-generation M3 chip is rumored to use TSMC’s 3nm technology and could release as soon as the second half of this year. Synergy.

Great article! Thanks for the introduction to Terry Smith!