Barstool Sports Hits Hyper-Growth, Mohnish Pabrai on Charlie Munger, Apple's Big Bet on Soccer, LEGO, and (Yes) Paramount

"All of us are very privileged to be living in the time of Warren and Charlie."

Happy Tuesday and welcome to our new subscribers!

Some of my favorite tweets and memes of the past week:

Barstool Sports x Penn National Gaming

As someone who followed Penn National Gaming’s partial acquisition of Barstool Sports with some interest, the past two years have been quite a rollercoaster ride.

After the Barstool news broke in late January 2020, Penn stock shot up 40% almost overnight — before crashing headlong into the Covid crisis that spring. With all major sports leagues suspended indefinitely and casinos closed nationwide, Penn then plummeted 80% to under $4 per share.

But the downturn didn’t last long. Penn came roaring out of the Covid shutdowns and uncorked a mind-blowing 1,500% gain in less than a year.

From there, though, it’s been one long slide back down to earth. Penn has now fallen 80% yet again and actually trades at a lower price than it did pre-Barstool.

I think I got whiplash just typing that out.

What’s so odd about the above volatility is that the Penn x Barstool thesis appears to be working out exactly as planned.

Origin Story. Penn National Gaming entered the online sports betting (OSB) biz in a big way by shelling out $163 million for 36% of Barstool Sports.

Barstool, for the uninitiated, pretty much runs the sports corner of the internet. Especially among the coveted younger demographic. Its huge, diehard following of both athletes and fans enjoys the brash, politically incorrect, sometimes controversial coverage of their favorite pastimes.

And, while I’m not sure anyone saw this particular partnership coming, Barstool is a natural fit for Penn. Way back when in 2003, Dave Portnoy created Barstool as a sports betting rag — hawking copies at stops along the Boston subway during rush hour to build an audience for his fledgling newspaper.

From these humble roots blossomed a sports and lifestyle empire.

After the Supreme Court overturned the ban on sports betting in 2018, Barstool pivoted back towards the increasingly-crowded gambling space. But, even after teaming up with Penn, many wondered how they could ever hope to beat entrenched competition like DraftKings and FanDuel.

But Penn had a plan.

Cultural Kingmaker. Almost immediately, Barstool became the face of Penn’s sports betting business — with a Barstool Sportsbook app for mobile users and physical locations inside casinos blanketed with the famous Barstool logo for its on-site bettors.

Most importantly, though, Penn relied on Barstool personalities’ seemingly effortless ability to go viral in order to keep marketing and promo costs to a minimum.

In particular, Portnoy and Dan “Big Cat” Katz are de facto perpetual marketing machines for Barstool Sportsbook. Their mastery of social media and live streaming — and a knack for grabbing headlines at the drop of a hat — gives Penn a far greater reach than any money could ever buy.

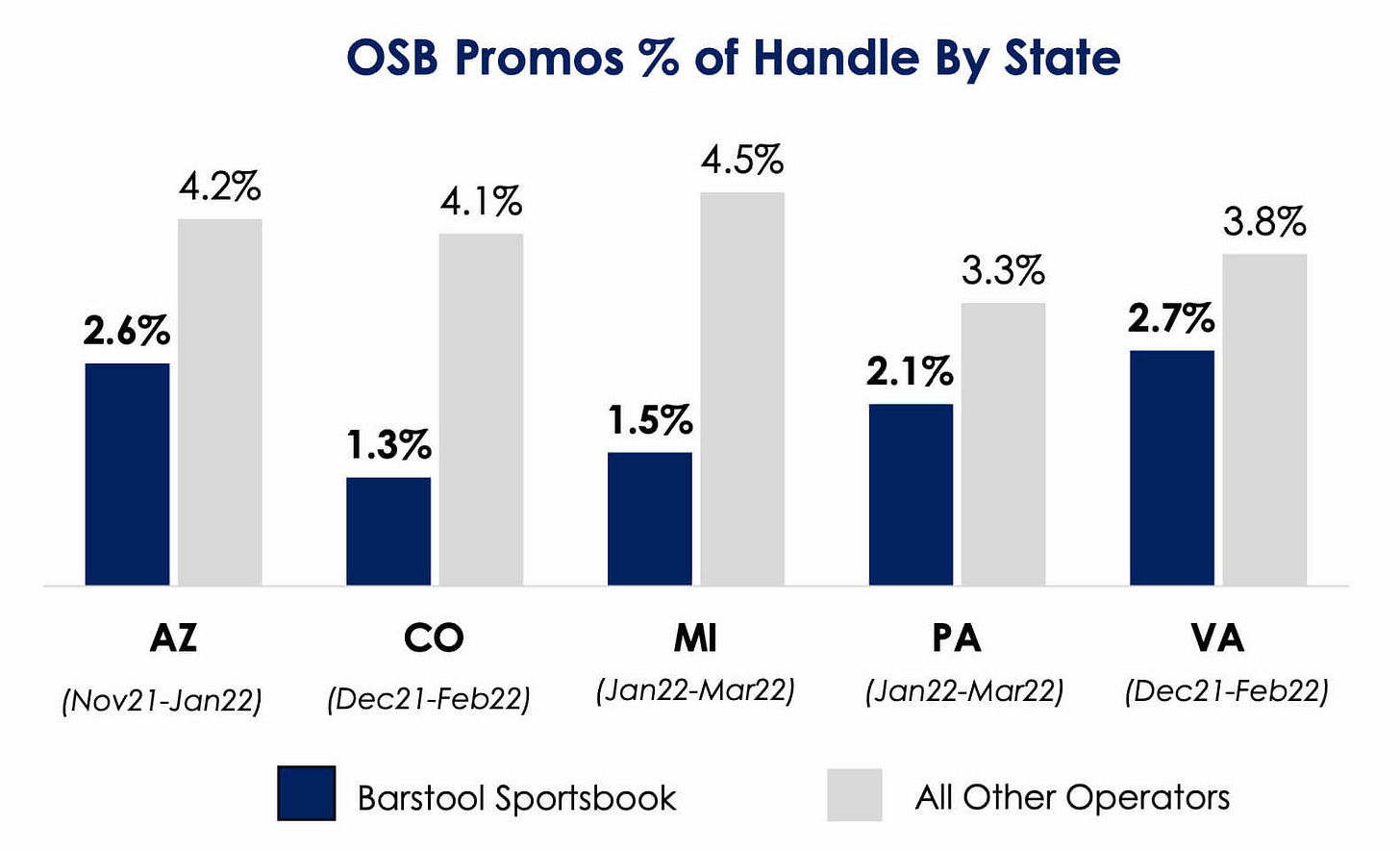

This chart says it all: the Penn x Barstool gambit is working.

In terms of online sports betting, the percentage of promo-related handle (total amount bet) consistently ranks lower for Barstool Sportsbook. In plain English, this means that Penn spends less money on promotion (“Place a free $100 bet on us when you sign up!”) than the others. Sometimes significantly less.

Companies like to talk about organic marketing and building direct connections with its customers, but often those are just buzzwords. At Penn, though, Portnoy can bust out a tweet or video that likely gets far better engagement than entire advertising campaigns perform for his OSB rivals.

That’s how you control costs. And, even better, it’s not easily replicated by other companies.

The Future. Penn CEO Jay Snowden describes Barstool Sports as a “hyper-growth sports media business” that is profitable, unlike many others in sports media. In fact, Barstool’s revenues grew by almost 150% over the last two years.

So it should come as no surprise that Penn plans to complete the $450 million acquisition of Barstool in early 2023.

“We couldn’t be more excited about moving our ownership position up from the current 36%,” says Snowden. “We look forward to being owner of Barstool 100%. They have been a great partner for us.”

So great, in fact, that Penn now believes that its Interactive segment — headlined by Barstool Sports — will be profitable sooner than expected. Penn slashed Interactive’s expected losses in 2022 from $80 million to $50 million and even guided for positive earnings as soon as next year.

🗣 Mohnish Pabrai on Charlie Munger

On the latest episode of William Green’s “Richer, Wiser, Happier” podcast, value investor extraordinaire Mohnish Pabrai joins the program and opens up on his friendship with the legendary Charlie Munger.

Pabrai tells many funny stories — but none better than about the time he first met Munger at a lunch arranged by Warren Buffett in 2009. Munger had done his research on his dining companion and shocked him by whipping out a list of Pabrai’s holdings for an impromptu evaluation. When he got to Sears Holdings, Munger shook his head in silent disapproval.

Message received.

Pabrai sold out of his Sears position the very next day.

The whole show is well worth a listen, but I pulled out a few of the more notable moments that piqued my interest.

On gratitude:

“I have to pinch myself at all of this because, on many fronts, all of us are very privileged to be living in the time of Warren and Charlie. It’s kind of like living in the time of Newton, Einstein, or any of those luminaries we look up to. So, that’s wonderful.”

On Munger’s colorful vocabulary:

“I’m actually surprised that at the Berkshire meeting or the Daily Journal meeting that there’s no F-words because it’s so natural to the way he speaks. I have never seen him in an interaction with me where there wasn’t colorful language. That has never happened.”

On Munger’s rare disagreements with Buffett:

“One of the areas where they diverged was Costco. Charlie tried to have Berkshire take a much larger position in Costco and Warren’s perspective was it’s too expensive. Charlie would always say, ‘For some things, you pay up.’”

“There was also a divergence in [Chinese EV and battery maker] BYD. Charlie told Warren that [BYD CEO] Wang Chuanfu is like Thomas Edison and you should invest with him. And Warren just kind of ignored that. Then he said, ‘Well, he’s like Thomas Edison and Henry Ford — both in the same person.’ And Warren still ignored that. Then Charlie told him, ‘He’s like Thomas Edison, Henry Ford, and Bill Gates — all in the same person.’ At that point, [Warren] went ahead after the third comment, but he didn’t use his own money. He went to David Sokol and had MidAmerican Energy use their money to buy the stake in BYD.”

Buffett has said many times that he and Munger never argue. But it’s still pretty cool to hear about those few times when the pair didn’t quite see eye to eye.

⚽️ Sports: A New Front in the Streaming Wars

Last week, Apple announced a 10-year, $2.5 billion deal to become the exclusive streamer/broadcaster of Major League Soccer. For the next decade, every MLS match will be shown only on Apple TV+.

Apple previously dipped its toe into sports streaming with “Friday Night Baseball” — but that partnership with Major League Baseball allows viewers to watch for free. Not so for MLS, unless you’re a season ticket holder.

This is just the latest salvo in the streaming wars — with live sports becoming the latest carrot to dangle in front of potential cord-cutters.

Sports are also the ideal weapon against churn. Subscribers often cancel a streaming service after a particular show or season ends, but a well-balanced sports portfolio could span the entire year and keep subs from getting a wandering eye.

Almost every streamer has had the same idea:

Peacock: Sunday Night Football (NFL), English Premier League, and MLB (Sunday morning games)

Paramount+: NFL, UEFA Champions Leagues (and lesser UEFA competitions), and Italy’s Serie A

Amazon Prime: Thursday Night Football (NFL) and France’s Ligue 1

ESPN+ (Disney): NHL, PGA Tour, Germany’s Bundesliga, Spain’s La Liga, and English soccer cup competitions

For whatever reason, Netflix remains the odd man out. Another puzzling decision out of Los Gatos.

Brick by Brick 🧱

There are two companies, above all others, that I really wish were publicly traded: Chick-fil-A and LEGO.

Alas, I wouldn’t hold my breath on either IPO-ing any time soon.

The Danish toymaker, in particular, boasts an iconic brand name and grew sales by 27% last year up to $7.8 billion.

Just an impeccable business.

My Obligatory Paramount Global Update

On June 14, Paramount CEO Bob Bakish spoke at the Credit Suisse 24th Annual Communications Conference. And, since I’ve exhaustively covered just about everything Paramount-related over the past few months, I figured why stop now?

Here are five nuggets that I found interesting for any Paramount bulls out there:

(1) Bakish reiterated that streaming revenue is still on track to reach $9 billion by 2024.

(2) The company’s streaming content costs will increase in both 2022 and 2023, before slowing down from there.

(3) Top Gun: Maverick continues to kill it — but it won’t hit Paramount+ for a few more months. In the meantime, though, the 1986 original is already putting in work. It’s quickly become one of the most-watched titles on the service — and ranked as its #3 acquisition driver last week. The power of Tom Cruise.

(4) An external survey puts P+ #2 in customer satisfaction among all streaming services.

(5) Paramount is no slouch in the battle for sports streaming supremacy. P+ already has NFL and some European soccer rights — and recently added the Copa Libertadores (South American equivalent of the Champions League) for streaming and broadcast in Brazil.

If you enjoy my work, please hit the ❤️ below and share this post with anyone who might be interested (or on social media). Thank you!

Disclosure: This is not financial advice. I am not a financial advisor. Do your own research before making any investment decisions.