Bad News Burry, CNN Shake Up, Kellogg's Conscious Uncoupling, and (Yes) Paramount

The good doctor knows a good deal when he sees it -- and he also knows when it's time to sound the alarm

Happy Thursday and welcome to our new subscribers!

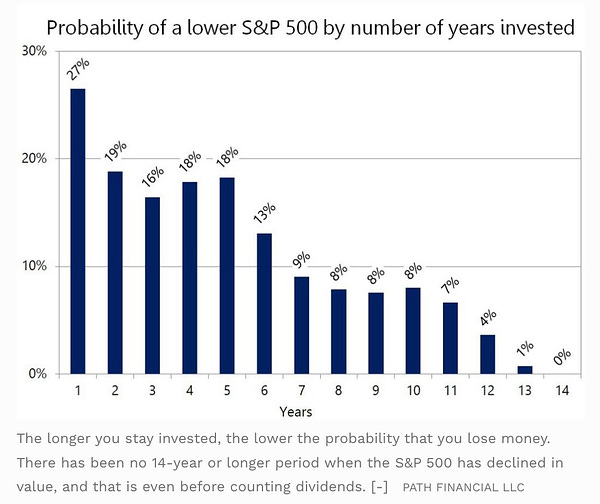

At times like these, owning stocks feels pretty risky.

The real risk, though, is leaving your money on the sidelines. Invest with a long-term mindset and you can’t go wrong.

Or, at least, it’s very, very unlikely.

The great Genevieve Roch-Decter returns from the holiday weekend with a dash of optimism for these troubled times:

Stay invested through thick and thin — and everything will turn out just fine.

Bad News Burry 📉

The S&P 500 just wrapped up its worst start to the year since 1970 — and, if that weren’t bad enough, the much-watched Atlanta Fed tracker now projects -2.1% GDP for the second quarter.

If correct, that means the U.S. economy will officially be in recession.

Not great.

But, according to Dr. Michael Burry, we’ve still got a long ways to fall.

Burry, immortalized in “The Big Short” for his brave bet against the housing market before the crash in 2008, tweeted that he thinks we’re only “halfway there” in terms of our current bear market.

Other recent Burry tweets predict that the U.S. will soon fall into recession spurred by a drop in consumer spending and that inflation is neither transitory nor at its peak.

Cheery guy.

But, despite these dire prophecies, Burry’s not heading for the exit door. In Q1 2022, he even started nibbling at a few undervalued companies — including two recently featured here on Kingswell.

Burry bought 80,000 shares of Meta Platforms and 750,000 shares of Discovery (which, shortly thereafter, turned into Warner Bros. Discovery).

I guess the good doctor knows a good deal when he sees it.

And he also knows when it’s time to sound the alarm.

🗣 David Zaslav on CNN

Speaking of Warner Bros. Discovery, CEO David Zaslav issued a new mandate for CNN (“Journalism First”) while holding court with reporters outside the exclusive, invite-only Allen & Co. Sun Valley Conference.

It’s not exactly breaking news that CNN has fallen on hard times. From plummeting cable ratings to the split-second life and death of the CNN+ streaming service, the company has seemingly squandered all of the good will and brand prestige earned over decades as the preeminent cable news network.

Zaslav hopes to rebuild CNN’s reputation “as a channel appealing to both sides of the political aisle”.

The stakes are high: a revived CNN could be a “sticky” jewel in Warner Bros. Discovery’s media portfolio. Streamers are desperately searching for content that will keep subscribers tuning in day after day — hence the recent push into live sports — and, in theory, CNN’s 24-hour news model could fit the bill.

But, at least for now, CNN can’t even give its product away.

In May, CNN averaged just 660,000 viewers (down 28% from a year ago) and finished a distant third in the cable news race. Forget about competing with Fox; CNN has been lapped by MSNBC and can barely be seen in the rearview mirror.

Frankly, these are embarrassing numbers for the network that created the cable news industry.

If you take a partisan slant on news and it pays off, that’s one thing. But if you do that — and, in the process, alienate half of your potential audience — and ratings fall, then heads must roll.

Zaslav seems to agree. “I think [new CNN head] Chris Licht is doing a great job pivoting CNN [to] journalism first. America needs a news network where everybody can come and be heard: Republicans and Democrats.”

If Zaslav and Licht pull this off, they not only will save CNN but also provide Warner Bros. Discovery’s forthcoming streaming service (combining HBO Max and Discovery+) with a sterling, churn-reducing asset.

🥣 Kellogg’s Conscious Uncoupling

Or, in this case, I guess it’s un-throupling.

Last month, stodgy ol’ Kellogg’s stirred up some headlines with the announcement that it will split up into three companies by the end of 2023.

Here’s how this whole thing will work:

Snacks (Pringles, Cheez-Its, Pop-Tarts)

Cereals (Rice Krispies, Raisin Bran)

Plant-based (MorningStar Farms)

This decision really boils down to wringing value (and a higher earnings multiple) out of Kellogg’s fast-growing snacks segment. Snacks accounted for $11.4 billion in sales during 2021 and includes the aforementioned brands as well as Nutri-Grain, Eggo waffles, and a promising noodle biz based in Africa.

Cereal, the company’s one-time shining star, is now an afterthought. And Kellogg’s plant-based segment — headlined by MorningStar Farms — might even be sold off entirely.

I usually tune out market analysts, but sometimes they’re helpful in getting a feel for how a particular move has been received by the broader investing community. And, in the case of Kellogg’s breakup, it looks like a split decision.

Nidhi Chauhan (GlobalData):

This trend is becoming increasingly common in the consumer goods industry, especially as businesses have faced unprecedented challenges in the last couple of years. Restructuring such as this is one way of finding growth opportunities as economies have slowed down and consumers are tightening their pursestrings.

Erin Lash (Morningstar):

Despite the increased focus that management claims this should afford, we don’t think this strategic action stands to enhance Kellogg’s competitive position or financial prospects. In our opinion, the motivation leans more toward unlocking a higher multiple for the faster-growing snack business once it’s unencumbered by the more mature North American cereal brands.

Robert Moskow (Credit Suisse):

It is difficult to ascribe a significantly higher valuation multiple for the much-larger global snack company (80% of sales) as a standalone business given that the spin does not reveal any new information about it or clear the way for better operating performance.

Bryan Spillane (Bank of America):

How much certainty could you have in a “value unlock” plan when you’ve got a market that’s uncertain about how to value things? Is this a time when you want to dilute your focus? Does the step down in profits more than offset the step up that you’re expecting to get in valuation?

All excellent questions.

When buying slow-growth consumer staples like Kellogg’s, investors must (I repeat MUST) get in at the right price. Pounce on these companies when they trade at a depressed valuation and then the combo of modest earnings growth, 3-5% dividends, and a rising multiple should add up to a solid return.

But, if you buy at the top, you’ll be crying.

(And, salt to taste, Kellogg’s at 16x earnings seems pricy to me.)

🏔 Obligatory Paramount Update

With Paramount Global stock back around $25, I think I found the company’s new motto (at least from an investment standpoint):

So, with Paramount bulls awash in a sea of red ink, I dug up some company news that will hopefully ensure that no one gets paper hands.

Top Gun: Maverick reached $1.1 billion at the global box office over the weekend — making it the highest-grossing movie of the year.

In even better news, those receipts are fueled by repeat viewers. 16% of moviegoers had already seen the film once before and 4% were already on their third (or more) screening.

That re-watchability bodes well for Maverick’s eventual star turn on Paramount+.

Streaming chief Tom Ryan (also founder of Pluto TV) recently spoke with Variety — and I found two comments especially noteworthy:

🗣 “I do believe that ‘one plus one of free and pay [streaming] equals three’.”

Paramount’s whole direct-to-consumer (streaming) strategy in a nutshell. The combination of subscription-based P+ and ad-supported Pluto TV provides a robust revenue stream that legacy streamers can’t match.

And, in explaining P+’s value proposition here in the United States:

🗣 “Live sports, breaking news, and a mountain of entertainment.”

In light of Netflix’s recent churn issues, it’s noteworthy to see Ryan highlight the importance of live sports to Paramount’s streaming efforts. Very sticky.

CEO Bob Bakish told The Guardian that Paramount will not remove, censor, or otherwise 🚫 older content on P+ (or Pluto TV) that might offend the current generation’s sensibilities.

“By definition, you have some things that were made in a different time and reflect different sensibilities. I don’t believe in censoring art that was made historically. That’s probably a mistake.”

He continued: “It’s all on demand — you don’t have to watch anything you don’t want to.”

Disney, take note.

If you’ve enjoyed reading this issue of Kingswell, please hit the ❤️ below and share it with your friends (and enemies) so they don’t miss out. It just costs you a few clicks of the mouse, but means the world to me. Thank you!

Disclosure: This is not financial advice. I am not a financial advisor. Do your own research before making any investment decisions.