Apple's iOS 16 at WWDC, Unilever, Nelson Peltz, Top Gun, and (Yes) Paramount

As iOS (and iPhone) goes, so goes Apple

Happy Thursday!

It’s really as simple as this:

📱 Apple to Unveil iOS 16 at WWDC

Next Monday, Apple will reveal the newest iteration of its iOS mobile operating system during Tim Cook’s keynote address at the Worldwide Developers Conference. Fans — and investors — the world over circle this date on their calendars because as iOS (and iPhone) goes, so goes Apple.

This will be the first public peek at the software that will power our iPhones in the year ahead. And, thankfully, Mark Gurman of Bloomberg has got the deets:

From what I’m told, the new software — codenamed Sydney — is a fairly significant upgrade. It will be chock full of changes across the operating system, including updates to notifications, iPad multitasking, and the Messages and Health apps. The makeover also includes a part of the interface that’s often an afterthought: the lock screen.

It looks like the iPhone lock screen will get new wallpapers complete with widget-like capabilities. Plus, the upcoming iPhone 14 Pro models might feature always-on lock screens similar to newer Apple Watches.

While I don’t expect an iOS 7-scale redesign in iOS 16 and iPadOS 16, I’m expecting major changes to windowing and multitasking, particularly on the iPad.

Exciting, but vague. Guess we’ll have to wait a few more days to find out exactly what Apple has in store for the iPad.

In Messages, I’d expect more social network-like functionality, particularly around audio messages.

I’ve always found Gurman to be a reliable Apple whisperer, so the above speculation stands a pretty good chance of panning out. And, no matter whether you’re an iPhone user or an Apple hater, iOS’s present and future is of the utmost importance when evaluating AAPL as an investment.

Nelson Peltz and Unilever

Some intriguing news: Activist investor Nelson Peltz will be joining the Unilever board of directors in July. I love Unilever as a company — particularly its bulletproof collection of consumer brands like Dove, Knorr, Lipton, Hellmann’s, Ben & Jerry’s, etc. — but I’ve grown a bit disillusioned with current management.

Between the dalliance with GlaxoSmithKline and the whole “Products with Purpose” campaign, Unilever seems to be a company blowing in the wind without a concrete strategy for growing those incredible consumer brands. Thirteen of which currently sell more than €1 billion annually.

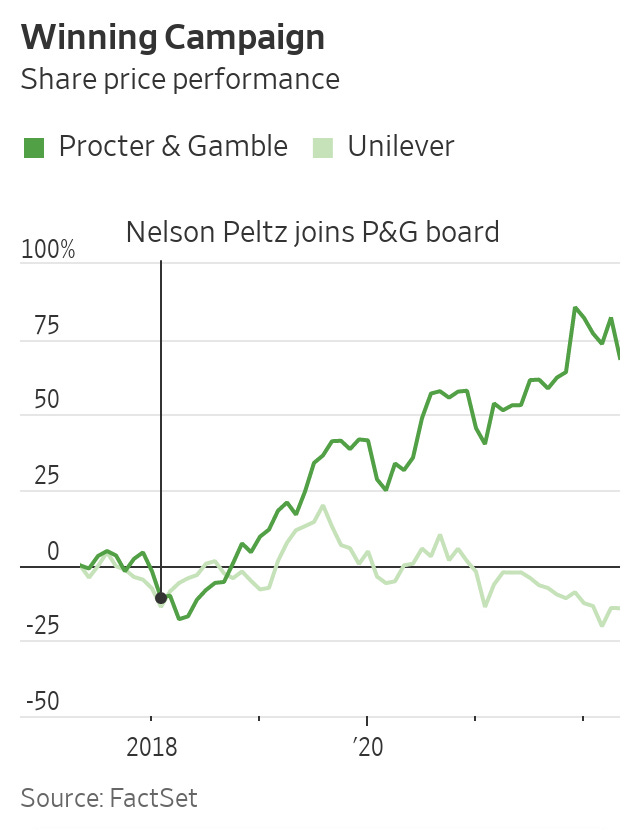

Unilever’s stock rose more than 10% on the news of Peltz’s arrival, with the market obviously hoping that he can work a little bit of his P&G magic on the UK conglomerate. Peltz’s activist campaign at Procter & Gamble led to its stock nearly doubling in value during the 3+ years he spent on the board.

Hopefully Peltz can do it again.

But he’s got his hands full.

I think Terry Smith of Fundsmith, never one to mince words, summed up Unilever’s malaise and lack of focus best:

“A company which feels it has to define the purpose of Hellmann’s mayonnaise has, in our view, clearly lost the plot. The Hellmann’s brand has existed since 1913, so we would guess that by now consumers have figured out its purpose (spoiler alert: salads and sandwiches).”

Tom Cruise Can’t Be Stopped

Last week, I mentioned that Doctor Strange 2’s performance at the box office represented a much-needed ray of sunshine for beleaguered Disney.

Now, it’s Top Gun’s turn.

Top Gun: Maverick, sequel to the 1986 original, brought in $156 million in U.S. box office receipts over the long Memorial Day weekend. That’s both the best Memorial Day weekend ever and, incredibly, the biggest opening for any Tom Cruise movie.

What makes this all the crazier is that we’re not talking about a superhero flick. Those are box office catnip. You almost have to try to mess those up.

Sure, the original Top Gun remains a beloved classic. But it also came out over thirty five years ago. No one really knew if the name Top Gun was enough to win over new generations of filmgoers — or bring the original diehards back to theaters.

Consider that case closed.

I get a little bored banging on about Paramount all the time, but it’s properties like Top Gun that make the company so compelling. It wasn’t too long ago that everyone thought movie theaters were dead. So, too, for broadcast and cable television. But money keeps pouring in from both.

That’s not a bad thing — especially as streaming services turned out to be way more expensive to operate than originally thought. Paramount’s ability to generate cash — and lots of it — from “dead” sources like films and linear television could be its secret weapon in The Streaming Wars.

And, after making hundreds of millions of dollars in theaters, Top Gun: Maverick should have a similarly euphoric effect on Paramount+ when it arrives later this summer.

If you enjoy my work, please hit the ❤️ below and share this post with anyone who might be interested (or on social media). Thank you!

Disclosure: This is not financial advice. I am not a financial advisor. Do your own research before making any investment decisions.