Adobe's $20 Billion Bet on Figma

When facing a material threat to your company’s moat and profit engine, pinching pennies is rarely a wise decision.

Happy Wednesday and welcome to our new subscribers!

Last week, Adobe sent shockwaves through the design world by announcing the $20 billion acquisition of one-time rival Figma.

And Mr. Market totally freaked out.

ADBE 0.00%↑ dropped 13% overnight and now sits more than 20% below its pre-announcement price. Investors and analysts alike quickly judged the deal a massive overpay.

So, what does a dyed-in-the-wool value investor like me, who cringes at any p/e above twenty, think about Adobe’s purchase? One that values Figma at an eye-watering 50x annual recurring revenue?

I don’t hate it.

Figma is, by all accounts, an incredible company.

In recent years, it emerged as the most credible alternative to Adobe’s creative apps — creating a real headache for the market leader with its cloud-based design software and heavy emphasis on real-time collaboration.

From Adobe’s official press release:

Figma has a total addressable market of $16.5 billion by 2025. The company is expected to add approximately $200 million in net new ARR (annual recurring revenue) this year, surpassing $400 million in total ARR exiting 2022, with best-in-class net dollar retention of greater than 150 percent. With gross margins of approximately 90 percent and positive operating cash flows, Figma has built an efficient, high-growth business.

And, now, this efficient, high-growth business — with all of its collaborative, cloud-based tools and knowhow — will be joining the Adobe fold.

For the time being, Figma will retain “complete autonomy” after the deal closes in 2023 and will remain a standalone product. Co-founder and CEO Dylan Field plans to stay on, too.

Still, I get the sticker shock. Figma was valued at just $10 billion last summer. Adobe will now pay 50x revenue — a very steep price at the best of times and completely out of step with the current market.

Of course, it’s not like Figma is just going to stop growing. If Field and co. can keep doubling revenue like they’ve been doing over the past few years, then this purchase price gets cast in a whole new light.

Adobe, too, is pretty incredible.

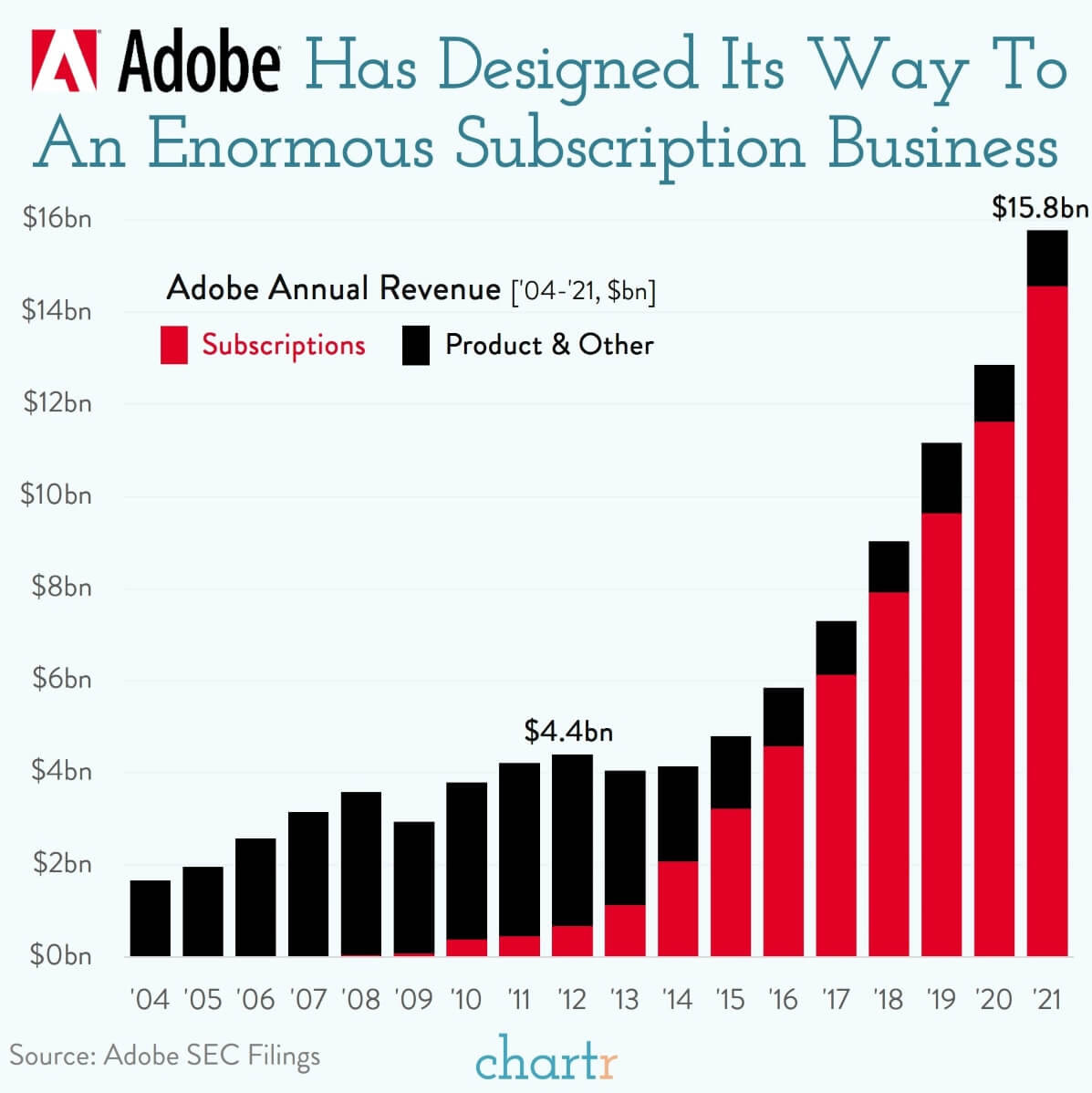

Under the inspired leadership of CEO Shantanu Narayen, Adobe successfully transformed its business model from one-off software purchases of Photoshop or Acrobat into recurring subscription revenue.

Instead of shelling out hundreds of dollars for a standalone release of Photoshop once a decade like in the old days, users can now subscribe to the company’s Creative Cloud suite of apps for a lower — albeit recurring — price.

Basically, Adobe figured out the cheat code for printing money.

And, like most SaaS (software as a service) companies, it can scale and grow with modest expense and relative ease.

But all is not well in Adobe-land.

Over on YouTube, Joseph Carlson pointed to a CNBC article that might have just been the canary in the coal mine for this whole deal.

[Figma] has since become so central to how Microsoft’s designers do their jobs that Jon Friedman, corporate vice president of design and research, said Figma is “like air and water for us”. It’s also used by engineers, marketers, and data scientists across Microsoft.

“Figma’s become, I would say, sort of the #1 common tool we use to collaborate across all of the design community in the community and beyond,” said Friedman, who’s worked at Microsoft for over 18 years.

In other words, Figma was encroaching on Adobe’s turf. And, when facing a material threat to your company’s moat and profit engine, pinching pennies is rarely a wise decision.

Anyone care to venture a guess as to how big of a check Mark Zuckerberg wishes he had written in 2020 to make TikTok go away?

Probably one with enough zeroes to evoke a similar response from analysts as this Adobe x Figma deal.

In retrospect, as TikTok continues to erode Meta’s market dominance, almost no price would have been too high.

As Hunter Walk put it:

Figma had crossed the “this matters to Adobe’s future” rubicon. They hit $400m ARR and were continuing to double. Figma revenue, independent of margin, was increasingly displacing revenue that might have gone to Adobe, or more specifically, creating pricing pressure on Adobe. It was a product designed natively to be collaborative, to be easier to use than Adobe’s professional tools, and without the baggage of features and nomenclature leftover from years of software releases, platform shifts, and business model changes.

This could also herald the next big shift at Adobe. The company already moved from one-off product purchases to subscription-based revenue — and, now, buying Figma might be the first step in a more collaborative, creator-centric direction.

Whatever I may think of Adobe and Figma and that $20 billion price tag, Wall Street was not amused.

Not even a little.

In the days following the announcement, analysts from Wells Fargo, Edward Jones, Bank of America, Oppenheimer, Baird, and Barclays all downgraded Adobe stock.

Apropos of nothing, I’m reminded of the great Philip Carret’s outspoken distaste for market analysts. “I don’t give a damn what they say,” he told Jason Zweig in 1994. “They’re frequently wrong.”

Nonetheless, Mr. Market and his analyst minions have done a number on Adobe stock over the past few days.

Even down in the low $290s, Adobe isn’t necessarily cheap per se with a 28.5 p/e. But that’s much lower than its normal valuation — ADBE 0.00%↑ hasn't had a p/e in the twenties since 2012.

(Adobe’s price-to-free-cash-flow, on the other hand, checks in at a very reasonable 19.)

You know me, I’m not going to offer any buy or sell recommendations here.

Maybe, even with Mr. Market throwing his toys out of the pram, Adobe is still overvalued. Or maybe anyone buying the dip right now will be handsomely rewarded over the next decade.

That’s a decision that every person must make for themselves.

I’ll leave you with these words from Amal Dorai, who defended the Figma acquisition on Twitter at a time when that was a decidedly unpopular opinion to hold. It can get a little technical, so I pulled out the best parts below:

I’m not surprised that Adobe is acquiring Figma for $20B, nor that Wall Street doesn’t understand it and ADBE 0.00%↑ stock is down more than $20B today. It's a smart move for Adobe...

In short, Adobe would have never caught up to Figma. It’s genuinely easier and cheaper for them to use Figma’s architecture to rebuild all of their existing applications than to try to make any of their existing apps as delightfully multiplayer as Figma.

This will go down as one of the smartest software acquisitions of all time, and if there are regrets they will be only Microsoft’s, for not offering more.

Emphasis added.

Paying 50x revenue for a smaller competitor is not for the faint of heart. And counting on rapid growth to carry on forever has led many an acquirer astray.

But some companies are special — and can keep growing at a fast clip.

Gravity doesn’t seem to apply them.

Adobe is betting that Figma is just such a company.

And, at $20 billion and 50x revenue, Adobe has to be right.

Time will tell.

(But I’m hopeful.)

If you’ve enjoyed reading this issue of Kingswell, please hit the ❤️ below and share it with your friends (and enemies) so they don’t miss out. It only costs you a few clicks of the mouse, but means the world to me. Thank you!

Disclosure: This is not financial advice. I am not a financial advisor. Do your own research before making any investment decisions.