A Closer Look at Berkshire Hathaway's Q2 2025 Earnings Report

All of the little (and big) details from Berkshire's latest 10-Q

Berkshire Hathaway released its Q2 2025 earnings report on Saturday morning, offering us a fresh glimpse into the inner workings of the legendary conglomerate.

In the spirit of Warren Buffett’s shareholder letters — renowned for distilling complex financial concepts into clear, essential insights — this is my own humble attempt to sift through the second quarter numbers and highlight those details that matter most to Berkshire’s trajectory.

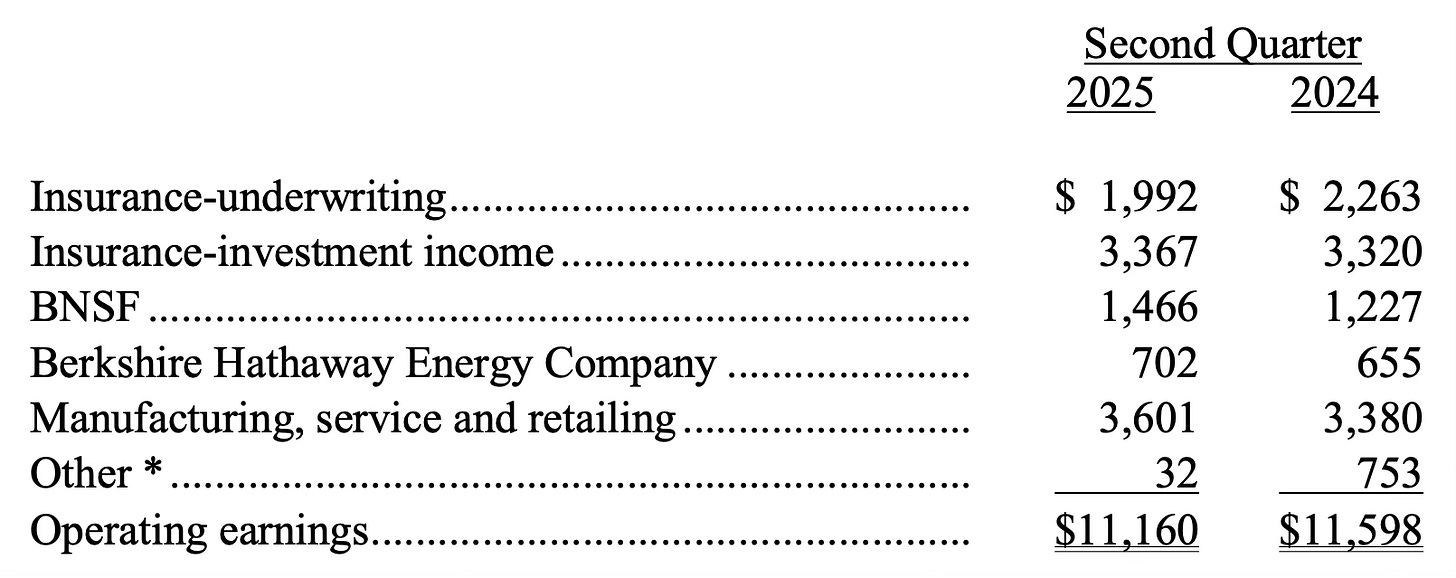

Warren Buffett and Charlie Munger have long championed operating earnings as the best measure of Berkshire Hathaway’s actual performance. Unlike net earnings, which can fluctuate wildly due to mark-to-market mood swings in Berkshire’s massive stock portfolio, operating earnings better reflect the health (or lack thereof) of its wholly-owned businesses. In Q2 2025, operating earnings dipped 3.8% to $11.2 billion, but even that number does not tell the full story. If you strip out the impact of foreign currency exchange — removing the $877 million “loss” in Q2 2025 and the $446 million “gain” in 2024 — Berkshire’s operating earnings were actually up 7.9%.

No matter where you come down on the for-ex adjustment issue, either of the above numbers offers a far more accurate picture of Berkshire’s performance than the nearly 60% plunge in net earnings. A ghastly figure — hopelessly distorted by stock market fluctuations — that tells us almost nothing about the firm’s true financial health. This GAAP-mandated accounting madness is dismissed by Berkshire as “usually meaningless” and “extremely misleading” to the lay investor.

Contrary to many media reports, Berkshire’s cash mountain grew bigger in the second quarter — all the way up to $339.8 billion. (Following in Buffett’s footsteps, I do not include cash held in Railroad, Utilities, & Energy in this total.) And, for the first time in several quarters, there was no U.S. Treasury Bills payable to subtract out, either. Those claiming Berkshire’s cash declined in Q2 apparently never accounted for this payable in last quarter’s numbers. In truth, cash increased by nearly $12 billion.

Berkshire’s swelling cash number underscores a familiar challenge: Buffett and co. just can’t find any compelling investment opportunities to spend money on right now. That includes no share repurchases during the entire quarter (plus the first three weeks of July) as well as an eleventh straight quarter as a net seller of stocks. This cautious stance signals Buffett’s unwavering discipline — waiting patiently for the right pitch in a market where valuations often seem untethered from reality.

Chris Bloomstran notes that, despite Berkshire’s stock trading above his personal intrinsic value estimate at times during the second quarter, “ongoing growth in intrinsic value and a ~12% decline from the peak has the shares now at about 85% of my appraisal and back down to valuation levels where Berkshire last bought back shares”. If he’s right, Buffett might fire up the ol’ buyback machine soon.

Berkshire’s stock portfolio ended the quarter valued at $267.9 billion — though we’ll have to wait for next week’s 13F to learn the specific ins and outs. Berkshire no longer discloses the market value of its five largest holdings, so there’s no surefire way to know whether Buffett sold off any more of his heavy hitters. Even if he did nibble around the edges, don’t expect too much upheaval. The same five companies — Apple, American Express, Bank of America, Coca-Cola, and Chevron — still remained atop the Berkshire portfolio at quarter’s end.

One notable blemish is Berkshire’s second write-down of its troubled Kraft Heinz investment. Following a $3 billion impairment in 2019, Berkshire got socked with another $3.76 billion charge ($5.0 billion pre-tax) in the second quarter. There’s not much else left to say other than that this merger really did not work out as planned.

Insurance underwriting earnings fell by $271 million, as GEICO’s continued good work got swamped by underperformance from BH Primary and BH Reinsurance. But, remember, Buffett called 2024 one of the best years ever for the insurance biz — so coming up short on year-over-year comparisons is hardly the end of the world. “Last year was as good a year as you’ll see in insurance,” he said in May. “It’s always unpredictable, but everything broke our way last year.”

GEICO posted a stellar 83.5% combined ratio in the second quarter en route to a 2.0% gain in pre-tax earnings. (An 83.5% combined ratio means that 83.5 cents of every dollar in premiums were spent on losses and expenses — leaving 16.5 cents in profit.) Best of all, the Berkshire-owned auto insurer managed to further drive costs down low enough to more than offset increased policy acquisition costs. Premiums written surged by $545 million, “reflecting an increase in policies-in-force and higher average premiums per policy”. After many quarters of trading growth for profitability, it’s starting to look like GEICO is back in business.

BH Primary’s woes — a 77.4% plunge in pre-tax earnings — can largely be laid at the feet of GUARD. Premiums written there have dropped 36% so far this year “due to management’s decision to exit certain unprofitable lines and tightened overall underwriting standards”. Other negative factors include a $300 million loss on the Southern California wildfires (over the first six months) and increased loss estimates for prior accident years.

BH Reinsurance suffered declines in some of its smaller units — Life/Health, Retroactive, and Periodic Payment Annuity — though the main Property/Casualty engine eked out a modest $23 million gain.

Full steam ahead! BNSF Railway rode improved operating efficiencies and productivity to a 19.5% earnings boost and a much-improved 64.8% operating ratio. (That’s well behind Union Pacific’s 59.0% operating ratio, but still a step in the right direction for BNSF.) Freight volume increased by 1.4% — with coal of all things leading the way and smaller 0.6% gains for Consumer and Agricultural/Energy Products. In May, Buffett pledged that BNSF would soon get back on track — “It’s not earning what it should be earning at the present time, but that’s solvable and is getting solved” — and these are certainly encouraging early returns on that score.

Berkshire Hathaway Energy enjoyed a 7.2% earnings gain, though that’s mostly the result of no wildfire loss accruals for U.S. Utilities in the quarter. BHE’s real estate brokerage business was flat and “continues to be negatively impacted by the limited availability of homes for sale and high home prices” — while the Natural Gas and Other Energy units each got tagged with 20+% drops in earnings.

MSR (Manufacturing, Service, & Retailing) not only grew earnings by 6.5%, but also expanded its margin from 8.0% to 8.7%. We’re always somewhat at Berkshire’s mercy as to what information we receive on the many, many operating businesses that make up this sprawling corner of the conglomerate — so I’ve tried to pull out the best little nuggets from this section of the earnings report.

Precision Castparts increased revenue by 1.6% to $2.7 billion — while pre-tax earnings rocketed upwards 37.0%. PCC’s turnaround story is built on higher sales and improved manufacturing and operating efficiencies. That eye-catching earnings number, though, seems to be the result of “insurance recoveries associated with a fire at a fasteners facility (SPS Technologies in Pennsylvania) that occurred in the first quarter of 2025”.

Marmon’s pre-tax earnings rose 6.9%, while Lubrizol (-11.6%) and IMC (-12.0%) faced headwinds from weaker sales and pricing pressures.

Building products suffered a $41 million decline in pre-tax earnings on “slowing customer demand and pricing pressures”. Clayton Homes made up $12 million of that drop — primarily due to higher interest expenses in its financial services arm.

Sales at “most of our [consumer products] businesses” have fallen so far this year. Jazwares revenue, in particular, plunged 38.5%. Brooks Sports is a rare standout in this category — with an 18.4% boost in revenue. (I bought two pairs of Ghost Max 2 shoes this spring, so I’m taking partial credit for Brooks’s success.)

NetJets, FlightSafety, TTI, XTRA, CORT, and Charter Brokerage paced the Service group to a $96 million (15.2%) gain in pre-tax earnings. NetJets earned extra plaudits for increasing the number of aircraft in its fleet, in-flight hours, and rates charged to clients. That’s the fractional airline trifecta.

The famously low-margin McLane parlayed a big margin improvement (1.1% to 1.4%) into 23.9% higher earnings.

Berkshire Hathaway Automotive remains the big dog of Retailing — with its sales accounting for 70% of the group’s overall revenue. BHA’s pre-tax earnings jumped 8.0% in the second quarter, while Nebraska Furniture Mart and See’s Candies earned shout-outs, too, for earnings improvements.

Pilot, meanwhile, fell flat with big drops in revenue (-22.2%) and pre-tax earnings (-40.2%). An ugly quarter no matter how you slice it — with significantly lower volumes on bulk fuel sales, lower average fuel prices, a shrinking sales margin, and higher expense costs. Yikes all around.

Pilot’s travails should not overshadow what was mostly an encouraging quarter for Berkshire Hathaway. After all, with so many subsidiaries in so many different industries, there’s always something to wring your hands over. It’s simply a numbers game — everything can’t be going well everywhere all the time. But life is less about never falling down and more about how quickly you can get up and dust yourself off. In recent years, major subsidiaries like GEICO, Precision Castparts, and BNSF all stumbled to one degree or another — and each one seems to now be somewhere on the road to recovery. CEO-in-waiting Greg Abel and (in GEICO’s case) Todd Combs deserve a lot of credit for turning these pivotal players around in relatively short order.

Great summary! My guess is that buybacks will resume this quarter, if they haven’t already since the July 21 share count in the 10-Q. One thing to watch is whether the A shares begin trading at a modest premium to 1500 Bs. In recent quarters, there has been virtually no premium. If Buffett starts repurchasing shares, he will prefer As even if his buying pushes them up to small premium over 1500x B.

Well done! Best analysis of all I've read since Saturday. Thank you!